The taxable amount of your settlement creates the ability for you to deduct expenses that were attributable to obtaining the income that is taxed. This includes your legal fees. However, it does not include the losses you sustained on investments that had to be used to allow you to financially survive while pursuing your argument with the courts.

Can I deduct a settlement on my taxes?

If you paid the settlement as result of a tax-deductible expense, such as unpaid wages or past-due rent, the settlement is tax deductible. If you paid the settlement as result of a nondeductible expense, such as a personal injury lawsuit or a government fine, you can't deduct the settlement.

Can you write off a small business settlement?

Small Business Deduction. If you paid the settlement as result of a tax-deductible expense, such as unpaid wages or past-due rent, the settlement is tax deductible. If you paid the settlement as result of a nondeductible expense, such as a personal injury lawsuit or a government fine, you can't deduct the settlement.

Are court orders and settlements tax deductible?

This means that, generally, monies paid pursuant to a court order or settlement agreement with a government entity are not deductible. However, the 2017 Tax Cuts and Jobs Act (TCJA) amended § 162 (f) to allow deductions for payments for restitution, remediation, or those paid to come into compliance with a law.

Can I deduct alimony or property settlement payments?

Tax Tips: Can I Deduct Alimony or Property Settlement Payments? No matter what your settlement agreement / divorce decree calls it, you can deduct payments to your ex under four circumstances. 3.) the payments are not child support, which is determined, in part, by a three-year payment analysis, and

Are settlement losses tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

How do you write off a settlement?

Taking the Write-Off Settlement costs that are legally deductible go on the form as Other Income. Subtract them, along with your other expenses, from your business revenue. Report your net business income on Form 1040, along with your any other taxable income and figure what you owe accordingly.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Does settlement money have to be claimed on taxes?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Are lump sum settlements taxable?

Under Section 104(a)(2) of the federal Internal Revenue Code, damages paid "on account of" a physical injury or wrongful death are excluded from an individual's income tax. But importantly for those who depend on this settlement, the investment income earned from a lump-sum settlement can be fully taxable.

How are settlement agreements taxed?

Normally on a settlement agreement there will be a “tax indemnity” which means that if an employer is later asked to pay the tax by the employee, the employer can then pursue the employee for that tax: plus interest, penalties and the cost of “grossing up”.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

Are 1099 required for settlement payments?

Issuing Forms 1099 to Clients That means law firms often cut checks to clients for a share of settlement proceeds. Even so, there is rarely a Form 1099 obligation for such payments. Most lawyers receiving a joint settlement check to resolve a client lawsuit are not considered payors.

How can you avoid paying taxes on a large sum of money?

Research the taxes you might owe to the IRS on any sum you receive as a windfall. You can lower a sizeable amount of your taxable income in a number of different ways. Fund an IRA or an HSA to help lower your annual tax bill. Consider selling your stocks at a loss to lower your tax liability.

Does an insurance payout count as income?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

What is deductible on a settlement statement?

The seller of a business or investment property may deduct condo fees, fees paid out of escrow (for utility bills, insurance, etc.), fire/casualty insurance premiums, interest, and real estate taxes. They can also include the same selling expense items as the seller of a principal residence.

What is deductible on a settlement sheet?

Deductible Expenses Interest on your loan paid at closing is tax deductible. Any prorated property taxes allocated as your expenses are also deductible. You can deduct loan origination fees or points, which are the fees a bank charges you for making the loan.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Where do you report settlement income on 1040?

Attach to your return a statement showing the entire settlement amount less related medical costs not previously deducted and medical costs deducted for which there was no tax benefit. The net taxable amount should be reported as “Other Income” on line 8z of Form 1040, Schedule 1.

What is a tax deductible item?

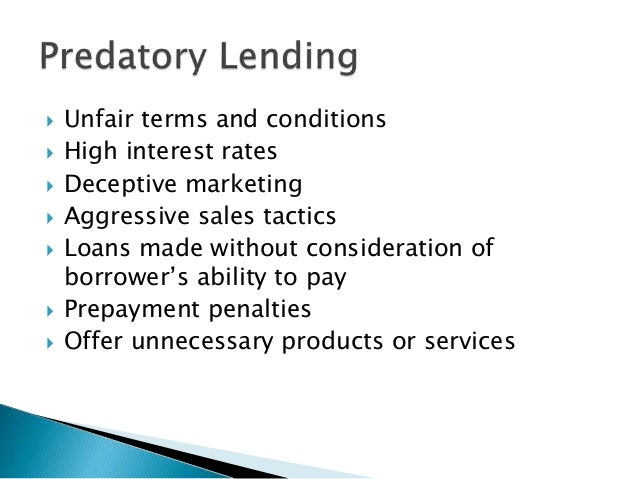

Tax deductible items are expenses that can be subtracted from adjusted gross income so as to reduce the net taxable income. These allowable deductions are useful to the defendant, who may be forced to make disbursements in favor of the plaintiff, since tax deductible items have the effect of reducing the defendant’s tax burden. Are lawsuit settlements deductible? The answer to this question hinges on the nature of the settlement and the damages awarded to the plaintiff in a court of law.

What is tax treatment for consumers?

Tax Treatment for Consumers. Tax treatment for consumers may be examined by taking the example of a divorce settlement. The payor is allowed a tax deduction for spousal support, for mortgage payments, insurance premium and real estate taxes paid as alimony in lieu of the home owned by the ex-spouse.

Is alimony taxable income?

Alimony is a tax-deductible expense as far as the payor is concerned while it is taxable income for the pay ee. Hence, the payee prefers a structured settlement, that reduces income tax payable, as compared to a lump sum. This brings us to the issue of the taxability of lawsuit settlements for a payee. Hopefully, the above article has answered the ...

Is a payment made by a defendant a reasonable expense?

Payments that are made by the defendant are tax deductible, provided they can be classified as reasonable, ordinary, and necessary business expenses. Expenses, that are required for producing income, may be tax deductible or the payor may have to capitalize and deduct these costs over time.

Is punitive damages deductible?

The opponents of this proposal believe that since tort abuse has escalated, the deductibility of punitive damages as ordinary and necessary business expense is one of the few relief measures available to business owners who may be required to dispense with payments that have no upper limit.

Is a corporation's expense deductible?

Tax Treatment for Corporates. The payor’s expenditure may be classified as deductible, capitalized, non-deductible, or non-capitalized expenditure. While the entire amount of deductible expenses can be subtracted from gross income, capitalizing expenses results in writing-off the amount of expenditure over an extended period of time.

Is understanding tax obligations complicated?

Hopefully, the above article has answered the query to the satisfaction of the reader. Understanding tax obligations can be complex and it’s definitely not the layman’s cup of tea. Hence, it would be prudent to consult an expert on law and taxation for further details in this regard.

Is settlement taxable income?

Some of your settlement is not taxable, that's the good news. The IRS tax law in these situations is based solely on whether you received taxable income as a result, and then you are allowed to deduct expenses only the extent of that taxable income.

Is personal attorney fees deductible?

Since personal attorney fees are a miscellaneous itemized deduction, they are limited by the two percent rule: They are deductible only if, and to the extent, they (along with all your other miscellaneous deductions, if any) exceed 2% of your adjusted gross income (AGI).

What happens if you fail to include identification and establishment language in your settlement agreement?

If they fail to do so, they may forfeit their ability to claim a deduction for those payments.

What is restitution in the new rule?

The new rule outlines enhanced requirements and greater definitional guidance on what qualifi es as “restitution,” “remediation,” and “coming into compliance with a law ,” particularly when it comes to environmental matters.

Is restitution deductible?

Restitution and remediation do not include amounts paid to a governmental account for general enforcement efforts or other discretionary purposes. Rather, to be deductible, the monies paid to a government or government entity must be paid into a separate fund or account and be used exclusively for the restitution or remediation of the environment, ...

Is a settlement agreement deductible?

This means that, generally, monies paid pursuant to a court order or settlement agreement with a government entity are not deductible. However, the 2017 Tax Cuts and Jobs Act (TCJA) amended § 162 (f) to allow deductions for payments for restitution, remediation, or those paid to come into compliance with a law.

Can you deduct a court order?

This means that, generally, monies paid pursuant to a court order or settlement agreement with a government entity are not deductible. However, the 2017 Tax Cuts and Jobs Act (TCJA) amended § 162 (f) to allow deductions for payments for restitution, remediation, or those paid to come into compliance with a law. Yet, in the years following the amendment to § 162 (f), taxpayers were left with several questions about what was and was not deductible.

What is a limitation to deduction?

When we talk about the limitation to the tax deduction we mean the things that you might think or may imagine will be considered part of business’ expenses but are not considered the expenses by the legislation. So, in a legitimate business, you have to be careful of such thing so that you are not burdened with more load regarding taxes than you imagine.

What is a lawsuit settlement?

A lawsuit settlement is when two different parties settle their case on an agreeable situation or payment. Mostly in such cases, one of the parties has to pay the other party a settlement amount to close the case legally. If you are new to the business side of the industry you will need to learn how to do your taxes and what things can lead to a deduction of taxes, even in such cases you have to know your limitations as to what extent tax can be deducted, and are lawsuit settlements tax deductible? You cannot expect your business tax to be deducted from a personal lawsuit because that is a personal matter, but if you are paying a business settlement there can be a chance of tax being deducted for that.

Can you deduct lawsuit settlements?

If you know the limitations to these things and are well aware of what things can increase the deduction you will have to pay a small amount of tax only in such a crisis. Any expenses of the business can help you in tax deduction and lawsuit settlements are one of the business’s expenditures just like the office rent is. So, this is the most understandable example of tax deduction due to lawsuit settlement.

Can you deduct business taxes from a personal lawsuit?

You cannot expect your business tax to be deducted from a personal lawsuit because that is a personal matter, but if you are paying a business settlement there can be a chance of tax being deducted for that.

Do business taxes increase or decrease?

Usually, when it comes to the business taxes, they are to be paid from the profit you have earned. Similarly, the tax will increase or decrease according to some loss or profit in your business. For the tax payments, your entire inventory is scanned for the very same reasons. If anything bad happens to your business that results in less profit, then it will eventually reduce the tax.

Is a settlement considered a company's expense?

If the lawsuit is against the whole business based on any kind of services, then the settlement will be considered as the company’s expenses. Even if you claim this as the company’s lawsuit it will be up to the decision of legislation as to what this lawsuit will be labeled as.

Can a company settle a lawsuit without paying taxes?

Even when the company settles down the lawsuit without any payment between the two parties there will still be the tax deduction and that will be based on the court fees and the lawyer’s fees. All these things will still be a part of the company’s expenditure and the business owner will not be obliged to include that during tax payment.

What is the tax consequences of a settlement?

Takeaway. The receipt or payment of amounts as a result of a settlement or judgment has tax consequences. The taxability, deductibility, and character of the payments generally depend on the origin of the claim and the identity of the responsible or harmed party, as reflected in the litigation documents. Certain deduction disallowances may apply.

How is proper tax treatment determined?

In general, the proper tax treatment of a recovery or payment from a settlement or judgment is determined by the origin of the claim. In applying the origin-of-the-claimtest, some courts have asked the question "In lieu of what were the damages awarded?" to determine the proper characterization (see, e.g., Raytheon Prod. Corp., 144 F.2d 110 (1st Cir. 1944)).

What is the exception to restitution?

The restitution exception applies only if (1) a court order or settlement identifies the payment as restitution/remediation or to come into compliance with law (identification requirement) and (2) the taxpayer establishes that the payment is restitution/remediation or to come into compliance with law ( establishment requirement).

What is the burden of proof for IRS?

The burden of proof generally is on the taxpayer to establish the proper tax treatment. Types of evidence that may be considered include legal filings, the terms of the settlement agreement, correspondence between the parties, internal memos, press releases, annual reports, and news publications. However, as a general rule, the IRS views the initial complaint as most persuasive (see Rev. Rul. 85-98).

What happens if you don't take the rules into account?

Taxpayers that fail to take these rules into account when negotiating a settlement agreement or reviewing a proposed court order or judgment may experience adverse and possibly avoidable tax consequences.

Is a claim for damages deductible?

