You should be aware of a couple of exceptions:

- When you close a short sale at a loss, the tax law treats the transaction as occurring on the settlement date. See Last Day to Sell.

- If you hold more than one lot of shares and sell part of your holdings, you may want to identify the shares you’re selling. You can identify shares (or change your identification) until the settlement date. ...

Can you sell stock before it is settled?

Settlement is the delivery of stock against the full payment that must take place within three business days after the trade. You can sell the purchased stock before the settlement — daytraders do it all the time — provided that you do not violate the free ride rule.

How long does it take for a stock trade to settle?

U.S. stock market rules allow a stock market trade three business days to settle, or become official. For an investor to be a shareholder of record on the record date, the shares must be purchased at least three business days before the record date to allow the settlement process to complete.

What happens if you sell stock before the dividend is paid?

All shareholders of record on the record date will receive a dividend on the payment date regardless of if and when the shares were sold. So, if you sell stock before dividend payable date and about two business days before the record date you will probably get the dividends for the previous period you held the investment.

Can you sell a stock 2 days before the record date?

Record Date Selling While it is possible to sell a stock during the two days before the record date and still receive the dividend, the loss on the stock will probably equal or exceed the dividend amount. To make this strategy work, a trader must wait for the share price to move back above the value on the date before the shares went ex-dividend.

How soon after buying a stock can I sell it?

You can sell a stock right after you buy it, but there are limitations. In a regular retail brokerage account, you can not execute more than three same-day trades within five business days. Once you cross that threshold, you are considered a pattern day trader and must maintain a $25,000 balance in a margin account.

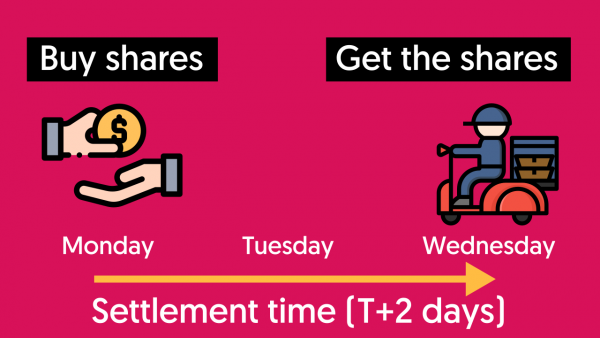

Why do stocks take 2 days to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

Can I sell share before t 2 days?

In the normal trading process, delivery shares are credited in the demat account on T+2 days (T being the day of order execution). You cannot sell shares before delivery in normal trading. However, with BTST, you can sell shares on the same day or the next day.

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock's share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

What is the T 2 rule?

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

Can you sell stock with unsettled funds?

If you bought the stock (or other type of security) using settled cash, you can sell it at any time. But if you buy a stock with unsettled funds, selling it before the funds used to purchase have settled is a violation of Regulation T (a.k.a. a good faith violation, mentioned above).

What happens if I sell before T 2?

The moment you sell the stock from your DEMAT account, the stock gets blocked. Before the T+2 day, the blocked shares are given to the exchange. On T+2 day you would receive the funds from the sale which will be credited to your trading account after deduction of all applicable charges.

What happens if I buy today and sell tomorrow?

BTST trades are those trades where traders take advantage of short-term volatility by buying today and selling tomorrow. Under this facility, traders can sell the shares- which they have bought previously- before they are delivered to their demat account or before they are credited into their demat account.

Is there a penalty for buying and selling stocks?

There is not a required holding period for stocks or any penalties for selling them. However, the price you receive may be significantly more or less than the original cost of the shares, and you could face a tax penalty depending on the situation.

What time of day are stock prices lowest?

The opening 9:30 a.m. to 10:30 a.m. Eastern time (ET) period is often one of the best hours of the day for day trading, offering the biggest moves in the shortest amount of time. A lot of professional day traders stop trading around 11:30 a.m. because that is when volatility and volume tend to taper off.

Can I buy back a stock I just sold?

You can buy the same stock back at any time, and this has no bearing on the sale you have made for profit. Rules only dictate that you pay taxes on any profit you make from assets.

What is the best time of day to buy shares?

The upshot: Like early market trading, the hour before market close from 3 p.m. to 4 p.m. ET is one of the best times to buy and sell stock because of significant price movements, higher trading volume and inexperienced investors placing last-minute trades.

Why does it take 3 days for stocks to settle?

The origins of settlement dates are rooted in trading practices which predate the modern electronic stock market. In the early days, a stock trade was executed by a buyer and a seller who had three days to deliver the securities and the money required to settle the transaction.

What happens if you buy shares today and sell tomorrow?

BTST trades are those trades where traders take advantage of short-term volatility by buying today and selling tomorrow. Under this facility, traders can sell the shares- which they have bought previously- before they are delivered to their demat account or before they are credited into their demat account.

What happens if you buy and sell a stock in the same day?

What Happens If You Sell and Buy Stock Same Day? If you're already registered to be a day trader, you're all set. But if you're not, your account could be flagged and your account may be restricted. Check with your broker about the rules for executing multiple transactions for the same stock within a single day.

How long do you have to hold a stock?

