In most cases, stocks and brokerage accounts can be garnished by a creditor with a money judgment. However, sometimes a brokerage account may be exempt from garnishment due to federal or state law. Brokerage Garnishment Procedure

Can my stocks be garnished?

Can Stocks Be Garnished? A garnishment occurs when a creditor legally freezes your financial accounts or takes your wages without your expressed permission. Stocks you own or money held inside your brokerage account may or may not be garnished, depending on what type of account you own.

Can I negotiate a wage garnishment settlement with a creditor?

Once a judgment is issued and the creditor is able to receive payment through wage garnishment, you have little leverage for negotiating a settlement. At this point, the creditor has sufficiently proven the debt is valid and the court has ordered you to repay it.

Can a brokerage account be garnished?

A garnishment occurs when a creditor legally freezes your financial accounts or takes your wages without your expressed permission. Stocks you own or money held inside your brokerage account may or may not be garnished, depending on what type of account you own.

Can my assets be garnished If I don't pay?

Your assets can also be garnished if you are sued and a judgment is rendered against you and you do not pay the judgment. The government can also garnish assets if you owe back taxes or child support payments.

Can a lawsuit Take your stocks?

A judge might allow creditors to take your stocks, money and just about everything except the shirt on your back. However, you can protect stock from creditors through careful preparation.

Can stocks be taken away?

Shareholders have an ownership interest in the company whose stock they own, and companies can't generally take away that ownership. However, there are a few situations in which shareholders must sell their stock even if they would prefer to hold onto their shares.

What accounts are protected from garnishment?

Open a Wage Account or Government Benefit Account In addition, most federal benefits, such as social security or disability payments, are exempt from garnishment by federal laws.

Are stocks protected from creditors?

Stocks held inside your 401k plan are protected from creditors by the The Employee Retirement Income Security Act (ERISA). ERISA is federal law, so it does not matter which state you live in.

How do I protect my stocks from a lawsuit?

Options for asset protection include:Domestic asset protection trusts.Limited liability companies, or LLCs.Insurance, such as an umbrella policy or a malpractice policy.Alternate dispute resolution.Prenuptial agreements.Retirement plans such as a 401(k) or IRA.Homestead exemptions.Offshore trusts.

Can a company take away your vested stocks?

Often, vested stock options expire if they are not exercised within the specified timeframe after service termination. Typically, stock options expire within 90 days of leaving the company, so you could lose them if you don't exercise your options.

What type of bank account Cannot be garnished?

In many states, some IRS-designated trust accounts may be exempt from creditor garnishment. This includes individual retirement accounts (IRAs), pension accounts and annuity accounts. Assets (including bank accounts) held in what's known as an irrevocable living trust cannot be accessed by creditors.

Can a creditor take all the money in your bank account?

If you can't file for bankruptcy and the judgment can't be overturned, then you will be unable to keep funds in your bank account. The creditor could continuously levy your bank account until the balance is paid in full. You could be relegated to using cashier's checks and money orders to pay your bills.

Can my bank account be garnished without notice?

Yes. A creditor can apply for an order to garnish your bank account without notifying you. The creditor doesn't need to have a judgment against you to do so. The creditor must start a lawsuit against you for the debt before getting a garnishing order.

Can my Robinhood account be garnished?

Yes these creditors can seize the bank and trading accounts if they accounts are solely in your name. A simple garnishment would do.

Are stocks exempt from bankruptcies?

Generally, stocks don't get any special treatment in a California bankruptcy. In other words, most stocks are treated like any other asset.

Can retirement accounts be taken in a lawsuit?

Key Takeaways. If you are sued, creditors may be able to access your retirement savings if you are required to pay a settlement. State protections for IRA funds in a lawsuit vary considerably among the 50 states. Exemptions for traditional IRAs and Roth IRAs are often different.

Do you owe money if your stock goes negative?

Do I owe money if a stock goes down? If a stock drops in price, you won't necessarily owe money. The price of the stock has to drop more than the percentage of margin you used to fund the purchase in order for you to owe money.