For example, a claim for damages arising from a personal transaction may be a nondeduct ible personal expense. A payment arising from a business activity may be deductible under Sec. 162, while payments for interest, taxes, or certain losses may be deductible under specific provisions of the Code (e.g., Sec. 163, 164, or 165). Certain payments are nondeductible (as explained further below), and others must be capitalized, such as when the payer obtains an intangible asset or license as a result of asettlement.

Is a settlement taxable income?

For a recipient of a settlement amount, the origin-of-the-claimtest determines whether the payment is taxable or nontaxable and, if taxable, whether ordinary or capital gain treatment is appropriate. In general, damages received as a result of a settlement or judgment are taxable to the recipient. However, certain damages may be excludable from income if they represent, for example, gifts or inheritances, payment for personal physical injuries, certain disaster relief payments, amounts for which the taxpayer previously received no tax benefit, cost reimbursements, recovery of capital, or purchase price adjustments. Damages generally are taxable as ordinary income if the payment relates to a claim for lost profits, but they may be characterized as capital gain (to the extent the damages exceed basis) if the underlying claim is for damage to a capitalasset.

Can you claim deductions for ex's death?

However, by making the payments terminate upon your ex’s death, you could claim a deduction that actually drops you into a lower tax bracket. The net result is your ex gets paid and you pay less taxes. The only one out of luck is Uncle Sam. That being said, the tax code, like most regulations, changes annually.

Can you deduct a payment from your income?

When you make payments under all of these circumstances, you can probably deduct the payments from your income.

Is property transfer taxable income?

Property transfers incident to divorce are not taxable income to the recipient and, therefore, are not tax deductible to the payor. This means, for example, you could not deduct your monthly payments to pay off your ex’s share of the equity in the home you keep.

Can you deduct divorce payments in Michigan?

Michigan Divorce Lawyer. No matter what your settlement agreement / divorce decree calls it, you can deduct payments to your ex under four circumstances. You can deduct payments that: 1.) are made pursuant to a written agreement or judgment; 2.) when you are not members of the same household, provided that.

Why do you capitalize lawsuits?

For example, if a lawsuit arises because a plaintiff challenges the validity of a merger transaction, such expenses incurred in defending the lawsuit must be capitalized because the claim is rooted in the acquisition of a capital asset. If, however, the plaintiffs allege that securities law violations by the board of directors harmed the value ...

Is defending a lawsuit tax deductible?

Background. Like the cost of office equipment and rent, the costs associated with defending a lawsuit are generally considered costs incurred in the ordinary course of business and are, therefore, tax deductible. Not all lawsuits and legal costs are treated equally. Court cases and legislation have narrowed the scope of what is, and what is not, ...

Can a company deduct legal expenses?

No company welcomes a lawsuit with open arms, but knowing that related expenses are generally deductible can be comforting as legal bills start to multiply. Companies must be aware of the limitations of writing off legal expenses, damages, and settlements so that they can take full advantage of the deduction on their next tax return. To fully assess your situation, it is always best to consult a professional regarding available tax deductions for costs incurred in litigation.

Is legal fees deductible?

Any legal fees or court costs incurred will be deductible as well as the cost of resolving the suit , whether the company pays damages to the plaintiff or agrees to settle the dispute. Moreover, if a company is defending itself against the government, any damages characterized as remedial or compensatory are deductible.

Is a lawsuit deductible for a company?

Any lawsuit a company faces is disruptive to business. The costs associated with hiring attorneys, defending a case, and paying for damages or a settlement can be exorbitant, and damage a company’s profitability. The good news is these payments are generally tax deductible business expenses. In order to maximize this deduction, however, companies ...

Is a fine deductible in a settlement agreement?

The characterization of such damages in the settlement agreement is critical. Fines and punitive and penal damages are not deductible. Consult a tax attorney when it comes to negotiating any settlement agreement to ensure that the desired tax treatment of costs is baked into the agreement.

Is a lawsuit deductible if it does not stem from a business activity?

This decision serves as a reminder to businesses that being a named defendant alone is not enough; if a lawsuit does not stem from a business activity, the legal fees and settlement expenses will not be deductible. Know Your Limits.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal phys…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - The …

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).