What is a settlement agent in real estate?

A settlement agent for real estate transactions might be a real estate attorney, escrow officer, or title company representative responsible for conducting the closing of a home purchase or commercial property transaction. How a Settlement Agent Works

What is a'settlement agent'?

What is a 'Settlement Agent'. For a real estate transaction, closing agents are professionals who function chiefly for the buyer by conveying the selling interest from the buyer to the seller and ensuring the orderly transfer of the legal title from the seller to the buyer through the closing process. A settlement agent plays a central role in...

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is the settlement process and who is involved?

The settlement process can be complex and it is prudent to use a qualified professional to guide you through the process to the completion of the settlement. Your settlement agent, conveyancer or lawyer, will complete a variety of tasks on your behalf including:

What is a HUD-1 form used for?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What is settlement on a form?

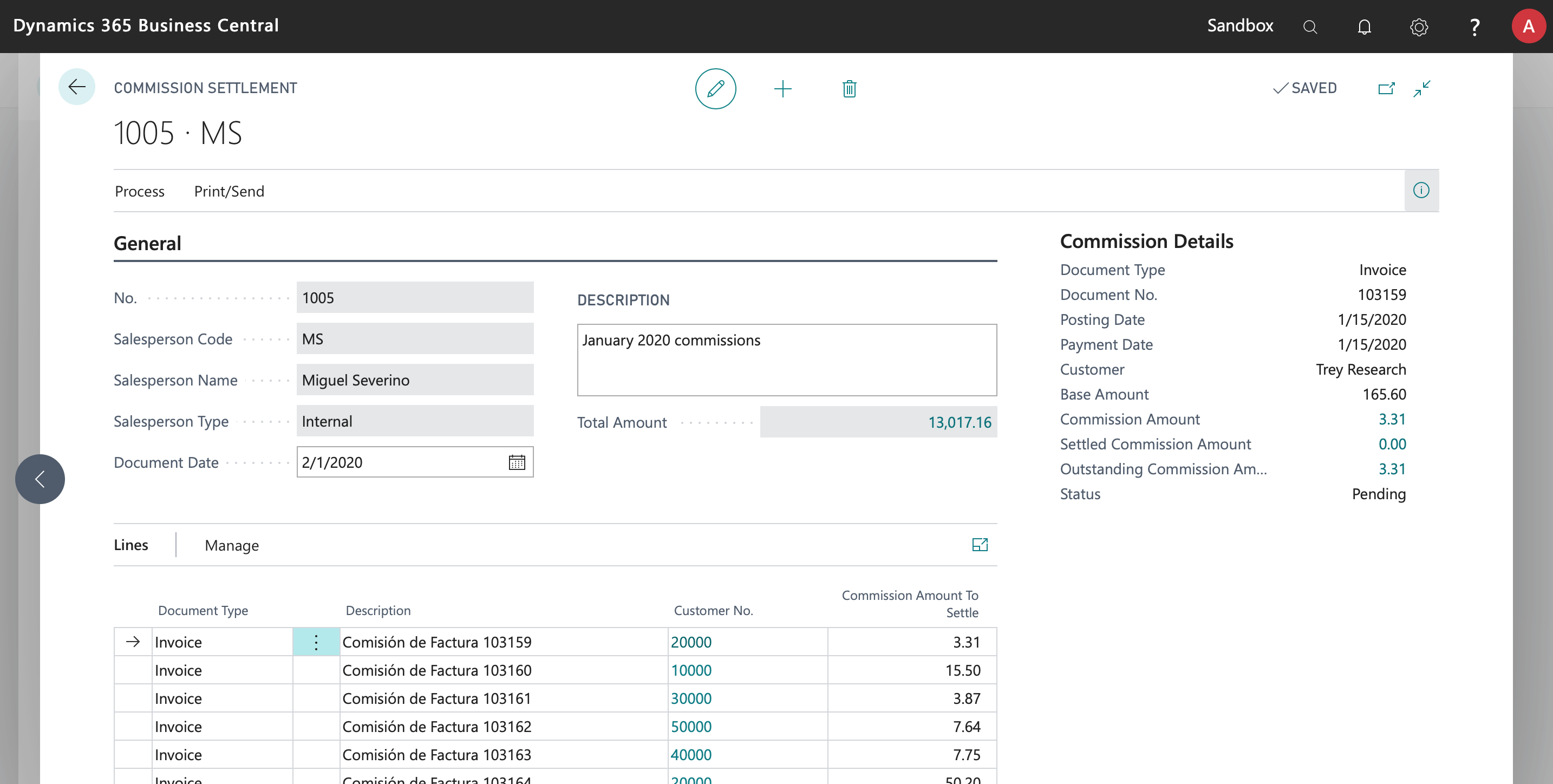

A settlement statement is a document that summarizes the terms and conditions of a settlement agreement between parties. Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller.

What is the most commonly used form for settlement statements?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What are types of settlement?

The four main types of settlements are urban, rural, compact, and dispersed. Urban settlements are densely populated and are mostly non-agricultural. They are known as cities or metropolises and are the most populated type of settlement. These settlements take up the most land, resources, and services.

What is a w9 used for in settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is a settlement statement quizlet?

HUD-1 Settlement Statement itemizes: All charges imposed upon the borrower and the seller by the loan originator.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

Are HUD-1 forms still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What is a closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

How do you write a settlement?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

