How are bonds used to pay for tobacco?

The answer: bonds. A bond is like a loan. Investors buy the bonds, providing states with cash. States repay the bondholders using the tobacco money. The typical bond lasts 30 years or less and pays interest every year. If tobacco payments fall short, investors have no right – ‘no recourse’ – to be repaid with taxpayer money.

How much tobacco money is still owed to taxpayers?

Because of the steep payments promised to some bondholders, that could take years or decades in which taxpayers lose out on the tobacco money. In all, states, counties, cities, and territories sold some $36 billion in tobacco bonds that are still outstanding.

What is the tobacco Master Settlement Agreement?

The Tobacco Master Settlement Agreement ( MSA) was entered on November 23, 1998, originally between the four largest United States tobacco companies ( Philip Morris Inc., R. J. Reynolds, Brown & Williamson and Lorillard – the "original participating manufacturers", referred to as the "Majors") and the attorneys general of 46 states.

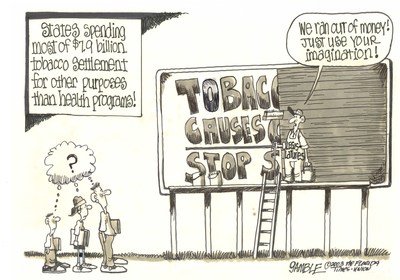

How did the tobacco settlement with Big Tobacco affect states?

A landmark 1998 settlement with Big Tobacco awarded states billions of dollars a year to offset the health-care costs of smoking. What seemed like a boon become a debt trap for many state and local governments when they used it to promise investors billions in the future in exchange for cash advances.

How many states issue tobacco settlement bonds?

Municipal tobacco settlement bonds are one of the largest, most liquid and highest yielding sectors within the municipal high yield bond market. Issued by 17 states, the District of Columbia, three territories and a handful of counties, senior lien tobacco bonds total about $32 billion in par amount outstanding, ...

What is municipal tobacco bond?

Municipal tobacco bonds issued against the proceeds of the landmark settlement are one of the largest, most liquid and highest yielding segments of the municipal bond market.

What are the risks of investing in bonds?

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

What are the effects of reductions in bond counterparty capacity?

Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax.

What is the most important factor affecting the stream of settlement payments under the MSA?

The most important factor affecting the stream of settlement payments under the MSA is U.S. cigarette consumption. A quick look back in history: Cigarette production began in the U.S. in the early 20th century. In 1964, the U.S. Surgeon General released a report titled “Smoking and Health” that warned of smoking’s adverse health effects. In 1981, the number of cigarettes smoked annually in the U.S. peaked at 640 billion. This number has since fallen to 263 billion for 2014 as usage bans, cigarette taxes and other restrictions have been enacted.

Can municipal bonds be used as investment?

Yes; however, municipal tobacco bonds can still be an attractive investment. This is because they behave differently from a typical corporate bond in a default scenario. For a typical corporate, assets are sold or debtor liabilities are reorganized, leaving the original creditor with a recovery claim. For a tobacco bond, if the tobacco trust does not have enough cash to pay interest and principal due, bonds remain outstanding (no acceleration) and payments continue to be made from whatever tobacco settlement revenues are available. As a reminder, the settlement payments go on in perpetuity until the bonds are paid off or people stop smoking altogether.

How much money did states sell in tobacco bonds?

In all, states, counties, cities, and territories sold some $36 billion in tobacco bonds that are still outstanding. Most had routine repayment terms. But to get extra cash up front, some sold capital appreciation bonds, or CABs which came with steeper repayments terms.

What was the settlement with Big Tobacco?

A landmark 1998 settlement with Big Tobacco awarded states billions of dollars a year to offset the health-care costs of smoking. What seemed like a boon become a debt trap for many state and local governments when they used it to promise investors billions in the future in exchange for cash advances.

How long do bonds last?

Investors buy the bonds, providing states with cash. States repay the bondholders using the tobacco money. The typical bond lasts 30 years or less and pays interest every year.

Can investors be repaid for tobacco?

If tobacco payments fall short, investors have no right – ‘no recourse’ – to be repaid with taxpayer money. But they retain rights to future tobacco payments. Because of the steep payments promised to some bondholders, that could take years or decades in which taxpayers lose out on the tobacco money.

What is the tobacco master settlement agreement?

The Tobacco Master Settlement Agreement ( MSA) was entered in November 1998, originally between the four largest United States tobacco companies ( Philip Morris Inc., R. J. Reynolds, Brown & Williamson and Lorillard – the "original participating manufacturers", referred to as the "Majors") and the attorneys general of 46 states. The states settled their Medicaid lawsuits against the tobacco industry for recovery of their tobacco-related health-care costs. In exchange, the companies agreed to curtail or cease certain tobacco marketing practices, as well as to pay, in perpetuity, various annual payments to the states to compensate them for some of the medical costs of caring for persons with smoking-related illnesses. The money also funds a new anti-smoking advocacy group, called the Truth Initiative, that is responsible for such campaigns as Truth and maintains a public archive of documents resulting from the cases.

