Will my settlement be taxable?

Taxation on settlements primarily depends upon the origin of the claim. The IRS states that the money received in a lawsuit should be taxed as if paid initially to you. For example, if you sue for back wages or lost profits, that money will typically be taxed as ordinary income.

Do I have to pay tax on a debt settlement?

The IRS may count a debt written off or settled by your creditor as taxable income. If you settle a debt with a creditor for less than the full amount, or a creditor writes off a debt you owe, you might owe money to the IRS. The IRS treats the forgiven debt as income, on which you might owe federal income taxes.

Are court settlements tax deductible?

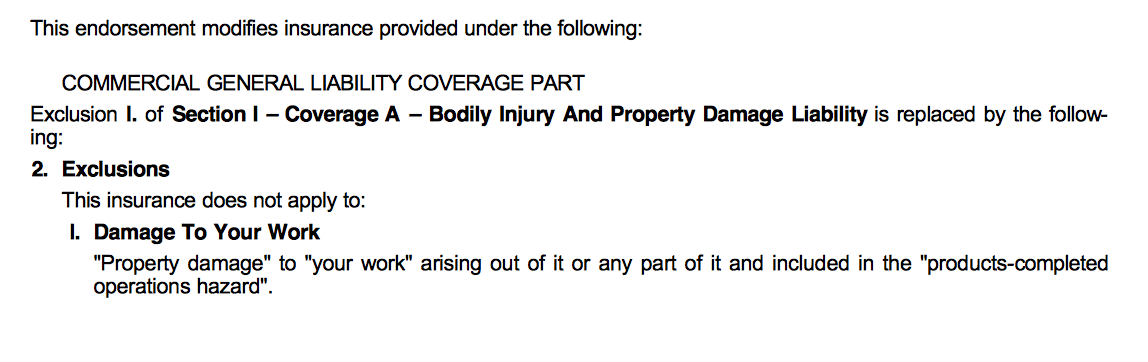

This means that, generally, monies paid pursuant to a court order or settlement agreement with a government entity are not deductible. However, the 2017 Tax Cuts and Jobs Act (TCJA) amended § 162(f) to allow deductions for payments for restitution, remediation, or those paid to come into compliance with a law.

Are restitution payments tax deductible?

The operative term, and the problem, is that the restitution is considered a penalty, and as such is not tax deductible. Punitive payments are not considered ordinary and necessary business expenses under IRC 162.

What settlement fees are tax deductible?

If you itemize your taxes, you can usually deduct your closing costs in the year in which you closed on your home. If you close on your home in 2021, you can deduct these costs on your 2021 taxes.

How do I report settlement payments on my taxes?

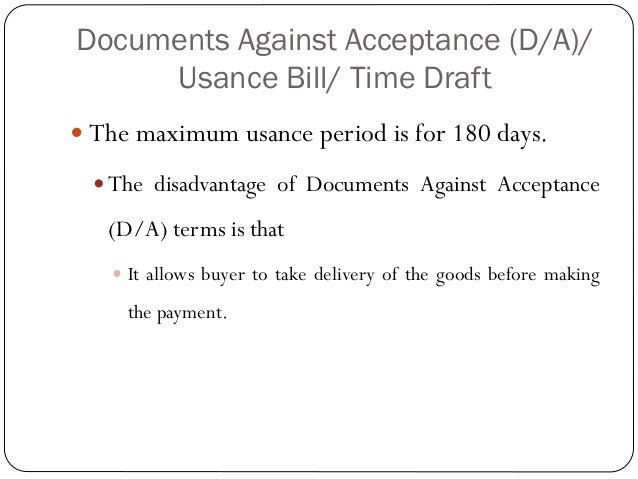

If you receive a taxable court settlement, you might receive Form 1099-MISC. This form is used to report all kinds of miscellaneous income: royalty payments, fishing boat proceeds, and, of course, legal settlements. Your settlement income would be reported in box 3, for "other income."

Is a settlement payment taxable income?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Do you get a w2 for a settlement?

The settlement agreement should also explicitly provide for how the settlement will be reported as well. The two primary methods to report the settlement to the IRS are either on a Form W-2 or a Form 1099-MISC.

Will I get a 1099 for a lawsuit settlement?

Most lawyers receiving a joint settlement check to resolve a client lawsuit are not considered payors. In fact, the settling defendant is considered the payor, not the law firm. Thus, the defendant generally has the obligation to issue the Forms 1099, not the lawyer.