What happens if a stock gets delisted?

To be delisted means to be removed from an exchange, meaning the stock is no longer traded on that specific stock exchange. A company can elect to delist its stock, pursuing a strategic goal, or it can be forced off the exchange because it no longer satisfies its minimum requirements.

Can you go negative in stocks?

The price of a stock can fall to extremely low levels and is capable of falling to zero if the issuing company goes bankrupt, but it can never get to a negative value. However, this does not mean that you cannot lose more than your initial capital — if you trade on margin, you may lose more than you invested.

How does a stock get delisted?

Delisting is the removal of a listed security from a stock exchange. The delisting of a security can be voluntary or involuntary and usually results when a company ceases operations, declares bankruptcy, merges, does not meet listing requirements, or seeks to become private.

How to protect stocks from garnishment?

If you cannot pay off your debt or taxes in full, you can try and get a stay of collections, which can protect you from garnishment while the stay is in place. You also have the right to challenge your creditor in court. If you file for a challenge, they cannot garnish your wages until after your case is heard. There may be other ways to postpone or stop a garnishment in your state, so it is a good idea to consult with your attorney.

What is garnishment in stock market?

Learn More →. A garnishment occurs when a creditor legally freezes your financial accounts or takes your wages without your expressed permission. Stocks you own or money held inside your brokerage account may or may not be garnished, depending on what type of account you own.

What happens if you don't pay your debt?

If you fail to make payments on debt you owe, your creditor can take you to court and ask for a judgment that allows them to garnish your assets to pay off the debt. Your assets can also be garnished if you are sued and a judgment is rendered against you and you do not pay the judgment. The government can also garnish assets if you owe back taxes or child support payments.

Can stock be garnished?

Can Stocks Be Garnished? A garnishment occurs when a creditor legally freezes your financial accounts or takes your wages without your expressed permission. Stocks you own or money held inside your brokerage account may or may not be garnished, depending on what type of account you own.

Can you garnish stocks in bankruptcy?

Non-Retirement Stocks. In most states, if you file for bankruptcy or have a judgment held against you, your creditors can generally garnish any stock held inside a non-retirement account, though a court order may be required.

Can you garnish wages after a challenge?

If you file for a challenge, they cannot garnish your wages until after your case is heard. There may be other ways to postpone or stop a garnishment in your state, so it is a good idea to consult with your attorney.

Is 401(k) stock protected from creditors?

Stocks held inside your 401k plan are protected from creditors by the The Employee Retirement Income Security Act (ERISA). ERISA is federal law, so it does not matter which state you live in. In some states, such as New York and New Jersey, other retirement accounts such as individual retirement arrangement accounts, or IRAs, are also protected from most garnishment. IRA and 401k plans are designed to help people save money for retirement, so the government has created special protections for money held inside these accounts.

How to protect your settlement from garnishment?

If the courts issue a judgment against you, protect your injury settlement by moving it to a prepaid debit card – not a bank account. The prepaid card should not have any connection to your traditional checking or savings accounts. This is a legal way to keep your settlement money exempt from garnishment, as collectors will not be able to garnish the prepaid card. Once again, keep a paper trail as proof that the money on the prepaid card came from your injury settlement. Do not commingle any other types of deposits onto the card.

How to keep settlement money separate from other income?

Keep Your Settlement Money Separate. Upon receiving your settlement check, don’t deposit it into the bank with other sources of income. Instead, keep it in its own account, separate from other wages. Do not deposit any other types of money into this account.

Can you garnish a workers comp check in Kansas?

Injury settlement checks through the workers’ compensation program in Kansas City follow much the same rules as other types of settlements. In most cases, workers’ comp settlements are exempt from garnishment as are other settlement types. Debt collectors cannot garnish them, with the exception of certain government agencies. For example, the KC government might be able to garnish a settlement received from workers’ compensation if you fail to pay spousal or child support. Treat a workers’ compensation settlement the same as other injury awards and take steps to protect it from garnishment.

