Should I Sell my Life insurance settlement?

By selling your settlement, you can: 1 Lower your expenses on high premiums 2 Exit an unfavorable life insurance policy 3 Receive value for a policy you no longer want or need

How do you qualify for a life insurance settlement?

To qualify for a life settlement, the policyholder must usually be over 65 and have a policy with a face value of at least $100,000. The Policy must also be “non-recourse,” meaning that the insurer cannot cancel the policy if the premiums are not paid.

How do life insurance settlements work?

Life settlements, also known as the secondary market, are contracts that allow policyholders to sell their existing life insurance policy to third-party investors in exchange for a lump sum of cash. The investor then becomes the new policyholder and pays the premiums until the original policyholder dies.

How do I Sell my Life insurance policy?

When you sell your life insurance policy, you will have to sign a release authorizing the release of medical and other personal information so that the buyer can determine how much to offer for your policy. You may also have to agree to provide periodic updates about your health.

Can a life settlement be sold for an amount greater than the current cash value?

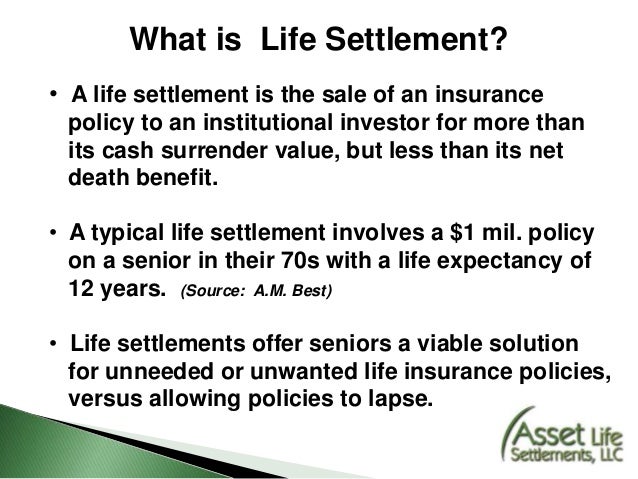

A life settlement is the sale of a life insurance policy by the policy owner to a third party. The seller typically gets more than the cash surrender value of the policy but less than the amount of the death benefit.

How much can you sell a life insurance policy for?

A policyholder could receive anywhere between 10% to 35% of the amount that would be paid when they die. On average, policyholders receive an upfront cash settlement that equals 20% of their life insurance policy death benefit.

How much is a life settlement worth?

A typical life settlement payout will be around 20% of your policy size, but the range could be anywhere from 10% to 25%+. For example, if you have a policy valued at $300,000 and you choose to sell it in a life settlement, your final return will be around $60,000.

Is it worth it to sell a life insurance policy?

If you can no longer afford to pay your life insurance premium, selling the policy might relieve the monthly payments and put some money back into your pocket. Life insurance settlements usually result in a larger payout than what you would get from cancelling or surrendering your policy.

Can I cash out my life insurance policy?

Can you cash out a life insurance policy before death? If you have a permanent life insurance policy, then yes, you can take cash out before your death. There are three main ways to do this. First, you can take out a loan against your policy (repaying it is optional).

Can you take out cash value of life insurance?

You might be allowed to withdraw money from a life insurance policy with cash value on a tax-free basis. However, if the sum you take out surpasses the amount of money you've built up as the cash value under your policy, you'll be required to pay income taxes on that money.

Is a life settlement tax Free?

Is A Viatical Settlement Taxable? Most of the time, viatical settlements are not taxable. Settlement proceeds for terminally ill insureds are considered an advance of the life insurance benefit. Life insurance benefits are tax-free, and so it follows that the viatical settlement wouldn't be taxed, either.

Are life settlements taxable?

To recap: Sale proceeds up to the amount of the cost basis are not taxable. Sale proceeds above the cost basis and up to the policy's cash surrender value are taxed as ordinary income. Any remaining sale proceeds are taxed as long-term capital gains.

How are life settlements calculated?

The Insured's Age and Health Status The most important driver of value in a life settlement transaction is the life expectancy of the insured. Age, smoking status, sex and many other factors related to the insured's health have an influence on life expectancy.

How much can you sell a $100 000 life insurance policy for?

Pros and Cons to Selling your Life Insurance Policy On average, if you have a $100,000 life insurance policy, you will be receiving about $25,000. The next big advantage is that you won't have to make any more premium payments on your insurance policy.

Who buys life insurance the most?

More than 8 in 10 families in the United States have some form of life insurance coverage today. Most people who own life insurance are family breadwinners who want to make sure that in the event they die, the future financial needs of dependents, such as a spouse, children or elderly parents, are met.

