Does debt consolidation stop garnishments?

Debt consolidation loans do stop garnishment if the funds are used to pay the debt completely. Consolidation plans will not, however, stop court ordered wage garnishment automatically. Unemployment, income exemptions and bankruptcies also stop wage garnishment, but it may be temporary.

Can you negotiate after wage garnishment?

Try to negotiate A wage garnishment judgment can be costly and time-consuming for a creditor to obtain and for you to appeal, so reaching a payment agreement early on, if at all possible, is recommended.

How do you get around wage garnishment?

If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

How do I stop a garnishment in Mississippi?

There are really only two ways to stop a wage garnishment in Mississippi. You can either pay the amount owed or you can file for bankruptcy. If you decide to pay the amount off, you may be able to negotiate a debt settlement or a payment plan with the creditor.

How do you write a letter to stop wage garnishment?

Include in your letter what steps you plan to take to address the default, such as making a reasonable effort at a payment plan. Mention any circumstances that have changed recently to make your ability to pay off the debt more likely. This conveys to the creditor your goodwill toward satisfying the debt.

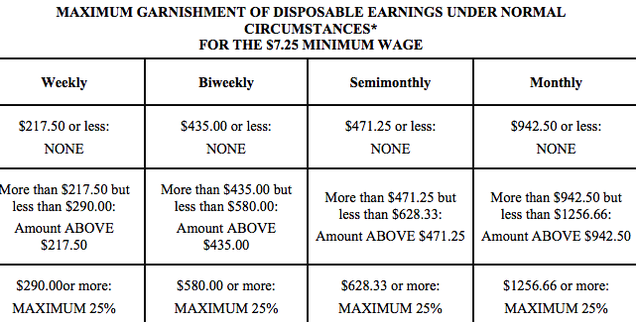

What is the most they can garnish from your check?

The garnishment law allows up to 50% of a worker's disposable earnings to be garnished for these purposes if the worker is supporting another spouse or child, or up to 60% if the worker is not. An additional 5% may be garnished for support payments more than l2 weeks in arrears.

How do I stop a garnishee order?

Unfortunately a garnishee order can only be stopped by bringing an application to court to have the order stopped, or, if the judgment creditor informs the employer or garnishee that he no longer needs to deduct money from your salary.

Does garnishment affect credit?

Wage Garnishment Public Record Reporting Wage garnishments negatively impact your credit report and credit score. However, creditors themselves do not typically report their decision to garnish your wages to credit agencies. Instead, they will report your accounts as being defaulted or closed.

How much do you have to owe before the IRS garnishes wages?

The following portions of income can be claimed as exempt from wage garnishment: About $12,200 annually for individuals filing as singles without any dependents. About $26,650 annually from a head of household's income with two dependents. About $32,700 annually from married persons jointly filing with two dependents.

What is the statute of limitations on collecting a debt in Mississippi?

three yearsMIssissippi Statute of Limitations on Debt Collection For mortgage debt, medical debt and credit card debt, the statute of limitations is three years. The statute of limitations for auto loan debt is four years.

Is Mississippi a garnishment state?

Federal and Mississippi laws limit this type of wage garnishment. Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. If you aren't supporting a spouse or child, up to 60% of your earnings may be taken.

How do I file a hardship for garnishment in Mississippi?

After being notified of a writ of garnishment related to a judgment against him, the debtor must file papers to request a hearing to prove hardship. Hardship exemptions may be granted if the debtor proves that she is unable to pay for basic necessities, such as food, utilities and rent, due to the wage garnishment.

How do you challenge a garnishee order?

To dispute the garnishment, you need to fill out some forms. You should ask the court clerk for a copy of the forms. You need to read your Writ of Garnishment to find the appropriate courthouse. You must file your exemptions in the same court that issued the garnishment order.

How do I stop a wage garnishment in Alabama?

You may be able to stop it by filing a claim of exemptions. This usually works if: You have bring home less than $1,000 per paycheck. ... For a form declaration of exemptions that you can fill in and file yourself, see the Motion to Stop Wage Garnishment (with Declaration and Claim of Exemption for Wages).

How do I stop a garnishment in Arkansas?

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

How do I stop a wage garnishment in Tennessee?

Tennessee's Slow Pay program allows you to avoid wage garnishment and set up an affordable payment plan for judgments. If a creditor is garnishing or is threatening to garnish your wages, Tennessee's "Slow Pay" process allows you to stop the garnishment and set up a payment plan you can afford.