No taxable gain or loss is recognized. Divorce lawyers will help couples understand what part of the settlement is taxable. The IRS has specific rules in place to prevent property settlements from qualifying for tax benefits.

How does a divorce settlement affect my taxes?

If your divorce settlement happened before 2019, then these changes will not affect you unless you specifically request to modify it. Under the old law, alimony was considered taxable income by the person receiving it and could be deducted by the person paying it. This put the biggest tax burden on the person receiving the alimony.

Does division apply to individual property in a Wisconsin divorce?

No. Under Wisconsin divorce laws, property division applies to "marital" property, but not "individual" property. (Wis. Stats. § 766.31.)

Is spousal support from a divorce settlement taxable?

This is not to be confused with alimony, also known as spousal support, which is taxable (and deductible) unless the settlement stipulates otherwise. In certain cases, a settlement will require an asset transfer and a lump sum alimony payment rather than monthly payments; in this case, the alimony would be taxable.

Are retirement accounts subject to distribution in a Wisconsin divorce?

Note also that Wisconsin marriage property laws require the couple to complete standardized forms that provide the court with a complete disclosure of all their property, as well as their debts and liabilities. (Wis. Stats. § 767.127.) Are Retirement Accounts Subject to Distribution? Yes. Retirement accounts are considered marital property.

Is money received in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

How does a divorce settlement affect taxes?

The typical agreement in a final decree for divorce provides that for each year of marriage, both parties are equally responsible for any federal income tax liability, and both parties are entitled to one-half of any federal income tax refund for any year of marriage.

Is separation settlement taxable?

Support funds made in entirely one payment are also neither taxable nor tax deductible. Whatever the couple agrees to should be formally written into a separation agreement that should be looked over by each party's independent legal counsel.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

How do I avoid capital gains tax in a divorce?

Primary Residence If you sell your residence as part of the divorce, you may still be able to avoid taxes on the first $500,000 of gain, as long as you meet a two-year ownership-and-use test. To claim this full exclusion, you should make sure to close on the sale before you finalize the divorce.

Who pays capital gains in divorce?

Property Settlements When this occurs and the property has increased in value since the time of the divorce, the seller may owe capital gains taxes based on the value of the property at the time of acquisition.

Is transfer of property in a divorce taxable?

Unlike transfers between spouses where attribution may cause the future income or capital gains to be taxed back to the transferring spouse, transfers to a former spouse may be exempt from the attribution rules. The attribution rules do not apply after divorce.

Should I file divorced or single?

Divorced or separated taxpayers who qualify should file as a head of household instead of single because this status has several advantages: There's a lower effective tax rate than the one used for those who file as single.

How does IRS know if you are divorced?

Hidden assets, undisclosed income and other facts will always become exposed in a divorce proceeding because of the required “forensic audit.” These facts are collected and reported by forensic accountants to property determine the value of all the income and assets for “equitable distribution.” But, the Judge is ...

Is lump sum spousal support taxable?

Lump sum payments are generally not taxable, unless they are made to bring overdue periodic payments up to date or are specifically ordered as retroactive payments. Therefore, lump sum payments may also be useful for the recipient's tax purposes.

Who pays Capital Gains Tax in a divorce?

If you and your spouse sell your house at the time you're getting divorced, the capital gains tax applies. But you're entitled to exclude a total of $500,000 of gain from tax if you lived there for two of the five years before the sale.

Are divorce expenses tax deductible in 2020?

So, can you deduct divorce attorney fees on your taxes? No, unfortunately. The IRS does not allow individuals to deduct any costs from: Personal legal advice, which extends to situations beyond divorce.

When do you have to file taxes if you divorced?

Once your divorce is finalized, you are considered unmarried for the entire year of your divorce, this includes if you get divorced on December 31 st. If your divorce is not finalized by December 31 st, you will have to file your taxes as married filing jointly or married filing separately.

Which parent can claim the child or children for the dependency exemption and take the applicable tax credits offered to parents?

Which parent can claim the child or children for the dependency exemption and take the applicable tax credits offered to parents? Generally, the parent with primary placement of the child (ren) may claim the child (ren) on their tax return. However, parties can negotiate who can claim the exemption in divorce cases or the court can order the same. It is imperative to include in the Marital Settlement Agreement an award of how each party shall claim the child (ren) on their respective tax returns.

Why is it important to speak with an attorney before a divorce?

Because each divorce is unique, it may be important to speak with an attorney or a tax professional to best address the tax consequences of your proposed divorce agreement before finalizing your divorce. If you are getting a divorce and have questions regarding the tax consequences of the issues outlined above, ...

Do I have to pay taxes on assets awarded to me in my divorce?

