In many situations, a debt settlement contract is a legal agreement and can be upheld in a court of law. There are several things you may be able to do, though, to get out of the agreement. Contact the company and request to be removed from the contract.

Full Answer

How to negotiate a debt settlement?

If you want to make a proposal to repay this debt, here are some considerations:

- Be honest with yourself about how much you can pay each month. ...

- Write down a summary of your monthly take-home pay and all your monthly expenses (including the amount you want to repay each month and other debt payments). ...

- Decide on the total amount you are willing to pay to settle the entire debt. This could be a lump sum or a number of payments. ...

Is a debt settlement worth it?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you’re able to offer a lump sum of money to settle your debt. If you’re carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you. There are numerous debt settlement and credit card companies that promise to help you settle your debt for half or even a small fraction of the total balance you owe, but is debt settlement really a good idea?

When is debt settlement worth it?

Debt settlement is a repayment strategy where you negotiate with a creditor to pay less than you owe. If you have a lot of unsecured debts, then a settlement might be the best way to get rid of them in the shortest time possible. Settling is difficult, however, and it comes with a few drawbacks such as credit score damage and the stress of negotiating with creditors. So, is debt settlement worth it? Questions To Ask Yourself if Debt Settlement is Worth It.

How to settle debt on your own?

To settle debt on your own you will need to:

- Learn the steps to settle debt on your own – What to say when negotiating, what to send to creditors in writing, and the overall order of operations.

- Obtain debt settlement letter templates, negotiating letters, counteroffers, settlement acceptance letters and much more. ...

- Understand the pros and cons when settling debt on your own. ...

Can you get out of a debt settlement contract?

Some of the requirements that debt settlement companies must tell you are: The price of the debt settlement. That you have the right to cancel the debt settlement contract at anytime without any penalties.

What is a debt settlement contract?

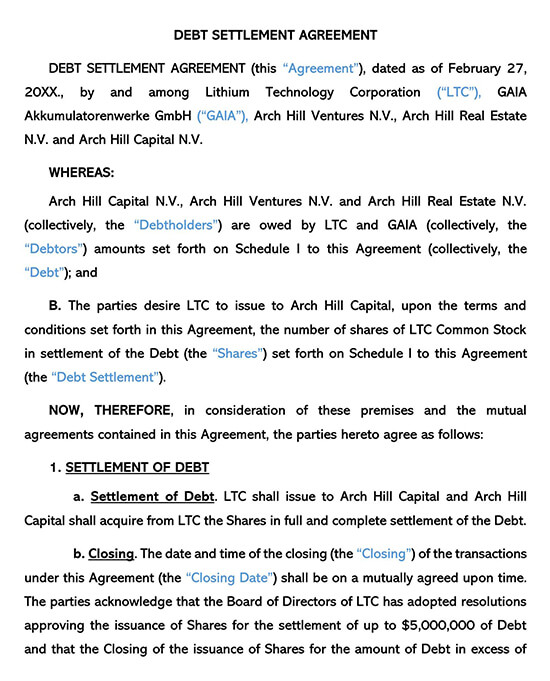

A debt settlement agreement is a legal document that outlines an arrangement between a creditor and debtor where the creditor forgives part of the debt in exchange for immediate payment. It's important to note that this is not bankruptcy, it is just one more option you can use to get out of debt.

What percentage should I offer to settle debt with collection agency?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