How many lawsuits were filed against tobacco companies?

By the mid-1950s, individuals in the United States began to sue the companies responsible for manufacturing and marketing cigarettes for damages related to the effects of smoking. In the forty years through 1994, over 800 private claims were brought against tobacco companies in state courts across the country. The individuals asserted claims for negligent manufacture, negligent advertising, fraud, and violation of various state consumer protection statutes. The tobacco companies were successful against these lawsuits. Only two plaintiffs ever prevailed, and both of those decisions were reversed on appeal. As scientific evidence mounted in the 1980s, tobacco companies claimed contributory negligence as they asserted adverse health effects were previously unknown or lacked substantial credibility.

How long does it take for a SPM to join the Master Settlement Agreement?

As an incentive to join the Master Settlement Agreement, the agreement provides that, if an SPM joined within ninety days following the Master Settlement Agreement's "Execution Date," that SPM is exempt ("exempt SPM") from making annual payments to the settling states unless the SPM increases its share of the national cigarette market beyond its 1998 market share, or beyond 125% of that SPM's 1997 market share. If the exempt SPM's market share in a given year increases beyond those relevant historic limits, the MSA requires that the exempt SPM make annual payments to the settling states, similar to those made by the OPMs, but based only upon the SPM's sales representing the exempt SPM's market share increase.

What was the 1997 National Settlement Proposal?

This proposed congressional remedy (1997 National Settlement Proposal (NSP), a.k.a. the "June 20, 1997 Proposal") for the cigarette tobacco problem resembled the eventual Multistate Settlement Agreement (MSA), but with important differences. For example, although the congressional proposal would have earmarked one-third of all funds to combat teenage smoking, no such restrictions appear in the MSA. In addition, the congressional proposal would have mandated Food and Drug Administration oversight and imposed federal advertising restrictions. It also would have granted immunity from state prosecutions; eliminated punitive damages in individual tort suits; and prohibited the use of class actions, or other joinder or aggregation devices without the defendant's consent, assuring that only individual actions could be brought. The congressional proposal called for payments to the states of $368.5 billion over 25 years. By contrast, assuming that the Majors would maintain their market share, the MSA provides baseline payments of about $200 billion over 25 years. This baseline payment is subject to

How many plaintiffs have ever prevailed in the tobacco case?

Only two plaintiffs ever prevailed, and both of those decisions were reversed on appeal. As scientific evidence mounted in the 1980s, tobacco companies claimed contributory negligence as they asserted adverse health effects were previously unknown or lacked substantial credibility.

When was the Master Settlement Agreement signed?

Adoption of the "Master Settlement Agreement". In November 1998 , the Attorneys General of the remaining 46 states, as well as of the District of Columbia, Puerto Rico, and the Virgin Islands, entered into the Master Settlement Agreement with the four largest manufacturers of cigarettes in the United States.

When was smoking linked to heart disease?

Private lawsuits before the settlement. In September 1950, an article was published in the British Medical Journal linking smoking to lung cancer and heart disease. In 1954 the British Doctors Study confirmed the suggestion, based on which the government issued advice that smoking and lung cancer rates were related.

How can I avoid paying taxes on bonds?

Here are a few strategies for avoiding – or at least reducing – the taxes you pay on bonds.

What is the tax rate on bonds?

There are seven tax brackets, ranging from 10% to 37%. So if you're in the 37% tax bracket, you'll pay a 37% federal income tax rate on your bond interest. 2020 Tax Brackets.

How long do you have to hold a bond to get capital gains tax?

Then the gain is taxed at your ordinary income tax rates. Long-term capital gains apply if you hold the bond for more than one year.

What are the two types of income that bonds generate?

Bonds and bond funds generate two types of income: interest and capital gains.

What is a zero coupon bond?

With a zero-coupon bond , you buy the bond at a discount from its face value, don't receive interest payments during the bond's term, and are paid the bond's face amount when it matures.

What is a municipal bond?

Municipal bonds, aka munis, are the main type of tax-exempt bonds. Munis are issued by states, counties, cities, and other government agencies to fund major capital projects, such as building schools, hospitals, highways, and other public buildings.

What is a bond?

Bonds are a type of debt instrument. When you buy a bond, you're loaning money to the government or company that issued it; in return, that entity pays you interest. Most bonds pay a fixed, predetermined rate of interest over their lifespan.