Your settlement check will have your name on it. In general, no one will be able to stop you from signing over your settlement check to someone else. You have to ask yourself why you are even considering signing over your settlement check to another person or entity.

Full Answer

Can YOU Cash a check made to someone else’s name?

It is possible to cash a check made to someone else’s name if the named party signs it over to you through an endorsement in full. You can also cash such a check if it has a blank endorsement because this kind of endorsement turns the check into a “bearer instrument” that anyone can cash.

Should I Sign my Lawyer's name on my settlement check?

You might be suspicious of any lawyer who wants to sign his name and also yours. Once you've given away your right to sign your settlement check, you might think your lawyer will keep the money for himself and give you all sorts of excuses about why your money isn't ready yet.

Where do I deposit my insurance company settlement check?

Before you can get your money, your insurance company settlement check, made out to you and to me, must be signed (endorsed) on the back of the check. That check needs to be deposited. Not into your bank account. Not into your attorney's personal bank account. Instead, it must go into a special attorney account first.

What happens if someone gives you a check with the wrong name?

If someone gives you a check and they've spelled your name incorrectly, endorse the back of the check with the incorrect spelling, and then sign your name with the correct spelling on the back of the check. Where can I cash a check without having a bank account?

Can you put a settlement in someone else's name?

You can use it any way you desire—it's your money.

How can I cash a settlement check without a bank account?

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.More items...

How long does it take for a check to clear from a settlement?

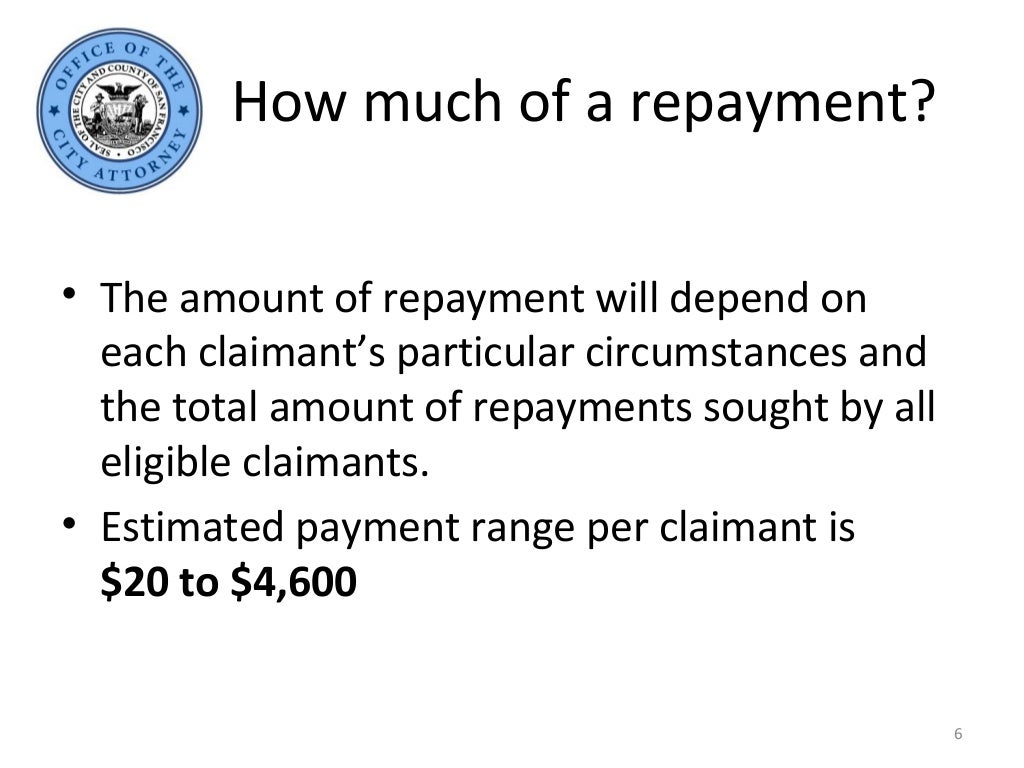

A settlement check is an amount you receive after other expenses have been paid in your lawsuit. The amount will vary and can take up to six weeks to be paid out once your personal injury case has been awarded.

Can I cash a settlement check at the issuing bank?

