A probate must be initiated before filing the survival action, although, depending upon whether or not there are any other assets in the estate that need to be probated, a judge is likely to allow the matter to remain fairly dormant until the lawsuit is concluded and monies from any settlement or judgment are paid.

What happens if a lawsuit is filed during probate?

Nothing snarls and slows down probate quite like a pending lawsuit. Probate ties up the loose ends of a decedent’s life. If someone files a lawsuit as part of the proceedings, or if the executor files a suit on behalf of the estate, then the estate generally can’t close until the issue is resolved.

How does an executor of an estate file a lawsuit?

The executor may also file suit on behalf of the estate for various reasons, including wrongful death or determination of the nature of a creditor's claim or an heir's gift. Executors must file these types of suit in civil court, not probate court, and if the lawsuit is successful and he recovers money, the money goes into the estate.

What is a probate litigation case?

The probate estate is all the property, of whatever kind, owned by the decedent (i.e the person who died) in their own name at the time they died. The executor or administrator has the legal authority to act on behalf of the probate estate. The purpose of a probate litigation lawsuit is to obtain an heir or beneficiary’s rightful inheritance.

Can a special administrator be used to open a probate estate?

The use of a special administrator is only allowed if no Petition for Letters of Office has been issued. If a probate estate is later opened by a representative other than the special representative, the court may substitute the representative of the estate for the special representative. See 735 ILCS 5/13-209.

Is probate required in Georgia?

Is Probate Required in Georgia? Probate isn't always required in Georgia. It is necessary by law if the assets belonged solely to the deceased person with no named beneficiary or with the estate as the named beneficiary. If the assets were included in a revocable living trust, probate won't be necessary.

What happens if you don't file probate in California?

Without opening probate, any assets titled in the decedent's name, including real estate and vehicles, will remain in the decedent's name for an indefinite period of time. This prevents you from selling them to pay off debts, distributing them to the beneficiaries, or keeping registration current.

What assets are exempt from probate in Georgia?

What Assets Do Not Go Through Probate? Property in a Revocable Trust, real estate owned as Joint Tenants with a Right of Survivorship, life insurance policies and retirement accounts with a designated beneficiary, bank accounts with payable on death (POD) or Transfer on Death (TOD) clause.

How long does probate take in Nevada?

In a routine probate proceeding, you can expect a minimum probate period of from 120 to 180 days. This allows for publication of creditor notices and gives creditors time to file claims. However, probate and estate administra- tion often take much longer if complications arise.

How do you determine if probate is necessary in California?

If the estate consists of assets in excess of the prescribed amount a probate is necessary. The threshold amount is calculated by totaling all of the probate assets owned by the decedent. In some cases, the actual estate may be well in excess of the threshold amount, but the small estate law can still be used.

What happens if I don't apply for probate?

If you don't apply for probate when it's needed, the deceased's assets can't be accessed or transferred to any of the beneficiaries. Probate gives a named person the legal authority to deal with the assets. Without this authority, they can't do anything with the assets.

Can you avoid probate in Georgia?

In Georgia, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Is probate expensive in Georgia?

Common Probate Fees in Georgia An uncontested probate could range from $1500 - $3000. If anyone contests the process, the cost could range from $3000 to more than $10,000. Fees to consider include: Attorney fees (if you use a probate attorney)

Is probate difficult in Georgia?

Georgia has among the most user-friendly of probate laws, allowing many estates to avoid probate altogether, as well as streamlining the administration of most estates that are probated. Because of this, there are some unique considerations for estate planning.

Is probate necessary in Nevada?

Is Probate Required in Nevada? Probate is necessary in Nevada to disperse the estate and is required by state statute. However, not all estates will need to go through probate. Before petitioning for probate, you need to know if an estate qualifies to skip the process.

How do I know if probate is needed?

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

How do you avoid probate in Nevada?

In Nevada, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

How long do you have to file probate after death in California?

How long does probate take? California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

How much does an estate have to be worth to go to probate in California?

In California, if your assets are valued at $150,000 or more and they are not directed to beneficiaries through either a trust plan, beneficiary designation, or a surviving spouse, those assets are required to go through the probate process upon your incapacity or death.

What assets are subject to probate in California?

Assets Subject to the California Probate Court Probate assets include any personal property or real estate that the decedent owned in their name before passing. Nearly any type of asset can be a probate asset, including a home, car, vacation residence, boat, art, furniture, or household goods.

How long does probate take in California?

In some cases, the probate process in California can take as little as nine months, but that is rare. It typically takes anywhere from half a year to eighteen months, and complicated cases may take as long as two years or more. However, having an idea of how long a case may take helps you understand the process.

What is probate court and probate approval?

Probate Courts are courts that have jurisdiction and authority to deal with issues regarding estates. The most common probate issue occurs when som...

When is probate approval required in a personal injury case?

If a plaintiff dies as a result of an accident or injury, the case will require intervention by the relevant probate court. In personal injury case...

What happens during the probate approval process in a personal injury case?

The probate approval process for a personal injury case includes Heir Identification where the court approves a list of heirs, Naming the Special A...