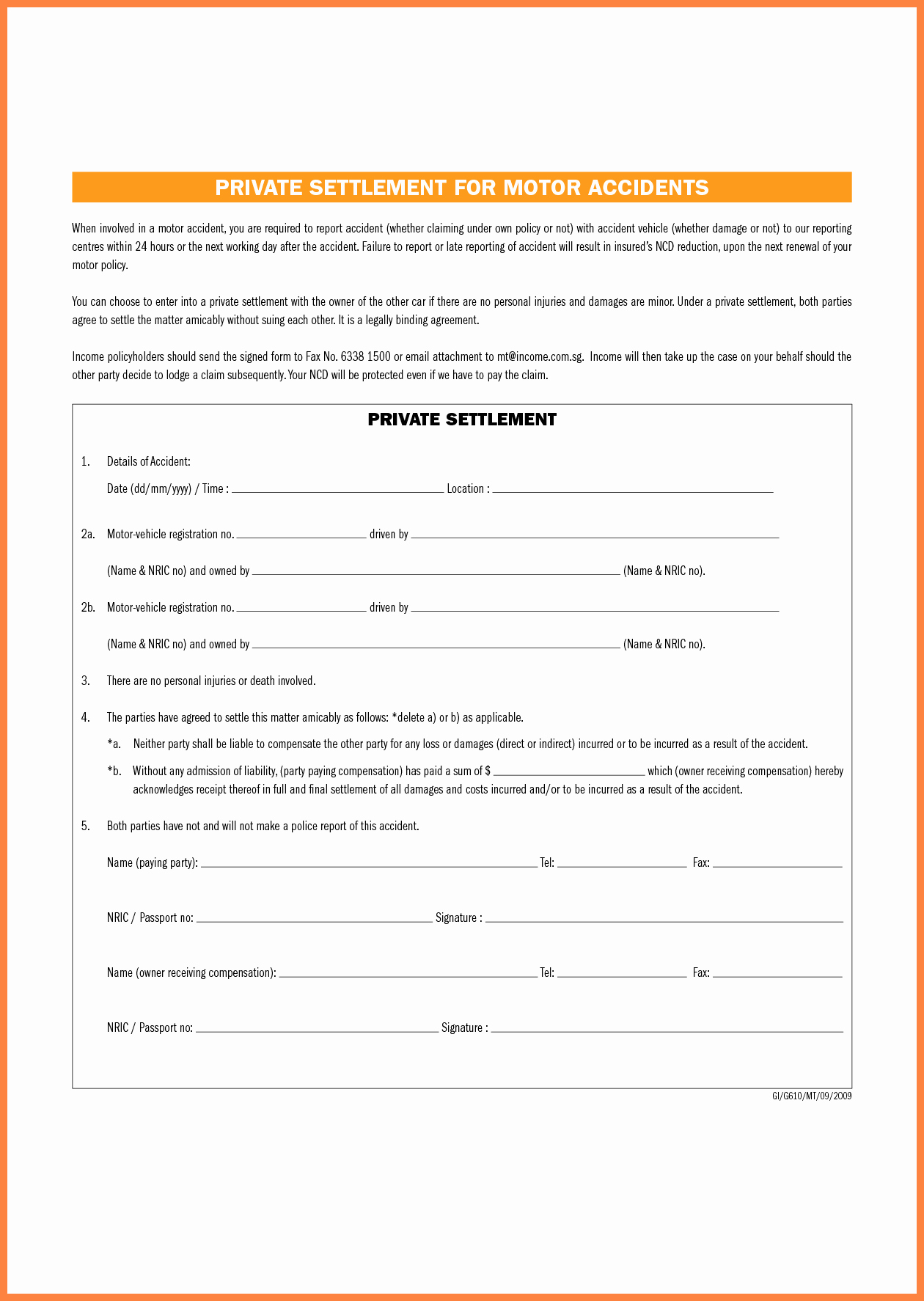

What does settlement and release mean?

A settlement and release agreement, or a mutual release and settlement agreement, is a legal agreement between parties. The settlement agreement may absolve a party from specific or any and all causes of action, liabilities, charges, or claims.

How do I write a settlement agreement?

A settlement agreement should be in writing....Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What is a settlement authorization form?

The Fee Settlement Authorization Form is used by a settlement agent to designate a financial institution to settle Federal Reserve Bank fees on behalf of the settlement agent and the settlement arrangement , including FedLine ® solution electronic access fees and NSS fees. The form must be submitted by the settlement agent in accordance with the instructions in the form.

What is an agent contact form?

The Agent Contact Information Form is used by a settlement agent to add, update, or delete the contact information of settlement agent staff authorized as contacts for all NSS-related operational matters relating to the settlement agent and the settlement arrangement (s) for which it has been designated to act as agent. The Agent Contact Information Form must be submitted by the settlement agent in accordance with the instructions in the form.

What is a participant update form?

The Participant/Settler Update Form is used by a settlement agent to request additions, updates, and deletions of participant/settler relationships in a settlement arrangement profile. This form should be used whenever changes to settlement arrangement relationships are needed. The form must be submitted by the settlement agent in accordance with the instructions in the form.

What Is a Settlement Agent?

A settlement agent is a party who helps complete a transaction between a buyer and a seller. This is done through the transfer of securities to the buyer and the transfer of cash or other compensation to the seller.

