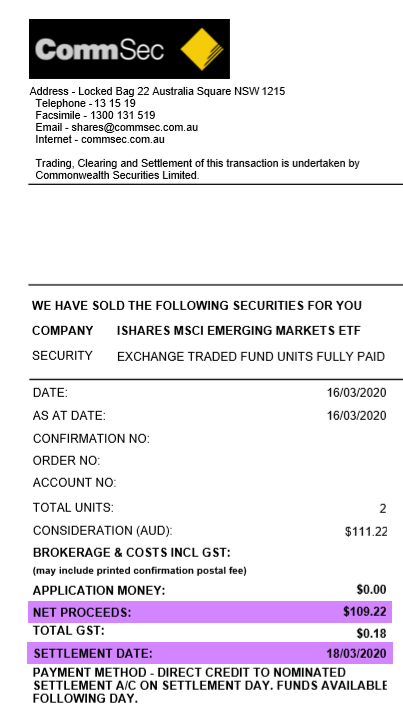

When you make a trade, both the trade date and the settlement date are listed on the brokerage confirmation you receive. These different dates have implications on tax and the liquidity of your funds. What you need to know about settlement date.

What is a settlement date in trading?

One example that stumps beginners and experienced investors alike has to do with the process that occurs whenever you buy or sell a stock or other investment. After you make a trade, you might notice on your brokerage confirmation that there are multiple dates listed, one called the trade date and the other called the settlement date.

What is a trade confirmation and how does it work?

Thanks to SEC-mandated and other regulatory requirements, when you begin placing trades through your brokerage account with your new stockbroker, you will get something known as a trade confirmation.

Does the SEC pay attention to settlement dates on stocks?

But the Securities and Exchange Commission also pays attention to settlement dates, and it has rules that can trip up investors who aren't mindful of those dates. If you have a cash brokerage account, then the SEC requires that you have enough available cash to pay for the purchase of any stock before you sell it.

What can you find on a brokerage trade confirmation?

What You Might Find on a Brokerage Trade Confirmation The name of the investment you traded, along with the ticker symbol Total shares bought or sold The cost or selling price per share

Is trade confirmation same as settlement?

A trade confirmation is the printed notification of a securities transaction. A confirmation must be sent to a customer on or before the completion of a transaction. The completion of a transaction is considered to be the earlier of the settlement date or the date when the buyer and seller exchange cash and securities.

Does trade confirmation mean settled?

A trade confirmation is a receipt of an executed order sent to you by your broker. Trade confirmations are sent to verify that the transaction has taken place and you will receive one after every trade you make. These can be used to assist with tax filings or settle any discrepancies.

What is a trade settlement date?

What Is a Settlement Date? The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

Does IRS use trade date or settlement date?

For US taxpayers, it's the trade date unless a short sale is involved. This is from IRS 2017 Instructions for Form 8949: "Use the trade date for stocks and bonds traded on an exchange or over-the-counter market.

What happens in trade confirmation?

Trade confirmations contain key trade details. These include the date and time of the transaction, price at which you bought or sold a security and the quantity of shares bought or sold.

What is a trade confirmation?

Related Content. Also known as a swap confirmation, or simply a confirmation. A document which parties to a derivatives transaction use to specify the commercial terms of the transaction, including pricing terms such as spreads.

Can I trade before settlement date?

Can you sell a stock before the settlement date? The key is knowing if you bought the stock using settled or unsettled cash. If you bought the stock (or other type of security) using settled cash, you can sell it at any time.

What is trade and settlement process?

Following a trade of stocks, bonds, futures, or other financial assets, trade settlement is the process of moving securities into a buyer's account and cash into the seller's account. Stocks over here are usually settled in three days.

Why does it take 2 days for trades to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What is the last day for tax loss selling in 2021?

Dec. 31First and foremost, any tax loss harvesting strategy must be executed by Dec. 31 in order for the loss to offset 2021 gains.

Are my capital gains recognized on the trade or settlement date?

In most cases, tax law considers the trade date as the date on which a gain or loss is recognized. If you sell a stock at a gain on December 31, you are responsible for any capital gains tax in the current tax year, even though the trade won't settle until the next year.

What happens if you sell stock before settlement date?

Only cash or the sales proceeds of fully paid for securities qualify as "settled funds." Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date.

What is meant by trade settlement?

Following a trade of stocks, bonds, futures, or other financial assets, trade settlement is the process of moving securities into a buyer's account and cash into the seller's account. Stocks over here are usually settled in three days.

