Are lawsuit settlement proceeds taxable in New Jersey?

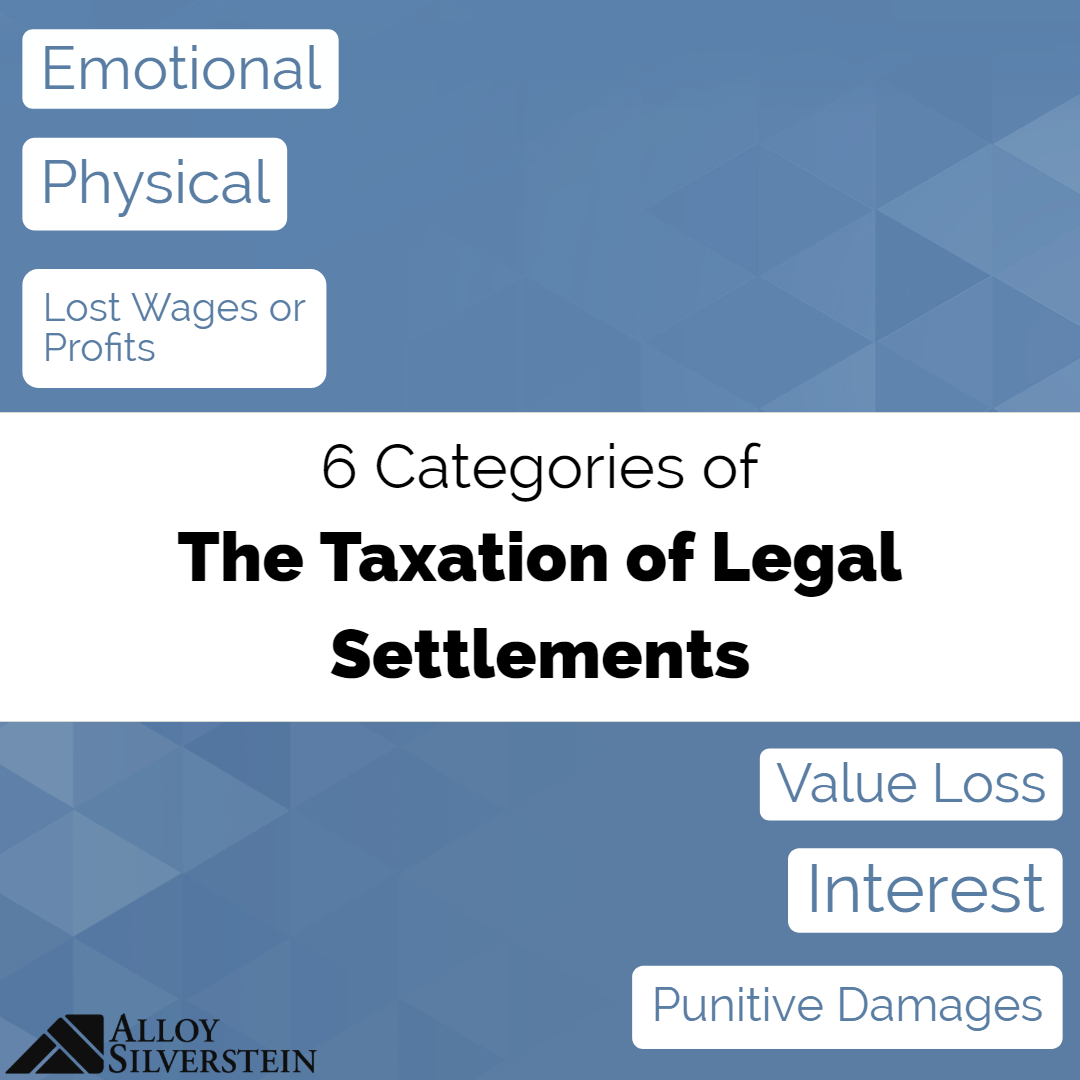

Are Lawsuit Settlement Proceeds Taxable in New Jersey? Generally speaking, any income you earn is subject to tax at the federal and state levels. New Jersey's state tax laws define income much the same as the IRS does. Taxable income includes income from sources that include wages, profits, net gains and interest.

Are punitive damages taxable in New Jersey?

New Jersey always considers punitive damages to be taxable income. Any interest added to any portion of your settlement also is taxable income. Money intended to compensate you for emotional distress you suffered as a result of a physical injury or illness is not taxable income in New Jersey.

Are personal injury settlements taxable?

In the IRS’s words, assets can be taxed, not liabilities, and personal injury settlements are a liability because they are mostly repaying the money you have already lost. Is Money From A Personal Injury Settlement Taxable?

Are lost wages from a workers’ compensation case taxable in New Jersey?