What is a closing agent?

For a real estate transaction, closing agents are professionals who function chiefly for the buyer by conveying the selling interest from the buyer to the seller and ensuring the orderly transfer of the legal title from the seller to the buyer through the closing process. A settlement agent plays a central role in ensuring a "quick close.".

What is clearing house?

For stock trades and other security transactions, a clearing firm or clearing house acts as a settlement agent. Stock exchanges have clearing houses that have a wide range of responsibilities to ensure the smooth settlement of trades. These responsibilities include collecting and maintaining margin funds, ensuring delivery of purchased securities, and reporting transaction details to all parties.

What is clearing in financial markets?

This process can occur several days after the original transaction. In the financial markets, clearing is the process by which trades settle. Clearing is the reconciliation of orders between the transacting parties in the purchase and sale of options, futures, stocks, and other securities.

What are the hurdles buyers and sellers must overcome in order to successfully settle the transaction?

A home inspection could show expensive defects, the title search could reveal problems with legal claims to the property, or the buyer's financing could fall through.

Is a settlement agent the same as a closing agent?

As such, not all agents are the same. For challenging transactions, specialized skills and knowledge may be required. Even a seasoned agent can be tested under the pressure of a high stakes close. Settlement agents are also known as "closing agents" or " conveyancers .".

Who coordinates the settlement date and time with the seller?

Coordinate the settlement date and time with your financial institution and the seller’s settlement agent.

How to prepare for settlement?

