Will I have to pay tax on my settlement?

You will have to pay your attorney’s fees and any court costs in most cases, on top of using the settlement to pay for your medical bills, lost wages, and other damages. Finding out you also have to pay taxes on your settlement could really make the glow of victory dim. Luckily, personal injury settlements are largely tax-free.

How much will the IRS usually settle for?

The IRS can seize up to the total amount of your tax debt from your bank account. For many taxpayers, this means the IRS can totally wipe out their account. How much will the IRS usually settle for? The average amount of an IRS settlement in an offer in compromise is $6,629.

How to negotiate a tax settlement with the IRS?

- Let the IRS know you'll pay the debt off within six years—but ideally within three years. 7

- Aim high. ...

- The regular (usually monthly) tax payment you introduce to the IRS should be tied to existing IRS criteria. ...

What is the tax rate on settlement money?

Unfortunately, you'll get taxed on the full amount of the settlement — not just the 60% you got to keep. Of course, that only applies if your settlement is taxable in the first place. To see how lawyers’ fees actually impact settlement taxation, let’s take a look at some examples.

/GettyImages-505872588-5bca34b346e0fb0051748309.jpg)

How much will the IRS usually settle for?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

Can I negotiate a payoff with the IRS?

Apply With the New Form 656 An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

Will IRS take a lump sum settlement?

A "lump sum cash offer" is defined as an offer payable in 5 or fewer installments within 5 or fewer months after the offer is accepted. If a taxpayer submits a lump sum cash offer, the taxpayer must include with the Form 656 a nonrefundable payment equal to 20 percent of the offer amount.

How likely is the IRS to accept an offer in compromise?

A rarity: IRS OIC applications and acceptances for 2010-2019 In 2019, the IRS accepted 33% of all OICs. There are two main reasons that the IRS may not accept your doubt as to collectibility OIC: You don't qualify. You can't pay the calculated offer amount.

Does the IRS offer one time forgiveness?

One-time forgiveness, otherwise known as penalty abatement, is an IRS program that waives any penalties facing taxpayers who have made an error in filing an income tax return or paying on time. This program isn't for you if you're notoriously late on filing taxes or have multiple unresolved penalties.

What do I do if I owe the IRS over 10000?

What to do if you owe the IRSSet up an installment agreement with the IRS. Taxpayers can set up IRS payment plans, called installment agreements. ... Request a short-term extension to pay the full balance. ... Apply for a hardship extension to pay taxes. ... Get a personal loan. ... Borrow from your 401(k). ... Use a debit/credit card.

What happens if you owe the IRS more than $50000?

If you owe more than $50,000, you may still qualify for an installment agreement, but you will need to complete a Collection Information Statement, Form 433-A. The IRS offers various electronic payment options to make a full or partial payment with your tax return.

What if I owe the IRS more than 100000?

The bottom line: if you owe more than $100,000 in taxes, the IRS will demand quick liquidation of your assets to pay the debt and dramatic reduction in your monthly living expenses to pay back what you owe.

Can the IRS go after your family?

If you don't file taxes for a deceased person, the IRS can take legal action by placing a federal lien against the Estate. This essentially means you must pay the federal taxes before closing any other debts or accounts. If not, the IRS can demand the taxes be paid by the legal representative of the deceased.

Who qualifies for IRS Fresh Start?

People who qualify for the program Having IRS debt of fifty thousand dollars or less, or the ability to repay most of the amount. Being able to repay the debt over a span of 5 years or less. Not having fallen behind on IRS tax payments before. Being ready to pay as per the direct payment structure.

How much does an Offer in Compromise cost?

$205Taxpayers can't always come up with the OIC offer amount. In 2020, the IRS released final regulations that increased the OIC user fee to $205 from $186. While a 10% increase may seem like a lot, it's only a small part of the potential cost of an OIC.

What do I do if the IRS rejects my offer in compromise?

Remember to mail your appeal to the office that sent you the rejection letter. You can request an Appeals conference by preparing either a Form 13711, Request for Appeal of Offer in CompromisePDF, or a separate letter with the following information: Name, address, Tax Identification Number and daytime telephone number.

How do you reduce the amount you owe the IRS?

