It is usually best if you can negotiate a settlement prior to the divorce. The court can then be asked to make any relevant financial orders once the decree nisi has been pronounced (when the court agrees that grounds for divorce have been proven, though there is a further delay before the decree absolute finalises the divorce).

What is a divorce financial settlement?

When a couple goes through a divorce, the financial side of the separating and legalising what has been agreed is sometimes called a divorce financial settlement. There are, confusingly, many names for the same thing as it's also known as a consent order, clean break consent order and financial order.

Is it harder to get a divorce after the divorce?

With less income coming in and all of the financial chaos that may soon ensue, it may be more difficult for either party to get one after the divorce, according to Tannahill. Think about how much the divorce will cost.

Are You too complacent about your financial situation after a divorce?

Don't get too complacent. Seale warns that she has seen that happen to many divorced individuals, where they think they have a financial arrangement worked out with an ex, but unfortunately, the ex doesn't do what they agreed to do.

Can a company be set up before a divorce?

However, if a company has been established a couple of months before a divorce, this may raise suspicions. If a judge rules this has been done with the sole intention of moving income, property or assets into a company structure, a spouse may be ordered to hand over the shares as part of an equitable settlement.

How do I protect my finances before divorce?

Join AARP Today – Receive access to exclusive information, benefits and discounts.Open accounts in your name only. ... Take inventory of assets and debts. ... Sort out mortgage and rent payments. ... Be prepared to share retirement accounts. ... Change your will.

Will my wife get half my pension if we divorce?

One of the most common questions that older divorcing couples have is, “Can I get half my spouse's pension in a divorce?” The answer is yes.

Can I cash out my 401k before divorce?

Although you can withdraw retirement money for your divorce, this should be your last resort. Withdrawals from a 401k, especially before age 59 1/2. generally result in taxes and penalties. There are limited exceptions to this rule, but early withdrawals for a divorce case is not one of them.

What should a woman ask for in a divorce settlement?

You can ask for life insurance, a smaller share of your accumulated debt, more of the family heirlooms or jewelry, or a higher percentage of the retirement funds. Just like women, the men can ask for whatever they feel like they're entitled to within the divorce.

Is it better to divorce before or after retirement?

And although you may have to give up to half of the assets you saved as a couple, you buy time to catch up with your own dedicated retirement savings plans. Finally, divorcing your spouse before tapping shared retirement accounts gives you more control over how those funds are spent or invested.

Do I get half of my husband's 401k in a divorce?

A 401(k) account allows employees to set aside a portion of their monthly paycheck for their golden years. If you decide to get a divorce from your spouse, you can claim up to half of their 401(k) savings. Similarly, your spouse can also get half of your 401(k) savings if you divorce.

Can cheating wife get alimony?

– It is true that is suit for the divorced is decreed after the trial on the ground of adultery then the wife will not be entitled to get permanent alimony and maintenance U/sec 25 of the Hindu Marriage Act 1955 because adultery alleged against her is proved.

When getting a divorce who gets the 401k?

Your desire to protect your funds may be self-seeking. Or it may be a matter of survival. But either way, your spouse has the legal grounds to claim all or part of your 401k benefits in a divorce settlement. And in most cases, you'll have to find a way to make a fair and equitable split of the funds.

How does a pension get divided in a divorce?

In terms of how much either spouse is entitled to, the general rule is to divide pension benefits earned during the course of the marriage right down the middle. Though that means your spouse would be able to claim half your pension, they are limited to what was earned during the course of the marriage.

How is pension split in divorce calculated?

This means that 75% of the pension value would be considered a marital asset. So if you had $200,000 total in a pension, that amount would be multiplied by 75%, meaning the marital value would be $150,000 to be divided. The pension owner would keep the other $50,000 as a separate asset.

How does pension work in divorce?

A general rule of thumb when it comes to splitting pensions in divorce is that a spouse will receive half of what was earned during the marriage, though it depends on each state's laws governing this subject.