Do I have to pay taxes on assets awarded to me in my divorce? A property transfer between divorcing spouses does not create any additional tax liabilities, if it is ordered in the divorce decree.

Can you claim a child exemption in divorce?

However, parties can negotiate who can claim the exemption in divorce cases or the court can order the same. It is imperative to include in the Marital Settlement Agreement an award of how each party shall claim the child (ren) on their respective tax returns.

Is child support taxable income?

Do I have to report child support as income? Child support payments are not deductible by the paying parent or taxable to the parent receiving the child support.

Is maintenance taxed after divorce?

tax consequences of maintenance. , tax considerations in divorce. Filing one’s taxes during or immediately after a divorce can be especially challenging. Before your divorce is finalized, there are a few tax considerations that should be addressed. Addressing these issues prior to finalizing your divorce will help ease the transition ...

What is considered marital property in Wisconsin?

Wisconsin is a community property state, meaning that marital property is under concurrent ownership. Even each spouse’s earnings are considered marital property in a divorce. Property that was acquired by a spouse before the marriage is still considered marital property, but the court has discretion over whether that property may remain with that spouse. For example, a home that a spouse owned before the marriage will be deemed marital property, whether the owner put the other spouse’s name on the house or not. The court can decide whether to give that spouse a credit for their premarital share. Property that is inherited or gifted to a spouse from a third party may also be categorized as separate property where it has remained separate and not comingled with marital property.

What happens to a spouse after divorce?

When spouses decide to divorce, child custody, placement schedules, and what will happen to the marital home become serious considerations. Maintenance (formerly called Alimony) and division of joint banking accounts and other assets also become a priority. One issue many couples fail to thoroughly discuss, however, is how the federal tax code will impact decisions made both during and after a divorce.

Can you transfer property to a former spouse?

The transfer of property between divorcing spouses typically does not provide for taxable gain or gift tax liability. An estate tax marital deduction is not permitted for transfers to a former spouse.

Is maintenance taxable in divorce?

Maintenance ( formerly known as Alimony) payments are typically deductible by the payer and taxable to the recipient. Maintenance does not include child support or property settlements. Spouses may spend a fair amount of time arguing as to whether a property settlement or an award of maintenance should be ordered in the divorce. In some cases, the paying spouse must take out life insurance and name the ex-spouse as the beneficiary to ensure that any remaining obligations are met after the payer’s death.

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

What is equitable distribution?

As a result, equitable distribution refers to a fair, but not strictly equal, division of marital assets.

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Is spousal support taxable?

This is not to be confused with alimony, also known as spousal support, which is taxable (and deductible) unless the settlement stipulates otherwise.

Do you have to accept the divorce?

Irrespective of how you feel about it, the fact remains that you agreed to the divorce and must accept the obligations that come with it.

Who is responsible for proving the presence of property in divorce?

It is the responsibility of the divorced parties to recognize and prove the presence of properties.

1 attorney answer

Alimony or maintenance (as it is referred to in Wisconsin) payments are normally deductible for tax purposes by the payor (herein, your husband) and includible in the payee's (your) income under the Internal Revenue Code (IRC), Section 71. If structured properly, such payments do not have to be taxable or deductible for either party.

Jean M. Kies

Alimony or maintenance (as it is referred to in Wisconsin) payments are normally deductible for tax purposes by the payor (herein, your husband) and includible in the payee's (your) income under the Internal Revenue Code (IRC), Section 71. If structured properly, such payments do not have to be taxable or deductible for either party.

When will tax reform change for divorce?

In 2017, sweeping tax reform laws were passed. Some of those changes have taken longer than others to go into effect. If your divorce settlement happened before 2019, then these changes will not affect you unless you specifically request to modify it.

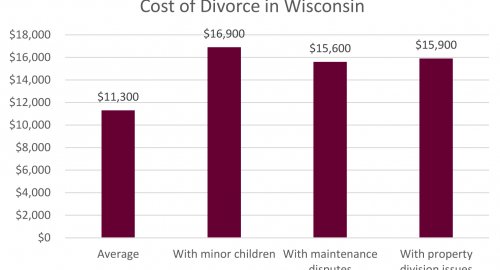

How much does Susan pay in taxes?

Because that is the only income she earned, that puts Susan in the 22% income bracket (see the highlighted section in blue below). Therefore, Susan pays 22% ($16,500) in taxes.

How much alimony does John have to pay?

John earns $350,000 a year and Susan is a stay-at-home parent. John is ordered to pay $75,000 in alimony per year. Note: Our examples use the 2020 tax bracket.

How much tax is John liable for?