Contribute to a Retirement Account.Open a Health Savings Account.Check for Flexible Spending Accounts at Work.Use Your Side Hustle to Claim Business Deductions.Claim a Home Office Deduction.Rent Out Your Home for Business Meetings.Write Off Business Travel Expenses, Even While on Vacation.More items...

Do you need a lawyer to negotiate with IRS?

You have the legal right to represent yourself before the IRS, but most taxpayers have determined that professional help, such as specialized attorneys, accountants, or tax specialists who are experienced in helping taxpayers resolve unpaid tax debts can significantly impact your odds of reaching an acceptable ...

Can you negotiate with IRS to remove penalties and interest?

First, you should know that it is possible to negotiate for an abatement of penalties and interest, but it is at the discretion of the IRS agent with whom you are working. Second, it takes time, sometimes a year or two, to negotiate with the IRS for a reduction of interest or penalties.

How do I deal with IRS debt?

Tax Debt: 3 Steps to Resolve Your Debt With the IRSFile your taxes — even if you can't pay. If you have a balance after crunching the numbers, make sure you still file. ... Make a payment plan, delay payment or settle. ... Tap an expert for assistance.

How Does a Tax Settlement Work?

You determine which type of settlement you want and submit the application forms to the IRS. The IRS reviews your application and requests more information if needed. If the IRS does not accept your settlement offer, you need to make alternative arrangements. Otherwise, collection activity will resume. If the IRS accepts your settlement offer, you just make the payments as arranged.

What is a tax settlement?

A tax settlement is when you pay less than you owe and the IRS erases the rest of your tax amount owed. If you don’t have enough money to pay in full or make payments, the IRS may let you settle. The IRS also reverses penalties for qualifying taxpayers.

What is penalty abatement?

Penalty Abatement. Penalty abatement is when the IRS erases all or some of the tax penalties. There are multiple ways to qualify for penalty abatement. The IRS realizes that there are legitimate reasons for not paying or filing on time, and the agency created penalty abatement for this purpose. In particular, if you are late for ...

How long do you have to pay back taxes?

If you personally owe less than $100,000 or if your business owes less than $25,000, it is relatively easy to get an installment agreement. As of 2017, the IRS gives taxpayers up to 84 months (7 years) to complete their payment plans.

What is partial payment installment agreement?

A partial payment installment agreement allows you to make monthly payments on your tax liability. You make payments over several years, but you don’t pay all of the taxes owed. As you make payments, some of the taxes owed expire. That happens on the collection statute expiration date.

How to settle taxes owed?

These are the basic steps you need to follow if you want to settle taxes owed. File Back Taxes —The IRS only accepts settlement offers if you have filed all your required tax returns. If you have unfiled returns, make sure to file those returns before applying.

What happens if you default on a settlement offer?

At that point, you are in good standing with the IRS, but if you default on the terms of the agreement, the IRS may revoke the settlement offer . To explain, imagine you owe the IRS $20,000, and the IRS agrees to accept a $5,000 settlement.

Can You Negotiate a Settlement with the IRS?

The IRS, perhaps more than any other kind of creditor or collection agency, will aggressively pursue the assets and income of anyone with outstanding tax debt. They have the means and the power to resort to measures other creditors could only dream of – which is why many rightfully fear getting on the wrong side of the IRS.

Does the IRS Ever Settle?

Yes. The U.S. tax court exists to provide the setting for taxpayers to appeal a notice of deficiency (CP3219A/CP3219N), determination (CP508C), and other notices. While it is exceedingly unlikely to wipe out your tax debt, the IRS is ultimately in the business of collecting revenue from taxpayers. If you have the evidence and the means to go to court to appeal any notice or sue the IRS, there is a chance that they will settle.

What is an offer in compromise?

First, an offer in compromise is not available to everyone with severe tax debt, and the IRS considers it something of a last resort. It represents an appeal to the IRS for a reduction of the outstanding debt on the basis of your income, ability to pay, current expenses, and asset equity.

What to do if you owe money to the IRS?

If you owe money to the IRS, you may be interested in negotiating a smaller payment. This can help save you money as you resolve the debt.

Where to take IRS appeal?