How long does it take to confirm a trade?

With these details, you can be confident that your broker has carried out your wishes. A few days after you have made the trade over the phone, you should receive a confirmation in the mail (or online) from your broker. Ensure that the details of this confirmation match your trading intentions.

What is trade clearing and settlement?

Clearing and settlement directly follows a trade. Clearing is what comes immediately after the trade, where all the terms of the deal are double-checked. Settlement is the final stage, in which the transfer of securities and money takes place.

When must trade confirmations be delivered?

Rule 10b-10 requires broker-dealers to send customers a written confirmation on or before the completion of a transaction. It also prescribes the type of information required to be displayed on securities confirmations.

When is the settlement date for a government bond?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date 2

Why did the stock market have settlement dates?

Settlement dates were originally imposed in an effort to mitigate against the fact that in earlier times, stock certificates were manually delivered, leaving windows of time where a stock's share price could fluctuate before investors received them.

What is the date of a security purchase?

Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

What is the first date of a buy order?

The first is the trade date , which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

How long after the trade date do you settle a mutual fund?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date. For foreign exchange spot transactions, U.S. equities, and municipal bonds, the settlement date occurs two days after the trade date, commonly referred to as "T+2". In most cases, ownership is transferred without complication.

Do buyers and sellers transfer ownership?

In most cases, ownership is transferred without complication. After all, buyers and sellers alike are eager to satisfy their legal obligations and finalize transactions. This means that buyers provide the necessary funds to pay sellers, while sellers hold enough securities needed to transfer the agreed-upon amount to the new owners.

How long after a trade date do you settle?

With stocks and exchange-traded funds, the settlement date is three business days after the trade date. Mutual funds and options settle more quickly, with a settlement date that's the next business day after the trade date. Why trade and settlement dates matter. The trade date is the key date for one very important aspect of investing: tax rules.

Why do settlement dates matter?

Settlement dates matter because of funding requirements from your broker. Some brokers will let you buy stock even if you don't have enough money currently in your account to pay for the shares, relying on you to deposit cash at some point between the trade date and the settlement date to cover the cost of the stock.

What does settlement date mean on a stock?

The settlement date, on the other hand, reflects the date on which your broker actually "settles" the trade. Technically, even though your online brokerage account will typically list the shares you've just bought among your holdings, your broker doesn't actually take the money out of your account and put the shares in until a later date.

What is the trade date?

Of these two terms, the trade date makes more sense intuitively. It's the date on which you actually entered and executed the trade. Most investors think of the trade date as the only one that truly matters, as it's the one that you have the most control over.

Does it matter if the settlement date comes later?

So as long as you get that trade executed before the market closes on the last day of the year, it doesn't matter that the settlement date comes later. Also, when measuring how long you've owned a stock to determine whether a gain is short-term or long-term, you'll use the trade date to measure your holding period.

Is settlement date lag good?

Having the settlement-date lag can actually be helpful from a liquidity standpoint. But the Securities and Exchange Commission also pays attention to settlement dates, and it has rules that can trip up investors who aren't mindful of those dates.

Do people think twice about trade dates?

Most people never think twice about those two dates , but there are a couple of situations in which it makes a huge difference knowing how trade dates and settlement dates differ. Let's take a look at the various uses of both dates and what you need to know to avoid some nasty surprises. An archaic distinction.

What Is a Settlement Date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date. Options contracts and other derivatives also have settlement dates for trades in addition to a contract's expiration dates .

What causes the time between transaction and settlement dates to increase substantially?

Weekends and holidays can cause the time between transaction and settlement dates to increase substantially, especially during holiday seasons (e.g., Christmas, Easter, etc.). Foreign exchange market practice requires that the settlement date be a valid business day in both countries.

How far back can a forward exchange settle?

Forward foreign exchange transactions settle on any business day that is beyond the spot value date. There is no absolute limit in the market to restrict how far in the future a forward exchange transaction can settle, but credit lines are often limited to one year.

How long does it take for a stock to settle?

Most stocks and bonds settle within two business days after the transaction date . This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

How long does it take to settle a stock trade?

Historically, a stock trade could take as many as five business days (T+5) to settle a trade. With the advent of technology, this has been reduced first to T=3 and now to just T+2.

Why is there credit risk in forward foreign exchange?

Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement risk because the currencies are not paid and received simultaneously. Furthermore, time zone differences increase that risk.

What is the date on which a trade is deemed settled?

The settlement date is the date on which a trade is deemed settled when the seller transfers ownership of a financial asset to the buyer against payment by the buyer to the seller.

