What is the tax rate on a lawsuit settlement?

What is the tax rate on lawsuit settlements? It's Usually “Ordinary Income” As of 2018, you're taxed at the rate of 24 percent on income over $82,500 if you're single. If you have taxable income of $82,499 and you receive $100,000 in lawsuit money, all that lawsuit money would be taxed at 24 percent.

Does money paid in a legal settlement get taxed?

The settlement money is taxable in the first place; If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Are lawsuit settlements considered taxable?

There can be a possibility that there is more than one type of damage claim that may arise from an injury. Some may be taxable while others are not. Lawsuit settlements are generally considered taxable income by the IRS. However, not all settlement payments are taxed the same way.

Do I have to pay taxes on a law suite settlement?

The tax treatment of a lawsuit settlement will depend on the type of lawsuit and the amount of money you received. In most cases, you will have to pay taxes on the money you receive. It is important to consult your lawyer and the IRS tax office before determining how much you can claim.

Are legal settlements tax deductible for individuals?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

What type of legal settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Are settlement fees tax deductible?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is “no.” The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

How do legal settlements avoid taxes?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Do you issue a 1099 for a legal settlement?

Forms 1099 are issued for most legal settlements, except payments for personal physical injuries and for capital recoveries.

What kind of legal fees are tax deductible?

Employment Discrimination Cases You may deduct 100% of the attorneys' fees you incur as a plaintiff in certain types of employment-related claims. These include cases where you're alleging unlawful discrimination, such as job-related discrimination on account of race, sex, religion, age, or disability.

What closing expenses are tax deductible?

Tax-deductible costs may include: Upfront and annual mortgage insurance premiums paid on a loan insured by the Federal Housing Administration (FHA) Funding fees charged for a loan guaranteed by the U.S. Department of Veterans Affairs (VA)

Are punitive damages deductible?

Punitive damages are not excludable from gross income under IRC § 104(a)(2). With the enactment of SBJPA, Public Law 104 -188, Section 1605(a) in 1996, Congress made it clear in IRC § 104(a)(2) that punitive damages are taxable, regardless of the nature of the underlying claim.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Are compensatory and punitive damages taxable?

In California & New York, punitive damages can be subject to taxation by both the state and the IRS. Because punitive damages are taxable and compensatory damages are not, it's critical to be meticulous in distinguishing each classification of damages that you're awarded in a personal injury claim.

Do you pay taxes on class action lawsuit settlements?

Oftentimes, the nature of a class action suit determines if the lawsuit settlement can be taxable. Lawsuit settlement proceeds are taxable in situations where the lawsuit is not involved with physical harm, discrimination of any kind, loss of income, or devaluation of an investment.

Is the roundup settlement taxable?

Do You Have to Pay Taxes on Roundup Settlement Checks? No. With a few exceptions, settlements in personal injury lawsuits are not taxable as income. So you do not pay taxes on your Roundup settlement check.

What is a limitation to deduction?

When we talk about the limitation to the tax deduction we mean the things that you might think or may imagine will be considered part of business’ expenses but are not considered the expenses by the legislation. So, in a legitimate business, you have to be careful of such thing so that you are not burdened with more load regarding taxes than you imagine.

What is a lawsuit settlement?

A lawsuit settlement is when two different parties settle their case on an agreeable situation or payment. Mostly in such cases, one of the parties has to pay the other party a settlement amount to close the case legally. If you are new to the business side of the industry you will need to learn how to do your taxes and what things can lead to a deduction of taxes, even in such cases you have to know your limitations as to what extent tax can be deducted, and are lawsuit settlements tax deductible? You cannot expect your business tax to be deducted from a personal lawsuit because that is a personal matter, but if you are paying a business settlement there can be a chance of tax being deducted for that.

Can you deduct lawsuit settlements?

If you know the limitations to these things and are well aware of what things can increase the deduction you will have to pay a small amount of tax only in such a crisis. Any expenses of the business can help you in tax deduction and lawsuit settlements are one of the business’s expenditures just like the office rent is. So, this is the most understandable example of tax deduction due to lawsuit settlement.

Is personal business expense a business expense?

As we know personal business is one of these things that are not to be mixed in your business and such expenses will never be considered part of your business expenses. Similarly, if the company is facing a lawsuit because of any employee or even the owner of a business, then money spent on them will never be considered a business expense but it will always be a personal expense. This is why any such settlements will not cause the deduction in the taxes.

