When you settle a debt that a creditor has turned over to a collection agency, you can negotiate to have the debt collector report the account as “paid in full” to the credit bureaus and delete derogatory information about the settled debt from your credit files.

Full Answer

What happens when a debt gets settled in full?

When a debt gets settled in full, you do not have to make any further payments. Your credit score, however, will likely drop, because you did not pay the debt in full. The settlement will be on your record for up to seven years.

How much does it cost to settle debt?

Debt settlement companies charge a fee, generally 15-25% of the debt the company is settling. The American Fair Credit Council found that consumers enrolled in debt settlement ended up paying about 50% of what they initially owed on their debt, but they also paid fees that cut into their savings.

How much does debt settlement hurt your credit?

The American Fair Credit Council found that consumers enrolled in debt settlement ended up paying about 50% of what they initially owed on their debt, but they also paid fees that cut into their savings. The report gives an example of a debt settlement client whose $4,262 account balance was reduced to $2,115 with the settlement.

What does it mean when a debt is paid in full?

“Paid in Full” – typically means that a consumer did pay the full balance and settled the account. The creditor will show no balance on the credit report indicating that there is no more debt obligation. How does the paying a debt effect the credit score?

Can I pay in full after settlement?

Settled in Full Settling in full means coming to an agreement with your creditor or debt collector on a debt management plan that may allow you to pay less than the original balance. Lenders and debt collection agencies would rather you pay some of your debt back rather than none.

Is it better to make a settlement or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

Can a settled account be removed from credit report?

If you feel like going directly to a credit bureau isn't the right attack, then you can send the lender a goodwill letter directly. This letter is a polite way to ask if a lender will remove the settled account from your credit history.

Is it better to settle a debt or let it fall off?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

How do I get rid of a paid settlement?

You can remove a settled account that's past the 7-year rule from your credit report. If it still appears on your credit report, then you have to file a dispute with the credit bureaus to delete it.

How do I raise my credit score after a settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

How long does it take to remove settled accounts from credit report?

seven yearsA settled account remains on your credit report for seven years from its original delinquency date. If you settled the debt five years ago, there's almost certainly some time remaining before the seven-year period is reached.

Does paid in full increase credit score?

Some credit scoring models exclude collection accounts once they are paid in full, so you could experience a credit score increase as soon as the collection is reported as paid. Most lenders view a collection account that has been paid in full as more favorable than an unpaid collection account.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

Will a paid in full collection help my credit score?

When you pay or settle a collection and it is updated to reflect the zero balance on your credit reports, your FICO® 9 and VantageScore 3.0 and 4.0 scores may improve. However, because older scoring models do not ignore paid collections, scores generated by these older models will not improve.

Does paid in full increase credit score?

Some credit scoring models exclude collection accounts once they are paid in full, so you could experience a credit score increase as soon as the collection is reported as paid. Most lenders view a collection account that has been paid in full as more favorable than an unpaid collection account.

How long does a settled account stay on your credit report?

seven yearsA settled account remains on your credit report for seven years from its original delinquency date. If you settled the debt five years ago, there's almost certainly some time remaining before the seven-year period is reached. Your credit report represents the history of how you've managed your accounts.

Will settling a charge-off raise credit score?

If you pay a charge-off, you may expect your credit score to go up right away since you've cleared up the past due balance. Unfortunately, it's not that easy. Over time, your credit score can improve after a charge-off if you continue paying all your other accounts on time and handle your debt responsibly.

What Is The Difference in “Settled in Full” Or “Paid in Full”?

The Credit Reporting Agencies (CRA’s) like Experian, Equifax, and TransUnion can place entries on a credit report after a debt has been paid with t...

How Does The Paying A Debt Effect The Credit Score?

Whether “Settled in Full” or “Paid in Full” is shown on the credit report it has little effect on the credit score itself. The credit score weighs...

New Court Ruling: How to Get Debt Collectors and Creditors to Show “Paid in Full?”

A new court ruling out of California may assist consumers in encouraging Debt Collectors and creditors to “paid in full” when they have actually pa...

How Do I Settle My Debt?

If you’re looking to save some dollars, you may decide that debt settlement is worth it. Here, you approach your creditor to negotiate your debt. You may do it yourself or hire the services of one of the top debt settlement companies to have the debt settled on your behalf – at a fee.

Can I Pay to Have My Bad Debts Deleted From My Credit Report?

As you seek options to settle your past due debts, chances are that you’ll come across something like “pay to delete.” This involves paying lenders or collection agencies to have your negative credit information removed from your credit reports.

Is it better to pay off debt or pay down debt?

