Are personal injury settlements taxable?

It is a common concern for individuals involved in a personal injury claim as to whether or not any financial compensation awarded in court, or in an out of court settlement, will be taxable. Tax laws in the United Kingdom are complicated, and it can often be easy to fall foul of them. 1: What are personal injury settlements?

Do I have to pay tax on injury compensation?

Claimants do not pay tax on injury compensation. If you receive financial compensation following an injury, specific legislation ensures that you do not have to pay tax on it. This is the case no matter whether the compensation is received as a lump sum or as staggered payments.

What is a personal injury settlement?

Personal injury settlements are financial compensation awarded as a result of an injury caused by something other than the person who sustained the injury. Personal injuries are varied in nature, and can include lesser injuries such as a sprain or broken leg, to more serious and life changing injuries such as brain damage.

What are periodic payments for personal injury claims?

In most cases, claims or actions for damages for personal injury are settled by way of payment of a lump sum to the injured person. But in some cases all or part of the damages are paid in the form of a continuing series of regular payments called ‘periodical payments’ to the injured person for the rest of his or her life.

Do you pay tax on personal injury payouts?

Claimants do not pay tax on injury compensation Whether the compensation is awarded by the court, or as an out-of-court settlement, you will be exempt from paying tax.

Do you pay tax on compensation payouts UK?

If you get interest on top of compensation for the period since you sold the investment (or it matured), you usually need to pay income tax on this part. The business would usually deduct this on your behalf and give you a tax deduction certificate. If you're not a taxpayer, you can reclaim any tax you paid from HMRC.

Do I pay tax on a compensation payout?

Where compensation relates to a loss of profits from a trade; loss of income from a property business; or breach of contract relat- ing to a business, any such payment is likely to be treated as taxable income. If compensa- tion includes interest, that element could also be taxable as income.

Do you pay taxes on pain and suffering?

Pain and suffering, along with emotional distress directly caused by a physical injury or ailment from an accident, are not taxable in a California or New York settlement for personal injuries.

What is the average payout for a personal injury claim UK?

Minor back injuries: up to £10,450. Moderate back injuries: £10,450 – £32,420. Severe back injuries: £32,420 – £134,590. Dislocated shoulder (with possible permanent damage): £10,670 – £16,060.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Is a lump sum settlement taxable?

Structured Settlement Tax Advantages Structured settlements and lump-sum payouts for compensatory damages in personal injury cases are tax exempt. So there is no distinct tax advantage to the type of settlement payout you receive.

What forms of compensation are taxable?

Employee Compensation In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options. You should receive a Form W-2, Wage and Tax Statement, from your employer showing the pay you received for your services.

Do you have to declare compensation?

Compensation settlements paid directly to a claimant are seen as savings and must be declared if the total exceeds the threshold. Of course, unless you know how much personal injury compensation you will receive, it is impossible to answer exactly as to whether or not your benefits claim would be affected.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What forms of compensation are taxable?

Employee Compensation In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options. You should receive a Form W-2, Wage and Tax Statement, from your employer showing the pay you received for your services.

Do you have to declare compensation?

Compensation settlements paid directly to a claimant are seen as savings and must be declared if the total exceeds the threshold. Of course, unless you know how much personal injury compensation you will receive, it is impossible to answer exactly as to whether or not your benefits claim would be affected.

Is a tribunal award taxable?

If you pay tax, you'll have to pay tax on the money you're awarded. Make sure you ask for the full amount you're owed before tax and national insurance are taken off. This is called the 'gross amount'.

What are Common Personal Injury Claims?

You can potentially claim for personal injury compensation if you have suffered due to the negligence of another person or institution, and personal injury compensation isn’t taxable.

How to calculate personal injury compensation?

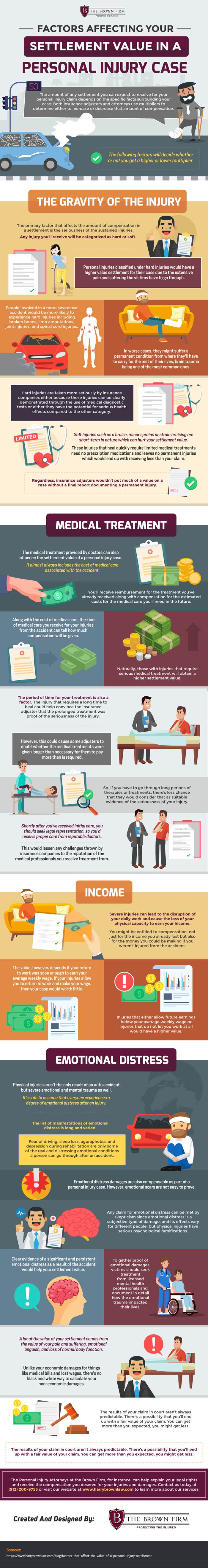

There are a number of different factors that need to be considered when estimating how your personal injury compensation will be calculated. Some of these are: 1 The cost of the medical treatment, such as physiotherapy or rehabilitation programmes, that you will have to receive 2 The loss of earnings that you may have suffered from not being able to work 3 The travel cost of getting to your medical appointments

What factors should be considered when estimating personal injury compensation?