Can you deduct business taxes from a personal lawsuit?

You cannot expect your business tax to be deducted from a personal lawsuit because that is a personal matter, but if you are paying a business settlement there can be a chance of tax being deducted for that.

Do business taxes increase or decrease?

Usually, when it comes to the business taxes, they are to be paid from the profit you have earned. Similarly, the tax will increase or decrease according to some loss or profit in your business. For the tax payments, your entire inventory is scanned for the very same reasons. If anything bad happens to your business that results in less profit, then it will eventually reduce the tax.

Is a settlement considered a company's expense?

If the lawsuit is against the whole business based on any kind of services, then the settlement will be considered as the company’s expenses. Even if you claim this as the company’s lawsuit it will be up to the decision of legislation as to what this lawsuit will be labeled as.

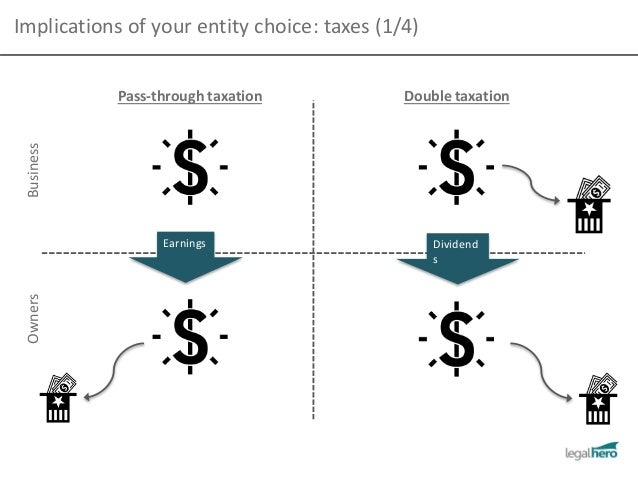

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What is compensatory damages?

For example, in a car accident case where you sustained physical injuries, you may receive a settlement for your physical injuries, often called compensatory damages, and you may receive punitive damages if the other party's behavior and actions warrant such an award. Although the compensatory damages are tax-free, ...

What happens if you get paid with contingent fee?

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Do you have to pay taxes on a 1099 settlement?

Where many plaintiff's 1099 attorneys now take up to 40% of the settlement in legal fees, the full amount of the settlement may need to be reported to the IRS on your income tax. And in some cases, you'll need to pay taxes on those proceeds as well. Let's look at the reporting and taxability rules regarding legal settlements in more detail as ...

Is money from a lawsuit taxed?

Taxation on settlements primarily depends upon the origin of the claim. The IRS states that the money received in a lawsuit should be taxed as if paid initially to you. For example, if you sue for back wages or lost profits, that money will typically be taxed as ordinary income. If you receive a settlement allocations for bodily personal physical ...

How much are startup costs deducted?

Startup costs are deducted in one of two ways. The costs for creating or buying a business can be deducted, up to $5,000 in the business’s first year . Remaining startup costs must be amortized over time. This includes the costs associated with creating legal documents or paying state incorporation fees.

How Much Can You Deduct?

After getting the answer to the question “are business legal expenses tax deductible?”, most people want to know how much they can deduct from their business taxes.

Can You Deduct Tax Preparation Fees?

Yes, you can write off tax preparation fees for your business. Keep in mind that you’ll need to keep your business return and your personal return separate.

What are legal fees for businesses?

These include: Attorney fees, court costs, and similar expenses related to the production or collection of taxable income.

What are legal expenses?

As mentioned earlier, any personal legal expenses, even if tangentially related to the business, are not tax-deductible. These include things like: 1 Legal fees related to child custody or divorce 2 Residential real estate sales or purchases 3 Creating or reviewing contracts for individuals 4 Estate planning 5 Personal income tax preparation 6 Legal fees related to immigration of family members or others who are not employees of the business

What is personal income tax preparation?

Personal income tax preparation. Legal fees related to immigration of family members or others who are not employees of the business. Don’t risk an audit by trying to deduct legal fees that aren’t related to your business.

What are business immigration expenses?

Business immigration expenses (if you are moving an employee to the US from abroad) Legal fees to file for bankruptcy (of the business, not personal bankruptcy) Attorney fees paid for filing lawsuits and defending the business in any lawsuits. Business tax fees. Fees related to whistleblower claims.