Ensure all inspections and any special conditions in the contract have been completed to your satisfaction before settlement takes place. Prepare and verify all necessary legal documents and forms. Ensure you have conducted your final inspection and all parties are ready for settlement.

How to settle a property?

Your settlement agent, conveyancer or lawyer, will complete a variety of tasks on your behalf including: 1 Search land titles to verify you are the legal owner. 2 Ensure the property is compliant with regulatory requirements such as ATO clearance certificates, outstanding rates and smoke alarm and electrical building codes. 3 Ensure any special conditions in the contract have been completed to your satisfaction before settlement takes place. 4 Prepare and verify all necessary legal documents and forms. 5 Attend to all adjustment of rates, taxes and levies as required. 6 Liaise with your financial institutions to confirm existing loan balances and provide payout instructions. 7 Coordinate the settlement date and time with your financial institution and the buyer’s settlement agent. 8 Provide updates on settlement progress and advise you of any potential delays, including your rights when it comes to compensation. 9 Attend settlement on your behalf to ensure correct exchange of legal documents and funds and let you know once settlement has occurred. 10 Provide a settlement statement.

Why do you attend settlement?

Attend settlement on your behalf to ensure correct exchange of legal documents and funds and let you know once settlement has occurred.

What is a liaise with your financial institutions?

Liaise with your financial institutions to confirm existing loan balances and provide payout instructions.

Who has the necessary qualifications and licenses to ensure that all legal requirements for the transfer of the title to the property are?

Lawyers and settlement agents have the necessary qualifications and licenses to ensure that all legal requirements for the transfer of the title to the property are complied with for the title to be registered in the name of the new owner.

Is settlement process complex?

The settlement process can be complex and it is prudent to use a qualified professional to guide you through the process to the completion of the settlement.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What is line 902 on a mortgage?

Line 902 shows mortgage insurance premiums that are due at settlement. Escrow reserves for mortgage insurance are recorded later. It should be noted here if your mortgage insurance is a lump sum payment that's good for the life of the loan.

What is line 903 used for?

Line 903 is used to record hazard insurance premiums that must be paid at settlement to have immediate insurance coverage on the property. It's not used for insurance reserves that will go into escrow.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is line 1400?

Line 1400 is for the total settlement charges paid from borrower's and seller's funds. They're also entered in Sections J and K, lines 103 and 502.

What is a transfer in full or partial satisfaction of a debt secured by the property?

Any transaction that is not a sale or exchange, including a be quest, a gift (including a transaction treated as a gift under section 1041), and a financing or refinancing that is not related to the acquisition of real estate. A transfer in full or partial satisfaction of a debt secured by the property.

Who is responsible for closing a transaction?

If the Closing Disclosure is not used, or no settlement agent is listed, the person responsible for closing the transaction is the person who prepares a Closing Disclosure that identifies the transferor and transferee, reasonably identifies the real estate transferred, and describes how the proceeds are to be or were disbursed.

What is a reportable real estate transaction?

Generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future ownership interest in any of the following. Improved or unimproved land, including air space.

How to request a TIN for a transfer?

Rather, it may be made in person, in a mailing that includes other items, or electronically. The transferor is required to furnish his or her complete, non-truncated TIN and to certify that the TIN is correct. For U.S. persons (including U.S. resident aliens), you may request a TIN on Form W-9, Request for Taxpayer Identification Number and Certification. Foreign persons may provide their TIN to you on the appropriate Form W-8. See part J in the 2021 General Instructions for Certain Information Returns.

What is an ownership interest?

An ownership interest includes fee simple interests, life estates, reversions, remainders, and perpetual easements. It also includes any previously created rights to possession or use for all or part of any particular year (for example, a leasehold, easement, or timeshare), if such rights have a remaining term of at least 30 years, including any period for which the holder may renew such rights, determined on the date of closing. For example, a preexisting leasehold on a building with an original term of 99 years and a remaining term of 35 years on the closing date is an ownership interest; however, if the remaining term is 10 years, it is not an ownership interest. An ownership interest does not include any option to acquire real estate. An ownership interest also includes any contractual interest in a sale or exchange of standing timber for a lump-sum payment that is fixed and not contingent.

