Are settlements taxed like income?

Settlements themselves are not taxed because the CRA does not consider a personal injury settlement to be “income.” Your settlement is considered “compensation” for expenses incurred by another person’s negligence. Indeed, personal injury settlements rarely function as any kind of windfall.

Do I have to pay tax on a settlement agreement?

Many people believe that if money is paid under a settlement agreement it must be tax free. However, this not necessarily the case. The key issue is the nature of the payment. Make sure you obtain legal advice about which payments are taxable and which are not. Which payments are taxable and which are not?

Do you pay taxes on a wrongful termination settlement?

When it comes to settlements for wrongful death claims, some compensation is taxable and some is tax-free. In most cases, the taxability depends on whether the compensation can be considered income. As a general rule, if the Internal Revenue Service (IRS) considers the settlement income, then it’s subject to federal taxes.

Is income from a legal settlement taxable?

The settlement money is taxable in the first place If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too.

How Are Lawsuit Settlements Paid?

There are several steps you will need to follow in order to get your money. Read all the paperwork carefully.

What Types of Lawsuits are Taxed?

In general, lawsuits that deal with wages are treated as wages. A lawsuit that deals with injuries or damages are not. However, this is not cut and dried, so always speak with a professional to determine how your lawsuit is laid out and how the damages are allocated.

What happens if you get a settlement from a lawsuit?

You could receive damages in recognition of a physical injury, damages from a non-physical injury or punitive damages stemming from the defendant’s conduct. In the tax year that you receive your settlement it might be a good idea to hire a tax accountant, even if you usually do your taxes yourself online. The IRS rules around which parts of a lawsuit settlement are taxable can get complicated.

What to do if you have already spent your settlement?

If you’ve already spent your settlement by the time tax season comes along, you’ll have to dip into your savings or borrow money to pay your tax bill. To avoid that situation, it may be a good idea to consult a financial advisor. SmartAsset’s free toolmatches you with financial advisors in your area in 5 minutes.

What can a financial advisor do for a lawsuit?

A financial advisor can help you optimize a tax strategy for your lawsuit settlement. Speak with a financial advisor today.

Is a physical injury taxable?

In general, damages from a physical injury are not considered taxable income. However, if you’ve already deducted, say, your medical expenses from your injury, your damages will be taxable. You can’t get the same tax break twice. In some cases, you may get damages for physical injury stemming from a non-physical suit.

Can you get damages for a non-physical injury?

You could receive damages in recognition of a physical injury, damages from a non-physical injury or punitive damages stemming from the defendant’s conduct. In the tax year that you receive your settlement it might be a good idea to hire a tax accountant, even if you usually do your taxes yourself online.

Is a lawsuit settlement taxable?

The tax liability for recipients of lawsuit settlements depends on the type of settlement. In general, damages from a physical injury are not considered taxable income. However, if you’ve already deducted, say, your medical expenses from your injury, your damages will be taxable. You can’t get the same tax break twice.

Is representation in a civil lawsuit taxable?

Representation in civil lawsuits doesn’t come cheap. In the best-case scenario, you’ll be awarded money at the end of either a trial or a settlement process. But before you blow your settlement, keep in mind that it may be taxable income in the eyes of the IRS. Here’s what you should know about taxes on lawsuit settlements.

Are legal settlements tax-deductible for defendants?

Up till now, we’ve been discussing legal settlements from a plaintiff’s perspective: what they’re taxed on, and what forms the proceeds will be reported on.

What to report on 1099-MISC?

What to Report on Your Form 1099-MISC. If you receive a court settlement in a lawsuit, then the IRS requires that the payor send the receiving party an IRS Form 1099-MISC for taxable legal settlements (if more than $600 is sent from the payer to a claimant in a calendar year). Box 3 of Form 1099-MISC identifies "other income," which includes ...

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What is compensatory damages?

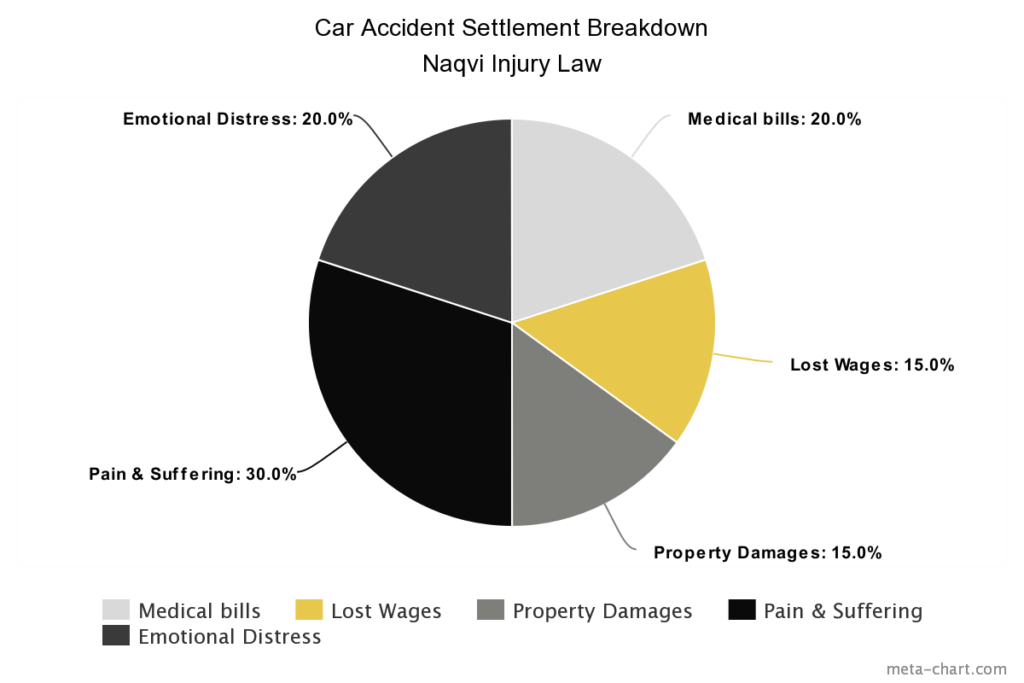

For example, in a car accident case where you sustained physical injuries, you may receive a settlement for your physical injuries, often called compensatory damages, and you may receive punitive damages if the other party's behavior and actions warrant such an award. Although the compensatory damages are tax-free, ...

What form do you report lost wages on?

In this example, you'll report lost wages on a Form W-2, the emotional distress damages on a Form 1099-MISC (since they are taxable), and attorney fees on a Form 1099-NEC. As Benjamin Franklin said after the U.S. Constitution was signed, "in this world nothing can be said to be certain, except death and taxes.".