There's no minimum amount of time when an investor needs to hold on to stock. Investors debating how long to hold their stocks will likely want to consider taxes. There's no minimum amount of time when an investor needs to hold on to stock. But, investments that are sold at a gain are taxed at a capital gains tax rate.

How long does it take to settle a stock?

Two days is by convention, you can get same-day settlement or one-day settlement if you want. Most shops want two days—or at least one day—in order to locate the shares and arrange any financing.

What is short selling?

HOW : There’s a term called ‘short selling’ . If the person who had sold you shares on monday (from whom you bought always anonymous ) had no particular shares left in his account which you bought so there is a possibility that he may not be able to deliver your stocks on t+2 day i. e. wednesday (exchange will impose penalty on him but that’s not your concern) .In that particular case exchanges will arrange on auction for your shares and you in that case will get delivery of your stocks on t+3 day i.e.Thursday BUT on thursday evening .

What is day trading?

To day trade, which would involve you buying and selling stock with unsettled funds (in other words, in a shorter time frame than T+3 for US equities), you must apply and be approved for a margin account.

What to disclose when applying for margin account?

When applying for a margin account, you will be asked to disclose things like your years of experience trading various financial instruments, liquid net worth, and investment objectives. It makes sense -- by approving you for a margin account, a brokerage firm is essentially extending you a line of credit, and needs to evaluate your credit-worthiness.

How much equity do day traders need?

Before he can do that, the broker must approve his account for day trading and the day trader must maintain a minimum $25,000 equity in the account at all times.

Can you sell stock before settlement?

You can sell the purchased stock before the settlement — daytraders do it all the time — provided that you do not violate the free ride rule.

Can you sell a stock immediately after buying?

you can sell it immediately after buying based on your brokerage account type.

How long before record date can you sell stock?

Record Date Selling. While it is possible to sell a stock during the two days before the record date and still receive the dividend, the loss on the stock will probably equal or exceed the dividend amount.

What does it mean to sell after ex dividend?

The three day stock settlement means someone who buys shares two business days before the record date will not become a shareholder of record until the day after the record date. This investor will not receive the dividend.

What is the record date for dividends?

With a soon to be paid dividend, the record date is used to determine who receives the dividend and which investors purchased shares too late to earn the dividend. The rules of stock settlement make it possible to sell shares before the actual record date. However, the financial results may not be what you are expecting.

What is the day before the record date called?

The day two days before the record date is called the ex-dividend date . So if you already own shares, it is possible to sell the shares on the ex-dividend day or the next day -- both before the record date -- and you will still be a shareholder of record on the record date. 00:00.

Do shareholders of record receive dividends on the record date?

All shareholders of record on the record date will receive a dividend on the payment date regardless of if and when the shares were sold.

Why did the stock market have settlement dates?

Settlement dates were originally imposed in an effort to mitigate against the fact that in earlier times, stock certificates were manually delivered, leaving windows of time where a stock's share price could fluctuate before investors received them.

How long after the trade date do you settle a mutual fund?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date. For foreign exchange spot transactions, U.S. equities, and municipal bonds, the settlement date occurs two days after the trade date, commonly referred to as "T+2". In most cases, ownership is transferred without complication.

What is the date of a security purchase?

Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

What is the first date of a buy order?

The first is the trade date , which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

When is the settlement date for a government bond?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date 2

Do buyers and sellers transfer ownership?

In most cases, ownership is transferred without complication. After all, buyers and sellers alike are eager to satisfy their legal obligations and finalize transactions. This means that buyers provide the necessary funds to pay sellers, while sellers hold enough securities needed to transfer the agreed-upon amount to the new owners.

How long do you have to wait to sell a stock?

Waiting two days to sell a stock will help you avoid any federal free-riding violations, which include freezing your trading account for 90 days. But some investors continue to observe the older three-day rule as a preference, although it's no longer a requirement.

Why do you have to wait two days after selling a stock?

Securities and Exchange Commission (SEC) calls this violation “free-riding.” Formerly, this time frame was three days after purchasing a security, but in 2017, the SEC shortened this period to two days. The reason for waiting two days is to allow the settlement cycle to run its course and ensure the successful transfer of stock securities.

How long does it take for a stock to leave your brokerage account?

At the end of the three days , the money leaves your brokerage account, replaced by the shares you bought.

How long does it take for a broker to freeze your account?

The penalty for free-riding is that your broker will freeze your account for 90 days . This doesn't mean you can’t trade during the penalty period. It does mean you must have the cash upfront to buy securities. You can’t rely on unsettled cash to pay for securities.

When did the T+2 settlement cycle change?

In 2017, the SEC amended the T+3 settlement cycle to a T+2 settlement cycle, effectively shortening the three-day rule to a two-day rule. The SEC's goal in changing this time frame was threefold: it more closely aligns with new technology, new products and the growth of trading volumes.

Can you rely on unsettled cash to pay for securities?

You can’t rely on unsettled cash to pay for securities. In other words, you have to pay for your purchases on the trade date, not the settlement date. Armed with this knowledge, you can avoid premature sale of a security and escape the inconvenience of a frozen account. 00:00.