Are insurance settlements taxable?

(Full Tax Guide 2022) Like with all things related to insurance or taxes, whether or not an insurance settlement is taxable depends on the situation you have found yourself in. Once you file an insurance settlement or claim, the money you receive does not tend to be taxable. However, in some cases, this money is subject to taxes.

Do I have to pay taxes on home insurance claims?

When you receive a home insurance claim, you don't normally have to pay taxes on it. Yet, home insurance claims may be taxable in some situations. Here is what you need to consider. Are Home Insurance Claims Taxable? Save up to 50% on your Home Insurance! Are Home Insurance Claims Taxable?

Are home insurance claim funds considered income?

These funds are also not considered income because they are a type of benefit paid to you for the loss of your property. When filing a home insurance claim, talk to your insurance agent about the process and expectations.

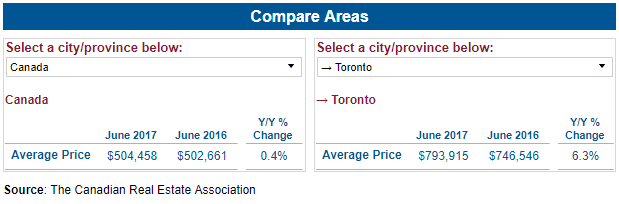

What is the average cost of Home Insurance in Canada?

But according to Ratehub.ca, the average annual cost of home insurance in Canada is $960. People in Ontario pay an average of $1,250, while those in Alberta pay $1,000, and those in Newfoundland and Labrador pay $780. Insurance companies consider several factors when calculating home insurance costs, including:

Are homeowners insurance proceeds taxable?

Home insurance payouts are not taxable because they aren't considered income—you're simply restoring the original state of your assets. The IRS taxes your wages and any source of income that increases your wealth. Unless your insurance company overpays you, your payout isn't considered income.

Is insurance compensation taxable in Canada?

Most amounts received from a life insurance policy are not subject to income tax. Regardless of the size of the policy, your spouse, child or anyone else you've named as a beneficiary would not have to report life insurance proceeds as taxable income on their Canadian tax return.

Do insurance payouts count as income?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Is a insurance settlement taxable?

Money you receive as part of an insurance claim or settlement is typically not taxed. The IRS only levies taxes on income, which is money or payment received that results in you having more wealth than you did before.

What is not taxable income in Canada?

amounts that are exempt from tax under section 87 of the Indian Act (Section 87 tax exemption) most lottery winnings. most gifts and inheritances. amounts paid by Canada or an allied country (if the amount is not taxable in that country) for disability or death of a war veteran due to war service.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

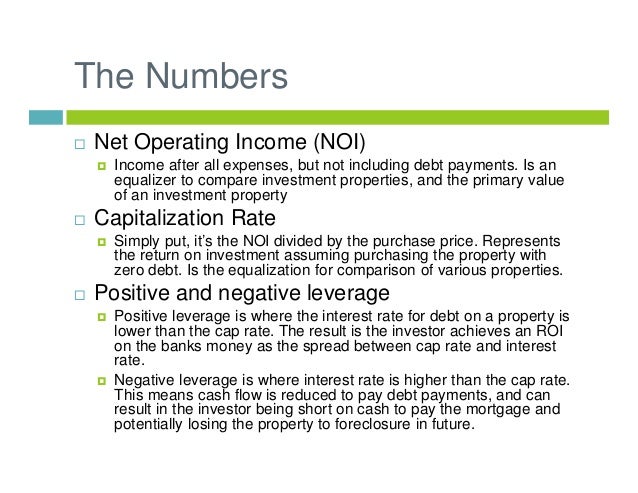

How are insurance proceeds treated in accounting?

If the proceeds check is larger than the loss, the surplus is recorded as a gain. If $10,000 of inventory is damaged, and the insurance proceeds are $12,000, record the transaction as a $12,000 debit to cash-fire damage reimbursement, a $10,000 credit to inventory, and a $2,000 credit to gain on insurance proceeds.

Do beneficiaries pay tax on inheritance in Canada?

A common misconception among Canadians is that they can be taxed on money they inherit. The truth is, there is no inheritance tax in Canada. Instead, after a person is deceased, a final tax return must be prepared on income they earned up to the date of death.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What is the tax rate on settlement money?

It's Usually “Ordinary Income” As of 2018, you're taxed at the rate of 24 percent on income over $82,500 if you're single. If you have taxable income of $82,499 and you receive $100,000 in lawsuit money, all that lawsuit money would be taxed at 24 percent.

How do you record an insurance claim in accounting?

How To Record Insurance Reimbursement in AccountingDetermine the amount of the proceeds of the damaged property. This is the amount sent to you by the insurance company. ... Locate the entry made to record the cost of the repair. ... Debit insurance proceeds to the Repairs account. ... Record a loss on the insurance settlement.

Is cash surrender value taxable in Canada?

When you surrender a permanent policy, you exchange your death benefit for a cash payout from your insurance company. In this situation, it is taxed as ordinary income—not capital gains—since the government counts the cash value as income.

Is life insurance benefit taxable in Canada?

So, is life insurance really taxable? For the most part life insurance in Canada is considered non-taxable which can be appealing since your beneficiaries will be able to collect the full death benefit. By non-taxable we mean that your beneficiaries won't need to pay income tax on the amount they receive when you die.

Property Insurance Proceeds

When a property is damaged or completely decimated in a natural or man-made disaster or an accident, the individual or company files a claim. The insurance company has the responsibility to financially cover all the damage and losses that have occurred to the property.

Why Does Tax Arise On Disposed Of Assets?

It is essential to understand the incidence of taxation in the case of asset disposal. The assets in the books of the taxpayer are depreciated every year for tax purposes. This is known as the tax value of the asset; however, the asset’s original cost is more than the tax value.

A Different Outlook

The insurance proceeds become taxable to the government when the value of proceeds exceeds the value required for indemnity. This is because the current investment value will always be greater than the first investment due to systematic inflation.

Endnote

The Canadian Government has one of the best property insurance rules. It is host to several wonderful profitable and safe insurance companies that give good coverage to your business and personal property. In case of any emergency, the response to such insurance claims is almost immediate.

What principle does a settlement follow?

As with a finding of damages, settlement amounts follow the surrogatum principle with respect to taxation. This is the principle that the payment takes on the attributes of what the payment is meant to replace and is taxed (or not) accordingly.

How much did the taxpayer settle for in the case of the investment company?

The taxpayer and the investment company eventually settle for $50,000, of which $20,000 was on account of the decrease in value of the taxpayer’s investments and an additional $30,000 was on account of investment income the taxpayer would have earned on his investments but for the negligence.

What damages are considered special damages?

This applies to 1) special damages such as out-of-pocket expenses like medical and hospital expenses and loss of both accrued and future earnings; and 2) general damages such as pain and suffering, loss of earning capacity, loss of amenities of life, and shortened expectation of life. So long as the amounts received qualify as special ...

Is surrogatum taxable?

The CRA generally repeated that the surrogatum principle applied. Assuming that the actions of the investment company amounted to negligence, then it was the CRA’s position that amounts paid as compensation for actual financial loss would likely be considered damages for personal injury and thus not taxable. On the other hand, any amounts paid as ...

Is a settlement taxable income?

That said, an amount awarded that is not considered damages and can reasonably be considered to be income from employment will still be taxable – for example, if as part of a settlement, the injured taxpayer is also guaranteed a severance payment, that severance payment will likely be considered employment income and thus taxable. Additionally, even where an amount awarded by a Court or included in a settlement is augmented by or includes an amount that is referred to as interest, that so-called interest amount remains non-taxable given that it is in respect of damages for personal injury. However, if an amount awarded for damages is held in a deposit account and interest accrues on that amount before it is paid out, that interest is taxable as income. While the difference seems minor, getting it wrong can mean an increased tax liability – speak to one of our experienced Canadian tax lawyers and make sure your settlement is structured in the most tax efficient way possible.

Is personal injury compensation taxable?

So long as the amounts received qualify as special or general damages for personal injury, those amounts are tax free even if they are determined with reference to the loss of earnings of a taxpayer. That said, an amount awarded that is not considered damages and can reasonably be considered to be income from employment will still be taxable – ...

Is a settlement payment taxed as business income?

For example, if the settlement is in respect of a broken contract that caused a taxpayer to fail to make several sales and lost business income, the settlement amount would also be taxed as business income. On the other hand, where a settlement payment is compensation for the loss of or damage to a capital asset, ...