Is a lump sum settlement taxable?

Structured Settlement Tax Advantages Structured settlements and lump-sum payouts for compensatory damages in personal injury cases are tax exempt. So there is no distinct tax advantage to the type of settlement payout you receive.

Are 1099 required for settlement payments?

In addition, if the proceeds are jointly payable to attorney and plaintiff, the defendant is required to issue a 1099 to attorney under § 6045 as amounts paid “in connection with legal services.” As a result, both attorney and plaintiff receive 1099s for the entire settlement amount.

Are 1099 required for settlement payments?

Issuing Forms 1099 to Clients That means law firms often cut checks to clients for a share of settlement proceeds. Even so, there is rarely a Form 1099 obligation for such payments. Most lawyers receiving a joint settlement check to resolve a client lawsuit are not considered payors.

Will I get a 1099 for a lawsuit settlement?

For example, settlement funds rewarded for lost wages are taxable and settlement funds rewarded for a personal injury are usually not. Also, if the funds you received are considered taxable income, then you will receive a tax form. Most settlements are reported on form 1099's.

Do you get a 1099 for insurance settlement?

If you do have to pay taxes on an insurance claim, you'll receive a 1099 form to help you file.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

What is the application to relator fees?

Application to Relator Fees under the False Claims Act. The False Claims Act (FCA) provides that either the Attorney General or a private citizen (the relator or qui tam plaintiff) may bring an action in the name of the government for a violation of the FCA. The FCA entitles the relator to a share of any amounts recovered.

What is FCA settlement?

The FCA entitles the relator to a share of any amounts recovered. Under the facts considered in the memorandum, the government intervened in a suit brought by a relator and eventually settled with the defendant. The settlement agreement provided that the defendant will pay a lump-sum amount to the government in settlement ...

What is a settlement agreement in FCA?

The settlement agreement provided that the defendant will pay a lump-sum amount to the government in settlement of all potential FCA claims. The settlement agreement also provided that a specified portion of the amount will be paid by the government to the relator in satisfaction of the statutory relator fees.

Is a relator fee a penalty?

The memorandum notes that other courts, including the U.S. Tax Court, have concluded that relator fees are not penalties. For example, the Tax Court said in Rocco v. Commissioner , "The payment to a relator in a qui tam action is not a penalty imposed on the wrongdoer; instead, it is a financial incentive for a private person to provide information and prosecute claims relating to fraudulent activity."

Is a settlement agreement more fact-intensive than determining the tax consequences to the payor of payments made under?

Few tax issues are more fact-intensive than determining the tax consequences to the payor of payments made under a settlement agreement with a governmental body when the agreement is silent as to the nature of the payments. In a legal advice memorandum, the IRS Office of Chief Counsel shed some light on the factors it thinks are important in such a situation. Whenever possible, of course, the taxpayer should seek to negotiate settlement agreement terms that would support the desired tax treatment.

Is a business payment deductible under 162(a)?

Another notable exception to the no tion that business payments ordinarily are deductible under section 162 (a) is section 162 (f), which prohibits the deduction of any "fine or other similar penalty paid to the government for the violation of any law.".

Is a settlement agreement deductible?

Payments made pursuant to a settlement agreement or court judgment ordinarily will be characterized, from the payor's perspective, as a deductible expense, a capital expenditure, or a nonde ductible, noncapital payment.

Why is punitive damages controversial?

The controversy regarding punitive damages stems from the fact that, allowing a tax deduction for punitive damages undermines the role of the same in discouraging and penalizing certain undesirable actions or activities.

What is a tax deductible item?

Tax deductible items are expenses that can be subtracted from adjusted gross income so as to reduce the net taxable income. These allowable deductions are useful to the defendant, who may be forced to make disbursements in favor of the plaintiff, since tax deductible items have the effect of reducing the defendant’s tax burden. Are lawsuit settlements deductible? The answer to this question hinges on the nature of the settlement and the damages awarded to the plaintiff in a court of law.

What is punitive compensation?

Damages or monetary compensation awarded by a court in a civil action, to the plaintiff who has been injured by the action of the defendant, may be punitive or compensatory. The latter is awarded as compensation for actual damages, that can be quantified, as well as compensation for emotional distress.

What is punitive damages?

These are awarded as payment for deliberate actions and negligent or fraudulent behavior. Armed with the knowledge of the classification of damages, we are now in a position to explore deductible lawsuit settlements.