Should you find yourself in a situation where the IRS has made a mistake or you wish to appeal a tax decision, you can take your complaint to the IRS’ Independent Office of Appeals, or if your appeal was rejected by the tax court, you may take the decision to a Court of Appeals (unless it was a small tax case, an expedited process for debts of $50,000 or less). Before deciding how to appeal, it’s best to contact a tax law professional.

When is an offer in compromise considered?

The IRS may consider an offer in compromise “when the amount offered represents the most we can expect to collect within a reasonable period of time.” It is important to note that the IRS will immediately reject any filed offer in compromise if you have not filed all required tax returns and have not paid estimated tax payments that you are eligible for.

Is the IRS a monolithic entity?

The IRS is not a monolithic or omnipotent entity – they make mistakes, and there are checks and balances in place to correct these mistakes.

Can I settle with the IRS myself?

You can absolutely settle your tax debts directly with the IRS, though it often requires many forms (and documentation) and tends to be a complicated process. See below for the forms you’ll need for each.

What options do I have for settling my IRS debt?

There are several routes you can take to settle your tax debts with the IRS. The only sure-fire way to reduce your total balance, though, is through an Offer in Compromise. Unfortunately, this tends to be challenging to come by.

What is an OIC?

Offer in Compromise (OIC) An Offer in Compromise allows you to settle your tax debts for less than you owe. Here’s how it works: You make an offer for what you can comfortably afford to pay (based on your assets, income, expenses, and other financial details), and the IRS will accept or reject it. If accepted, you’ll have two payment options ...

What happens to your IRS if your financial situation improves?

If the agency finds that your financial situation has improved, it can increase your payment or begin taking other measures to collect on the original debt.

How much does the IRS settle for OIC?

The average settlement on an OIC is around $5,240.

What happens if you ignore your taxes?

Taxpayers who ignore tax debts can face serious penalties. For one, it increases the overall costs of your taxes by adding fees and extra interest to your balance. Late fees start at 0.5% of the tax debt, while interest comes in at the federal short-term rate, plus 3%.

What do you need to do before you can get a PPIA?

Before you can be eligible for a PPIA, you’ll need to use all assets to try and repay your debt. The IRS can also ask that you use the equity in those assets (like your home equity, for example) to pay off the balance.

What is partial payment installment?

A Partial Payment Installment Agreement is when you make payments based on what you can afford rather than the monthly amount required to satisfy the taxes in full before the CSEDs expire. The balance gets reduced as the statute of collections comes into effect. Under that statute of limitations on taxes expires after a certain period of time (generally 10 years from the date it is assessed). As the expiration date hits, that tax amount owed is erased, and you are no longer responsible for it.

What is penalty abatement?

Penalty abatement is when the IRS forgives penalties. This is a very common method for settling taxes for less than you owe. In fact, about a third of all IRS penalties are removed at a later date.

What is an offer in compromise?

An offer in compromise is when you settle taxes for less than you owe. It’s not for everyone. The process is difficult, and there are strict qualification requirements. The IRS will only accept an offer in compromise if your offer is equal to or greater than the amount the agency would be able to collect using forced collection mechanisms (seizing assets, garnishing wages, etc.).

Is innocent spouse relief available?

Innocent spouse relief is available to taxpayers who have filed jointly with their spouse or former spouse. Normally, both spouses are liable for all tax, penalties, and interest, but there are some rare situations where it’s unfair to hold both spouses liable. If you qualify, the IRS still holds the spouse liable, but you aren’t responsible.

Can bankruptcy eliminate taxes?

Bankruptcy can sometimes eliminate taxes owed. You can eliminate certain taxes through Chapter 7, but it depends on the age of the taxes and several other factors. Bankruptcy is not always the best option if you solely looking at it to discharge taxes. Consequently, it generally negatively impacts your credit and forces you to liquidate assets. If you are considering this option, contact a bankruptcy attorney.

What happens if you accept a tax offer?