Those lost wages would not be taxable income in New Jersey. Levinson Axelrod Attorneys at Law: Will I Need to Pay Taxes on my Settlement or Verdict?

Do you pay tax on personal injury payouts?

Claimants do not pay tax on injury compensation Whether the compensation is awarded by the court, or as an out-of-court settlement, you will be exempt from paying tax.

Does the IRS tax personal injury settlements?

Neither the federal government (the IRS), nor your state, can tax you on the settlement or verdict proceeds in most personal injury claims. Federal tax law, for one, excludes damages received as a result of personal physical injuries or physical sickness from a taxpayer's gross income.

What lawsuit settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do you have to pay taxes on pain and suffering?

Pain and suffering, along with emotional distress directly caused by a physical injury or ailment from an accident, are not taxable in a California or New York settlement for personal injuries.

Are 1099 required for settlement payments?

Forms 1099 are issued for most legal settlements, except payments for personal physical injuries and for capital recoveries.

Do you have to pay taxes on insurance payouts?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Are legal settlements paid tax deductible?

This means that, generally, monies paid pursuant to a court order or settlement agreement with a government entity are not deductible. However, the 2017 Tax Cuts and Jobs Act (TCJA) amended § 162(f) to allow deductions for payments for restitution, remediation, or those paid to come into compliance with a law.

Are lawyer fees tax deductible?

You can deduct the legal or extrajudicial fees you paid for: the establishment of your initial right to receive support payments, the collection of those support payments or the review of your right to receive support payments; or.

Is the roundup lawsuit a personal injury settlement?

Roundup lawyers typically take between 33-40% of the total amount recovered in a personal injury lawsuit. Contingency fee agreements may vary depending on the circumstances of each case. The attorneys' fees in a Roundup lawsuit will be contingent upon whether the case is resolved through settlement or trial.

Is emotional distress money taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes.

Is mental anguish taxable?

If you make claims for emotional distress, your damages are taxable. If you claim the defendant caused you to become physically sick, those can be tax free. If emotional distress causes you to be physically sick, that is taxable.

Are wrongful death settlements taxable?

In General, Wrongful Death Settlements Are Not Taxable The Internal Revenue Service (IRS) applies “26 CFR § 1.104-1 Compensation for injuries or sickness” to most of the money damages people receive in wrongful death cases because they are for personal injuries or sickness.

How do I report a class action settlement on my taxes?

Reporting Class Action Awards The individual who receives a class-action award must report any and all income received on Line 21 of Form 1040, for miscellaneous income. This amount is included in adjusted gross income and is taxable.

Is a 1099 taxable?

When you receive a personal injury settlement, the insurance company will submit a 1099 claim to the IRS. The IRS does not generally consider proceeds from a personal injury claim taxable , which is also the general rule under federal or state law. The rule applies to insurance settlement amounts as well as awards given to judges or juries.

Is personal injury tax free?

The Trump Administration signed a tax law in 2017, which stipulates that personal injury settlements or awards are only tax-free if the injuries are physical. The law can be simplified as follows:

Is North Bergen personal injury settlement taxable?

If a dispute arises, your North Bergen Personal Injury Attorney can ensure that the largest portion of your claim amount is non-taxable.

When are Settlements and Jury Awards Taxable?

There are numerous exceptions where the IRS deems it acceptable to charge taxes on any settlements or awards relating to physical and emotional injuries or lost wages. If, for example, a person receives a tax benefit related to their claim, the IRS considers that to be “double-dipping”. This means that you already received compensation for those injuries and anything on top of those benefits is income that is subject to taxation. Additionally, IRS considers an income any interest which you receive from a settlement and is therefore not tax-exempt.

Is punitive damages taxed?

Punitive damages are reasonably rare in personal injury claims, but they are not impossible. How though, are they handled for taxation purposes? The IRS considers a punitive award as income and therefore subject to taxation. These damages are taxed as such because they are designed to punish the negligent party, rather than compensate the injured person.

How do I Protect my Personal Injury Settlement From the IRS?

Another way that some people choose to deal with the tax is to receive payment through a structured annuity over time, and not all at once. This can reduce the amount due to the IRS.

What is punitive damages?

This is also true in cases in which punitive damages were awarded. Punitive damages are amounts awarded as punishment for the other party’s bad behavior. These types of awards are different from monies received for injuries and corresponding medical bills, emotional distress, and pain and suffering related to the injury. Awards for pain and suffering etc., are given to make the person whole or to attempt to undo the wrongs committed and are compensation for your injuries. Punitive damages are not designed to make you whole. Instead, they are awards intended to simply punish the other party.

Is personal injury settlement taxable?