What is tax treatment for consumers?

Tax Treatment for Consumers. Tax treatment for consumers may be examined by taking the example of a divorce settlement. The payor is allowed a tax deduction for spousal support, for mortgage payments, insurance premium and real estate taxes paid as alimony in lieu of the home owned by the ex-spouse.

When did the Obama administration eliminate punitive damages?

The Obama administration has introduced as a part of its Federal Budget Proposal for the fiscal year 2010, a measure that calls for the elimination of the deductibility of punitive damage payments incurred on or after December 31, 2010. The opponents of this proposal believe that since tort abuse has escalated, the deductibility of punitive damages as ordinary and necessary business expense is one of the few relief measures available to business owners who may be required to dispense with payments that have no upper limit.

Can you deduct punitive damages?

At present, the payor is allowed a tax deduction for punitive damages provided these are reasonable, ordinary and necessary business expenses. Tax deduction for punitive expenses has been under fire for a long period of time. The controversy regarding punitive damages stems from the fact that, allowing a tax deduction for punitive damages undermines the role of the same in discouraging and penalizing certain undesirable actions or activities.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.

What is a lawsuit settlement?

A lawsuit settlement is when two different parties settle their case on an agreeable situation or payment. Mostly in such cases, one of the parties has to pay the other party a settlement amount to close the case legally. If you are new to the business side of the industry you will need to learn how to do your taxes and what things can lead to a deduction of taxes, even in such cases you have to know your limitations as to what extent tax can be deducted, and are lawsuit settlements tax deductible? You cannot expect your business tax to be deducted from a personal lawsuit because that is a personal matter, but if you are paying a business settlement there can be a chance of tax being deducted for that.

What is a limitation to deduction?

When we talk about the limitation to the tax deduction we mean the things that you might think or may imagine will be considered part of business’ expenses but are not considered the expenses by the legislation. So, in a legitimate business, you have to be careful of such thing so that you are not burdened with more load regarding taxes than you imagine.

Can a company settle a lawsuit without paying taxes?

Even when the company settles down the lawsuit without any payment between the two parties there will still be the tax deduction and that will be based on the court fees and the lawyer’s fees. All these things will still be a part of the company’s expenditure and the business owner will not be obliged to include that during tax payment.

Can you deduct lawsuit settlements?

If you know the limitations to these things and are well aware of what things can increase the deduction you will have to pay a small amount of tax only in such a crisis. Any expenses of the business can help you in tax deduction and lawsuit settlements are one of the business’s expenditures just like the office rent is. So, this is the most understandable example of tax deduction due to lawsuit settlement.

Is personal business expense a business expense?

As we know personal business is one of these things that are not to be mixed in your business and such expenses will never be considered part of your business expenses. Similarly, if the company is facing a lawsuit because of any employee or even the owner of a business, then money spent on them will never be considered a business expense but it will always be a personal expense. This is why any such settlements will not cause the deduction in the taxes.

Can you deduct business taxes from a personal lawsuit?

You cannot expect your business tax to be deducted from a personal lawsuit because that is a personal matter, but if you are paying a business settlement there can be a chance of tax being deducted for that.

Do business taxes increase or decrease?

Usually, when it comes to the business taxes, they are to be paid from the profit you have earned. Similarly, the tax will increase or decrease according to some loss or profit in your business. For the tax payments, your entire inventory is scanned for the very same reasons. If anything bad happens to your business that results in less profit, then it will eventually reduce the tax.

What are the rules for fines and penalties in 2021?

On January 19, 2021, the Internal Revenue Service (IRS) issued final rules on the deductibility of fines, penalties, and settlement payments made to a government or governmental entity in relation to the violation of a law. The new guidance addresses the deductibility of payments made to regulators such as the Securities and Exchange Commission, the Environmental Protection Agency, and the Commodity Futures Trading Commission, as well as payments made in connection with Department of Justice False Claims Act cases and investigations.

What is restitution in tax law?

The new guidance includes definitions of “restitution,” “remediation,” and “paid to come into compliance with a law.”. In order to qualify for the exception, an order or settlement agreement must specifically identify a qualifying, tax deductible payment as restitution, remediation or paid to come into compliance with law ...

Is disgorgement and forfeiture a fact based test?

