How long does a settlement negotiation take?

Negotiating a settlement might take a few weeks to several months. If the case goes to court, it can take longer to agree to a fair offer. Learn more here.

How to negotiate the best possible settlement agreement?

Your solicitor will be able to advise you on factors such as:

- The amount of compensation you should be entitled to in the settlement agreement

- The most cost-effective way of drafting the document to avoid having to pay tax unnecessarily

- Whether you have any prospect of an Employment Tribunal claim against your employer and what the value of that claim would be

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

How to write a convincing debt negotiation letter?

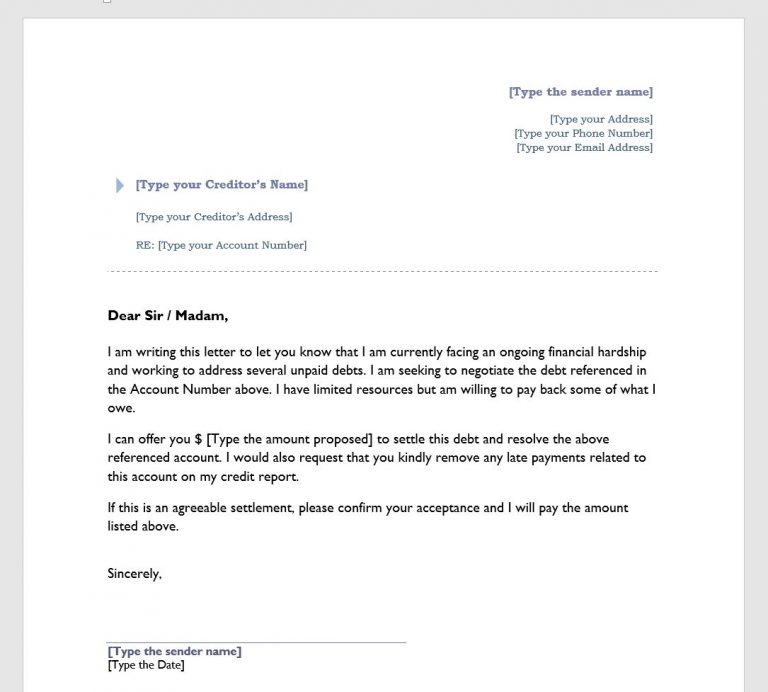

Writing a Debt Negotiation Letter [Free Sample]

- Formal Business Letter. Because this is a formal business letter, you need to begin as such. ...

- First Paragraph. The first paragraph needs to have valuable account information. ...

- Second Paragraph. The second paragraph needs to give them a reason why you need help. ...

- Third Paragraph. ...

- Sample Debt Negotiation Letter

How much can you negotiate on a settlement?

Offer a Lump-Sum Settlement Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

Can I negotiate a settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

Is it good to pay settlement offers?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Will Debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What should you not say to debt collectors?

9 Things You Should (And Shouldn't) Say to a Debt CollectorDo — Ask to see the collector's credentials. ... Don't — Volunteer information. ... Do — Make a preemptive offer. ... Don't — Make your bank account accessible. ... Maybe — Ask for a payment-for-deletion deal. ... Do — Explain your predicament. ... Don't — Provide ammunition.More items...

Does settlement affect credit score?

Loan settlements impact on the CIBIL score When a loan is termed settled, it is viewed as a negative credit behaviour and the borrower's credit score drops by 75-100 points. The CIBIL holds this record for over 7 years.

Should I pay a 5 year old collection?

If you have a collection account that's less than seven years old, you should still pay it off if it's within the statute of limitations. First, a creditor can bring legal action against you, including garnishing your salary or your bank account, at least until the statute of limitations expires.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

How much should I offer in a settlement agreement?

The rough 'rule of thumb' that is generally used to determine the value of a settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary.

How do you respond to a low settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

How do you counter offer a settlement?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

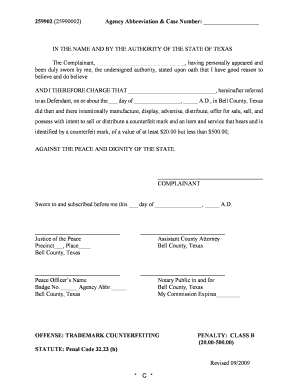

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the second step in negotiating a debt?

