Are EEOC settlements taxed? Yes, settlements for employment discrimination are considered taxable. What happens when the EEOC determines that an employer is guilty?

Are employment discrimination settlements taxable?

TAXABILITY OF SETTLEMENTS IN EMPLOYMENT DISCRIMINATION CASES. Proceeds from a settlement involving an employment-related discrimination case may be taxable to the employee under some circumstances and not taxable in others.

Do you have a lawsuit with the EEOC?

The EEOC currently has a number of on-going lawsuits and settlements of lawsuits. We are looking for people who may have been affected by the unlawful discrimination alleged in these suits.

Do you have to pay taxes on a settlement?

Tax Implications of Settlements and Judgments The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

Which proceeds from a personal injury settlement are taxable?

Emotional distress, pain or suffering not resulting from a physical injury; and Punitive damages. It is important to know which proceeds are taxable since the worth of a settlement may depend heavily on whether that settlement amount will be decreased by the payment of income taxes.

Is a settlement from EEOC taxable?

Because the entire settlement — including attorneys' fees — will generally be income to the claimant, the full amount must be reported as paid to the claimant. This may be done with Forms W-2, 1099-MISC, or both, depending on the character of the payments (i.e., taxable wages or other income).

What type of legal settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Are damages for discrimination taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes.

How can I avoid paying taxes on a settlement?

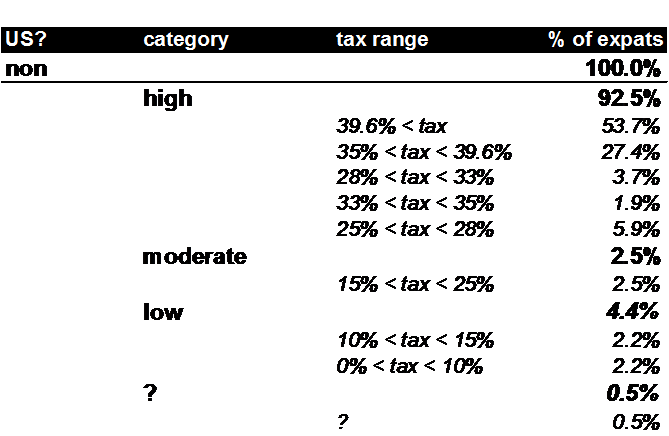

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

Do you pay tax on a settlement agreement?

Settlement agreements (or compromise agreements as they used to be called), usually involve a payment from the employer to the employee. Such payments can attract income tax or national insurance contributions – but they can also sometimes rightly be paid tax free.

Are legal settlements paid tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Is a racial discrimination settlement taxable?

According to Revenue Ruling 93- 88, compensatory damages, including back pay, received in satisfaction of a claim of racial discrimination under 42 U.S.C. section 1981 and Title VII of the Civil Rights Act of 1964 are excludable from gross income, even if the only damages received are back pay.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

How can you avoid paying taxes on a large sum of money?

Research the taxes you might owe to the IRS on any sum you receive as a windfall. You can lower a sizeable amount of your taxable income in a number of different ways. Fund an IRA or an HSA to help lower your annual tax bill. Consider selling your stocks at a loss to lower your tax liability.

Are legal settlements 1099 reportable?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Are compensatory and punitive damages taxable?

In California & New York, punitive damages can be subject to taxation by both the state and the IRS. Because punitive damages are taxable and compensatory damages are not, it's critical to be meticulous in distinguishing each classification of damages that you're awarded in a personal injury claim.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

What happens if the agency does not respond to the appellant?

If the agency has not responded to the appellant, in writing, or if the appellant is not satisfied with the agency's attempt to resolve the matter, the appellant may appeal to the Commission for a determination as to whether the agency has complied with the terms of the settlement agreement or final decision.

How long does an appellant have to sign an employment agreement?

Federal law provides that the appellant may have 21 days from receipt of the agreement to review and consider this agreement before signing it. The appellant further understands that he/she may use as much of this 21-day period as he/she wishes prior to signing and delivering this agreement. Federal law further provides that the appellant may revoke this agreement within seven (7) days of the appellant's signing and delivering it to the agency. Federal law also requires us to advise the appellant to consult with an attorney before signing this agreement. Having been informed of these rights, and after consultation with his/her counsel, appellant waives these rights. [ADEA Clause]

Do you have to disclose the fact of settlement?

Except as may be required under compulsion of law, the parties agree that they shall keep the terms, amount, and fact of settlement strictly confidential and promise that neither they nor their representatives will disclose, either directly or indirectly, any information concerning this settlement (or the fact of settlement) to anyone, including but not limited to past, present, or future employees of the agency who do not have a need to know about the settlement. Employees who have a need to know about the settlement include [Names].

Is there discrimination against an appellant?

that there shall be no discrimination or retaliation of any kind against the appellant as a result of filing this charge or against any person because of opposition to any practice deemed illegal under [the Rehabilitation Act, the ADEA, or Title VII], as a result of filing this complaint, or for giving testimony, assistance or participating in any manner in an investigation, proceeding or a hearing under the aforementioned Acts.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

How much did the employee receive in the settlement?