What is settlement date?

Settlement date is an industry term that refers to the date when a trade or derivative contract is deemed final, and the seller must transfer the ownership of the security to the buyer against the appropriate payment for the asset. It is the actual date when the seller completes the transfer of assets, and the payment is made to the seller.

When Does Settlement Occur?

The settlement date is the number of days that have elapsed after the date when the buyer and seller initiated the trade. The abbreviations T+1, T+2, and T+3 are used to denote the settlement date. T+1 means the trade was settled on “transaction date plus one business day,” T+2 means the trade was settled on “transaction date plus two business days,” and T+3 means the trade was settled on “transaction date plus three business days.”

What are the risks of a lag between a transaction date and a settlement date?

The lag between the transaction date and the settlement date exposes the buyer and the seller to the following two risks: 1. Credit risk . Credit risk refers to the risk of loss resulting from the buyer’s failure to meet the contractual obligations of the trade. It occurs due to the elapsed time between the two dates and the volatility of the market.

What is the difference between settlement date and transaction date?

Transaction date is the actual date when the trade was initiated. On the other hand, settlement date is the final date when the transaction is completed. That is, the date when the ownership of the security is transferred from the seller to the buyer, and the buyer makes the payment for the security to the seller.

Why does a buyer fail to make the agreed payment?

The buyer may fail to make the agreed payment by the settlement date, which causes an interruption of cash flows. 2. Settlement risk.

How long does it take for a bond to settle?

Bonds and stocks are settled within two business days, whereas Treasury bills and bonds are settled within the next business day. Where the period between the transaction date and the settlement date falls on a holiday or weekend, the waiting period can increase substantially.

What is the settlement date for a stock?

Settlement date refers to the date on which payment is made to settle the purchase or sale of a security such as a stock , bond, mutual fund, or exchange-traded fund (ETF). If you purchase a security, the settlement date is the day you must pay for your purchase. If you sell a security, it is the date you will receive money for the sale.

Why is the settlement date important?

In addition, the settlement date may be important for tax, accounting, and other purposes, including:

How long does it take for a securities transaction to settle?

The settlement date is different for different types of securities, but it typically occurs within three business days of the transaction or trade date. This article will review the settlement dates for different securities and explain why it is important.

What is a settlement violation?

Settlement violations occur when purchases go through and there is not sufficient settled cash in the investor’s account to pay for the trade on settlement day. A brokerage firm is responsible for settling a trade if the investor has not provided the funds by the settlement date. If payment for a purchase is not provided by the settlement date, a brokerage may sell the security (thereby canceling the transaction), and charge the investor for any loss resulting from a drop in the market value of the security. A brokerage may also charge interest or impose fees.

How long does it take to settle a stock on a Monday?

The settlement date for stocks specifically is two days after a trade is executed. 1

Why is it important to settle trades?

It has always been important to settle trades in financial markets as quickly as possible. Unsettled trades pose risks, particularly if market prices drop steeply and trading volume soars. A long period between trade and settlement in this situation increases the risk that investors could no longer pay for their transactions .

How long does it take for a certificate of sale to settle?

The settlement date was originally longer to make up for the time it would take for a certificate of sale to arrive manually, but since the introduction of electronic trades, the period between the trade date and the settlement date has shrunk to as little as one or two days for most securities.