Can you garnish a prepaid card?

This is a legal way to keep your settlement money exempt from garnishment, as collectors will not be able to garnish the prepaid card. Once again, keep a paper trail as proof that the money on the prepaid card came from your injury settlement. Do not commingle any other types of deposits onto the card.

Can a bankruptcy court garnish a settlement?

Ideally, this is true, but there are cases in which creditors and the bankruptcy court might threaten a settlement with garnish ment. In Kansas City, as in most places in the country, injury settlements are exempt from garnishment and from bankruptcy cases.

Can a lien be placed on an injury settlement?

It is possible for a creditor to place a lien on an injury settlement if the law entitles the third party to some or the entire award. For example, an entity paid your medical bills with the agreement that you would repay the entity if and when you won a settlement. Hospitals, medical care providers, and insurance companies can potentially place a lien against your settlement to get the money the plaintiff owes. While you must pay these entities at some point, talking to a lawyer can help protect your recent injury settlement. In some cases, a skilled attorney can help prevent liens and negotiate payment plans to avoid settlement garnishment.

Do you need to keep receipts for settlement checks?

You will need to keep receipts, deposits, and other documentation providing a “paper trail” of which money came from your wages and which came from a settlement check. This is why it’s easiest to simply deposit the settlement and only the settlement into its own account.

What happens if you don't write a check to creditors?

If your creditors can't get you to write them a check, garnishing your money is an alternative way to get the cash. Once they obtain a court order confirming the debt, creditors can target your bank account, your wages or possibly an investment plan such as an Individual Retirement Account.

Can you garnish a 401(k)?

If you set up your investment account through your job -- a 401 (k) or 403 (b0 account, for instance -- the federal Employee Retirement Income Security Act (ERISA) protects it from garnishment. There is a possible exception, however: The federal Mandatory Victims Restitution Act (MVRA) requires that criminals make full restitution to their victims in various types of property-damage or personal injury cases. Some federal courts have ruled that if restitution requires garnishing a retirement account, MVRA trumps ERISA.

Why are structured settlements better than lump sum settlements?

What is clear is that structured settlements provide much greater protection and a much more effective chance of preserving the settlement funds from creditors than do lump sum settlements, which are far more accessible by them.

Can a life insurance company sue for incorrectly redirecting payments?

If the structure recipient, after losing his/her payments, were to sue to enforce the terms of the settlement, the owner may presumably then advance a claim against the life insurer, for incorrectly redirecting the payment s.

Can a notice of garnishment be contested?

To our knowledge, none of the courts which have issued Notices of Garnishment and few of the life insurance companies on which they have been served have engaged in this detailed analysis. In many cases, if Notices of Garnishment were contested by the structure recipient and the matter thoroughly argued before the court, there would ultimately be no redirection of the structured settlement payments. The reality, however, for most structure recipients is that they do not have the financial resources to fund such a contest.

Do life insurance companies serve notices of garnishment?

In the past, creditors of structured settlement recipients have served Notices of Garnishment upon the life insurers making the payments to those recipients. Some life insurers have, in fact, redirected payments in accordance with those. It is likely, however, that the courts issuing the Notices of Garnishment and the life insurers acceding to them did so incorrectly.

Is a structure payment a debt owed by the life insurer to the structure recipient?

In our view, a structure payment is certainly not a debt owed by the life insurer to the structure recipient. On the other hand, it may be an amount payable.

Is a structured settlement a beneficiary?

On the other hand, the structure recipient is almost certainly a beneficiary, as defined in the Insurance Act and under the very broad interpretation of this definition by the Ontario Court of Appeal, since the policy specifically provides that the structure payments are irrevocably directed to the recipient.

Should the courts issue notices of garnishment?

In our view, based on the provisions of the Insurance Act, the courts should not properly issue Notices of Garnishment in most cases in respect of structured settlement annuities. The fact that they seem to be willing to do it in some instances is likely due to a lack of understanding of the intricacies of structured settlements. Further, the life insurers place themselves at significant risk in acceding to such Notices.