What was eliminated in the new tax law?

It eliminated not only personal legal fees, but also unreimbursed employee expenses that exceeded 2% of the taxpayer’s adjusted gross income (AGI). 1 Several other miscellaneous fees were also eliminated.

What are legal fees?

You can only deduct a handful of personal legal fees under current tax law. They include: 1 Legal fees in employment discrimination cases (where the you as the taxpayer are the plaintiff): The deduction is limited to the total amount of the your gross income. 2 Claims against the federal government for damage to property: If you are a deployed soldier and your home is damaged while you are gone, you can sue Uncle Sam for damages. 3 Whistleblower rewards: Say you report a person or business for tax fraud or evasion. If that person or business is caught, then you will be paid a percentage of the amount that was evaded. This deduction is limited to the amount that you are paid.

What is tax advice?

Defending any patent, trademark or copyright claims. Tax advice for your business is usually tax-deductible, unlike fees for personal tax guidance.

Can you deduct personal legal fees?

Personal Legal Fees You Can Deduct. You can only deduct a handful of personal legal fees under current tax law. They include: Legal fees in employment discrimination cases (where the you as the taxpayer are the plaintiff): The deduction is limited to the total amount of the your gross income.

Can you deduct legal fees on taxes?

You can only deduct a handful of personal legal fees under current tax law . They include:

Is tax advice tax deductible?

Tax advice for your business is usually tax-deductible, un like fees for personal tax guidance.

Is legal fees deductible in 2017?

Eliminating most itemized deductions in 2017 precluded the possibility of deducting legal fees for any type for personal litigation. There are a few exceptions, but most legal fees that are incurred for personal reasons are now nondeductible.

Why do you capitalize lawsuits?

For example, if a lawsuit arises because a plaintiff challenges the validity of a merger transaction, such expenses incurred in defending the lawsuit must be capitalized because the claim is rooted in the acquisition of a capital asset. If, however, the plaintiffs allege that securities law violations by the board of directors harmed the value ...

Is defending a lawsuit tax deductible?

Background. Like the cost of office equipment and rent, the costs associated with defending a lawsuit are generally considered costs incurred in the ordinary course of business and are, therefore, tax deductible. Not all lawsuits and legal costs are treated equally. Court cases and legislation have narrowed the scope of what is, and what is not, ...

Can a company deduct legal expenses?

No company welcomes a lawsuit with open arms, but knowing that related expenses are generally deductible can be comforting as legal bills start to multiply. Companies must be aware of the limitations of writing off legal expenses, damages, and settlements so that they can take full advantage of the deduction on their next tax return. To fully assess your situation, it is always best to consult a professional regarding available tax deductions for costs incurred in litigation.

Is legal fees deductible?

Any legal fees or court costs incurred will be deductible as well as the cost of resolving the suit , whether the company pays damages to the plaintiff or agrees to settle the dispute. Moreover, if a company is defending itself against the government, any damages characterized as remedial or compensatory are deductible.

Is a lawsuit deductible for a company?

Any lawsuit a company faces is disruptive to business. The costs associated with hiring attorneys, defending a case, and paying for damages or a settlement can be exorbitant, and damage a company’s profitability. The good news is these payments are generally tax deductible business expenses. In order to maximize this deduction, however, companies ...

Is a fine deductible in a settlement agreement?

The characterization of such damages in the settlement agreement is critical. Fines and punitive and penal damages are not deductible. Consult a tax attorney when it comes to negotiating any settlement agreement to ensure that the desired tax treatment of costs is baked into the agreement.

Is a lawsuit deductible if it does not stem from a business activity?

This decision serves as a reminder to businesses that being a named defendant alone is not enough; if a lawsuit does not stem from a business activity, the legal fees and settlement expenses will not be deductible. Know Your Limits.

What is the tax consequences of a settlement?

Takeaway. The receipt or payment of amounts as a result of a settlement or judgment has tax consequences. The taxability, deductibility, and character of the payments generally depend on the origin of the claim and the identity of the responsible or harmed party, as reflected in the litigation documents. Certain deduction disallowances may apply.

How is proper tax treatment determined?