In a settlement, the employee agreed to receive $175,000 and the settlement agreement noted that it was for emotional distress and not for wages-likely an attempt to ensure that it would not be taxable.

What is non taxable settlement?

Non-taxable settlement amounts: Medical expenses associated with medical distress; Emotional distress, pain or suffering resulting from a physical injury; Personal injury or sickness; and. Legal costs associated with the case.

How long did the employee get fired for an altercation with a supervisor?

She took leave from work while being treated by a therapist to emotionally recover from stress allegedly caused by this altercation. Ten months after the altercation (eight months of which were spent on leave) she was terminated by her employer. In a settlement, the employee agreed to receive $175,000 and the settlement agreement noted that it was for emotional distress and not for wages-likely an attempt to ensure that it would not be taxable.

What is tax attorney?

A tax attorney can assist the parties in crafting a demand, complaint or settlement that may make the difference between an award non-taxable rather than taxable. Although the tax attorney would always prefer to be part of the case from the beginning, if you have already received your settlement or judgment you want to consult with ...

Can you characterize a settlement for tax purposes?

Unfortunately, not everyone involved with an employment discrimination case is familiar with the most desirable settlement characterization for tax purposes, and even if they are, they may not be able to properly characterize the settlement to pass IRS scrutiny.

Is emotional distress a tax deductible injury?

However, the Tax Court held that damages for emotional distress ( even physical symptoms of emotional distress) are not excludable from ordinary income if they were caused by a non-physical injury such as discrimination.

What does it mean to pay taxes on a $100,000 case?

In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law generally does not impact physical injury cases with no punitive damages. It also should not impact plaintiffs suing their employers, although there are new wrinkles in sexual harassment cases. Here are five rules to know.

Can you sue a building contractor for damages to your condo?

But if you sue for damage to your condo by a negligent building contractor, your damages may not be income. You may be able to treat the recovery as a reduction in your purchase price of the condo. The rules are full of exceptions and nuances, so be careful, how settlement awards are taxed, especially post-tax reform. 2.

Do you have to pay taxes on a lawsuit?

Many plaintiffs win or settle a lawsuit and are surprised they have to pay taxes. Some don't realize it until tax time the following year when IRS Forms 1099 arrive in the mail. A little tax planning, especially before you settle, goes a long way. It's even more important now with higher taxes on lawsuit settlements under the recently passed tax reform law . Many plaintiffs are taxed on their attorney fees too, even if their lawyer takes 40% off the top. In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law generally does not impact physical injury cases with no punitive damages. It also should not impact plaintiffs suing their employers, although there are new wrinkles in sexual harassment cases. Here are five rules to know.

Is there a deduction for legal fees?

How about deducting the legal fees? In 2004, Congress enacted an above the line deduction for legal fees in employment claims and certain whistleblower claims. That deduction still remains, but outside these two areas, there's big trouble. in the big tax bill passed at the end of 2017, there's a new tax on litigation settlements, no deduction for legal fees. No tax deduction for legal fees comes as a bizarre and unpleasant surprise. Tax advice early, before the case settles and the settlement agreement is signed, is essential.

Is attorney fees taxable?

4. Attorney fees are a tax trap. If you are the plaintiff and use a contingent fee lawyer, you’ll usually be treated (for tax purposes) as receiving 100% of the money recovered by you and your attorney, even if the defendant pays your lawyer directly his contingent fee cut. If your case is fully nontaxable (say an auto accident in which you’re injured), that shouldn't cause any tax problems. But if your recovery is taxable, watch out. Say you settle a suit for intentional infliction of emotional distress against your neighbor for $100,000, and your lawyer keeps $40,000. You might think you’d have $60,000 of income. Instead, you’ll have $100,000 of income. In 2005, the U.S. Supreme Court held in Commissioner v. Banks, that plaintiffs generally have income equal to 100% of their recoveries. even if their lawyers take a share.

Is $5 million taxable?

The $5 million is fully taxable, and you can have trouble deducting your attorney fees! The same occurs with interest. You might receive a tax-free settlement or judgment, but pre-judgment or post-judgment interest is always taxable (and can produce attorney fee problems).

Is emotional distress tax free?

2. Recoveries for physical injuries and physical sickness are tax-free, but symptoms of emotional distress are not physical. If you sue for physical injuries, damages are tax-free. Before 1996, all “personal” damages were tax-free, so emotional distress and defamation produced tax-free recoveries. But since 1996, your injury must be “physical.” If you sue for intentional infliction of emotional distress, your recovery is taxed. Physical symptoms of emotional distress (like headaches and stomachaches) is taxed, but physical injuries or sickness is not. The rules can make some tax cases chicken or egg, with many judgment calls. If in an employment dispute you receive $50,000 extra because your employer gave you an ulcer, is an ulcer physical, or merely a symptom of emotional distress? Many plaintiffs take aggressive positions on their tax returns, but that can be a losing battle if the defendant issues an IRS Form 1099 for the entire settlement. Haggling over tax details before you sign and settle is best.