Property taxes and HOA fees in condos are the two items most likely to be prorated on a buyer’s settlement statement. The buyer and seller will either be credited or debited for property taxes based on when the closing falls in the tax year.

What is a seller’s settlement statement and why is it important?

The Seller’s Settlement Statement will list the purchase price of the property as well as a few other items like the real estate agent commissions, mortgage loan payoffs, prorated taxes, utilities and escrow fees and anything else associated with the home sale.

What is a buyer’s settlement statement (BSS)?

The Buyer’s Settlement Statement will list the purchase price of the property as well as a few other items like loan costs, prorated taxes, title and escrow fees, homeowner’s insurance, seller credits, and anything else associated with the buyer’s purchase.

What is a settlement statement on a balance sheet?

Like your typical budget balancing sheet, the settlement statement is organized into Debits (expenses) and Credits (deposits or increases) to the account. Other forms might have columns labeled as “Seller Charge” and “Seller Credit,” which mean the same thing.

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is prorated on a settlement statement?

Prorations are credits and debits that show up on the closing statement and are assigned based on which person owned the home at the time the cost occurred. They help make sure the mortgage transaction between the buyer and seller is fair.

What is a prorated item?

Prorated Item means: (A) prepaid cost or expense based on a period of time; or (B) charge or payment based on a period of time of performance or possession under any lease, service Contract, maintenance Contract, marketing or advertising Contract or similar Contract).

What is a prorated item quizlet?

A proration. is a proportionate calculation based on who actually owes an expense for a given period of time. items will be either accrued or prepaid. Accrued expenses.

What is prorating Name 3 items that are likely to be prorated?

Commonly prorated expenses include property tax, homeowners insurance and mortgage interest.Advance and Arrears Payments. Some prorated items, such as homeowners insurance, are paid in advance. ... Items Commonly Prorated. Property tax is the most common prorated expense. ... Credits to Buyer. ... Credits to Seller. ... Charges at Closing.

How do you prorate an item?

For a monthly proration, divide the total amount by the actual number of days in the month to obtain the daily amount. 3. Multiply the daily amount times the seller's number of days of ownership. The result is the seller's pro rata share of the item.

Which of the following items would be prorated at closing?

Mortgage interest, general real estate taxes, water taxes, insurance premiums, and similar expenses are usually prorated at closing.

What is a proration in real estate quizlet?

Prorations. The adjustment of expenses that have either been paid or are in arrears in proportion to actual time of ownership as of the closing or other agreed-upon date.

What are two types of Prorations?

There are two basic proration types used in residential real estate transactions. These two types of proration methods are referred to as LONG proration and SHORT proration. The type of proration used in a transaction is predicated by the Purchase Contract provision regarding real estate taxes.

Which of the following expenses is prorated on a 365 day calendar basis?

Annual dues are prorated using the 365-day method. Because the seller paid the dues in advance, the buyer owes the seller for the unexpired portion of the dues.

What is a prorated example?

In accounting and finance, prorated means adjusted for a specific time period. For example, if an employee is due a salary of $80,000 per year, and they join the company on July 1, their prorated salary for that year would be $40,000.

When an item is prorated between buyer and seller on a settlement statement the closing officer must?

What should appear on the closing statement? * The item must be prorated and recorded as a debit to one party and a credit to the other party for the same amount. If a item to be prorated affects buyer and seller, and no outside party, which of the following statements is true?

What does prorated mean in real estate?

Prorations are credits between the buyer and seller at closing. They ensure that each party is only paying these costs for the time that they owned the home. They will show up as debits or credits on each party's closing statement. Prorations can be for costs such as: Homeowner's association fees.

What is a prorated charge?

Prorated charges are a partial charge for the time between starting the new service and your bill date. Example. If your bill date is the 8th and you add a $10 per month service on November 20, you'll be charged for the time between November 20 and December 8 (your next bill date).

What is prorated refund?

Pro Rata Refund means a refund of the amounts pre-paid to Supplier by Customer for the portion of a Product, or any related costs or expenses, that will not be provided or consumed by Supplier as of the date that Customer is entitled to receive any such refund, calculated (i) for any subscription-based Fees, based on ...