Under the proposed regulations, these payments were not covered by the exception language, but in the final rules, the IRS provides for a circumstantial, fact-based test to determine deductibility for disgorgement and forfeiture payments.

Does IRC 162 apply to settlements?

The new regulations confirm that IRC Section 162 (f) now applies to a broader universe of settlements and payments than before the TCJA changes, covering not just fines and penalties paid to the government, but any payments paid to, or at the direction of, the government or governmental entities. It also applies not just to the resolution of actual violations, but also of potential violations.

Does the disallowance apply to settlement agreements?

An exception was allowed, however, that states that the disallowance does not apply to amounts that taxpayers establish, and court orders or settlement agreements identify, are paid as “restitution, remediation, or to come into compliance with a law.”.

What is the exception to restitution?

The restitution exception applies only if (1) a court order or settlement identifies the payment as restitution/remediation or to come into compliance with law (identification requirement) and (2) the taxpayer establishes that the payment is restitution/remediation or to come into compliance with law ( establishment requirement).

What is the burden of proof for IRS?

The burden of proof generally is on the taxpayer to establish the proper tax treatment. Types of evidence that may be considered include legal filings, the terms of the settlement agreement, correspondence between the parties, internal memos, press releases, annual reports, and news publications. However, as a general rule, the IRS views the initial complaint as most persuasive (see Rev. Rul. 85-98).

How to contact Christine Turgeon?

For additional information about these items, contact Ms. Turgeon at 973-202-6615 or [email protected].

What happens if you don't take the rules into account?

Taxpayers that fail to take these rules into account when negotiating a settlement agreement or reviewing a proposed court order or judgment may experience adverse and possibly avoidable tax consequences.

What is the tax consequences of a settlement?

Takeaway. The receipt or payment of amounts as a result of a settlement or judgment has tax consequences. The taxability, deductibility, and character of the payments generally depend on the origin of the claim and the identity of the responsible or harmed party, as reflected in the litigation documents. Certain deduction disallowances may apply.

How is proper tax treatment determined?

In general, the proper tax treatment of a recovery or payment from a settlement or judgment is determined by the origin of the claim. In applying the origin-of-the-claimtest, some courts have asked the question "In lieu of what were the damages awarded?" to determine the proper characterization (see, e.g., Raytheon Prod. Corp., 144 F.2d 110 (1st Cir. 1944)).

Can a taxpayer be the recipient of a settlement?

During the normal course of business, a taxpayer may find itself the recipient or payer of a settlement or judgment as a result of litigation or arbitration. The federal tax implications of a settlement or judgment, which can be significant, often are overlooked. For both the payer and the recipient, the terms of a settlement or judgment may affect ...

How to opt out of Google Analytics?

To opt-out of being tracked by Google Analytics across all websites visit http://tools.google.com/dlpage/gaoptout. This will allow you to download and install a Google Analytics cookie-free web browser.

What is JD Supra?

JD Supra is a legal publishing service that connects experts and their content with broader audiences of professionals, journalists and associations.

What is disclosure in law enforcement?

Any court, governmental authority, law enforcement agency or other third party where we believe disclosure is necessary to comp ly with a legal or regulatory obligation, or otherwise to protect our rights, the rights of any third party or individuals' personal safety, or to detect, prevent, or otherwise address fraud, security or safety issues.

What is readership information?

Readership information is provided to publishing law firms and companies and authors of content to give them insight into their readership and to help them to improve their content.

Why do you capitalize lawsuits?

For example, if a lawsuit arises because a plaintiff challenges the validity of a merger transaction, such expenses incurred in defending the lawsuit must be capitalized because the claim is rooted in the acquisition of a capital asset. If, however, the plaintiffs allege that securities law violations by the board of directors harmed the value ...

Can a company deduct legal expenses?

No company welcomes a lawsuit with open arms, but knowing that related expenses are generally deductible can be comforting as legal bills start to multiply. Companies must be aware of the limitations of writing off legal expenses, damages, and settlements so that they can take full advantage of the deduction on their next tax return. To fully assess your situation, it is always best to consult a professional regarding available tax deductions for costs incurred in litigation.

Is a lawsuit deductible for a company?

Any lawsuit a company faces is disruptive to business. The costs associated with hiring attorneys, defending a case, and paying for damages or a settlement can be exorbitant, and damage a company’s profitability. The good news is these payments are generally tax deductible business expenses. In order to maximize this deduction, however, companies ...

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal physi…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - Th…

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).