Where to find sample certification for 2007?

A sample certification format can be found in Rev. Proc. 2007-12, 2007-4 I.R.B. 354, available at IRS.gov/irb/2007-04_IRB#RP-2007-12.html. The sample certification does not include an assurance that there has been no period of nonqualified use and an assurance that the full amount of the gain from the sale is excludable under section 121. The seller must add the information as explained earlier.

Who is the mortgage lender?

Mortgage lender means a person who lends new funds in connection with the transaction, but only if the loan is at least partially secured by the real estate. If there is more than one lender, the one who lends the most new funds is the mortgage lender.

What is a settlement authorization form?

The Fee Settlement Authorization Form is used by a Settlement Agent for a Settlement Arrangement and a financial institution that the Settlement Agent has designated as the institution whose Master Account may be used to settle (1) NSS fees applied to the Settlement Arrangement, in accordance with section 6.6 of the Federal Reserve Banks’ Operating Circular 12; and/or (2) FedLine® solution electronic access fees applied to the Settlement Agent. Under the Federal Reserve Banks’ Operating Circular 12, only a financial institution that is a Settler in the Settlement Arrangement may be designated to settle NSS fees applied to the Settlement Arrangement. A financial institution does not need to be a Settler in the Settlement Arrangement to settle electronic access fees applicable to the Settlement Agent.

What section of the financial institution is the settlement agent's Master Account?

Please identify the fees that the Settlement Agent requests to settle in the financial institution’s Master Account identified in section 3A and provide the requested effective month to begin settlement. The codes for the selected fees will be shown on the financial institution’s Statement of Service Charges.

What is section 3A?

This section 3A must be signed by an individual that appears as an authorized individual on the financial institution’s OAL currently on file with the Federal Reserve Banks using an ink signature or an electronic signature that is acceptable to the Federal Reserve Banks.

What Is A Settlement Agent?

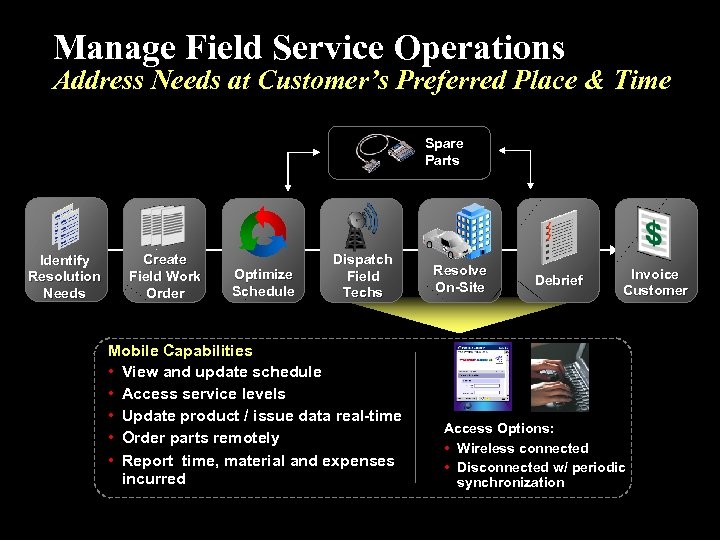

How A Settlement Agent Works

- During the settlement of a trade in which actual securities and money are exchanged, settlement agents are responsible for settling the accounts of traders and making the process more efficient. This process can occur several days after the original transaction. In the financial markets, clearingis the process by which trades settle. Clearing is the reconciliation of orders between th…

Types of Settlement Agents

- For stock trades and other security transactions, a clearing firm or clearing house acts as a settlement agent. Stock exchanges have clearing houses that have a wide range of responsibilities to ensure the smooth settlement of trades. These responsibilities include collecting and maintaining margin funds, ensuring delivery of purchased securities, and reporting transacti…

Special Considerations

- Settlement riskrefers to the risk that a buyer or seller fails to meet their obligations in the transaction. This frequently results in the failure of the transaction to successfully close or settle. In the securities market, there are two main types of settlement risk: default risk and settlement timing risk. Default risk is when one of the parties completely fails to deliver on their obligations, …