If the settlement you received was not subject to taxes, as is the case with damages awarded for a physical injury or illness, you should not receive a 1099. If you are awarded back pay, you'll receive a W-2 reporting that amount.

Do I get a 1099 for a lawsuit settlement?

If you receive a court settlement in a lawsuit, then the IRS requires that the payor send the receiving party an IRS Form 1099-MISC for taxable legal settlements (if more than $600 is sent from the payer to a claimant in a calendar year). Box 3 of Form 1099-MISC identifies "other income," which includes taxable legal settlement proceeds.

What happens if you don’t issue a 1099?

In addition to the $270-per-failure penalty, the IRS also may try to deny a deduction for the item that should have been reported on a Form 1099. That means if you fail to issue a form for a $100,000 consulting fee, the IRS could claim it is nondeductible.

Do I need a Form 1099-R If I have paid taxes?

But for many other Forms 1099, if you know about your payment, you don't really need the form. One possible exception: the IRS suggests that if you don’t receive a Form 1099-R, you should ask.

Do law firms need to issue Forms 1099 to clients?

One confusing tax reporting issue for law firms is whether to issue Forms 1099 to clients. Practice varies considerably, and many firms issue the forms routinely; however, most payments to clients do not actually require the forms. Of course, many lawyers receive funds that they pass along to their clients.

Do I have to report income if I didn't receive a 1099?

Do I Need a 1099 Form to File Taxes? Taxpayers must report any income even if they did not receive their 1099 form. However, taxpayers do not need to send the 1099 form to the IRS when they file their taxes.

What do I do if I didn't receive my 1099?

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

Do Settlements get reported to IRS?

If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Can I look up my 1099 online?

Receive Form 1099G You can access your Form 1099G information in your UI OnlineSM account. If you received taxable unemployment compensation, including if you became disabled and began receiving disability benefits, your UI Online account will be updated with this information by January 31.

What happens if a company doesn't issue a 1099?

If an employer did not send a 1099-misc, or other 1099 form, by the end of February, the IRS says you must contact it to let it know. As of 2020, you can call the IRS at 800-829-1040.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

What type of legal settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do you pay tax on a settlement agreement?

Settlement agreements (or compromise agreements as they used to be called), usually involve a payment from the employer to the employee. Such payments can attract income tax or national insurance contributions – but they can also sometimes rightly be paid tax free.

What is the deadline for 1099 to be sent out?

The redesigned 1099-MISC has different box numbers for reporting certain income. Businesses must send Form 1099-MISC to recipients by February 1, 2021, and file it with the IRS by March 1 (March 31 if filing electronically).

How do I get my 1099s form?

To order these instructions and additional forms, go to www.irs.gov/EmployerForms. Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website. Filing and furnishing.

How do I know if my 1099 was issued?

You can find out by contacting the IRS. But you must do so after the IRS reporting deadline has passed for the business or entity that may have mailed you a reporting document. The IRS phone number: 1-800-829-1040.

How much money do you have to make to get a 1099?

$600The IRS requires businesses to issue a form 1099 if they've paid you at least $600 that year. Depending on your money-making activities, you may receive a few different 1099 forms to track your income.

Who is required to issue a 1099?

For taxable settlements, the defendant is required to issue a 1099 to the plaintiff under § 6041. In addition, if the proceeds are jointly payable to attorney and plaintiff, the defendant is required to issue a 1099 to attorney under § 6045 as amounts paid “in connection with legal services.”.

What is the IRS 1099?

Generally speaking, information returns like Form 1099-MISC (“1099”) are necessary for payments of $600.00 or more distributed in the course of business.

What happens if a settlement agreement is silent?

On the other hand, if the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the “intent of the payor” to characterize the payments and determine the 1099 reporting requirements.

Can an attorney receive a separate check for damages?

To avoid a situation whereby the IRS interprets the entire settlement as income to the attorney, the attorney can simply request a separate check payable to plaintiff for damages and one payable to attorney for attorney’s fees and reimbursable costs: only the amounts paid to attorney are reportable under § 6045.

Is settlement income taxable?

So what settlement proceeds are taxable? All amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid “on account of” physical injury. This covers observable bodily harm and may include emotional distress if there is a causal link to the physical injury.

Do you have to issue a 1099 for a settlement?

Consequently, defendants issuing a settlement payment, or insurance companies issuing a settlement payment on behalf of the defendant, are required to issue a 1099 to the plaintiff unless the settlement qualifies for one of the tax exceptions. See IRC § 6041 . In some cases, a tax provision in the settlement agreement characterizing the payments can result in their exclusion from income. Although tax provisions are not controlling, the IRS is generally reluctant to override the intent of the parties. Accordingly, any settlement payments made expressly for nontaxable damages are excluded from the 1099 reporting requirements.

What is required to file a 1099?