How are pensions shared on divorce?

Pension sharing is one of the options available on divorce or the dissolution of a civil partnership. It provides a clean break between parties as the pension assets are split immediately. This means that each party can decide what to do with their share independently.

Why do people spend money on divorce?

Spending Money Before Divorce to Reduce the Financial Settlement. If you’re considering or going through a divorce, then the financial aspects of your separation are likely to be one of your major concerns. During the divorce a spouse may suspect that their partner is spending (or moving) money before the divorce is completed in an attempt ...

What to do if spouse spends money?

If you do notice your spouse is starting to spend money, or they begin to move assets around, you should contact a specialist family solicitor in order to ensure that you are protected in the event of a divorce.

What are the warning signs a spouse is spending, and what should I look out for?

Divorce is a stressful event, and sometimes the parties involved can behave vindictively, particularly where their finances are concerned.

How can I prevent my spouse spending money?

As we have seen, in order to litigate because you believe your spouse is recklessly reducing the value of your marital assets, you have to be able to prove that their behaviour was ‘wanton’ and that they were motivated by a desire to reduce your financial settlement.

Can a spouse be forced to ‘add back’ to the pot the money or assets they’ve spent?

While there are some ways of preventing your estranged spouse from dissipating your financial assets, you may be in a situation where they have already started to spend money since you separated.

Are company assets treated differently to ‘private’ assets?

In the past, there have been cases where spouses had tried to hide assets from their partner in company structures with the aim of reducing the size of a divorce settlement.

Do you need help with your divorce?

Your details are NOT used by Wiselaw after you submit them. Your data is secured and encrypted the moment you send it. By sending this form you agree to Wiselaw's Terms and Privacy Policy. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

What to do if you are planning on divorcing?

Greenblatt suggests that if you are planning on divorcing, "figure out which funds you will be able to access once you announce your intentions. To the extent possible, make sure you have enough to get by while you figure out strategy with a lawyer."

How does divorce affect retirement?

Think about your retirement accounts. "Divorce can impact your retirement trajectory and other long-term goals and risk preferences, so it is crucial to revisit your investment portfolio to readjust and rebalance," Richardson says. "Also consider how divorce may impact your retirement accounts. This typically depends on the divorce settlement as well as when the accounts were established, state laws and any preexisting agreements like a prenup."

What are the steps to take during a divorce?

Financial Steps to Take During a Divorce. Continually monitor your expenses. Of course, you should do this all the time, whether you're divorcing or single and never plan to marry. But this is a time to be especially on guard that your spending stays under control.

What to do after divorce 2020?

May 18, 2020, at 12:52 p.m. Financial Steps to Take During a Divorce. More. Apply for a credit card in your own name. It may be more difficult for either party to get one after the divorce. (Getty Images) Once you remove love and emotion from a divorce equation, pretty much all you have left is money. So if your marriage is coming to an end, ...

How to get divorce settlement?

Step 1: Gather and assess financial information. So that a divorce financial planning professional can work with you to help you reach the best possible settlement, the first step you take will be the most critical. You must gather as much accurate and comprehensive information as possible.

What information will I need to start the divorce financial planning process?

The more thorough you are in gathering your information, the better the financial plan that can be created and implemented for you and your situation.

Who should I hire to assist me with divorce financial planning?

Because divorce can be a complicated process, chances are that you will need to not only retain a seasoned family law attorney, you will also need the services of other professionals who can fully understand and interpret your divorce-related financial, tax and long-term wealth issues.

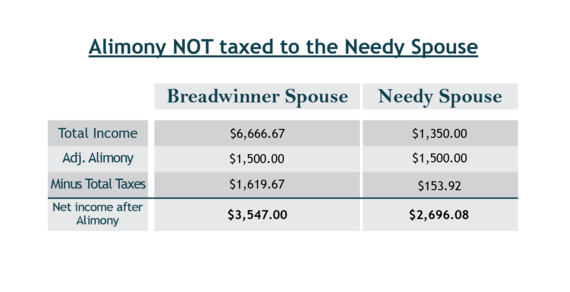

How is Alimony Calculated in Divorce Financial Planning?

