The settlement date is the day that the stock's owner has to pay for a sale. You can sell your shares before then, or after, and you'll receive the same price. If a stock trades for less than the calculated settlement price, and you're planning on selling it, you'll have to wait until the settlement date to sell it.

Can you sell stock before it is settled?

Settlement is the delivery of stock against the full payment that must take place within three business days after the trade. You can sell the purchased stock before the settlement — daytraders do it all the time — provided that you do not violate the free ride rule.

What does the settlement date mean for stock trading?

The settlement date is important because market volatility impacts the outcomes of trades. In the past, cash settlement could take a week. This meant those funds were tied up for several days. Read More : What Does Hold Stock Mean? What Is a Settlement Violation?

How long does it take for a stock to settle?

U.S. stock market rules allow a stock market trade two business days to settle or become official. Therefore, for an investor to be a shareholder of record on the record date, the shares must be purchased at least two business days before the record date to allow the settlement process to complete.

Can you sell a stock 2 days before the record date?

Record Date Selling While it is possible to sell a stock during the two days before the record date and still receive the dividend, the loss on the stock will probably equal or exceed the dividend amount. To make this strategy work, a trader must wait for the share price to move back above the value on the date before the shares went ex-dividend.

What happens if you sell before settlement date?

Only cash or the sales proceeds of fully paid for securities qualify as "settled funds." Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date.

Can you trade before settlement?

Cash accounts require that all funds be fully settled before they can be used for trades. The settlement date is important because market volatility impacts the outcomes of trades. In the past, cash settlement could take a week. This meant those funds were tied up for several days.

Can I sell share before t 2 days?

In the normal trading process, delivery shares are credited in the demat account on T+2 days (T being the day of order execution). You cannot sell shares before delivery in normal trading. However, with BTST, you can sell shares on the same day or the next day.

Can I buy and sell with unsettled funds?

Consider margin investing for nonretirement accounts. Take note when buying a security using unsettled funds. You'll incur a violation if you sell that security before the funds used to buy it settle. Review settlement dates of securities sales that have generated unsettled credits.

How quickly can you sell a stock after buying?

You can sell a stock right after you buy it, but there are limitations. In a regular retail brokerage account, you can not execute more than three same-day trades within five business days. Once you cross that threshold, you are considered a pattern day trader and must maintain a $25,000 balance in a margin account.

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock's share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

What happens if I buy today and sell tomorrow?

BTST trades are those trades where traders take advantage of short-term volatility by buying today and selling tomorrow. Under this facility, traders can sell the shares- which they have bought previously- before they are delivered to their demat account or before they are credited into their demat account.

What happens if I sell before T 2?

The moment you sell the stock from your DEMAT account, the stock gets blocked. Before the T+2 day, the blocked shares are given to the exchange. On T+2 day you would receive the funds from the sale which will be credited to your trading account after deduction of all applicable charges.

Can I sell share on same day?

Yes, You can sell delivery shares on the same day without any issues in the stock market. However, Your trade will be considered as an Intraday instead of delivery Regardless of whether the trade is placed in CNC or MIS order type.

Can you sell unsettled funds?

Good faith violation: While unsettled funds may be used to purchase a security in good faith, you cannot sell any part of the newly purchased security before the funds have settled. Doing so is a good faith violation.

Why do trades take 2 days to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What is a liquidation violation?

What is it? A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully. paid securities after the purchase date.

How do you day trade with unsettled funds?

Unsettled cash cannot be used to day trade. If you buy stocks using unsettled funds, you must wait at least two trading days before selling the position, or you will incur a Good Faith Violation.

What is the difference between trade date and settlement date?

The first is the trade date, which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

Can you trade with unsettled funds TD Ameritrade?

Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs.

What is good faith violation in trading?

What is it? A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Only cash or the sales proceeds of fully paid for securities qualify as “settled funds.”

How long does it take to settle a stock?

Two days is by convention, you can get same-day settlement or one-day settlement if you want. Most shops want two days—or at least one day—in order to locate the shares and arrange any financing.

What is short selling?

HOW : There’s a term called ‘short selling’ . If the person who had sold you shares on monday (from whom you bought always anonymous ) had no particular shares left in his account which you bought so there is a possibility that he may not be able to deliver your stocks on t+2 day i. e. wednesday (exchange will impose penalty on him but that’s not your concern) .In that particular case exchanges will arrange on auction for your shares and you in that case will get delivery of your stocks on t+3 day i.e.Thursday BUT on thursday evening .