In general, the proper tax treatment of a recovery or payment from a settlement or judgment is determined by the origin of the claim. In applying the origin-of-the-claimtest, some courts have asked the question "In lieu of what were the damages awarded?" to determine the proper characterization (see, e.g., Raytheon Prod. Corp., 144 F.2d 110 (1st Cir. 1944)).

What is the exception to restitution?

The restitution exception applies only if (1) a court order or settlement identifies the payment as restitution/remediation or to come into compliance with law (identification requirement) and (2) the taxpayer establishes that the payment is restitution/remediation or to come into compliance with law ( establishment requirement).

What is the burden of proof for IRS?

The burden of proof generally is on the taxpayer to establish the proper tax treatment. Types of evidence that may be considered include legal filings, the terms of the settlement agreement, correspondence between the parties, internal memos, press releases, annual reports, and news publications. However, as a general rule, the IRS views the initial complaint as most persuasive (see Rev. Rul. 85-98).

Is a claim for damages deductible?

For example, a claim for damages arising from a personal transaction may be a nondeduct ible personal expense. A payment arising from a business activity may be deductible under Sec. 162, while payments for interest, taxes, or certain losses may be deductible under specific provisions of the Code (e.g., Sec. 163, 164, or 165). Certain payments are nondeductible (as explained further below), and others must be capitalized, such as when the payer obtains an intangible asset or license as a result of asettlement.

Is a settlement taxable income?

For a recipient of a settlement amount, the origin-of-the-claimtest determines whether the payment is taxable or nontaxable and, if taxable, whether ordinary or capital gain treatment is appropriate. In general, damages received as a result of a settlement or judgment are taxable to the recipient. However, certain damages may be excludable from income if they represent, for example, gifts or inheritances, payment for personal physical injuries, certain disaster relief payments, amounts for which the taxpayer previously received no tax benefit, cost reimbursements, recovery of capital, or purchase price adjustments. Damages generally are taxable as ordinary income if the payment relates to a claim for lost profits, but they may be characterized as capital gain (to the extent the damages exceed basis) if the underlying claim is for damage to a capitalasset.

Is a settlement deductible?

For both the payer and the recipient, the terms of a settlement or judgment may affect whether a payment is deductible or nondeductible, taxable or nontax able, and its character (i.e., capital or ordinary). In general, the taxpayer has the burden of proof for the tax treatment and characterization of a litigation payment, ...

What is a tax deductible item?

Tax deductible items are expenses that can be subtracted from adjusted gross income so as to reduce the net taxable income. These allowable deductions are useful to the defendant, who may be forced to make disbursements in favor of the plaintiff, since tax deductible items have the effect of reducing the defendant’s tax burden. Are lawsuit settlements deductible? The answer to this question hinges on the nature of the settlement and the damages awarded to the plaintiff in a court of law.

What is tax treatment for consumers?

Tax Treatment for Consumers. Tax treatment for consumers may be examined by taking the example of a divorce settlement. The payor is allowed a tax deduction for spousal support, for mortgage payments, insurance premium and real estate taxes paid as alimony in lieu of the home owned by the ex-spouse.

Is alimony taxable income?

Alimony is a tax-deductible expense as far as the payor is concerned while it is taxable income for the pay ee. Hence, the payee prefers a structured settlement, that reduces income tax payable, as compared to a lump sum. This brings us to the issue of the taxability of lawsuit settlements for a payee. Hopefully, the above article has answered the ...

Is a payment made by a defendant a reasonable expense?

Payments that are made by the defendant are tax deductible, provided they can be classified as reasonable, ordinary, and necessary business expenses. Expenses, that are required for producing income, may be tax deductible or the payor may have to capitalize and deduct these costs over time.

Is punitive damages deductible?

The opponents of this proposal believe that since tort abuse has escalated, the deductibility of punitive damages as ordinary and necessary business expense is one of the few relief measures available to business owners who may be required to dispense with payments that have no upper limit.

Is a corporation's expense deductible?

Tax Treatment for Corporates. The payor’s expenditure may be classified as deductible, capitalized, non-deductible, or non-capitalized expenditure. While the entire amount of deductible expenses can be subtracted from gross income, capitalizing expenses results in writing-off the amount of expenditure over an extended period of time.

Is understanding tax obligations complicated?

Hopefully, the above article has answered the query to the satisfaction of the reader. Understanding tax obligations can be complex and it’s definitely not the layman’s cup of tea. Hence, it would be prudent to consult an expert on law and taxation for further details in this regard.