Some of these are: The cost of the medical treatment, such as physiotherapy or rehabilitation programmes, that you will have to receive.

How old do you have to be to file a personal injury claim?

If a child has suffered a personal injury, then they have 3 years from the year that they turn eighteen to enter into the personal injury claims process. As a parent of an injured child you may also make a claim on their behalf whilst they are still under 18 years of age.

What are some examples of personal injury?

Incidents of personal injury can for example include: Accidents caused by criminal offences, like assault. Accidents caused by the negligence of medical professionals. Road traffic accident – whether you were in a vehicle or hit by a vehicle or bicycle. Accidents caused by faulty goods or services.

Is personal injury compensation taxable?

Personal injury compensation isn’t taxable. The law in the UK states that compensation or damages that are awarded for personal injuries are free from tax. This also includes any interest from the date of the injury to the date that the settlement is agreed upon. Get In Touch With Us to Claim Personal Injury Compensation.

Can you file a no win no fee claim with Slater and Gordon?

We're here to reassure you that pursuing a claim for injury compensation under a No Win No Fee agreement with Slater and Gordon, won't leave you with a tax bill.

Do you have to worry about compensation if you have been injured?

We understand you have enough to worry about if you've been injured in an accident that wasn't your fault. One thing you don't have to worry about is being charged tax on any compensation payments you receive. This is because most tax is based on earnings, or income, so any compensation you receive won't fall into that category.

What is PPI compensation?

The main focus of the reports in the media was compensation paid out for mis-sold payment protection insurance ( PPI) on credit cards, loans, and other lending products. Successful claimants who received compensation for lost interest, in addition to the original PPI premiums, would have to pay tax on the interest component of their compensation.

What if I invest my compensation award and earn interest on it?

If you invest your damages award, any interest generated would be liable for tax. This is usually taxed at source for basic rate taxpayers but would need to be declared on a self-assessment return or to HMRC.

Is compensation taxable in 2014?

In 2014, HMRC revised its rules so that certain types of compensation became taxable. Press reports suggesting that claimants have to pay tax on certain types of compensation created anxiety for people pursuing an injury claim. Many claimants were concerned that compensation calculated to meet treatment costs could be depleted after tax deductions.

Is interest paid on a claim taxable?

Even though a claim has been settled and an amount awarded, there may still be delays before you receive your compensation being paid to the claimant. Any interest that the payer adds to the compensation because of a delay in payment is taxable because the interest is likely to be paid gross (no tax deducted).

Who deducts interest on a tax return?

In most cases, tax will be deducted by the party (usually the defendant or their insurance company) paying the interest. Even if the tax is deducted before you receive the payment, you will still have to declare it to HMRC.

Do you have to pay taxes on a lump sum settlement?

If you receive financial compensation following an injury, specific legislation ensures that you do not have to pay tax on it. This is the case whether a compensation settlement is received as a lump sum or in staggered payments. Whether the compensation is awarded by the court, or as an out-of-court settlement, you will be exempt from paying tax.

Do you have to pay taxes on personal injury?

Injured people do not usually have to pay tax on personal injury compensation. There are some exceptions, however. This article explains the tax situation for personal injury claimants.

Why are structured settlements more appropriate than lump sum settlements?

Such settlements are often seen by the Courts as more appropriate than lump sum settlements because they can be arranged to provide a certain level of income which is guaranteed for the life of the injured person.

What is structured settlement?

In most cases, claims or actions for damages for personal injury are settled by way of payment of a lump sum to the injured person.

When did courts have the power to impose a periodical payment?

From 1 April 2005, courts have the power to impose an order providing for periodical payments to the injured person without the consent of the parties. Before this time, an order providing for periodical payments could only be made if both parties agreed.

Who is liable for damages in medical negligence?

by the defendant (the person liable for the damages), for instance in medical negligence cases involving the NHS, where payments are made through the NHS Litigation Authority

Is periodical payment taxable income?

On first principles, periodical payments are annual payments which would be taxable as income - under ITTOIA05/S422 if they are annuity payments and under ITTOIA05/S683 if they are other annual payments.

.jpg?width=1164&name=MB-Blog-Personal-Injury-Settlements-and-Taxes-What-You-Need-to-Know-IMAGES-1(1).jpg)

Introduction

Periodical Payments

- Where all or part of the damages are paid in the form of a continuing series of regular payments to the injured person for the rest of his or her life these are called periodical payments. This type of arrangement, often referred to as a ‘structured settlement’, is more likely to arise in larger personal injury cases, such as road accident or medical negligence cases, and particularly wher…

Methods by Which Payments Are Made

- Depending on the circumstances, there are several ways by which periodical payments of damages are made to the injured person: 1. by the defendant (the person liable for the damages), for instance in medical negligence cases involving the NHS, where payments are made through the NHS Litigation Authority 2. by an insurance company that acts for the defendant, for instanc…

Tax Treatment and Exemption

- Periodical payments are treated as taxable income under ITTOIA05/S422 as annuities, and under ITTOIA05/S683 if they are other annual payments. However, where the periodical payments are made under certain types of court orders from UK or foreign courts or settlement agreements or undertakings from the MIB as described in IPTM5020, none of the perso...