What is pro rate pay?

A prorated salary is when you divide an employee's wages proportionally to what they actually worked. Prorating an employee's salary only applies to salaried workers. Hourly workers don't receive predetermined wages.

What does prorated mean in rent?

When a resident occupies a room for only a partial term (month, week, day, etc.), the amount a owner charges is known as “prorated rent.” Prorated rent is charged only for the number of days the unit is occupied. It's based on a monthly rate rather than daily since a daily rate tends to be pricier.

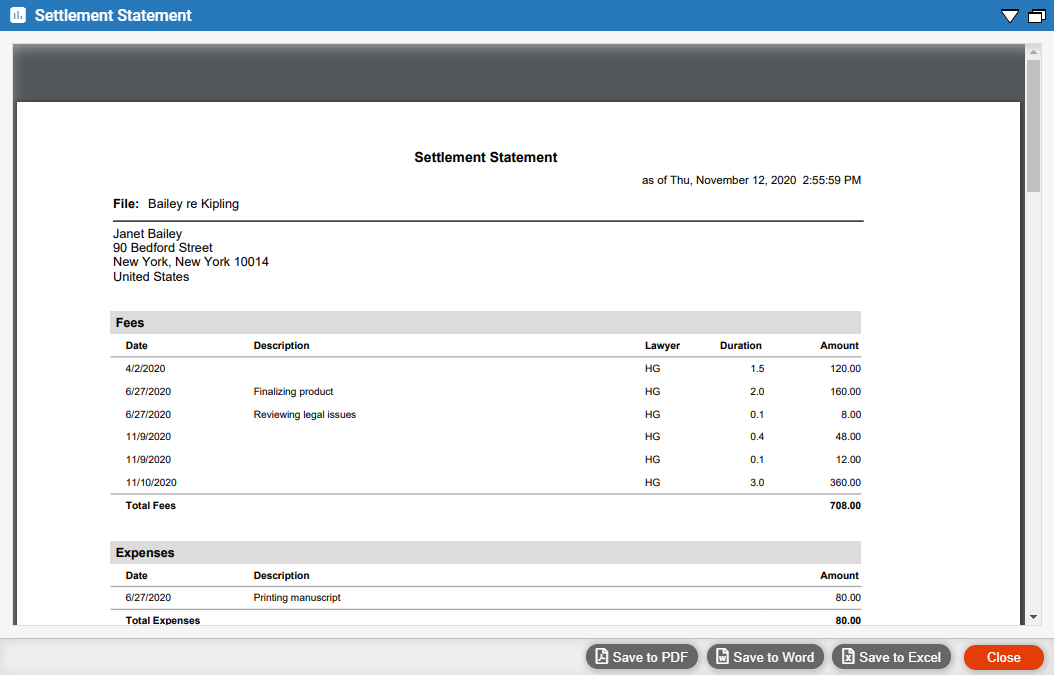

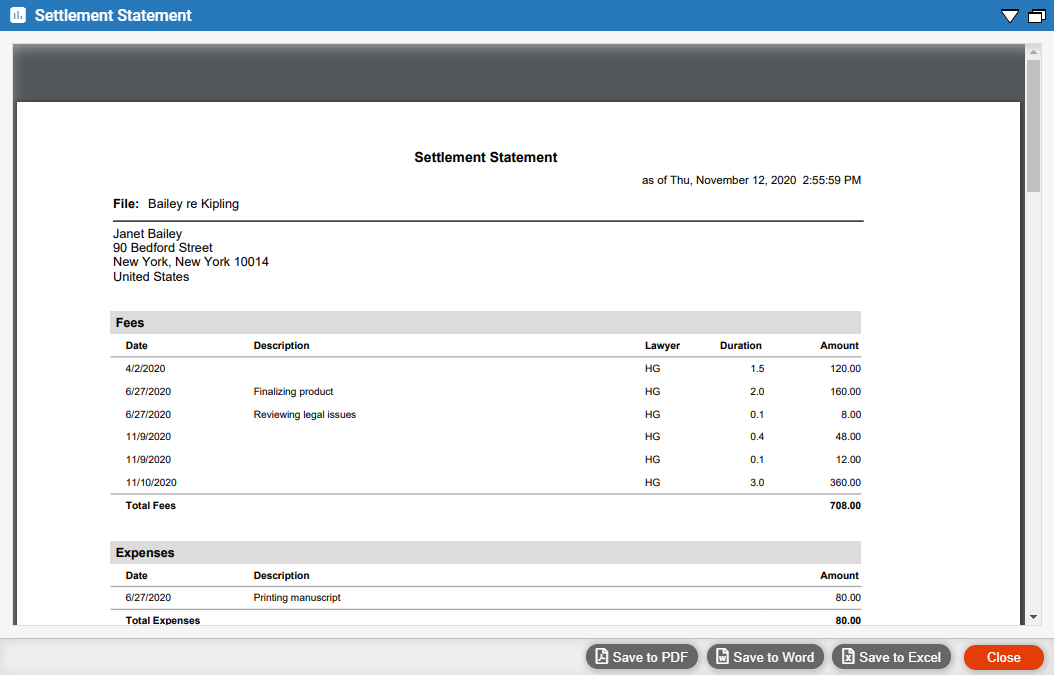

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What is a broker statement?

a statement (in no less than 10-point type) that states the broker's name and licensed by the Bureau of Real Estate.

Who will use the purchase agreement and all the supporting documentation to compile the escrow instructions?

2) The escrow holder will use the purchase agreement and all the supporting documentation to compile the escrow instructions.

What is escrow process?

the process in which a disinterested third party holds all money and documents relating to a transaction until all of the terms and conditions of the escrow instructions have been satisfied.

What is the last page of a residential purchase agreement?

1) The last page of the Residential Purchase Agreement and Joint Escrow Instructions has an acknowledgement for receipt of the signed agreement to be signed by the escrow company .

Can a broker advertise escrow?

A broker cannot advertise that he or she conduct s escrows unless:

What is an annual escrow statement?

with an annual escrow statement which summarizes all charges and credits in the prior 12-month period.

What is an "other item"?

Other items are those expenses that the seller incurred but have not yet been billed for at the time of closing.

What is a loan form?

form provides a means for borrowers to compare loan offers. This form clearly breaks down the costs of the loan, such as the interest rate, mortgage insurance costs, and closing costs

How does proration work in Virginia?