The second step is deciding what terms you’ll agree to. During negotiations, the biggest item to discuss will be how much of the debt you need to pay. But don’t overlook another important term: how the debt will show up on your credit report.

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

Who do you send a settlement demand letter to?

Finally, you are ready to submit your settlement demand letter to the defendant or his or her insurance company. Oftentimes, there will be a lot of negotiating back and forth between you and the insurance company with regard to the value of the claim, until an agreement is reached.

What happens if you don't settle with insurance company?

The bottom line, however, is that if you and the insurance company do not come to some sort of a voluntary settlement agreement, you will have to go to trial where a judge or jury will determine the amount of damages, if any, to which you are entitled.

What happens if you are partly to blame for an accident?

If you were partly to blame for the accident, your settlement will decrease by some amount based on your "contribution" of fault. Multiple defendants.

What do you need to do before you can settle a personal injury claim?

Before You Can Start. Before you can begin the settlement process of a personal injury claim you must first get medical attention. Your doctor will be able to determine the type and extent of the injury and begin the appropriate treatment.

What happens if you are injured by someone else's negligence?

If you have been injured as a result of someone else's negligence or carelessness, you have the legal right to be compensated for your losses. You will eventually want to consider whether or not to settle your case before going to trial (or in some cases, before even filing a lawsuit).

Why is voluntary settlement important?

Resolving your claim by way of a voluntary settlement agreement may be beneficial to you because it saves you the time and cost of going through a court trial. But determining a fair value for which to settle your injury claim can be difficult, since it is dependent on a variety of factors.

Do you have to give consent to a lawyer to text you?

You are not required to provide consent as a condition of service. Attorneys have the option, but are not required, to send text messages to you. You will receive up to 2 messages per week from Martindale-Nolo. Frequency from attorney may vary.

What happens if you owe $400?

If you have an account with a small balance (e.g., $400), it’s less likely that the creditor will try to sue you over the creditor you owe $4,000. This is because it costs money for creditors to take legal action. Consequently, if you owe less, there will be less motivation involved in the creditor to sue.

What happens if a collection agency proves a debt is valid?

If the collection agency proves a debt is valid, then it’s time to settle. This first video shows you about the mindset required when attempting to settle a debt on your own, provided by Paul J Paquin – the CEO at Golden Financial Services.

Can a collection agency settle a debt?

Only settle the debt if the collection agency can prove they are legally authorized to collect on it. Here’s a debt validation letter creator. This validation letter template can help you deal with small debts, but if you have high debt that is over $7,500, you’ll most likely need more than just a one-page dispute.

Can debt arbitrators make payments?

Experienced debt arbitrators can make paying the fees for a debt relief program worth the cost. Plus, the fees are built into the monthly payments. So your payments can immediately get reduced, and that reduced amount includes all costs after being enrolled in a program.

Can a creditor sue you for a small amount?

If you have an account that has a small balance (e. g., $400), it’s less likely that the creditor will try to sue you over the creditor that you owe $4,000 to. It costs money for creditors to take legal action. Consequently, if you owe less, there will be less motivation involved in the creditor to sue.

Do you have to settle debt to get a settlement?

Most of the time, you won’t need to use debt settlement to resolve your debt.

Can I settle debt on my own?

Most of the time, you can settle a debt on your own . Collection agencies will send you settlement offers before you even contact them to negotiate, offering to settle the debt anywhere from 50%-70% of the balance.

What does it mean to send a settlement offer letter?

By sending in your settlement offer letter, you exhibit willingness.

What is the goal of a settlement letter?

The goal of sending a settlement offer letter is to pay less than what you owe and put that account in your rearview mirror. Some of us may approach this effort with a specific credit reporting outcome, such as getting the negative account deleted from your credit bureau reports as a condition of paying the settlement.

How long does it take to get a settlement offer from a bank?