Should I get a lawyer to help me in probate court?

Due to the complexity of Cook County personal injury cases that involve a probate court, it is important to have a knowledgeable attorney working f...

Does probate litigation seem like the right step for you?

If you haven’t gotten your rightful inheritance then know you have to take action to make that happen. Nothing happens automatically when trust administration has gone bad. Let’s be very clear, if you think probate litigation is right for you and walk away without taking any action, you could lose some or all of your inheritance.

What is probate litigation?

Probate litigation is a lawsuit filed by an heir or beneficiary against an executor, administrator, or a third party. Let’s take a look at every person that could be involved in probate litigation.

What does "in bad faith" mean?

A person in bad faith, has wrongfully taken, concealed, or disposed of property belonging to the probate estate;

What does undue influence mean?

Undue influence means excessive persuasion that causes the testator to act or refrain from acting by overcoming the testator’s free will and results in inequity. In simpler words, someone was able to override the testator’s free will in order to have their wishes put into the will.

What are the most commonly sought non-monetary outcomes in probate litigation?

The most commonly sought non-monetary outcomes in probate litigation are removing the personal representative and instructing the personal representative.

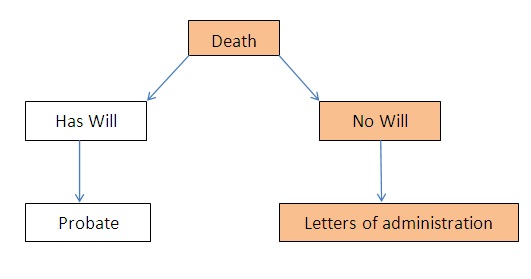

What is a will in probate?

A will is the document which states who will be in charge of a probate, who gets the property (and on what terms), and who will be in charge of the probate. This requires filing of the petition for probate, a number of supporting documents, and an order from the probate court appointing the executor of the probate estate.

What is the term for lack of mental capacity?

Lack of mental capacity is also referred to as mental incompetence. Whatever term you use, a testator lacks mental capacity if he or she is:

Why do you have to go to probate court?

There really are only five reasons why you'd have to go to probate court to either make your claim on the deceased's assets or to prove that you are a legal beneficiary. If any one of the following applies to you or to the deceased, then you might want to consult a probate attorney. 1. Probate court is necessary if the will is deemed invalid ...

What happens if you don't have a will?

2. Probate is required if the deceased didn't have a Last Will and Testament. If there is no will, then there has to be a legal and equitable probate court process for distributing the deceased assets and for transferring the title of probate property. The only way to do this is with probate. 3.

What is probate in common law?

What this means if the deceased owned property jointly with another person, such as in the case of a common law marriage, then probate is required to ensure that the deceased's share of the property is properly distributed to legal heirs. 5.

When is probate court necessary?

1. Probate court is necessary if the will is deemed invalid for one of these reasons:

Do you have to name beneficiaries in a life insurance policy?

In the case of life insurance policies, retirement funds or certain savings accounts, beneficiaries are usually named. But if all the named beneficiaries have passed away or if the deceased didn't name beneficiaries, then probate is required to transfer the money or title to the beneficiaries.

Can you probate a deceased person's assets?

Assets eligible for probate varies from state to state, country to country . You have to check for specific probate laws or with a probate lawyer in your region to determine if the deceased's assets were significant enough to warrant a probate .

How to reopen an estate?

In other situations, the court can decide on a case by case basis whether to reopen the estate. These are some cases in which the court may or may not agree to open an estate for probate: 1 You argue that the decedent’s assets were not correctly distributed according to the instructions in the will. 2 You have discovered a version of the will other than the one that was administered during probate, and you believe that the newly discovered will is the one that accurately represents the decedent’s wishes. 3 You discovered additional assets that belonged to the decedent and were eligible for probate but were not distributed during the original probate process.

What happens when an estate settles?

When the estate finally settles, most people pour themselves a glass of champagne and celebrate the fact that the probate is over and their work as personal representative is done. They are usually correct that their tenure as personal representative is entirely in the past, but there are a few situations in which it is possible, or even necessary, ...

What is the role of a personal representative in probate?

During probate, one of the personal representative’s duties is to locate all the heirs mentioned in the will. The best wills mention every name by his or her current legal name as well as other names by which he or she may be known. If the will says something like “the remainder of my estate shall be divided equally among my sons and daughters,” and after the estate settles, a long-lost son or daughter previously unknown to the personal representative surfaces, the court must reopen the estate at the request of this heir so that the heir can seek his or her fair share of the inheritance.

Can you reopen an estate if you discovered assets that belonged to the decedent?

You discovered additional assets that belonged to the decedent and were eligible for probate but were not distributed during the original probate process. If you wish to reopen an estate for one of these reasons, a probate lawyer can help you draft the strongest possible petition to reopen.

Can you collect debt from an estate that has already settled?

Trying to collect a debt from an estate that has already settled is almost always a losing proposition . The original probate process keeps the estate open long enough for creditors to claim their debts and involves public notices encouraging them to do so.