What is day trading?

To day trade, which would involve you buying and selling stock with unsettled funds (in other words, in a shorter time frame than T+3 for US equities), you must apply and be approved for a margin account.

What to disclose when applying for margin account?

When applying for a margin account, you will be asked to disclose things like your years of experience trading various financial instruments, liquid net worth, and investment objectives. It makes sense -- by approving you for a margin account, a brokerage firm is essentially extending you a line of credit, and needs to evaluate your credit-worthiness.

Can you sell stock before settlement?

You can sell the purchased stock before the settlement — daytraders do it all the time — provided that you do not violate the free ride rule.

Can you sell a stock immediately after buying?

you can sell it immediately after buying based on your brokerage account type.

Do you have to have margin to buy stock?

It may be cash, other marginable securities, or a combination of both. If you don’t have sufficient funds, you won’t be able to buy the stock, much less sell it, without paying.

What is settlement date?

Settlement date is an industry term that refers to the date when a trade or derivative contract is deemed final, and the seller must transfer the ownership of the security to the buyer against the appropriate payment for the asset. It is the actual date when the seller completes the transfer of assets, and the payment is made to the seller.

What is the date on which a trade is deemed settled?

The settlement date is the date on which a trade is deemed settled when the seller transfers ownership of a financial asset to the buyer against payment by the buyer to the seller.

When Does Settlement Occur?