Generally, personal injury settlements are not considered income and, in many cases, are not taxable unless there is a portion allotted for lost wages. More specifically, awards for pain and suffering related to an injury, emotional distress for such injury, as well as medical bills, and amounts paid out for attorney’s fees are not taxed. This does not mean that taxes are never owed on money derived from such cases or that the amount received does not have to be reported.

Is emotional suffering taxed?

Similarly, there are times when emotional suffering not based on an injury is taxed. In other words, things that you may be going through as a result of the emotional distress would not be tax-free unless it is related to an actual physical injury sustained.

Do you have to pay taxes in New Jersey?

All New Jersey residents have to pay taxes to New Jersey and the Federal Government via the IRS. Taxes are due and owing on earned income. Earned income commonly includes money derived from your employment or self-employment.

Is a settlement for a personal injury taxable?

Generally, settlement money received for a personal physical injury is not taxable. (There are exceptions, but this is the general rule.) However, it is important to take into consideration that the settlement amounts may be subject to reimbursement to Medicaid/Medicare or medical insurance.

Is a settlement recovery subject to taxes?

A settlement recovery for lost wages is subject to taxes in the same way that wages are subject to taxes. The settlement income is treated just like it would be as normal employment income (since that is, in fact, what the plaintiff is recovering).

Is emotional distress taxable income?

If a plaintiff receives money to compensate damages of emotional distress or mental anguish which originates from a personal physical injury, that amount is also typically not taxable as income. However, if a plaintiff receives damages for emotional distress or mental anguish which originates from some other source (not physical injury) then the recover may need to be included as taxable income at least in part.

Is punitive damages taxable?

Also, punitive damages are almost always taxable and should be reported as “other income.”. However, settlements do not often designate payments as punitive damages. Settlements may allocate payments for multiple types of damages: such as lost pay, emotional distress, and attorneys’ fees.

Is lost wages a tax liability?

Thus, settlement proceeds from an employment litigation in the form of lost wages are likely subject to social security taxes , Medicare taxes , employment tax withholding , etc. While this tends to be a significant tax liability, there is a logical basis for it.

Do you have to file a 1099 for a settlement?

Further, a defendant may need to issue a 1099 to the plaintiff along with the disbursement of settlement funds. These determinations are highly fact-sensitive and every party should consult their own CPA or other tax professional who would be most familiar with each parties’ particular situation.

Is money that you pay for property damage taxable?

Similarly, money that reimburses you for property damage is not taxable, unless you've realized a profit because the settlement amount was greater than the value of the damaged property.

Does New Jersey take out of pocket expenses?

Recovery of Out-of-Pocket Expenses. New Jersey does not take taxes from settlement amounts intended to compensate you for expenses you incurred treating physical or mental injuries, such as medical bills. However, if you've already deducted those medical bills to lower your tax liability in a previous year, reimbursement ...

Is punitive damages taxable in New Jersey?

Your settlement may include punitive damages, which are intended to punish a company or individual that has violated your rights or harmed you in some way. New Jersey always considers punitive damages to be taxable income. Any interest added to any portion of your settlement also is taxable income.

Is a legal settlement taxable income?

Taxable income includes income from sources that include wages, profits, net gains and interest. A legal settlement may have taxable and non-taxable portions, depending on how those damages are classified.

Is lost wages taxable?

However, if you receive compensation for lost wages directly related to a physical injury from someone other than your employer, the income is not taxable. For example, if you were in a car accident and sued the driver of the other car, your settlement may include a portion to compensate you for lost wages while you were recovering ...

Is money for emotional distress taxable in New Jersey?

Compensation for Non-Physical Injuries. Money intended to compensate you for emotional distress you suffered as a result of a physical injury or illness is not taxable income in New Jersey. However, if you suffer emotional distress as a result of something other than a physical injury, any money you receive for that is taxable income.

Exceptions to The No Tax Rule Applied to Physical Injury Compensation

- Unfortunately, not every single physical injury case is completely untaxed. There are exceptions to the general rule. For instance, if the basis for your case involves a breach of contract, then you will be taxes on the damages. Another involves a punitive damages claim, which is always taxable. I…

Physical Versus Emotional Injuries

- It is important to understand that the government is very specific about the type of injury claims that are nontaxable. When they say physical injuries are nontaxable, they mean that exactly. It has to be something that you can prove has caused you physical pain or suffering. If you are suing on the basis of an emotional injury such as PTSD, severe stress, depression, etc., your co…

Taxes on Interest on Judgement

- A final exception to the nontaxable rule on physical injury lawsuits has to do with interest on judgement. Like many states, New Jersey actually has interest added to personal physical injury verdict. If you were to file on January 1, 2018 and win your physical injury lawsuit, you would receive interest on the verdict starting on that file date. If for some reason your lawsuit was drag…