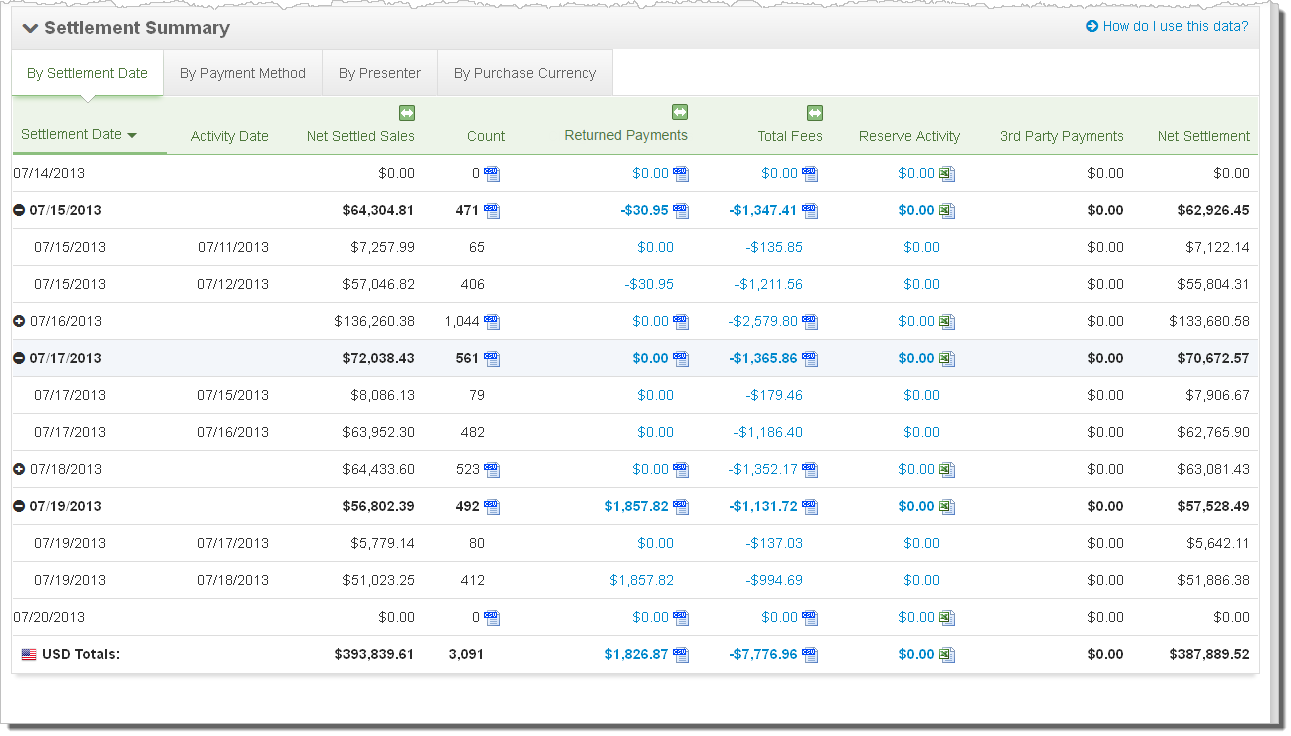

What Is a Brokerage Trade Confirmation?

When you place trades through a brokerage account , you will receive a report known as a brokerage trade confirmation. This is a detailed record of the trade completed. While trade confirmations can vary, they often includes:

What is a detailed record of the trade?

It is a detailed record of the trade includes what was traded; date of the trade; cost; net value; any commissions or fees that your broker charged; and more.

What to do if a broker is uncooperative?

If the brokerage is uncooperative or you suspect unethical behavior on their part, there are agencies that can help. Tip. If you bring up any concerns with your broker, keep notes of your conversations and actions for future reference. These can be useful if you later need to file a complaint.

What does it mean when a brokerage sells you a security?

That means they are benefitting from the transaction by marking prices up or down. These are commission equivalent charges and must be disclosed.

What to do before choosing a broker?

Before choosing a broker, you may also want to use FINRA's broker checking tool and view their list of banned brokers. You can also contact the agency with regulatory or other questions.

What to do if you bring up a complaint with a broker?

If you bring up any concerns with your broker, keep notes of your conversations and actions for future reference. These can be useful if you later need to file a complaint.

What is the SEC?

The Securities and Exchange Commission (SEC) is the regulatory authority for financial trading. You can file complaints with them. You can also find answers to investing questions.

What Is A Settlement Date?

Understanding Settlement Dates

Settlement Date Risks

- The settlement date, on the other hand, reflects the date on which your broker actually \"settles\" the trade. Technically, even though your online brokerage account will typically list the shares you've just bought among your holdings, your broker doesn't actually take the money out of your account and put the shares in until a later date. With st...

Life Insurance Settlement Date

Understanding Settlement Dates

- The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchang...

When Does Settlement occur?

- The financial market specifies the number of business days after a transaction that a security or financial instrument must be paid and delivered. This lag between transaction and settlement datesfollows how settlements were previously confirmed, by physical delivery. In the past, security transactions were done manually rather than electronically. Investors would have to wait for the …

Settlement Date Risks

- The elapsed time between the transaction and settlement dates exposes transacting parties to credit risk. Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement riskbecause the currencies are not paid and received simultaneously. Furthermore, time zone differences inc…

Additional Resources

- Life insurance is paid following the death of the insured unless the policy has already been surrendered or cashed out. If there is a single beneficiary, payment is usually within two weeks from the date the insurer receives a death certificate. Payment to multiple beneficiaries can take longer due to delays in contact and general processing. Most states require the insurer pay inter…