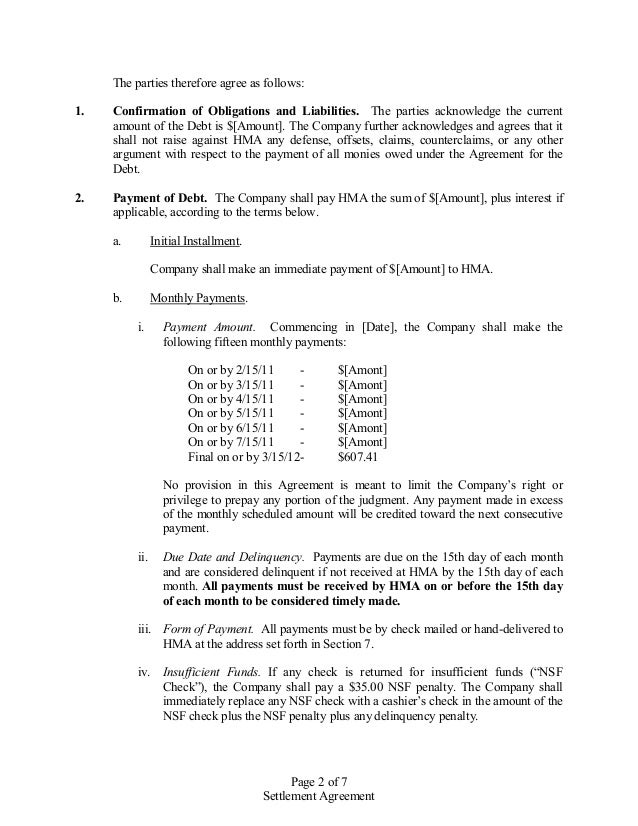

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How Much Do debt settlement companies charge?

a 15% to 25%Debt settlement companies typically charge a 15% to 25% fee to tackle your debt; this could be a percentage of the original amount of your debt or a percentage of the amount you've agreed to pay.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Will Debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

What happens if a debt collector won't negotiate?

If the collection agency refuses to settle the debt with you, or if the agency or creditor agrees to settle, but you renig on your end of the agreement, the collection agency or creditor may decide to pursue more aggressive collection efforts against you, which may include a lawsuit.

How can a debt lawsuit be dismissed?

In a motion to dismiss, you can ask the judge to throw out any or all of the claims in the lawsuit. The judge will review your claims and issue a ruling. Use SoloSuit to respond to a debt collection lawsuit and win your case.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

How do you propose a settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What is debt settlement and how does it work?

Debt settlement is when your debt is settled for less than what you currently owe, with the promise that you'll pay the amount settled for in full. Sometimes known as debt relief or debt adjustment, debt settlement is usually handled by a third-party company, although you could do it by yourself.

Is debt settlement better than not paying?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

What happens after you settle a debt?

When you settle an account, its balance is brought to zero, but your credit report will show the account was settled for less than the full amount. Settling an account instead of paying it in full is considered negative because the creditor agreed to take a loss in accepting less than what it was owed.

What do debt settlement companies have to tell you?

Some of the requirements that debt settlement companies must tell you are: The price of the debt settlement. That you have the right to cancel the debt settlement contract at anytime without any penalties.

What to do if a debt settlement company refuses to return money?

If the debt settlement company refuses to return the money that is legally yours, you can sue the company. Also, we recommend filing a complaint against the company with the New York Attorney General’s office or the New Jersey Attorney General’s office.

How long does it take for a credit card to negotiate a delinquent account?

However, they fail to tell consumers that as their accounts continue to go into delinquent status, the impacts on their credit score can be severe. Debt negotiation can take anywhere from 36 to 48 months. This is almost three years of accounts being in delinquent status.

What to do if you are falling behind on your bills?

Debt Lawyer. If you are falling behind on your bills, it is best to speak with a bankruptcy lawyer who can help you determine which route is best for your financial situation. Keep in mind, that filing bankruptcy is usually the better option when you are in debt.

Can you cancel a debt settlement contract?

That you have the right to cancel the debt settlement contract at anytime without any penalties.

Can you keep up with debt settlement?

During this time interest, fees and penalties continue to accrue. Most consumers can’t keep up with these payments and thus, never make it to the end of any debt settlement plan. More importantly, debt settlement companies fail to inform consumers about the risks of being delinquent on their credit cards.

Kurt Duane Elkins

In california most of the "settlement" firms are not living up to the terms of the contracts. It is a very tough business with a lot of new firms, they tend to over promise and under deliver based on the cases I have seen. You should ask for a refund, if they are honest they will refund your money, If you...

Dorothy G Bunce

The contract you have with the debt settlement company should have specified exactly how you can cancel & what portion of your money you can receive as a refund. Typically, your payment is broken into 2 categories - service fees, which include...

Scott Richard Kaufman

My experience is that mostly, these companies are shams that prey on people already in dire need of financial help. I'm guessing you are now figuring this out. Years ago there was one or two firms doing this work and they were quite honorable.

Kathryn Ursula Tokarska

It's simple to cancel. Give them notice IN WRITING and request accounting and a refund. Over the past 3 years, I've seen a bunch of these settlement contracts and been digusted by the terms. People who prey on the desperate and vulnerable are the worst, in my book.

