The short answer is that you can't deduct the medical or disability liens because the settlement income is not taxable. There is an overall tax law principle that tax deductions can be used to reduce your taxable income, but tax deductions can't be used if the income is not taxed in the first place, since there is no tax owed to be reduced.

Full Answer

Can a medical lienholder settle for less than the amount?

It may be possible to persuade a lienholder to settle for less than the lien amount. Your attorney may be able to negotiate a reduced amount with a medical lienholder, but it won’t be like negotiating a personal injury settlement with an insurance company. Medical providers have the right to be paid in full for their services.

How does a medical lien affect a personal injury case?

By perfecting the lien, the healthcare provider guarantees that they will be paid from the personal injury verdict or settlement, first. They come even before the victim, who would be the case’s plaintiff. Payment of medical liens can also create delays in the disbursement of the settlement proceeds.

Can Medicare place a lien on my settlement proceeds?

If Medicare, Medicaid, or the Veterans Administration paid any of your treatment costs related to the accident, they have the right to place a lien on your settlement proceeds. If you haven’t received their notice yet, don’t assume you’re in the clear. Medicaid and Medicare have up to six years to notify you of a lien.

What is a medical lien agreement?

A medical lien, sometimes referred to as a hospital lien, is an agreement between a patient and his or her healthcare provider. The legally binding contract is known as a lien agreement. Liens are most frequently used when the patient has no other way to pay for the care they need after being hurt in an accident.

What is a lien in medical terms?

A medical lien is any demand for repayment for medical services that can be placed against the settlement money paid out in a personal injury case.

How do Medi-cal liens work?

If Medi-Cal pays for your accident-related injuries, it expects the liable party or insurer to reimburse it. The Medi-Cal system automatically creates a lien for the reasonable value of the services it paid for. It's called the Department of Health Care Services (DHCS) Personal Injury Program.

Can Medi-cal take my settlement?

Medi-Cal can't take more than 50% of your settlement. If you fail to notify the government that you're filing a lawsuit, the DHCS can take legal action against you to obtain Medi-Cal reimbursements.

What is a medical lien in Arizona?

Under Arizona law, physicians and other health care providers are entitled to record medical liens for their "customary charges" in treating an injured person. Such liens apply to claims that the injured person may have for damages against the person who caused the injury.

How do you negotiate a Medi Cal lien?

Negotiating Tips for Health Insurance Liens in Personal Injury...Tip #1: Read the Contract. ... Tip #2: Narrow the Claim. ... Tip #3: Reduce for Unrelated and Unreasonable Charges and Obtain Credit for Co-pays. ... Tip #4: Reduce for Actual Recovery of Medical Bills. ... Tip #5: Reduce to the Statutory Cap.More items...•

How long is a medical lien good for in California?

four yearsCalifornia's statute of limitations for medical liens is generally four years after the debtor breaks his/her promise to pay.

Do I have to report a settlement to Medi-Cal?

Medi-Cal recipients are required by law to report to the State's Department of Health Care Services any claims and lawsuits they have filed to recover compensation for their damages in a personal injury action. That report must be submitted within thirty days after a lawsuit is filed.

Does lawsuit settlement affect Social Security benefits?

Generally, if you're receiving SSDI benefits, you typically won't need to report any personal injury settlement. Since SSDI benefits aren't based on your current income, a settlement likely wouldn't affect them. But if you're receiving SSI benefits, you need to report the settlement within 10 days of receiving it.

How are personal injury settlements paid?

When a settlement amount is agreed upon, you will then pay your lawyer a portion of your entire settlement funds for compensation. Additional Expenses are the other fees and costs that often accrue when filing a personal injury case. These may consist of postages, court filing fees, and/or certified copy fees.

How long does a lien last in Arizona?

How long does a judgment lien last in Arizona? A judgment lien in Arizona will remain attached to the debtor's property (even if the property changes hands) for five years.

Do medical liens attach to real property in Arizona?

The lien does not attach to any real or personal property of the injured party. The lien does not attach to any workers' compensation benefits.

Can a hospital put a lien on your house in Arizona?

If you are injured in an accident caused by someone else's negligence, and suffer injuries requiring medical treatment or hospitalization, Arizona law provides hospitals, doctors, or other healthcare providers treating your injuries with the right to file a lien with the county recorder to secure payment of their “ ...

What is an Ahcccs lien?

The purpose of the lien is to recover the cost of AHCCCS benefits provided upon the member's death or upon the sale or transfer of the property.

Is balance billing legal in Arizona?

Patients can only be required to pay in-network costs for these services. The law also prohibits “balance billing” which would leave patients on the hook for covering the difference between the provider's charge and what insurance covers.

What If I Don’t Want My Attorney to Withhold Any Liens?

The law requires your attorney to honor these liens. If they are not paid, both you and your attorney could ultimately be held financially responsible. A failure to pay Medicare liens could result in penalties and interest on top of the amount owed. For a health care lien, your insurance company could refuse to pay future bills for you if it is not satisfied.

Why Does It Take So Long to Negotiate These Liens?

Sadly, there is no time schedule or penalties for an insurance company to respond to a lien. Many do not make it a priority and sometimes the bills paid must be retrieved from years past. Governmental liens such as Medicare and VA benefits are notoriously slow at responding. COVID-19 has made this process even slower. It can take many months and sometimes up to a year to negotiate a lien because of the lack of response. Unfortunately, there is often nothing an attorney can do to speed up this process except to be persistent. And even that does not always work.