What is 87 tax exemption?

amounts that are exempt from tax under section 87 of the Indian Act ( Section 87 tax exemption) most lottery winnings. most gifts and inheritances. amounts paid by Canada or an allied country (if the amount is not taxable in that country) for disability or death of a war veteran due to war service. GST/HST credit and Canada child benefit (CCB) ...

What is family allowance in Quebec?

family allowance payments and the supplement for handicapped children paid by the province of Quebec. compensation received from a province or territory if you were a victim of a criminal act or a motor vehicle accident. most amounts received from a life insurance policy following someone's death.

Is strike pay taxable?

most types of strike pay you received from your union, even if you perform picketing duties as a requirement of membership. Note. Income earned on any of the above amounts (such as interest you earn when you invest lottery winnings) is taxable .

Is home insurance required by law in Canada?

No, but some lenders will not extend a mortgage without the purchase of home insurance. Plus, if your home suffers damage, think of how much money you’ll need to replace it and the items inside.

What is home insurance?

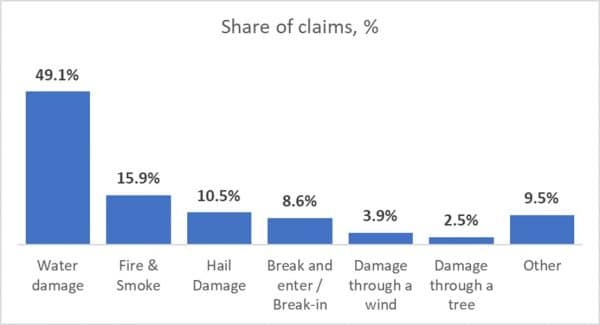

Home insurance is a plan you purchase that protects you, your home and your personal items from damage or loss, as well as injuries to visitors. You may also see home insurance referred to as “property insurance.” Coverage includes:

What doesn’t home insurance cover?

There are certain things standard home insurance won’t cover. Some events that are routinely left out of standard policies include:

What are the different types of home insurance?

Now that we’ve listed what isn’t covered, let’s look at the different kinds of home insurance that are available and what they cover.

How do you calculate the value of your stuff?

This is the time to take a systematic approach to calculate the value of your belongings, otherwise, you may undervalue how much your stuff is actually worth.

How much coverage do you need?

It depends on your home, the location and your possessions. Most home insurance providers will have a calculator that will help you figure out how much coverage you’ll need.

How much does home insurance cost?

But according to Ratehub.ca (an aggregator website owned by Ratehub Inc., which also owns MoneySense.ca), the average annual cost of home insurance in Canada is $960. People in Ontario pay an average of $1,250, while those in Alberta pay $1,000, and those in Newfoundland and Labrador pay $780.

Are Home Insurance Claims Taxable?

Yet, when this happens, you may be wondering if you should save some of it to pay taxes. Here is what you need to know about when home insurance claims are taxable and how the insurance claims process works most of the time.

What Are Homeowners Insurance Claims?

As described in the above situation, a home insurance claim occurs when a person files a request to their home insurance company for payment of damages that the policy covers. A claim is considered a type of benefit. It is not considered any type of income to you. That is an important difference because of how it applies to taxation.

Is Your Property Claim Taxable?

As noted, it is not common for any component of these benefits to be taxable. Just like the premiums you pay to have that policy are not a tax deduction, neither is the funds sent to you when a claim occurs. The IRS does not even need to be told about it – because it is not income, it does not impact their process.

What is a claim on a home insurance policy?

As described in the above situation, a home insurance claim occurs when a person files a request to their home insurance company for payment of damages that the policy covers. A claim is considered a type of benefit. It is not considered any type of income to you.

When filing a home insurance claim, do you need to do so?

When it comes to filing a home insurance claim, do so when you need to as a result of a legitimate and verifiable loss. Then, keep track of your claims as well as how the money is spent making repairs on your property. If there is ever a question about this later on, you should have the receipt and details to verify the situation.

Is home insurance considered income?

It is not considered any type of income to you. That is an important difference because of how it applies to taxation. When you file a home insurance claim, the insurance company accesses the damage. They determine what the underlying cause of the damage is, verifies that your insurance policy covers the damage, and then writes a check to you. ...

Does filing a claim hurt your home insurance?

What You Should Know About Home Insurance Claims and Your Costs. There are other ways, though, that filing home insurance claims can hurt you. For example, if you file a number of claims on your home over a short period of time, this can cause the insurance company to raise your coverage rates.