The New Law – Marriages Settled After Jan. 1, 2019. In the new law, John is liable to pay income tax on the $75,000 alimony payment. Because John’s annual income of $350,000 puts him in the 35% tax bracket, he would have to pay an estimated $26,250 in taxes (see the tax bracket section below). He cannot deduct this from his income.

Can you use alimony to contribute to retirement?

If you are receiving alimony under the new rules, there’s one additional thing to consider. Under the updated tax laws, you can no longer use alimony payments to contribute to a retirement account.

Is alimony taxable income?

Under the old law, alimony was considered taxable income by the person receiving it and could be deducted by the person paying it. This put the biggest tax burden on the person receiving the alimony. The new law flips that. Now, the spouse paying alimony must pay income taxes on it, and the person receiving it does not pay taxes on it ...

Does Susan have to pay taxes on alimony?

When Susan receives the $75,000 alimony payment, she does not have to pay income tax on it.

What is the definition of marital property in Wisconsin?

The law presumes that all property the couple acquire after the "determination date" is marital property. In most cases the determination date is the date of the marriage. (Wis. Stats. § 766.01.) And under Wisconsin marital property law, each spouse has a one-half interest in each marital asset, no matter whose name is on the title.

Why do non-owner spouses get their share of the retirement plan?

Stats. § 766.62.) Because most divorces occur before retirement plans are in payout status, the typical means of providing non-owner spouses with their share of the account is to award those spouses a greater portion of other marital assets to balance the scales.

Do Courts Take Debts Into Account When Dividing Property in Wisconsin?

Absolutely. In fact, in cases where there's not much property, dividing debts is often the main issue. Wisconsin law presumes that an obligation (debt) a spouse acquires during the marriage is incurred in the interest of the marriage or the family.

Is All Property Subject to Distribution?

No. Under Wisconsin divorce laws, property division applies to "marital" property, but not "individual" property. (Wis. Stats. § 766.31.) The term "property" encompasses pretty much everything the couple own, such as a house, cars, bank accounts, stocks, furniture, art, and so on. Income earned during the marriage is also considered marital property.

Are Retirement Accounts Subject to Distribution?

Yes. Retirement accounts are considered marital property. Depending on the type of retirement plan, calculating the account's value can be tricky. Defined contribution plans, such as 401 (k)s, are relatively easy to value. But the value of defined benefit pension plans aren't as clear-cut, and will probably require hiring an actuary to determine the dollar amount subject to distribution.

What is separate property?

Individual property (sometimes referred to as "separate" property) consists of assets a spouse owned before the marriage. It also includes whatever a spouse received as an inheritance or a gift (from someone other than the other spouse) at any time, including during the marriage.

Can a non-owner spouse become marital property?

There's another way in which individual property can become marital property. It could happen when non-owner spouses contribute substantial labor, or physical or intellectual skills, to the individual property. A non-owner spouse's efforts in growing the other spouse's business might fall into this category.

When is property transfer incident to divorce?

A property transfer is incident to your divorce if the transfer: Occurs within one year after the date your marriage ends, or Is related to the ending of your marriage. If it is a division of the marital estate it is NOT taxable -- it was already yours in the first place.

Can you transfer your spouse to your divorce?

Your former spouse, but only if the transfer is incident to your divorce.

Is property settlement taxable?

If it is a division of the marital estate it is NOT taxable -- it was already yours in the first place.

The Division of Marital Property in Wisconsin

- In a divorce, all property—which includes both assets and debts—must be divided. Typically, any property that is acquired after the parties marry is clearly marital property. Wisconsin is a community property state, meaning that marital property is under concurrent ownership. Even each spouse’s earnings are considered marital property in a divorce. Property that was acquired …

Is One Spouse Hiding Property?

- Any transfer of propertythat occurs before or during a divorce will come under scrutiny by the courts. Since some spouses may sell or transfer property without any dishonest intentions, courts typically ask the following questions about the transaction: 1. Was consideration exchanged for the property? 2. How big was the property in comparison to the spouse’s total wealth? 3. At wha…

Specific Tax Concerns

- The transfer of property between divorcing spouses typically does not provide for taxable gain or gift tax liability. An estate tax marital deduction is not permitted for transfers to a former spouse. Under relevant laws, a transfer of property will be considered as part of a divorce if it occurs no later than one year after the marriage ended and is noted in a divorce or separation order.

Alimony/Maintenance

- Maintenance (formerly known as Alimony) payments are typically deductible by the payer and taxable to the recipient. Maintenancedoes not include child support or property settlements. Spouses may spend a fair amount of time arguing as to whether a property settlement or an award of maintenance should be ordered in the divorce. In some cases, the pa...