What happens when you sell a life insurance policy?

How does selling a life insurance policy work? Selling a life insurance policy is called a life settlement, sometimes known as a viatical settlement. You sell the policy to a third party for cash, usually a broker or settlement company. They pay your premiums and receive the death benefit when you die.

What happens when you sell a life insurance policy?

A life settlement is the sale of a life insurance policy to a third party. The owner of the life insurance policy gets cash for the policy. The buyer becomes the new owner and/or beneficiary of the life insurance policy, pays all future premiums and collects the entire death benefit when the insured dies.

How do I find out how much my life insurance is worth?

4 ways you can find out the cash value of the policyCall your insurance company or agent. ... Log in to your insurance company's web portal. ... Use the insurance company's online contact form. ... Download your insurance company's mobile application.

Is the sale of a life insurance policy taxable?

Answer: Any gain from the sale of a life insurance policy you own will be subject to income tax. Like the sale of most other assets, the difference between the amount realized or the amount you receive from the sale and your tax basis in the policy will be subject to tax.

What Is A Life Settlement?

In the past, if you owned a life insurance policy that you no longer wanted or needed, you generally had two choices: surrender the policy for its...

How Do Life Settlements Work?

The purchasers of life settlements, sometimes called life settlement companies or life settlement providers, generally are institutions that either...

Factors to Consider When Deciding to Sell Your Life Insurance Policy

Life settlements have proven profitable not only for institutional investors that purchase policies, but also for the providers and brokers who han...

How Can I Protect myself?

If you decide to go forward with a life settlement, here are some questions you should be sure to ask. 1. Is the life settlement broker or provider...

Where to Turn For Help and Additional Resources

Life settlements can involve almost any kind of insurance policy, including variable policies. However, because only variable insurance products ar...

What is life settlement?

Life settlement refers to taking a life insurance policy and selling it to a third party in exchange for a one-time cash payment. This results in the purchaser becoming the life insurance policy’s beneficiary and they take over making premium payments.

What happens if you sell a settlement?

If you sell your settlement, you can open up a door of new options for you to help you in your personal financial planning. By selling your settlement, you can:

What is the best way to sell a life insurance policy?

The most common and in some regard, the most popular form of selling your policy entails selling the entire policy for a cash value greater than the cash surrender value. An alternative to this is to sell a portion of your life insurance policy whilst retaining a portion of the policy to leave behind for your loved ones.

What is a good life settlement broker?

A good life settlement broker is one that educates you on the life settlement industry and all its various facets. Moreover, the settlement firm will represent the policyholder throughout the process of selling the policy and even after the process has been completed.

When do life settlements happen?

Usually life settlements are only done whenever an insured individual doesn’t have any known life-threatening illnesses. Often they are done through the use of “key individual” insurance policies that companies hold on executives, who do not work there any longer.

Is life insurance a secondary market?

The fact that life settlements exist has provided life insurance policies with a secondary market. Although the life insurance secondary market is fairly new, it was in the making for 100 years, thanks to numerous key individuals, judicial rulings and events.

Can you sell life insurance through a broker?

Nonetheless, for more than 30 years now, selling life insurance policies in a life settlement transaction, usually through settlement brokers has been a viable option for many life insurance policyholders.

What is a Life Settlement?

A life settlement is a cash payment in exchange for selling your life insurance policy. Selling a life insurance policy can be a financial solution to help alleviate debt or maintain a higher quality of life. If there is no longer a need for the policy, if there are no beneficiaries, or if the policy premium becomes too expensive to pay for, the policyholder can sell their life insurance contract to a third-party buyer.

Why sell life insurance?

Selling a life insurance policy can be a financial solution to help alleviate debt or maintain a higher quality of life. If there is no longer a need for the policy, if there are no beneficiaries, or if the policy premium becomes too expensive to pay for, the policyholder can sell their life insurance contract to a third-party buyer.

Why do brokers solicit bids on life insurance?

Brokers are able to solicit bids on your policy to help you get the highest sale price. Pro Tip. Financial professionals play an important role in protecting their clients’ assets and providing reliable financial options for selling life insurance policies.

What happens when you find a life insurance broker?

When you find a broker or provider to handle your life insurance policy, they will take the next steps in selling your policy: They will acquire your medical records to help calculate your life expectancy. The shorter your life expectancy, the lower the amount of premium charges the buyers will have to pay and the shorter amount ...

What happens when you receive a life insurance closing package?

Once the package is returned and all appropriate documents are signed and approved, the buyer assumes responsibility of the policy and will begin making payments on the premium.