What happens if you protect stocks after a court judgement?

If you try to protect stocks only after a court judgment, you might be charged with fraudulent transfer and find yourself in even worse straits. Always work with a local attorney if you find your assets under siege because some protection strategies depend on state law.

How to protect stocks from a divorce?

Although state laws vary, you might be able to protect stocks by owning them in a non-qualified variable annuity plan. You can contribute any amount to a non-qualified variable annuity and use the money to buy stocks, mutual funds and other investments. Some states protect the cash surrender value of an annuity, while others protect the death benefit. Still other states offer no protection at all. Your lawyer will advise you on how your state handles annuities. You can also establish an annuity in your spouse’s name or simply transfer stock ownership to your spouse. However, things might not work out as planned if you and your spouse divorce.

Can a neighbor be a creditor?

Your next-door neighbor might become your creditor if he is hurt on your property. The judgment from a liability lawsuit might force you to sell your stocks to pay the damages. You can protect yourself from large liability awards though an umbrella liability insurance policy, which cover almost all types of liabilities, except in cases in which you deliberately attempt to defraud the insurer. You can buy policies that provide several million dollars of protection. If you lose a liability lawsuit, the insurance company pays, and you get to keep your stocks.

What is an escrow account?

Escrow accounts, Stocks (including any dividends), Present or future contract interests, Partnership interests, Interest in an executory negotiable letter of credit. As you can see, the list is rather long and gives judgment-creditors a wide range of targets to go after for satisfaction of their money-judgment.

What is a judgment creditor in New York?

A “judgment-creditor” is the person or company that sued you and obtained a monetary damages award, or “money-judgment,” against you. In New York State, the property that can be seized from you can be broken down into two basic categories: Debts owed to you, that are payable to you.

Can a judgment creditor pursue you after filing bankruptcy?

For example, a judgment-creditor generally may not pursue you once you have filed bankruptcy. Additionally, outside of the bankruptcy context, many exemptions are afforded to you in order to provide you and your family with reasonable living requirements – regardless of money-judgment (s) entered against you.

Can a creditor snatch a debt in New York?

The second category is “debts owed to you, that are payable to you.”. Regardless of whether the debt is being repaid from within New York or from outside of the state, a creditor (through the proper legal avenues) can snatch any current or future debt that you are expecting repayment on.

Why is it important to know what assets can be seized by a judgment creditor?

That is why it is important for you to know what assets can be seized by a judgment creditor. You should inform yourself about asset protection strategies that you can use to make asset forfeiture very unlikely. Judgment in hand, a creditor has a number of options that they can pursue. First they need to discover exactly what assets can be seized ...

What happens if you have all the assets in your possession?

If these assets are all that remain in the debtor’ s possession the exemptions can render the judgment virtually hollow. In addition to certain state-sanctioned assets that are exempt from judgments, there are legal ways to protect one’s assets.

What happens at a judgment debtor examination?

At the judgment debtor examination, the debtor will be placed under oath. This means he or she must answer the creditor’s questions truthfully or risk perjuring themselves. Perjury can carry a heavy fine or even jail time. However, a debtor is not under a legal obligation to volunteer any information about his or her assets. A creditor must ask the right questions. After the procedure, the creditor must file another motion in court. Only then will they be able to attach a claim to the debtor’s assets or properties that are not exempted by the state.

Why is it important to sign a judgment?

This is important because a judge signing it and a creditor serving it obliges a debtor. They must appear at the examination or risk being held for contempt by the court. At the judgment debtor examination, the debtor will be placed under oath.

What to do if you have a lawsuit against you?

You’ll likely realize you stand to lose more than you first thought. That is, you actually have assets that can be attached to a judgement. Perhaps then, if you have not done so, you will take action on protecting your assets.

Can a creditor take a judgment on a property you do not own?