Bank That Issues Check If the issuing bank operates a local branch, you can cash the settlement check at the issuing bank. You must present two forms of identification that can include a driver's license or a state-issued identification card.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

How do I deposit a large settlement check?

The bank may ask you to bring two forms of ID when you are cashing a large check. The teller may also call the issuing bank to verify the check's legitimacy and ask you some questions about the source of the check. This is a normal bank procedure and nothing to worry about. You should then receive your cash.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

Why is settlement check taking so long?

Delays with your attorney may be due to: Your attorney has been notified of liens against your settlement proceeds and is waiting for confirmation on each lien. Your attorney is in the process of negotiating your medical bills and liens, so you end up with more of your money.

What is the largest check a bank will cash?

Banks don't place restrictions on how large of a check you can cash. However, it's helpful to call ahead to ensure the bank will have enough cash on hand to endorse it. In addition, banks are required to report transactions over $10,000 to the Internal Revenue Service.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What is the maximum amount you can cash a check for?

According to the Consumer Financial Protection Bureau, a check can be cashed for any amount if it is written on an account from the institution where it is being cashed, there is enough money in the account to cover the check, the check is dated within the last six months and the person cashing the check presents a ...

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How can I cash a large check without a hold?

Take your check to a friend or family member's bank or credit union. Go to the bank or credit union that issued the check to cash it. Go to any bank or credit union to cash a check. Go to a supermarket or retail store to cash a check.

Can I cash a 9000 dollar check at Walmart?

Check-Cashing Limits Walmart has a simple limit for check-cashing: $5,000 per check. During the months of January through April, this limits is increased temporarily to $7,500 to accommodate the larger checks that customer might bring in as a result of their tax refunds.

What is the maximum amount you can cash a check for?

According to the Consumer Financial Protection Bureau, a check can be cashed for any amount if it is written on an account from the institution where it is being cashed, there is enough money in the account to cover the check, the check is dated within the last six months and the person cashing the check presents a ...

What Is the Point of a Settlement Check?

Let’s start at the beginning again. The only reason that you are getting a settlement check at all is that you have a serious personal injury, and you need to be reimbursed for expenses related to medical bills, lost wages, and such related to the accident that you suffered at the hands of a negligent person.

Your Settlement Check Is Your Settlement Check

The settlement check that you get at the settlement of your accident losses, damages, and claims is meant to reimburse you for losses and personal injuries related to the accident. Imagine that you have an accident that results in personal injuries. This accident will be a surprise to you and quite unexpected.

Is There Fraud Going On?

If you have the idea to sign over your settlement check, is there a fraudulent transfer going on for this transaction? Your settlement check is meant to be used for the personal injuries that you suffered from your accident. If you sign over the settlement check to someone else, it is the same as saying, “No, I’m good.

CEO Lawyer – Winning Atlanta Personal Injury Lawyer

We are here for you and know what to do to get you the money you deserve in this type of situation related to signing over a settlement check. Just call us at 833-ALI-AWAD, (833) 254-2923. We are ready to help you get back the money you deserve when you are personally injured in these cases.

What Does It Mean When a Check Made Out to Another Person Is Endorsed to You?

Whether you are paying outstanding balance vs. principal balance off, you still need money to pay which sometimes involves check deposits into your account. In the previous section, we discussed that it’s generally impossible to cash a check made out to another person unless the check is endorsed to you. If you’ve been following closely, you’ve probably noticed that we mentioned this phrase a couple of times already.

Who must sign over a check?

As we mentioned earlier, you must involve the originally designated payee of the check with this kind of endorsement because they need to sign over the check to you before you can cash it.

What does a blank endorsement mean?

A blank endorsement doesn’t necessarily mean that the endorsement is “blank” per se. Instead, it means that the check is signed to an unspecified payee. This means that anyone holding that check can cash it because the signature essentially turns the check into a bearer instrument.

How to clear a third party check?

Get in touch with your bank, or better yet, visit one of its branches and determine whether a third-party check signed over to you will clear. If the bank accepts such checks, inquire if there are any additional requirements because bank policies vary. For instance, some banks will require both you and the person signing the check over to have/open accounts with the bank.

What should a name be signed with?

The name should be signed with a pen (not a pencil) and should correspond to your official names without spelling errors.

Can you cash a check made out to your spouse?

