.png)

Divorce & Taxes: The 4 Things You Must Know

- There is No Difference Between Alimony and Child Support Concerning Taxes. ...

- The Tax Impact of Dividing Property. Thanks to §1041 of the Internal Revenue Code, the division of property in a divorce is not a taxable event.

- Understanding Your Filing Status. ...

- Which of Your Divorce Attorney’s Fees Are Tax Deductible. ...

Do you pay taxes on an EEOC settlement?

The appellant acknowledges that this settlement payment is taxable, and agrees to pay all applicable taxes. to award appellant backpay with interest and other benefits, including subsequent within grade salary increases within 30 calendar days of the date of this Agreement.

Do I need to pay tax on my divorce settlement?

The law relates to payments under a divorce or separation agreement. This includes: Divorce decrees. Separate maintenance decrees. Written separation agreements. In general, the taxpayer who makes payments to a spouse or former spouse can deduct it on their tax return. The taxpayer who receives the payments is required to include it in their income.

What is money paid out on settlement of a divorce?

Alimony is paid usually on the basis of the length of the marriage, the usual formula for alimony is that it is paid for half the years of the length of the marriage. For example, if the marriage lasted twenty-two years, what to expect in a divorce settlement would be alimony for eleven years.

Will you pay alimony after the divorce?

Spousal support is financial assistance one spouse pays to the other after a divorce. Depending on where you live, the court may refer to spousal support as alimony or spousal maintenance. In most cases, spousal support is not an automatic right, meaning you’ll need to ask the court to determine whether you qualify, but the law doesn’t ...

What is the recapture rule in divorce?

For instance, if a divorce decree orders the husband to pay his wife a large amount of alimony for one year with a lower amount to follow, the IRS uses the “recapture rule.”. This requires the paying party to “recapture” some of the money as taxable income. As if a divorce is not complicated enough, it is challenging to understand what part ...

Do you have to live separately to exchange money?

To begin, the exchange must be in cash or an equivalent, payment must be made under a court order, the parties must live separately, there are no requirements of payment after the receiving party dies and each party files tax returns separately.

Is it better to give one party a lump sum settlement?

For instance, when the couple has a home with a mortgage, it is common for one party to keep the house and pay the other spouse the equity as a property settlement. No taxable gain or loss is recognized.

Is child support deductible in divorce?

When a divorcing couple has children, child support is often part of the settlement. This money is not deductible. Besides alimony, divorce usually contains a property settlement as well. Many times, it is not recommended for a couple to equally divide marital assets.

Is alimony settlement taxable?

Is Divorce Settlement Money Taxable? After a divorce is final, assets change hands. It is important to understand what part of the settlement is taxable and to what party. In the case of alimony, the amount is taxable to the person who receives the support. In return, the person paying the money receives a tax deduction.

What changes to the tax law affect alimony?

These payments are made after a divorce or separation. The Tax Cuts and Jobs Act changed the rules around them, which will affect certain taxpayers when they file their 2019 tax returns next year.

Is alimony deductible for 2019?

Beginning January 1, 2019, alimony or separate maintenance payments are not deductible from the income of the payer spouse, or includable in the income of the receiving spouse, if made under a divorce or separation agreement executed after December 31, 2018.

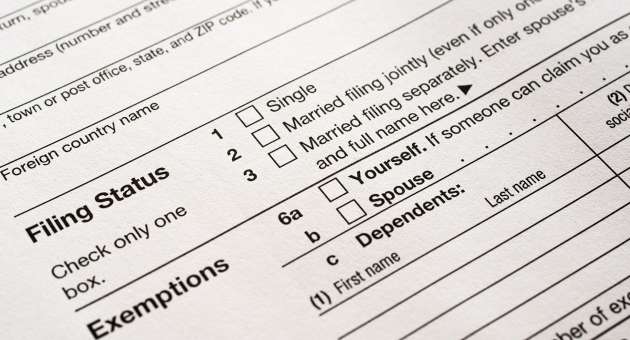

What is the filing status for divorce?

There are different filing statuses available (depending on certain factors) for those going through divorce: single, married, or head of household. Different statuses (as well as the decision whether to file jointly or separately with a spouse) may yield significantly different tax liabilities.

Is property division taxable in divorce?

Thanks to §1041 of the Internal Revenue Code, the division of property in a divorce is not a taxable event. There is, however, a potentially huge tax impact hidden within: tax basis. Tax basis is, simply put, the price used to determine the capital gains tax when property is sold (usually the purchase price). While some property (such as cash) carries no capital gain when sold and other property (such as a residence owned by the taxpayer) has an exemption from capital gain up to a given dollar amount, many forms of investment will be hit with a capital gains tax when sold.

Is a divorce attorney's fee deductible?

Unfortunately, most of the fees paid to a divorce attorney are not tax deductible. There is, though, one loophole: §212 of the Internal Revenue Code allows that fees paid to a divorce attorney in the production or collection of gross income are tax deductible.

Is there a difference between child support and alimony?