Can Lien Deductions Be Reduced?

There is never a guarantee that a lien asserted on an injury settlement can be reduced. However, the Minnesota Personal and Product Liability Injury Attorneys at GoldenbergLaw have over 35 years of experience successfully negotiating the most complicated of settlement liens. We are guided by our experience and expertise and will fight for you to receive as much of your personal injury settlement as possible. We understand the complexities of lien negotiations and will do everything possible to reduce them.

What is a medical lien in Illinois?

A medical lien is a repayment demand that may be claimed against your injury compensation. If you were injured, and if another party paid all or part of your medical expenses – or agreed to withhold billing until you received your recovery – you may have ...

How much of a medical lien is a jury verdict?

When a personal injury victim in this state receives an out-of-court settlement or a jury verdict, a medical lien against that compensation may not exceed forty percent of the total amount. Even with multiple lienholders, medical liens may not exceed forty percent of the recovery amount.

How to file a personal injury lien?

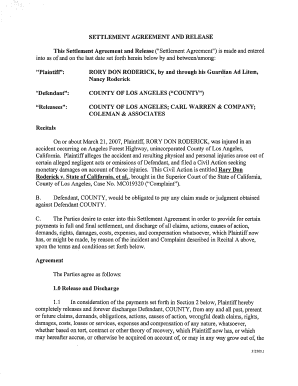

1. It must include the injury victim’s name, address, date of the injury, the healthcare provider’s name and address, and the name of the defendant in the injury victim’s personal injury claim. 2. The lien has to be “served” on both the injured victim and the personal injury defendant. The law requires sending it by certified or registered mail ...

What is the process of subrogation?

When a health insurance company or a healthcare provider seeks to be reimbursed for your medical costs from your personal injury recovery , it is a process known in the law as “subrogation.”

How long does it take to file a subrogation claim in Illinois?

In Illinois, the statute of limitations for a subrogation action is two years. An insurance company or a healthcare provider must file its subrogation claim within two years of the injury date. This is the same amount of time that an injury victim has to file a personal injury lawsuit in this state. If you are injured because of another person’s ...

What happens if you are injured in Illinois?

If you are injured in the state of Illinois because another person was negligent – a careless driver, property owner, or dog owner, for example – it is imperative to put your case immediately in the hands of an experienced Chicago car accident attorney. The injured victims of negligence are entitled under state law to complete compensation ...

What does it mean to get a quick settlement?

A quick settlement also means waiving your right to take further legal action or to seek additional compensation.

Andrew Daniel Myers

Unfortunately your questions give rise to many more questions than answers. Generally speaking your lawyer is correct. The lien is something that has to be paid. If your attorney were to release the money and leave it up you to satisfy, and you didn't pay it, he could end up being responsible for the lien.

Bruce H Murray

Depending on the type of lien, the other party may be on the settlement check. If this is the case, your attorney would not be able to cash the check until the lien is released by the lienholder. Even if you fired your attorney, the insurance company will not release the funds until they have confirmation that the lien has been resolved.

Kelly A. Broadbent

What you suggest is fraudulent conduct, and any person who would let you get away with it would be abetting you.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

How Much Will Medicare Take From My Settlement

A statute involving the Medicare lien requires anyone interested in transferring money to resolve or settle any outstanding personal injury debt. These programs also aim to provide qualified people with medical benefits.

Things To Do To Properly Address Medicare Liens

So finally, the question is what should you do in case of a personal injury settlement and medical treatment through Medicare? There are a few simple things you need to do: 1) Let your attorney know that you received treatment through Medicare, 2) Be prepared to repay Medicare, 3) Be alert to billing items unrelated to your accident, and perhaps most importantly, 4) Start early in addressing these issues..

Medicare Medicaid And Schip Of 2007

MMSEA brought us what is argued to be the most significant and most demanding reporting requirements in the history of Medicare. MMSEA requires that all entities that pay judgments to any personal injury plaintiff report the information to the Centers for Medicare and Medicaid Services .

Do You Have To Accept Whatever Amount Medicare Sends

No you dont. Keep in mind that Medicare is only entitled to reimbursement for the medical care you received as a result of the injuries you suffered in the accident. For instance, if you suffered a broken leg in the accident and then undergo treatment on the leg from January to May, you have to reimburse them for those treatments.

What Part Of My Lawsuit Settlement Can Healthcare Providers Take

After a successful personal injury claim, the injured receives his or her compensation through settlement or judgement. And, the total of all healthcare liens cannot exceed 40% of the total recovery. Furthermore, no single group can receive more than 1/3 of the total recovery. If the total amount of liens exceed 40%, the liens will reduce.

A Guide And Warning For Asbestos Claimants

The Stricker decision shows that insurers, attorneys and their asbestos exposure clients need to use caution when settling mesothelioma claims where there is a possibility that Medicare beneficiaries are included.

Can A Personal Injury Settlement Affect Your Eligibility For Medicare

If you are a Medicare beneficiary and are about to receive a personal injury settlement, your lawyer may have already informed you about issues that will likely arise regarding your eligibility for the program. Without careful settlement planning, you might not comply with Medicares rules and you could lose your benefits.