This can mean the best time to mail an offer is at 150 days. That leaves you with only one month to hear back from them. Now, because some banks simply ignore written settlement offers, and there is only a month left to negotiate a settlement you can agree to and pay, you will lose the opportunity to prevent charge off and get a better settlement deal now than you may be able to get later – and prevent your account from being placed with a collection law firm by creditors that do that right away.

How long does it take to mail a debt?

Mail takes time. Perhaps even weeks. What if you are dealing with a contingency debt collector, the most common type of debt collection agency? This type of collector only gets paid if they get you to pay.

What do you want in a settlement agreement?

What you do want in writing: The settlement agreement. Getting your settlement agreement in writing is critical. You absolutely want a letter that outlines the creditor, collection agency or law firm is taking less than what you owe. You want it to clearly identify you, and the outline of the deal being made.

When to ask a creditor to validate a debt?

And asking a creditor to validate a debt before you agree to pay is something you do when you are trying not to pay, or need clarity on whether to pay.

Can a credit card be placed with a collection agency?

The bank you have your credit card with may only have placed your account with the collection agency for a limited time.

What to expect after settling?

After you make your payment and fulfill the terms of the settlement, you will receive a debt clearance letter. This letter will serve as proof that you are no longer financially responsible for the particular student loan.

Who can help you negotiate student loans?

Negotiate yourself. There's no law against you going the DIY route and contacting the debt collection agency that has your student debt to offer a settlement. However, be careful about resetting the clock on old private student loan debt by agreeing you owe the loans and setting up payment. Federal student loans never go away, so you don't have to worry about restarting the statute of limitations.

What is a student loan settlement?

A student loan settlement is when the loan holder agrees to accept less money than you currently owe after you've missed payments for several months.

Can you settle student loans in good standing?

You cannot settle federal student loans or private student loans that are in good standing. With both federal and private loans, a student loan settlement doesn't become an option until you enter loan default — and that can take up to 270 days.

Does settling student loan debt hurt your credit?

Settling student loan debt may hurt your credit and FICO score. Lenders understand that settlements happen after delinquency and default, and the settlement will be on your credit history for years to come.

What is a settlement for student loans?

In a student loan settlement, you (the borrower) and your student loan lender agree that you can satisfy a student loan for less than you owe. This requires you to pay a lump sum of a large percentage of the principal balance and accrued interest.

What is a lump sum settlement?

Lump sum settlement - you make one large payment to settle your student loan debt for less than the current balance. You usually get the biggest discount with this type of settlement agreement.

What to do if you don't accept a counter offer?

Consider the counter-offer, and then decide if you want to accept it or not. If you do, fine. Take the money, and sign a release. If you don't, get ready to file a personal injury lawsuit in court.

When should you send a demand letter?

In short, it's best to send a demand letter only after you have taken a thorough look at the impact of your injury on all aspects of your life, and made a reasonable valuation of your injury claim. This is important because in your demand letter, you will be detailing for the insurance carrier or the defendant:

When is a demand letter sent?

But the demand letter is usually only sent once an investigation into the circumstances of the accident (including fault) has been made, and the extent of the injured person's losses are known—or those damages can be reasonably forecast if future medical care or lost income is expected.

Can an insurance adjuster negotiate a low settlement?

Remember, the insurance adjuster will probably low-ball you but then you can start to negotiate. It's okay if your demand is on the high side - this will give you room to negotiate later. Learn more about responding to a low personal injury settlement offer.

Can you negotiate a personal injury settlement?

And in cases where your injuries are relatively minor and the other side's fault is pretty clear, it may be more economical to negotiate your own personal injury settlement, rather than handing over one-third of your award to a lawyer (which is common practice under personal injury lawyer fee agreements ).

Can an insurance adjuster settle a personal injury claim?

Most claims are negotiated and settled outside of court. Remember, most adjusters will be more willing to help you (i.e. settle your claim) if you are polite, reasonable, and explain your story. You will need to show clear liability and records of all your injuries before they can settle with you. Learn more about working with an insurance adjuster to settle your personal injury claim.