What is a debt settlement letter?

A debt settlement, especially for an amount less than what you owe, is one option that will address your debt and save you money. A debt settlement letter contains a proposal offer that will hopefully open the door to negotiate a fair and reasonable debt settlement.

What is a Jud judgement settlement letter?

Judgment Settlement Letter Templates - Download Legal Docs It is to notify you that the final decision of the court has been announced and settlement judgment has been passed. I am writing to share the decision of the It is to notify you that the final decision of the court has been announced and settlement judgment has been passed.

How do I negotiate a debt settlement with a creditor?

After initiating the negotiation process with your settlement letter, you can discuss any settlement with your creditor over the phone. Know that any agreement you reach must be in writing to be legally binding. Your debt settlement letter will be most effective if it clearly expresses the detailed terms of your settlement request in writing.

Can a creditor send an offer letter to settle a debt?

A creditor may also send a debtor an offer letter. Usually, debt settlement offer letters are sent when a debt is past the due date and has probably been moved to a collection agency, and the debtor is unable to pay all the debt they’ve accumulated.

How do I write a settlement letter for Judgement?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

Can you negotiate a debt after a Judgement?

Negotiate With the Judgment Creditor It's never too late to negotiate. The process of trying to grab property to pay a judgment can be quite time-consuming and burdensome for a judgment creditor.

How do you write a full and final settlement letter?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How do I write a final payment letter?

Dear Sir/Madam [or “To Whom It May Concern”], I am attaching my final payment for the account referenced above. I request a written confirmation from you that this account is [paid in full/settled in full] according to the terms of our agreement on [insert date of agreement].

What is the lowest a creditor will settle for?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Will debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle a debt or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

How does a Judgement affect you?

Does someone have a judgment against you? You cannot be sent to jail for failing to pay a debt or for having a judgment against you; however, a judgment can greatly affect your financial position. A judgment allows a creditor to garnish wages, garnish bank accounts, or take a lien against property in your name.

What percentage should I offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do you write a payment arrangement letter?

I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

What is a debt settlement agreement?

Debt settlement is a means of reducing or eliminating unsecured debt by negotiating an agreed upon payoff amount with creditors. This usually does not occur if a debt is secured, since the lender will have the right to take the property that secures the loan in lieu of payment.

What is calculated in your debt to income ratio?

To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out.

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!

What is a debt settlement request letter?

Writing a debt settlement request letter is a good way to negotiate your debt and to agree on a new financial agreement to either pay down or pay off your financial obligations.

Why do we need a debt settlement letter?

Writing a well-written debt settlement letter is a great tool if you’re seeking a plausible solution to protect your credit score or avoid bankruptcy.

What to do when creditor agrees to offer?

When the creditor agrees to your offer, it’s crucial that you keep up with your payment plan. Develop a budget and stick to it at all costs.

Why do collections agencies pressure people?

Collection agencies often pressure people since they get a percentage of your settlement.

Is it bad to pay off a debt without a written statement?

In terms of credit reporting, debt buying, and debt collection, paying off a debt without a documented written statement could prove to be a huge mistake.

Can anything you say in a letter be held against you?

Therefore, anything you say in your letter can be held against you in the event you have to go to court and face legal action.

Can credit card debt affect your credit score?

No matter if you’re credit card debt is overwhelming you or you can’t make your mortgage payments, your credit score can be seriously harmed by financial delinquency.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

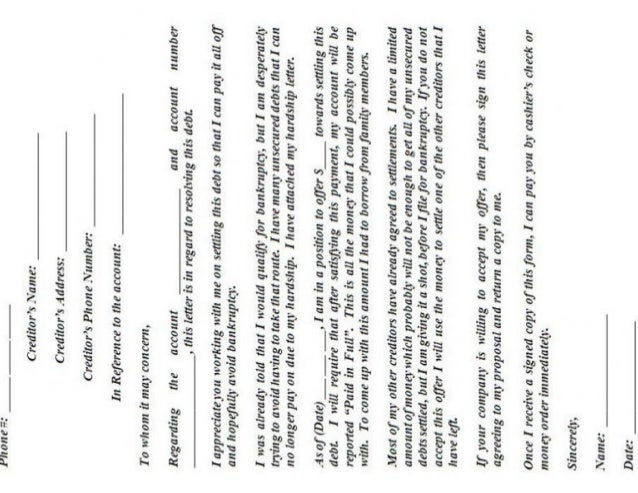

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

What is a debt settlement offer letter?

The Debt Settlement Offer Letter is a form that shows a debt is willing to be closed if the parties agree to new terms. Typically, this letter is from the debtor in order to offer a lump sum payment if the creditor is willing to release the burden of the full amount. After the letter is accepted, the parties will enter a debt settlement agreement unless a simple receipt is enough to satisfy the debtor.

What happens after a letter is accepted?

After the letter is accepted, the parties will enter a debt settlement agreement unless a simple receipt is enough to satisfy the debtor.

What is the next empty space in a letter?

The next empty space is reserved for the Date of this Letter. Make sure to enter the current date in the traditional Month Name, Two-Digit Day, and Four-Digit Calendar Year.

What is a debt settlement offer letter?

A debt settlement offer letter is a written proposal that a debtor or his attorney sends to a creditor or a debt collections agency to offer a specific amount of money to forgive a debt. A creditor may also send a debtor an offer letter. Usually, debt settlement offer letters are sent when a debt is past the due date and has probably been moved to a collection agency, and the debtor is unable to pay all the debt they’ve accumulated.

What information is needed for a debt settlement letter?

Your personal information includes your full legal name, mailing address, and current date.

Why is it beneficial to settle debt?

Settling debt is beneficial to the collector because it implies that they will get a significant part of the total amount owed. As you may already know, the odds of getting an account in collections paid are not good. It is more likely that the debtor will file for bankruptcy and the debt automatically discharged. This means that the debt collector risks getting nothing out of what they are owed. And even if the debtor does not file for bankruptcy, it will still cost a lot of time and money trying to take legal action against the debtor to collect the debt.

Is it bad to settle a debt?

Although settling a debt account is considered negative by many people, it won’t hurt you as much as not paying at all. Suppose you are planning to make a major purchase, for example, buying a home. In that case, you may be required to either settle or clear any outstanding delinquent debts before you can qualify for a loan from any financial lending institution. If paying the debt in full is not an option due to financial constraints, consider settling the account because it is more beneficial to your financial health than letting the debt go delinquent or, worse, to default.

What is a scumbag letter?

This letter is response to the default judgment filed in FILING COUNTY county on DATE JUDGMENT WAS FILED in the amount of $DOLLAR AMOUNT OF JUDGMENT plus interest and attorney fee’s known as (“account”), Between PARTY THAT FILED A JUDGMENT represented by scumbag attorney known as (“ Scumbags” (common name for judgment filing party)) and Your name, individually, and your company ( only if judgment was against you and your company) collectively known as (“ANGEL” common name for you throughout offer). All parties are collectively referred to throughout this settlement offer as “parties” This offer is effective today’s date.

Can a judgment be vacated?

First of all, only the court which rendered the judgment can have it vacated. Payment alone of a judgment is seldom grounds for vacating.