Prorating property taxes adds an additional hiccup. In Virginia, property taxes are paid in arrears semi-annually. So, if a jurisdiction’s property tax bill due date is December 5, 2016, the payment of that bill covers the period from July 1, 2016 to the end of the year. Thus, whether the bill has been paid or not will determine how the proration will be structured. For example, if at the time of closing, the property tax bill has not been paid, then in the above example, the seller will have to credit the buyer from July 1, 2016, to whenever the settlement date is, thus covering the tax payment for the seller’s period of ownership. Practically, the buyer will pay the whole property tax bill when due, but will have already been credited by the seller at closing. Alternatively, if the seller has already paid the property tax bill, then the proration would work in reverse. In other words, the buyer would have to credit the seller from the Settlement Date forward to cover the buyer’s ownership in the property for the balance of the remaining tax period. In our example above, the credit would run from the Date of Settlement to the end of the year.

What is the adjustment paragraph in Virginia real estate?

The “Adjustments” paragraph of the Virginia Residential Real Estate Contract states in relevant part, “ [r]ents, taxes, water and sewer charges, condominium unit owner’s association, homeowners’ and/or property owners’ association regular periodic assessments (if any) and any other operating charges, are to be adjusted to the Date of Settlement. Taxes, general and special, are to be adjusted according to the most recent property tax bill (s) for the Property issued prior to Settlement Date . . .”

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

Can fees be lumped together?

Many tasks fees can be lumped together when one person performs several of them.

When is Prorating Used?

There are many examples of times when a prorated number is required. Let’s review a list of the most common situations.

When is a utility bill prorated?

When a utility company bills for less than a full month of service. When a tenant moves into a rental space mid-month. While there are lots of situations that require prorating numbers, there are also many instances where numbers are not prorated. One of the most common is that of payment of stock dividends.