When considering settling debt vs paying in full, our advice is to prioritize paying off large amounts of debt while making small contributions to your savings. After you’ve paid off your debt, you can begin to build your savings more aggressively by contributing the full amount you were previously paying toward debt each month.

Is it bad to settle a debt for less?

However, depending on your financial situation, it is not always a bad idea to settle a debt for less. Every year, debt settlement assists thousands of people in getting out of debt at a lower cost.

Is It Better to Pay Off Debt or Settle It?

In general, paying off your debt in full is a better option than debt settlement because it will not harm your credit score. Debt settlement, on the other hand, can help you get out of debt faster and at a lower cost by making a single lump sum payment.

How does the paying a debt effect the credit score?

The credit score weighs more heavily on whether a negative account is When the account was placed on the credit report and last updated, has a Balance, and the Rating of the Account

What does "settled in full" mean?

“Settled in Full” – typically means that a consumer did not pay the full balance and settled the account. The creditor will show no balance on the credit report indicating that there is no more debt obligation.

What does "paid in full" mean on credit report?

“Paid in Full” – typically means that a consumer did pay the full balance and settled the account.

What credit reporting agencies can put a debt on your credit report?

The Credit Reporting Agencies (CRA’s) like Experian, Equifax, and TransUnion can place entries on a credit report after a debt has been paid with the creditor or debt collector showing the accurate status of the acccount and how it was paid.

How long does it take for a zero balance to be updated?

Once a zero balance item is updated on the credit report for more than 24 months the score almost ignores it. It has little effect on a credit score. When a negative account has a Balance reporting the credit scoring algorithm looks at it unfavorably because a consumer has not paid their alleged debts. Some consumers are forced to pay a debt ...

What happens if you have a negative credit report?

If a negative account was placed on the credit report over 2 years ago then it could have a major impact lowering your credit score when payment is made. If the debt is older and you must settled the debt then time will heal the damage.

Is it better to settle a debt with "settled in full" or "paid in full"?

Is it better to settle a debt with “Settled in Full” or “Paid in Full” notation on the credit report? During the credit repair process it is often necessary to settled a debt. Doing it the right way can help improve the credit scores and eliminate future problems.

How long does it take to settle a debt?

Third, you need to be patient, because debt settlement can take 18 months to four years. Fourth, you need to be OK with the settlement dragging down your credit score for seven years.

What happens if you pay off debt in full?

If you can pay off the debt in full, you will prevent it from being reported as bad debt – and it will show that way on your credit report. Another upside: You won’t have to deal with the IRS. Advertisement. Advertisement.

How long does a charge off stay on your credit report?

Even worse, you’re not even allowed to make minimum payments – yet the credit card issuer might continue to report the amount as past due. Once a charge-off goes on your credit report, it can say there for seven years.

Can a reader pay off his debts?

A reader can pay off his old debts, but he’s wondering if it’s better not to.

Is debt settlement a real option?

Debt settlement is a real option for some struggling people, but it doesn’t sound like you’re struggling right now, Ryan. Of course, that’s the final piece to this puzzle. Decisions like these aren’t made in a vacuum. If we were meeting to discuss this, I’d ask about the rest of your life. While you have the money now to pay in full, do you have anything else saved? Are you facing big expenses coming up? Is your job secure?

What happens when you settle a debt?

In debt settlement, the company will instruct you to stop making payments to the creditors. Your accounts become delinquent, and the debt settlement company tries to negotiate a settlement on your behalf. In the meantime, you give your money to the debt settlement company, who also is not paying the creditor with it.

How long does it take for a debt settlement to pay?

Meanwhile, the company will negotiate with your creditors to settle for a lower amount. Once you’ve paid the amount the agreement is for into the escrow account, the debt settlement company will pay your creditor. This process can take 2-3 years.

Why Work with a Debt Settlement Company?

Often there’s a good reason – a layoff or reduction in pay, big medical bills, an unexpected emergency expense. No matter what the reason, it can be difficult to get out from under overwhelming debt on your own. This is particularly true for credit card debt or other revolving debt, that never seems to decrease, even if you’re paying monthly.

What is debt settlement?

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly. Get Debt Help.

What do debt settlement companies have to explain?

Debt settlement companies must explain price and terms, including fees and any conditions on services.

How much does a debt settlement company charge?

Debt settlement companies charge a fee, generally 15-25% of the debt the company is settling. The American Fair Credit Council found that consumers enrolled in debt settlement ended up paying about 50% of what they initially owed on their debt, but they also paid fees that cut into their savings. The report gives an example of a debt settlement client whose $4,262 account balance was reduced to $2,115 with the settlement. So, at first it would seem she saved $2,147, the different between what she owed and what the settlement amount was. But she also paid $829 in fees to the debt settlement company, so she ended up saving $1,318.