What happens if a debt settlement company has already begun working on your behalf?

If the debt settlement compay has already begun working on your behalf, it may have already contacted your creditors, so you need to let them know the same thing you told the bank, which is that you are canceling the agreement.

How to handle credit card debt?

Generally, those options are to: Continue to handle the debt on your own. Contact the creditors for help. Settle the debt either on your own or with the assistance of a third party.

Can failure to pay void your credit card agreement?

In some instances, failure to pay may void your agreement, which would actually be to your benefit. Either way, you need to know that you do still owe your credit card debt. Once you have made the call to your bank, your next call should be to your credit card companies.

Do you have to tell creditors you owe them?

Because you do still owe the debt, you will need to be prepared to tell your creditors how you plan on repaying the debt . Your decision to sign on with this firm in the first place tells me that you don’t really have a plan for paying the debt. There are several options when it comes to handling credit card debt. Generally, those options are to:

Is The Contract Binding?

You wanted debt relief when you signed up with the debt settlement company, but most people still take the time to read through the contract provided. In some situations, you and your attorney can prove that the contract is not legally binding. If it was not signed and witnessed by both parties, it may not be binding.

What To Do When You Cannot Get Out

In many situations, a debt settlement contract is a legal agreement and can be upheld in a court of law. There are several things you may be able to do, though, to get out of the agreement.

Hire An Attorney

In nearly all situations in which a consumer feels a debt settlement company is not fulfilling its responsibilities or that the company is in some way misrepresenting them, it is best to hire an attorney to handle your case. The attorney can help determine what legal action you can take against the company or to avoid a lawsuit.

What is debt settlement?

Debt settlement companies are companies that say they can renegotiate, settle, or in some way change the terms of a person's debt to a creditor or debt collector. Dealing with debt settlement companies can be risky. Debt settlement companies, also sometimes called "debt relief" or "debt adjusting" companies, often claim they can negotiate ...

What happens if you stop paying debt settlement?

This can have a negative effect on your credit score and may result in the creditor or debt collector filing a lawsuit while you are collecting settlement funds. And if you stop making payments on a credit card, late fees and interest will be added to the debt each month. If you exceed your credit limit, additional fees and charges may apply. This can cause your original debt to increase.

How to avoid paying credit card debt?

Avoid doing business with any company that promises to settle your debt if the company: 1 Charges any fees before it settles your debts 2 Represents that it can settle all of you debt for a promised percentage reduction 3 Touts a "new government program" to bail out personal credit card debt 4 Guarantees it can make your debt go away 5 Tells you to stop communicating with your creditors 6 Tells you it can stop all debt collection calls and lawsuits 7 Guarantees that your unsecured debts can be paid off for pennies on the dollar

What is an alternative to a debt settlement company?

An alternative to a debt settlement company is a non-profit consumer credit counseling service. These non-profits can attempt to work with you and your creditors to develop a debt management plan that you can afford, and that can help get you out of debt.

What happens if you stop paying your credit card bills?

If you stop paying your bills, you will usually incur late fees, penalty interest and other charges, and creditors will likely step up their collection efforts against you.

Is forgiven debt taxable income?

If a portion of your debt is forgiven by the creditor, it could be counted as taxable income on your federal income taxes. You may want to consult a tax advisor or tax attorney to learn how forgiven debt affects your federal income tax. Read full answer.

Can a debt settlement company settle all your debts?

In many cases, the debt settlement company will be unable to settle all of your debts. If you do business with a debt settlement company, the company may tell you to put money in a dedicated bank account, which will be managed by a third party. You may be charged fees for using this account.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

What to do if you agree to a settlement?

If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed these payments. Get it in writing before you make a payment.

What happens if the statute of limitations is passed?

If the statute of limitations has passed, then your defense to the lawsuit could stop the creditor or debt collector from obtaining a judgment. You may want to find an attorney in your state to ask about the statute of limitations on your debt. Low income consumers may qualify for free legal help.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

What to do if you don't recognize the creditor?

If you don’t recognize the name of the creditor, you can ask what the original debt was for (credit card, mortgage foreclosure deficiency, etc.) and request the name of the original creditor. After you receive the debt collector’s response, compare it to your own records.