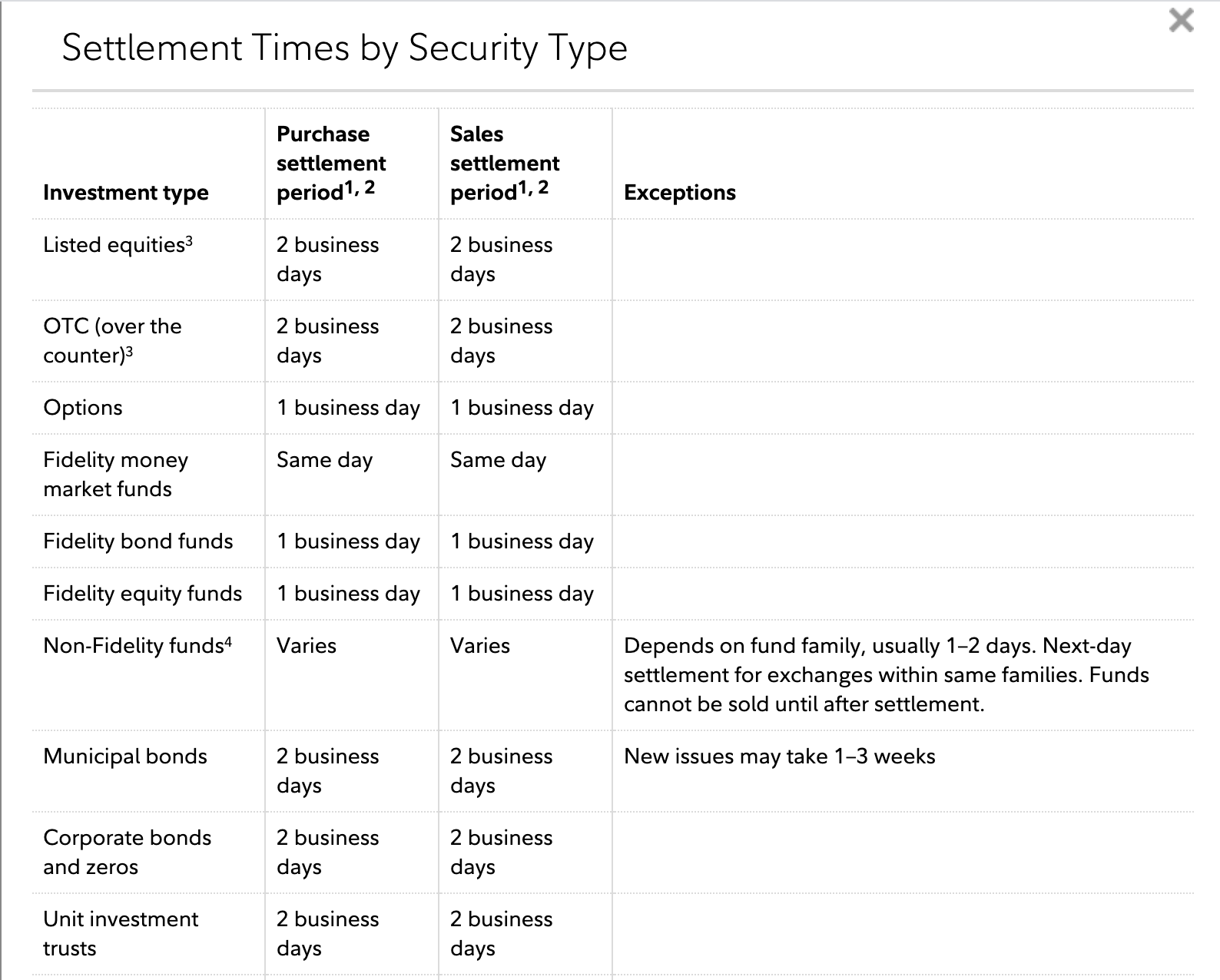

The settlement date is the number of days that have elapsed after the date when the buyer and seller initiated the trade. The abbreviations T+1, T+2, and T+3 are used to denote the settlement date. T+1 means the trade was settled on “transaction date plus one business day,” T+2 means the trade was settled on “transaction date plus two business days,” and T+3 means the trade was settled on “transaction date plus three business days.”

What are the risks of a lag between a transaction date and a settlement date?

The lag between the transaction date and the settlement date exposes the buyer and the seller to the following two risks: 1. Credit risk . Credit risk refers to the risk of loss resulting from the buyer’s failure to meet the contractual obligations of the trade. It occurs due to the elapsed time between the two dates and the volatility of the market.

What is the difference between settlement date and transaction date?

Transaction date is the actual date when the trade was initiated. On the other hand, settlement date is the final date when the transaction is completed. That is, the date when the ownership of the security is transferred from the seller to the buyer, and the buyer makes the payment for the security to the seller.

Why does a buyer fail to make the agreed payment?

The buyer may fail to make the agreed payment by the settlement date, which causes an interruption of cash flows. 2. Settlement risk.

How long does it take for a bond to settle?

Bonds and stocks are settled within two business days, whereas Treasury bills and bonds are settled within the next business day. Where the period between the transaction date and the settlement date falls on a holiday or weekend, the waiting period can increase substantially.

How long before record date can you sell stock?

Record Date Selling. While it is possible to sell a stock during the two days before the record date and still receive the dividend, the loss on the stock will probably equal or exceed the dividend amount.

What does it mean to sell after ex dividend?

The three day stock settlement means someone who buys shares two business days before the record date will not become a shareholder of record until the day after the record date. This investor will not receive the dividend.

What is the record date for dividends?

With a soon to be paid dividend, the record date is used to determine who receives the dividend and which investors purchased shares too late to earn the dividend. The rules of stock settlement make it possible to sell shares before the actual record date. However, the financial results may not be what you are expecting.

What is the day before the record date called?

The day two days before the record date is called the ex-dividend date . So if you already own shares, it is possible to sell the shares on the ex-dividend day or the next day -- both before the record date -- and you will still be a shareholder of record on the record date. 00:00.

Do shareholders of record receive dividends on the record date?

All shareholders of record on the record date will receive a dividend on the payment date regardless of if and when the shares were sold.

Why is it important to maintain sufficient settled funds to pay for purchases in full by settlement date?

It is important to maintain sufficient settled funds to pay for purchases in full by settlement date to help you avoid cash account restrictions.

What happens if you buy a stock on a Monday?

If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: good faith violations, freeriding, and cash liquidations.

Why is there a cash liquidation violation?

Why? Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday.

What happens if Marty sells ABC stock?

If Marty sells ABC stock prior to Wednesday (the settlement date of the XYZ sale), the transaction would be deemed a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase.

Is liquidating a position before it was paid for with settled funds a good faith violation?

Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date.

Is it legal to falsely identify yourself in an email?

By using this service, you agree to input your real e-mail address and only send it to people you know. It is a violation of law in some jurisdictions to false ly identify yourself in an e- mail. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.The subject line of the e-mail you send will be "Fidelity.com: "