How much money did a debt settlement save?

The report found that debt settlement clients settled an average of about 50% of what was originally owed, but realized savings of about 30%.

When Is a Debt Paid in Full?

A debt is paid in full when the total amount owed has been paid off. It is essential to note that this is different than when a debt is settled in full.

What happens when you make your final payment?

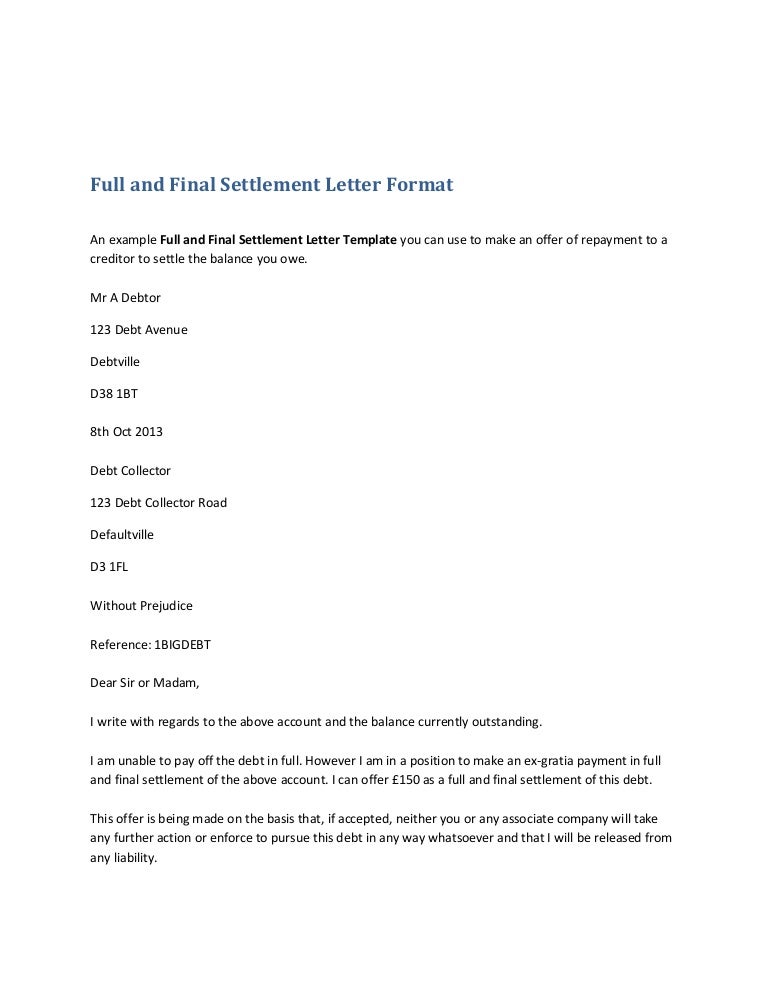

When you make the final payment, you send the creditor or collections agency a “paid in full” letter, which gives them notice that you are making your last payment and requests their confirmation that all requirements of the debt are satisfied . You will write in the letter that you expect the creditor or debt collector to take no further action ...

How to write a letter to a creditor?

Write the body of the letter. This includes the reason for composing the letter.#N#You may add details like the amount of the debt owed, the date of the agreement, and the date on which you will make the final payment.#N#If you send the payment along with the letter, you can point out that it is enclosed. You should also let the creditor know that you expect a written confirmation that the debt is paid in full. 1 You may add details like the amount of the debt owed, the date of the agreement, and the date on which you will make the final payment. 2 If you send the payment along with the letter, you can point out that it is enclosed. You should also let the creditor know that you expect a written confirmation that the debt is paid in full.

How much of your credit score is impacted by missed payments?

Your payment history accounts for 35% of your score. This metric doesn’t improve when you pay a debt in full because lenders do not remove the missed payments from your record. You need to write a letter of good will to ask for missed payments to be removed from your credit history.

How long does it take for a delinquent to disappear from your credit report?

This is because newer data has a higher priority in these models. Delinquencies also disappear from your credit report after seven years.

What happens if you close a paid in full account?

Your score in this area may fall if you close the paid-in-full account, since the average age of your accounts will drop.

How long does a debt stay on your credit report?

When you pay a debt in full without missing a payment, your account is “in good standing,” and this status will remain on your credit report for 10 years after you close the account .