Section 6041 of the Code and its regulations require businesses that make certain payments to file an IRS Form 1099 with the IRS and also provide a copy of the Form 1099 to the recipient of the payment. More specifically, under section 6041 and the regulations, a business must file a Form 1099 when the business makes a payment of $600 or more to another person in the tax year, provided the payment represents fixed or determinable gains, profits, or income. If a business fails to comply with the Form 1099 reporting requirements, the business can be subject to penalties for the failure.

Do you have to be careful before entering into a settlement agreement?

Taxpayers should tread carefully before they enter into settlement agreements with other parties. Indeed, at a minimum, they should carefully consider how the settlement payment will be treated for federal income tax purposes and whether the party will issue information returns, such as Forms 1099, which can be transmitted to the IRS and the recipient well after the payment is received. After the settlement agreement has been executed, taxpayers are at the mercy of what was agreed upon in the existing settlement agreement.

Does the IRS report 1099 income?

In instances where there is an omission of income— i.e., the income from the Form 1099 is not reported on the tax return—the IRS will usually flag the return and select it for examination.

Is a settlement payment taxable on a 1099?

The lower court held for the defendants, concluding that they had a good-faith basis for their belief that federal tax law required them to report the settlement payment proceeds as taxable to Mr. Best on an IRS Form 1099. Specifically, the court noted that although settlement payments made on account of personal physical injuries or physical sickness were not taxable under Section 104 (a) (2) (and thus not reportable on an IRS Form 1099), any payments by the defendants to Mr. Best strictly for emotional distress were taxable (and thus reportable on an IRS Form 1099). In this regard, the court concluded that because Mr. Best’s amended complaint sought “damages for mental and emotional suffering,” his settlement payment likewise constituted taxable remuneration for emotional distress. In addition, the court reasoned that claims alleging loss of liberty do not typically fall within the exclusion of Section 104 (a) (2).

Do you have to file a 1099?

Generally, defendants are concerned that they must issue an IRS Form 1099 or face tax penalties for not doing so. However, if the facts support a position that the settlement payment is not taxable under federal tax law, a simple letter informing the defendant of the federal tax law may give the defendant and defendant’s counsel comfort in not ...

When do you get a 1099 for a lawsuit settlement?

If you received a taxable settlement, in most cases you should receive a 1099-Misc in January of the following year, showing the amount of your settlement. Use this form to aid in preparing your tax return.

Do you have to file a 1099 if you received a settlement?

Exceptions. If the damages were less than $600, the payee is not required to provide you with a 1099. If the settlement you received was not subject to taxes, as is the case with damages awarded for a physical injury or illness, you should not receive a 1099.

Do you have to send a 1099 to a lawsuit?

If you win a settlement in a lawsuit, the person or business that pays out the settlement, or that person or business's insurance company, is required to send you a 1099 if the settlement is taxable. Most settlements are taxable, unless the award was for a physical injury or illness.

What happens if you don't report a 1099?

In fact, you’re almost guaranteed an audit or at least a tax notice if you fail to report a Form 1099.

When do 1099s arrive?

Share to Linkedin. Most Forms 1099 arrive in late January or early February, but a few companies issue the forms throughout the year when they issue checks. Whenever the Forms 1099 arrive, don’t ignore them. Each form includes your Social Security number. If you don’t include the reported item on your tax return, bells go off.

What happens if you don't include your Social Security number on your tax return?

Each form includes your Social Security number. If you don’t include the reported item on your tax return, bells go off. IRS Forms 1099 remind you that you earned interest, received a consulting fee, or were paid some other kind of income. They notify the IRS too.

What is a 1099-MISC?

Sometimes, you even receive a Form 1099 that reports more than you received . The most common is Form 1099-MISC, which can cover just about any kind of income.

Do you need a 1099 for a lawsuit?

But if you have arguments that the lawsuit recovery shouldn't be taxable, the last think you want is a Form 1099.

Can you deduct legal fees on a 1099?

Getting Forms 1099 can be especially since now with many lawsuit settlements, legal fees can’t be deducted. Check out my website .

Is consulting income a 1099?

Consulting income is a big category for 1099-MISC. In fact, apart from wages, whatever you were paid is likely to be reported on a Form 1099. Companies big and small churn them out. If you’re in business–even as a sole proprietor–you also may need to issue them.

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

What to report on 1099-MISC?