Can you receive a life insurance settlement if you sold it?

Once you’ve sold your life insurance policy and ownership has been transferred to a buyer or investor, you will be able to receive the life settlement disbursement. It is common for policyholders to receive a lump sum in exchange for rights to their previous life insurance policy.

Can you use a lump sum for life insurance?

Though life settlements can also help to alleviate debt, policyholders can use the disbursed lump sum however they choose. Typical life settlements provide more flexibility and are meant for individuals with an extended life expectancy. Be sure to consider your options when pursuing a payout for life insurance policy.

How Do Life Settlements Work?

The purchasers of life settlements, sometimes called life settlement companies or life settlement providers, generally are institutions that either hold the policies to maturity and collect the net death benefits or resell policies—or sell interests in multiple, bundled policies— to hedge funds or other investors. In exchange, you receive a lump sum payment. The amount you will receive in the secondary market depends on a range of factors, including your age, health and the terms and conditions of your policy—but it is generally more than the policy's cash surrender value and less than the net death benefit.

Why are life settlements important?

Life settlements can be a valuable source of liquidity for people who would otherwise surrender their policies or allow them to lapse —or for people whose life insurance needs have changed. But they are not for everyone. Life settlements can have high transaction costs and unintended consequences.

What to consider when buying a life insurance policy?

Ongoing Life Insurance Needs— If you are considering buying a new policy with the proceeds of the life settlement, you will need to determine whether you will be able to get a new policy with equivalent coverage—and at what cost. Your old policy will still be in force and may affect your ability to get additional coverage. Even if you can get a new policy, you may have to pay higher premiums because of your age or changes in your health status. If your goal is to retain coverage but lower the premiums you pay or otherwise obtain different features, you might want to consider options such as reducing your existing amount of policy coverage or making a "1035 Exchange."

How to file a complaint about a life insurance settlement?

If you have questions or wish to file a complaint about a life settlement, be sure to call or write your state insurance commissioner. If your complaint concerns a variable life insurance policy, you may also file a complaint with FINRA.

What happens if you sell a life insurance policy?

In the past, if you owned a life insurance policy that you no longer wanted or needed, you generally had two choices: surrender the policy for its cash value or allow it to lapse. Life settlements present a third option: selling your policy (or the right to receive the death benefit) to an entity other than the insurance company that issued the policy. That transaction is known as a life settlement.

How to protect your privacy in a life settlement?

How can I protect my privacy? Before accepting any offer from a life settlement company, you should carefully read the application, and make sure that the company has procedures in place to protect the confidentiality of your information. If it will be sold, ask to whom, and whether the end buyers will have access to your personal information. If you use a life settlement broker, find out the names of the life settlement companies from whom the broker solicits bids, and ask about the privacy policies of all parties or potential parties to the transaction. In many cases, state regulations govern the handling of confidential information. Contact your state insurance commissioner to find out what regulations apply.

What is the term for selling life insurance for cash?

A life settlement, or senior settlement , as they are sometimes called, involves selling an existing life insurance policy to a third party—a person or an entity other than the company that issued the policy—for more than the policy's cash surrender value, but less than the net death benefit.

Why Do People Sell Their Life Insurance for a Life Settlement?

With health care, long-term care, and living costs on the rise , retirees often find themselves in a situation where they need more money. Here are some of the most common reasons you may consider selling your life insurance policy:

What is a Life Settlement?

In terms of definition, a life settlement is the financial transaction of an existing life insurance policy to a licensed life settlements buyer for more than its cash surrender value, but less than its death benefit.

How Many Different Life Settlement Options Are There?

There are three life settlement options to help your financial future today: traditional, hybrid, and retained benefit. Each option is dependent on what will suit you and your family’s needs the best.

How Long Does Selling Your Policy Take?

At Abacus, we aim for the life settlement process to take 30 days or less. Generally, the length of time selling a policy takes varies on a case-by-case basis.

Are Life Settlements Legal?

Yes, life settlements are legal and have become a regulated industry. Laws regarding life settlements are enforced at the state level. Each state differs on specific licensing and procedures, so be sure to check with the state insurance department for more information. We want to ensure that you have all the most updated information to get started.

What Types of Life Insurance Policies Qualify to Be Sold?

Almost all types of policy types qualify to be sold through a life settlement.

How Can I Use the Cash from Selling My Policy?

The cash from selling your policy through a life settlement has no restrictions on how the proceeds are spent. Even though it is up to your discretion how you utilize the money, here are some common ways people choose to spend their cash from a life settlement: