A prorated expense on the settlement statement is a debit to one party and a credit to the other. The amount a buyer owes at closing is equal to the excess of the buyer's debits over the buyer's credits.

What is a prorated sale of property?

Proration is the divvying up of property expenses (like taxes) between the buyer and seller. It's a way for the seller to pay for these expenses only for as long as they have owned the property. Prorated costs, like property taxes and HOA fees, are usually due at closing.

What is the assumed balance on the settlement statement?

C If a buyer assumes a seller's loan, the assumed balance is a credit for the buyer and a debit for the seller. 15. A refund for prepaid fire insurance would be listed on the settlement statement as a: A. debit for the buyer B. debit for the seller C. credit for the buyer D. credit for the seller 15.

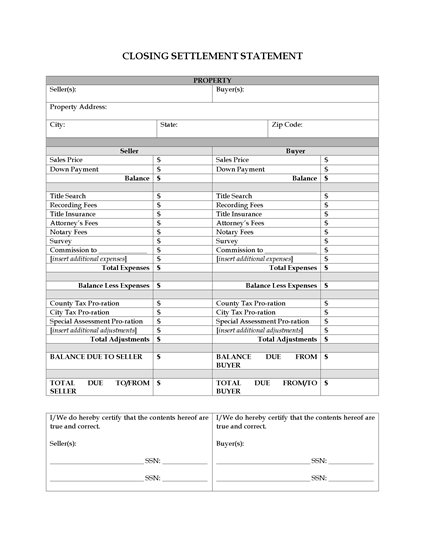

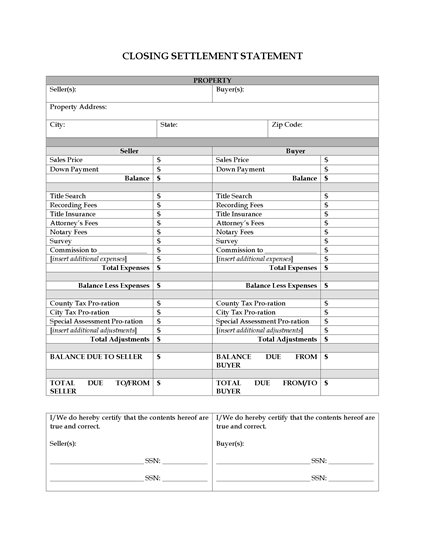

What is a settlement statement on a balance sheet?

Like your typical budget balancing sheet, the settlement statement is organized into Debits (expenses) and Credits (deposits or increases) to the account. Other forms might have columns labeled as “Seller Charge” and “Seller Credit,” which mean the same thing.

How does hazard insurance appear on the settlement statement?

If prorations are calculated on a 360-day basis, the hazard insurance will appear on the settlement statement as a: A. $58.38 credit to the seller B. $58.38 debit to the seller C. $237.62 credit to the seller D. $237.62 debit to the seller 2. A The per diem rate is $0.8222 ($296 ÷ 360 = $0.82).

What is prorated on a closing statement?

Prorations are credits between the buyer and seller at closing. They ensure that each party is only paying these costs for the time that they owned the home. They will show up as debits or credits on each party's closing statement.

What is a prorated expense to the seller at closing?

🗓️ Proration is the divvying up of property expenses (like taxes) between the buyer and seller. It's a way for the seller to pay for these expenses only for as long as they have owned the property. Prorated costs, like property taxes and HOA fees, are usually due at closing.

What is a prorated item quizlet?

A proration. is a proportionate calculation based on who actually owes an expense for a given period of time. items will be either accrued or prepaid. Accrued expenses.

Which of the following items would not be prorated at a settlement or closing?

Most closings involve the division of financial responsibility between the buyer and the seller for such items as loan interest, taxes, rents, fuel, and condominium or homeowners association fees. Which of the following items is not prorated at closing? The answer is loan amount.

What does prorated mean?

Definition of prorated : divided, distributed, or assessed proportionately (as to reflect an amount of time that is less than the full amount included in an initial arrangement) The catch is that the Dolphins can get back the prorated portion of the $5 million if Madison defaults on the contract.—

How do you prorate an expense?

Calculating your prorated amounts is easy once you know the monthly rate of your service and the number of months you used the service during the year. Simply multiply the number of months used up by your monthly rate. The result is the prorated expense to report on your annual business tax return.

What is a proration in real estate quizlet?

Prorations. The adjustment of expenses that have either been paid or are in arrears in proportion to actual time of ownership as of the closing or other agreed-upon date.

What are two types of Prorations?

There are two basic proration types used in residential real estate transactions. These two types of proration methods are referred to as LONG proration and SHORT proration. The type of proration used in a transaction is predicated by the Purchase Contract provision regarding real estate taxes.

Which of the following expenses is prorated on a 365-day calendar basis?

Annual dues are prorated using the 365-day method. Because the seller paid the dues in advance, the buyer owes the seller for the unexpired portion of the dues.

Which of the following would most likely be prorated on a closing statement?

Which of the following items would be prorated at closing? The answer is furnace fuel bills. Most closings involve the division of financial responsibility between the buyer and the seller for such items as loan interest, taxes, rents, fuel, and condominium or homeowners association fees.

When an item is prorated between buyer and seller on a settlement statement the closing officer must?

What should appear on the closing statement? * The item must be prorated and recorded as a debit to one party and a credit to the other party for the same amount. If a item to be prorated affects buyer and seller, and no outside party, which of the following statements is true?

How do you calculate prorated interest?

Pro Rata for Interest Rates If an investment earns an annual interest rate, then the pro rata amount earned for a shorter period is calculated by dividing the total amount of interest by the number of months in a year and multiplying by the number of months in the truncated period.

Which of the following items are typically prorated at closing?

Mortgage interest, general real estate taxes, water taxes, insurance premiums, and similar expenses are usually prorated at closing.

When an item is prorated between buyer and seller on a settlement statement the closing officer must?

What should appear on the closing statement? * The item must be prorated and recorded as a debit to one party and a credit to the other party for the same amount. If a item to be prorated affects buyer and seller, and no outside party, which of the following statements is true?

How are expenses handled that the seller has incurred but have not yet been billed for at the time of closing?

How are expenses handled that the seller has incurred but have not yet been billed for at the time of closing? These items are paid in arrears.

What describes when some expenses paid at closing are divided proportionally between the buyer and seller?

money paid. money owed. one that is so free of defects that the buyer is certain he or she will not have to defend the title. expenses paid at closing must be prorated or divided proportionally between the buyer and the seller.

When is Prorating Used?

There are many examples of times when a prorated number is required. Let’s review a list of the most common situations.

When is a utility bill prorated?

When a utility company bills for less than a full month of service. When a tenant moves into a rental space mid-month. While there are lots of situations that require prorating numbers, there are also many instances where numbers are not prorated. One of the most common is that of payment of stock dividends.

What is dividend per share?

Dividend Per Share (DPS) Dividend Per Share (DPS) is the total amount of dividends attributed to each individual share outstanding of a company. Calculating the dividend per share. when they are paid.

What happens if the seller's tax payment is not yet due?

By contrast, if the seller’s tax payment for the period was not yet due, then she would be charged the appropriate (prorated) tax amount at closing, and the buyer would pay the remainder of the tax bill for that tax period.

What does an escrow agent do?

The escrow agent typically figures out what expenses are paid in advance vs. in arrears, and separates charges and any tenant income accordingly, between the buyer and seller.

What are transferable fees at closing?

Proration is the process of dividing various property expenses between the buyer and seller in a way that allows each party to only pay for the days he or she owns the property .

Do you have to prorate escrow closings?

Since escrow closings don’t always conveniently happen at the end of a month, expenses often need to be prorated for partial months or partial years. For example, if a sale closes on April 10th, the seller will pay for property expenses - like property taxes and HOA fees - from January 1 through April 9, and the buyer would pick up any expenses beginning April 10. Rental income from a tenant may also be divided between the seller and buyer at closing (i.e. prorated), if the closing occurred sometime other than the end of the month.

When do you pay your mortgage in advance?

Here are a couple of examples: In advance: When you pay your homeowner’s insurance on April 30, you are paying for coverage that will happen in May. In arrears: When you pay your mortgage on April 30, you are paying the principal and interest that already accrued in April.

Can you get a credit for prepaid property taxes?

If a seller has already prepaid her property taxes through some date after the close of escrow, they may receive a credit at closing for a prorated portion of that prepaid amount. In this case, the buyer would be charged the prorated amount at closing.

When can the seller elect the proration method?

C. the seller may elect the proration method on the day of closing.

Which act prescribes closing procedures that must be followed whenever a transaction is closed?

3. The Real Estate Settlement and Procedures Act prescribes closing procedures that must be followed whenever

What does "d" mean in a credit?

D. a debit to one party and a credit to the other.

What is a closing document?

A. document the procedures employed to close a transaction.

What is a prorated expense on a settlement statement?

the buyer must pay the expense. A prorated expense on the settlement statement is. a debit to one party and a credit to the other. The amount a buyer owes at closing is equal to. the excess of the buyer's debits over the buyer's credits.

Why are buyer financing arrangements often concluded at closing?

A buyer's financing arrangements are often concluded at closing, because. the lender wants to ensure proper handling of the. collateral for the loan. According to the Real Estate Settlement and Procedures Act, a uniform settlement statement must be used whenever. the loan is to be sold to FNMA.

When do you need a uniform settlement statement?

According to the Real Estate Settlement and Procedures Act, a uniform settlement statement must be used whenever

What is a sale contract?

A sale contract stipulates that a buyer is to pay the seller's title insurance expenses. This practice is not customary in the area. In this case,

What is the Consumer Financial Protection Bureau?

The Consumer Financial Protection Bureau is a federal agency that helps consumer finance markets work by making rules more effective, by consistently and fairly enforcing those rules, and by empowering consumers to take more control over their economic lives

How many home loans does Ajax write?

AJAX Mortgage Service writes four home loans per year. What type of paperwork must AJAX use?

Do you have to pay prorated expenses on closing day?

the seller must pay prorated expenses inclusive of the day of closing .

Does a loan estimate require insurance?

A: The Loan Estimate states that the loan requires homeowner's insurance on the property, which the consumer may obtain from a company of his or her choice that the lender finds acceptable.

Can a creditor issue a revised loan estimate?

A creditor can issue a revised Loan Estimate

What is the purpose of a settlement statement?

7. A The primary purpose of the settlement statement is to set forth all of the financial details of closing, showing each party's costs and credits. 8.

What is a closing accounting?

A. To provide a detailed accounting of each party's expenses and credits, and the amount each will receive or be required to pay at closing

What is the purpose of title D?

D. To provide the necessary documentation for a proper conveyance of title

Is security deposit prorated at closing?

5. C A security deposit would not be prorated at closing, since it must continue to be held in trust. It would simply be transferred from the seller to the buyer.

Is the origination fee a debit?

9. D Like most charges connected with a new loan, the origination fee is usually a debit for the buyer.

Is a buyer's loan a credit?

1. B The buyer's loan is listed only as a credit for the buyer. The buyer's loan is part of the purchase price already credited to the seller, so it does not appear on the seller's side of the statement.

Is appraisal a debit or credit?

8. B The appraisal is typically required by the buyer's lender, so the fee is ordinarily listed as a debit for the buyer.