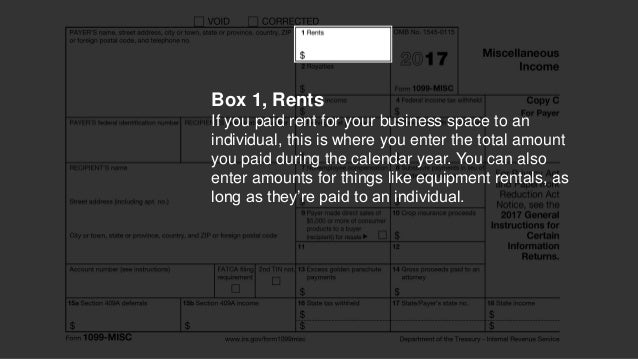

What to Report on Your Form 1099-MISC. If you receive a court settlement in a lawsuit, then the IRS requires that the payor send the receiving party an IRS Form 1099-MISC for taxable legal settlements (if more than $600 is sent from the payer to a claimant in a calendar year). Box 3 of Form 1099-MISC identifies "other income," which includes ...

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What form do you report lost wages on?

In this example, you'll report lost wages on a Form W-2, the emotional distress damages on a Form 1099-MISC (since they are taxable), and attorney fees on a Form 1099-NEC. As Benjamin Franklin said after the U.S. Constitution was signed, "in this world nothing can be said to be certain, except death and taxes.".

What happens if you get paid with contingent fee?

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Do you have to pay taxes on a 1099 settlement?

Where many plaintiff's 1099 attorneys now take up to 40% of the settlement in legal fees, the full amount of the settlement may need to be reported to the IRS on your income tax. And in some cases, you'll need to pay taxes on those proceeds as well. Let's look at the reporting and taxability rules regarding legal settlements in more detail as ...

What is the exception to the IRS 1099 rule?

Payments made to a corporation for services are generally exempt; however, an exception applies to payments for legal services. Put another way, the rule that payments to lawyers must be the subject of a Form 1099 trumps the rule that payments to corporation need not be. Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a Form 1099, and it does not matter if the law firm is a corporation, LLC, LLP, or general partnership, nor does it matter how large or small the law firm may be. A lawyer or law firm paying fees to co-counsel or a referral fee to a lawyer must issue a Form 1099 regardless of how the lawyer or law firm is organized. Plus, any client paying a law firm more than $600 in a year as part of the client’s business must issue a Form 1099. Forms 1099 are generally issued in January of the year after payment. In general, they must be dispatched to the taxpayer and IRS by the last day of January.

How much is the penalty for not filing 1099?

Most penalties for nonintentional failures to file are modest—as small as $270 per form . This penalty for failure to file Forms 1099 is aimed primarily at large-scale failures, such as where a bank fails to issue thousands of the forms to account holders; however, law firms should be careful about these rules, too.

Why do lawyers send 1099s?

Copies go to state tax authorities, which are useful in collecting state tax revenues. Lawyers receive and send more Forms 1099 than most people, in part due to tax laws that single them out. Lawyers make good audit subjects because they often handle client funds. They also tend to have significant income.

How does Larry Lawyer earn a contingent fee?

Example 1: Larry Lawyer earns a contingent fee by helping Cathy Client sue her bank. The settlement check is payable jointly to Larry and Cathy. If the bank doesn’t know the Larry/Cathy split, it must issue two Forms 1099 to both Larry and Cathy, each for the full amount. When Larry cuts Cathy a check for her share, he need not issue a form.

What percentage of 1099 does Larry get?

The bank will issue Larry a Form 1099 for his 40 percent. It will issue Cathy a Form 1099 for 100 percent, including the payment to Larry, even though the bank paid Larry directly. Cathy must find a way to deduct the legal fee.

When do you get a 1099 from a law firm?

Forms 1099 are generally issued in January of the year after payment. In general, they must be dispatched to the taxpayer and IRS by the last day of January.

Can a plaintiff lawyer issue a 1099 to Jones Law Firm?

Seeking to help their clients avoid receiving Forms 1099, some plaintiff lawyers ask the defendant for one check payable to the “Jones Law Firm Trust Account.” Many defendants are willing to issue a single Form 1099 only to the Jones Law Firm in this situation. Technically, however, Treasury Regulations dictate that you should treat this Jones Law Firm Trust Account check just like a joint check payable to lawyer and client. That means two Forms 1099, each in the full amount, are required.

Reporting Requirements

Taxable v. Nontaxable

- So what settlement proceeds are taxable? All amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid “on account of” physical injury. This covers observable bodily harm and may include emotional distress if there is a causal link t…

Attorney Or Client?

- For taxable settlements, the defendant is required to issue a 1099 to the plaintiff under § 6041. In addition, if the proceeds are jointly payable to attorney and plaintiff, the defendant is required to issue a 1099 to attorney under § 6045 as amounts paid “in connection with legal services.” As a result, both attorney and plaintiff receive 1099s f...

Recommendation

- All taxpayers need to issue 1099s for payments to attorneys, including payments from attorneys to other attorneys, as well as for payments under the $600.00 rule. In litigation, this is the responsibility of the defendant or the defendant’s insurance company. One way to avoid the necessity of requesting separate checks from the defendant or the defendant’s insurance comp…