While it may be difficult to imagine, a creditor going after a property you do not yet own, this happens often enough in these types of cases. Again, it helps to understand that property does not just refer to a tangible asset. You may receive commissions as part of your compensation at work. The creditor can attach your future commissions to the judgment against you. A judgment can also seize royalties (from a book or film or some other type of creative work). The same is true for tax refunds. It also includes most insurance payouts. In some cases, it even means income from certain types of trusts or dividends from company shares. Stocks options, as long as they are fully vested and assignable, are considered future property too. Therefore, a creditor can attach them to a judgment as well.

Can a creditor attach stock options to a judgment?

Stocks options, as long as they are fully vested and assignable, is considered future property too. Therefore, a creditor can attach them to a judgment as well. None of this happens automatically, of course .

Why is it so hard to settle a wage garnishment?

Settling a debt becomes difficult once a creditor is granted a court order for wage garnishment, as there is little incentive for the creditor to agree to take less.

How to file a complaint against a garnishment?

If you feel the wage garnishment is in violation of the law, you can file a complaint with the Wage and Hour Division by calling their toll-free number 866-4US WAGE. In cases where your state's wage garnishment law differs from the federal law, the smaller garnishment is applied. If you feel there is an error in the court order mandating the wage garnishment, you can file a motion to vacate the judgment or consult an attorney for legal assistance.

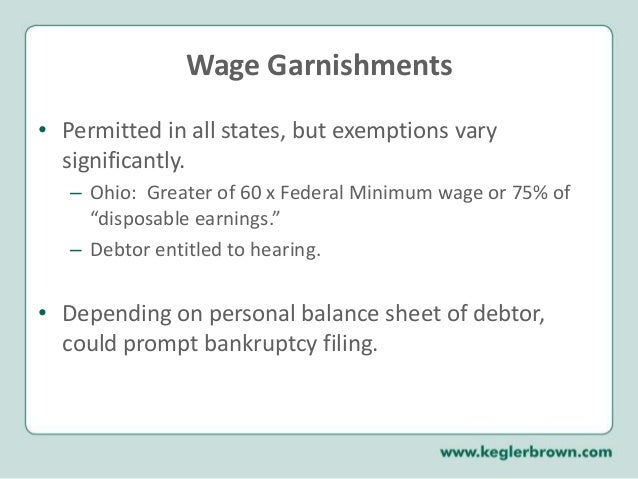

What percentage of wages are garnished?

Although employees are protected from losing their wages completely, as well as their jobs, creditors with a court order or legal authority can require employers to withhold up to 25 percent of an employee’s disposable earnings. In some cases, such as unpaid child support or tax payments, an employer may have to withhold up to 60 percent of disposable income. Settling a debt becomes difficult once a creditor is granted a court order for wage garnishment, as there is little incentive for the creditor to agree to take less.

What is the process of settling a debt?

Settling Debts. Settling a debt requires that you have some leverage. The creditor must believe that by settling the debt, you will pay them back money you otherwise might not. Once a judgment is issued and the creditor is able to receive payment through wage garnishment, you have little leverage for negotiating a settlement.

Can you garnish your wages?

Since most wage garnishments are court ordered, you can expect legal action to precede the garnishment. Generally, creditors must obtain a judgment to garnish your wages. By aggressively contesting the creditor before a judgment is entered, you may be able to avoid wage garnishment.

Can you file a motion to vacate a wage garnishment?

In cases where your state's wage garnishment law differs from the federal law, the smaller garnishment is applied. If you feel there is an error in the court order mandating the wage garnishment, you can file a motion to vacate the judgment or consult an attorney for legal assistance.

Is garnishment bad for you?

One wage garnishment is bad enough, so do what you can to take care of other debts before they make their way to your paycheck, too. If you have more than one outstanding debt with the same creditor or collector, they may pursue additional wage garnishment. If you cannot afford to pay your debt in full, or are unable to negotiate a settlement you can afford, willing ly make payment arrangements with the creditor . For some individuals, bankruptcy may provide a fresh start.