If cashing a check made out to the other signatory to a joint bank account, you’d need this person to endorse the check to you so the bank will accept.

Can you cash a check that was not originally made to your name?

You can only cash a check that wasn’t initially made to your name if it’s signed over through an endorsement in full or a blank endorsement. You can’t cash a check handed over through a restrictive endorsement because such types can only be deposited.

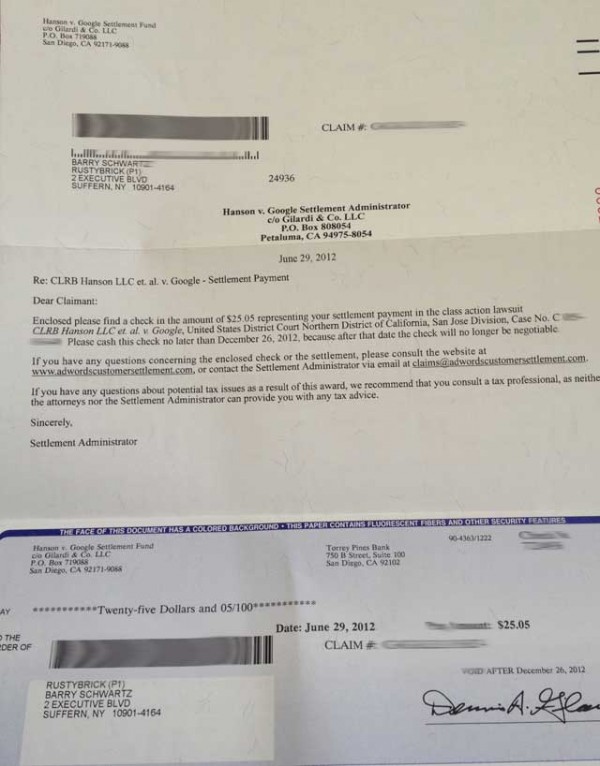

What is settlement check?

A settlement check refers to an amount of money that you expect to receive in the form of a check following the resolution of a lawsuit.

When a claim is filed against an insurance company, can you expect to receive a check for the settlement?

When a claim is filed against an insurance company, you can also expect to receive a check for the settlement of the claim.

How to settle a case?

To settle a case, you’ll generally need to sign a settlement agreement and release so the defendant or insurance company makes a deposit in your attorney’s escrow account who will then need to pay you in return

What happens when a person files a lawsuit for personal injury?

For example, when a person files a lawsuit for personal injury claiming damages, the case may eventually settle where the defendant (or insurance company) agrees to pay a certain amount of money to prevent further litigation.

Why does a defendant accept to pay the plaintiff?

The reason why a defendant (or party to a lawsuit) accepts to pay the plaintiff (or the injured party) a sum of money compensating it for damages and , in return, gets the plaintiff to dismiss the lawsuit.

What is the next step in a settlement?

Once both parties have reached a settlement, the next step is to submit the settlement to the court and obtain a settlement order.

What is the first step to get a settlement check?

For you to receive a settlement check, you must first be in a legal proceeding of some form such as a motor vehicle accident claim lawsuit, personal injury lawsuit, medical malpractice lawsuit, defective product lawsuit, or any other type of legal action.

Where is the settlement check signed on an insurance check?

Before you can get your money, your insurance company settlement check, made out to you and to me, must be signed (endorsed) on the back of the check.

What happens when a check arrives in your attorney's office?

The first thing that happens when the check arrives in your attorney's office is that we must sign (endorse) our name on the back of the check. The second thing that happens is that you must also sign your name to the back of the check. Remember, both of our names are on the check.

How long does it take for a settlement check to clear?

That check must clear. That usually takes a few days. Once your settlement check clears, your lawyer must calculate a number of things. He must calculate the expenses on your case. He must calculate the attorney's fee.

Where is the check drawn from?

The check that you physically receive will be drawn from your lawyer's trust (escrow) account.

Can a bank honor a settlement check?

The bank will not honor your check if there is only one signature on the check. You might be thinking that if you go into your attorney's office to sign your settlement check, you'll walk out of his office with your money.

Can I deposit a check without signing?

The answer is yes there is. Since you and I are both legally obligated to sign that check in order to deposit it, I cannot deposit it into my escrow account without your signature. That means if you don't sign it, I can't deposit it. That means I can't give you your settlement money.