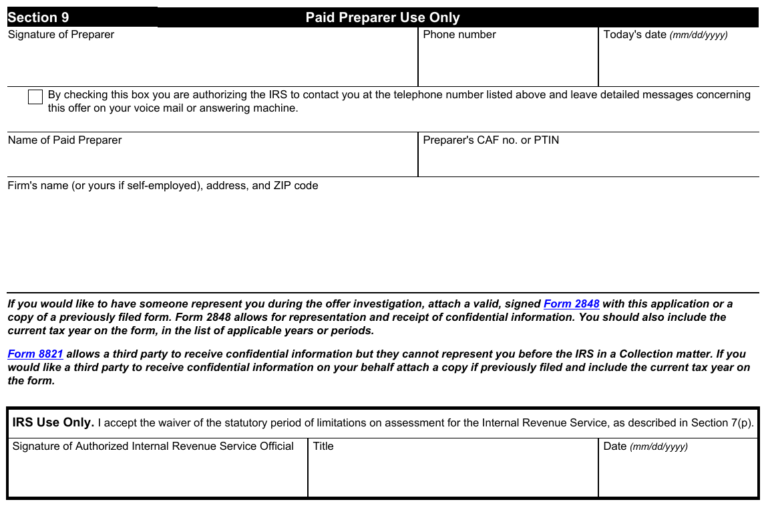

You must meet all the Offer Terms listed in Section 7 of Form 656, including filing all required tax returns and making all payments; Any refunds due within the calendar year in which your offer is accepted will be applied to your tax debt;

How long does it take for an IRS offer to be accepted?

Your offer is automatically accepted if the IRS does not make a determination within two years of the IRS receipt date.

What is an offer in compromise?

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability, or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Asset equity.

Does the IRS return an OIC?

The IRS will return any newly filed Offer in Compromise (OIC) application if you have not filed all required tax returns and have not made any required estimated payments. Any application fee included with the OIC will also be returned. Any initial payment required with the returned application will be applied to reduce your balance due. This policy does not apply to current year tax returns if there is a valid extension on file.

Do you have to pay the application fee for low income certification?

If accepted, continue to pay monthly until it is paid in full. If you meet the Low Income Certification guidelines, you do not have to send the application fee or the initial payment and you will not need to make monthly installments during the evaluation of your offer. See your application package for details.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.

What is an offer in compromise?

Offer in Compromise — Certain taxpayers qualify to settle their tax bill for less than the amount they owe by submitting an Offer in Compromise. To help determine eligibility, use the Offer in Compromise Pre-Qualifier tool. Now, the IRS is offering additional flexibility for some taxpayers who are temporarily unable to meet the payment terms of an accepted offer in compromise.

Why did the IRS assess its collection activities?

The IRS assessed its collection activities to see how it could apply relief for taxpayers who owe but are struggling financially because of the pandemic, expanding taxpayer options for making payments and alternatives to resolve balances owed.

What is IRS relief?

Relief from Penalties — The IRS is highlighting reasonable cause assistance available for taxpayers with failure to file, pay and deposit penalties. First-time penalty abatement relief is also available for the first time a taxpayer is subject to one or more of these tax penalties.

How long do you have to pay your taxes in the IRS?

Taxpayers who qualify for a short-term payment plan option may now have up to 180 days to resolve their tax liabilities instead of 120 days. The IRS is offering flexibility for some taxpayers who are temporarily unable to meet the payment terms of an accepted Offer in Compromise.

Does the IRS add tax balances to an existing tax agreement?

The IRS will automatically add certain new tax balances to existing Installment Agreements, for individual and out of business taxpayers. This taxpayer-friendly approach will occur instead of defaulting the agreement, which can complicate matters for those trying to pay their taxes.

When is IR-2020-248 due?

IR-2020-248, November 2, 2020. WASHINGTON — The Internal Revenue Service today announced a number of changes designed to help struggling taxpayers impacted by COVID-19 more easily settle their tax debts with the IRS.

Can you delay IRS collection?

Temporarily Delaying Collection — Taxpayers can contact the IRS to request a temporary delay of the collection process. If the IRS determines a taxpayer is unable to pay, it may delay collection until the taxpayer's financial condition improves.

Can I do my own fresh start payment plan?

For many people, the best solution is one of the I RS Fresh Start payment plans and those can easily be done yourself. See our video link below regarding the latest for 2021.

Can I negotiate with the IRS?

Here we answer the commonly asked tax relief question: Can I negotiate with the IRS myself? The answer is yes and in many simpler cases, there is no benefit to hiring someone to do your case.