1. There is No Difference Between Alimony and Child Support Concerning Taxes. Alimony (support paid from one spouse to another for the benefit of the receiving spouse), is different from child support (support paid from one spouse to another for the benefit of the child) in several ways, but taxes is not one of them.

Is Apple stock worth the same as a $250,000 divorce settlement?

So, in a divorce settlement $250,000 worth of Apple stock is not worth the same as a $250,000 marital residence because the stock will be subject to capital gains tax when sold while the residence will not. 3. Understanding Your Filing Status.

Does cash carry capital gains tax?

While some property (such as cash) carries no capital gain when sold and other property (such as a residence owned by the taxpayer) has an exemption from capital gain up to a given dollar amount, many forms of investment will be hit with a capital gains tax when sold.

Is alimony tax deductible?

Before 2018, alimony was tax deductible by the payer and child support was not. Now, both alimony and child support are not tax deductible to the payer, and the recipient owes nothing in terms of taxes. All agreements going forward will fall under these terms.

Can you avoid paying capital gains tax in divorce?

In theory, you can avoid paying capital gains tax in divorce. Every individual has an annual exemption, so they’re able to make gains without paying tax, as long as they don’t reach the threshold – which can change year by year.

Will you pay capital gains tax on a marital home in divorce?

Even without the spousal exemption, you will not generally have to pay capital gains tax on the marital home in divorce – assuming one of the two parties still lives there as their main home, under what’s known as Principal Private Residence Relief (PPRR). If they remain in the marital home and have lived there throughout ownership of the house, there will be no capital gains tax liability.

Is capital gains tax the same amount for divorce settlements?

When a couple gets divorced, they’re treated individually for the purposes of capital gains tax – both parties get taxed on their own gains and relief on their own losses. Hence, each party can end up paying differing amounts in capital gains tax.

What happens if you sign a transfer deed when you divorce?

First, who owns the home? If you signed a transfer deed when you divorced and it is only in your ex's name, then you have no tax consequences from the sale. If your ex pays you $65,000 then it's not taxable to you no matter how your ex got it.

Do you have to pay capital gains tax if you sell your house?

If either you or your spouse has lived in the home for at least the last 2 years, then both of you qualify to use the capital gains exclusion even though you moved out. You can exclude the first $250,000 of capital gains each, then any higher gains are subject to capital gains tax.

Is a 401(k) taxable if you transfer assets?

However, if the asset transfer includes a tax-advantaged retirement fund like a pension, annuity, IRA or 401 (k), then the money will be taxed by the spouse when they withdraw it. Such plans are always taxable on withdrawal because the money was not taxed when it was contributed. If you receive IRA-type assets in a divorce, you may have several options on what to do with it, with different tax consequences.

Is alimony taxable in divorce?

Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer. This is different than alimony, also called spousal maintenance, which is taxable (and deductible) unless the settlement specifies that it is not. In some cases, a settlement might include an asset transfer and a lump sum of alimony instead of periodic payments—in that case the alimony will generally be taxable.

When is property transfer incident to divorce?

A property transfer is incident to your divorce if the transfer: Occurs within one year after the date your marriage ends, or Is related to the ending of your marriage. If it is a division of the marital estate it is NOT taxable -- it was already yours in the first place.

Can you transfer your spouse to your divorce?

Your former spouse, but only if the transfer is incident to your divorce.

Is property settlement taxable?

If it is a division of the marital estate it is NOT taxable -- it was already yours in the first place.

How much is the child tax credit for divorce?

The child tax credit is worth $2,000 per child (up to $1,400 is refundable), while the credit for other dependents can be as high as $500 for each qualifying dependent (e.g., children over 16 years of age).

What happens when a divorce settlement shifts property from one spouse to another?

When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay tax on that transfer. That's the good news.

How much can you exclude after divorce?

For sales after a divorce, if the two-year ownership-and-use tests are met, you and your ex can each exclude up to $250,000 of gain on your individual returns. If the two-year tests haven't been met, sales after a divorce can still qualify for a reduced exclusion.

Can you deduct alimony from your income?

Getty Images. You can deduct alimony you pay to an ex-spouse if the divorce agreement was in place before the end of 2018. Otherwise, it's not deductible (or taxable to the recipient). You also lose the deduction if the agreement is changed after 2018 to exclude the alimony from your former spouse's income.

Can a non-custodial parent claim a child's credit?

What many people don't know is that it's perfectly legal for the noncustodial parent to claim one of these credits for a son or daughter if the other parent signs a waiver agreeing not to claim an exemption for the child on his or her return (which means the custodial parent can't claim the credit). Form 8332 must accompany the noncustodial parent's return each year he or she claims the credits for the child. This could make financial sense if the noncustodial parent is in a higher tax bracket.

Can you claim child tax credit for divorced parents?

Credits for Children. As a general rule, only the custodial parent (the one the kids live with most of the year) can claim the child tax credit or credit for other dependents for a divorced couple's qualifying children.

Do you pay capital gains tax on a property you split?

That's why, when you're splitting up property, you need to consider the tax basis as well as the value of the property.