Some states are generous when it comes to providing for the needs of one spouse following a divorce. Other states will set a limited time frame that a spouse can receive spousal support, depending on a number of factors, including:

What Information do I Need to Provide on my Assets, Debts and Liabilities?

Depending on the state you are getting a divorce in, you will need to provide full financial disclosure either at the beginning or throughout the process of your divorce.

Why is divorce emotional?

Because divorce is an emotional experience, without guidance your judgment can be compromised at times, causing you to make mistakes that could take years to recover from, or cost you thousands of dollars. When you get assistance from a divorce financial planning professional, you can work together to develop a strategic plan ...

What can a family law attorney do for you?

Just as a family law attorney will focus on legal issues, and other resources will help you with emotional support issues, you can only make the best possible financial decisions when you tap into the extensive knowledge and experience provided by a professional trained to deal with critical financial decisions as they relate to divorce.

How Do You Protect Yourself Financially in a Divorce?

In general, it’s a good idea to close joint credit card accounts so that one spouse can’t run up debt for which the other one will be held responsible. Reviewing your credit reports and monitoring your credit can help you make sure that your spouse hasn’t done anything to damage your credit. Do not take assets that are not yours, because a judge may sanction you heavily for doing so. A family law attorney and an accountant can help you take the specific steps that your situation warrants.

When selling assets in the process of dividing them during a divorce, do spouses need to be careful?

When selling or transferring assets in the process of dividing them during a divorce, spouses need to be careful to avoid unnecessary capital gains taxes and gift taxes. An accountant can help you follow Internal Revenue Service (IRS) rules about timing and documentation to do a transfer incident to divorce and steer clear of or minimize these taxes.

What Are the Tax Consequences of Selling or Transferring Marital Assets?

When selling or transferring assets in the process of dividing them during a divorce, spouses need to be careful to avoid unnecessary capital gains taxes and gift taxes. An accountant can help you follow Internal Revenue Service (IRS) rules about timing and documentation to do a transfer incident to divorce and steer clear of or minimize these taxes.

How to keep more than your fair share of assets in a divorce?

Through trusts, overseas accounts, and less sophisticated methods, such as transferring assets to trusted family members or friends , spouses may attempt to keep more than their fair share of marital assets in a divorce. Hiring a forensic accountant or an attorney who specializes in finding hidden assets can help you make sure that you don’t lose anything you are entitled to in your divorce.

Why should each spouse obtain their own independent valuation of major assets?

That’s why each spouse should obtain their own independent valuation of major assets to make sure that they are divided fairly. A mediator, an arbitrator, or a judge can look at both valuations and help ensure a fair division.

Why do couples want their ex out of their lives?

This is especially true when physical, emotional, or financial abuse is involved. The problem with a rushed divorce is that it can lead to an unfair division of assets for the more vulnerable spouse. One party may take advantage of the other party’s desire to get things over with and convince them to leave the relationship with less than they deserve and without the support that they need to start over.

How does divorce affect financial aid?

The divorce can also affect the child’s financial aid award for college because some schools assume a certain contribution from each parent even if one parent has left the picture. 4 And parents will need to decide who will claim the child tax credit each year, because only one parent can claim it. They also will need to address possible issues created by advance child tax credit payments and shared custody. 5 6

What happens to a decree absolute at the end of a divorce?

The decree absolute at the end of the divorce process brings an end to your marriage and you are no longer husband and wife but it does not end financial claims between you.These can only be dismissed by the Court in a separate order and otherwise continue until the death of one of you.

What is a financial application?

A financial application normally covers a wide range of financial orders: dealing with pensions, the transfer or sale of property, lump sum orders and maintenance orders. Child maintenance is dealt with separately by the Child Maintenance Service unless it is agreed.