Please note that you must report any settlement you receive to your caseworker within 10 days of receiving the funds.

What happens after a HUD complaint is filed?

When your complaint's investigation is complete, HUD will issue a determination as to whether or not reasonable cause exists to believe discrimination occurred. If HUD determines that there is reasonable cause to believe that discrimination occurred, HUD will issue a Determination of Reasonable Cause and a Charge of Discrimination.

How long do I have to file a HUD discrimination lawsuit?

You must file your lawsuit within two (2) years of the most recent date of alleged discriminatory action. If you have already filed a complaint with HUD, the time during which HUD was processing your complaint is not counted in the 2-year filing period.

Can I file a federal private civil lawsuit against HUD?

You may not be able to file a federal private civil suit if (1) you have already signed a HUD Conciliation Agreement to resolve your HUD complaint; or (2) an Administrative Law Judge has commenced a hearing for your complaint. If you could lose the home due to discrimination, HUD may be able to assist you during the investigation.

Where do HUD administrative law cases go?

Cases before HUD Administrative Law Judges are handled by HUD's Office of General Counsel, and cases in the federal courts are handled by the U.S. Department of Justice. Process for Fair Housing Act Complaints Learn more about what you can expect if a Fair Housing Act complaint is filed with HUD.

How does HUD calculate adjusted gross income?

Adjusted Income is defined as Annual Income minus any HUD allowable deductions. So, to calculate your Adjusted Income, you must first calculate your Annual Income, and then subtract certain amounts deemed “deductible” by HUD.

Are assets considered income?

Assets themselves are not counted as income. But any income that an asset produces is normally counted when determining a household's income eligibility.

What can a federal judge award in a fair housing lawsuit?

If the Federal Court decides in your favor, a Judge or jury may order the following relief: Compensation for actual damages, including out-of-pocket expenses and emotional distress damages. Permanent injunctive relief, such as an order not to discriminate.

What does the HUD stand for?

United States Department of Housing and Urban DevelopmentUnited States Department of Housing and Urban Development / Full nameCreated as part of President Lyndon B. Johnson's War on Poverty, the Department of Housing and Urban Development (HUD) was established as a Cabinet Department by the Department of Housing and Urban Development Act (42 U.S.C. 3532-3537), effective November 9, 1965.

How does HUD define income?

(1) The full amount, before any payroll deductions, of wages and salaries, overtime pay, commissions, fees, tips and bonuses, and other compensation for personal services; (2) The net income from the operation of a business or profession.

Is a personal bank account an asset?

Yes, the money you keep in your savings account is considered an asset, and therefore, can be added to your net worth. In fact, since an asset is anything of monetary value that you own, any cash you keep on hand (whether in a bank account or not) is considered an asset.

Which of the following would be a fair housing violation?

It is illegal discrimination to take any of the following actions because of race, color, religion, sex (including gender identity and sexual orientation), disability, familial status, or national origin: Refuse to rent or sell housing. Refuse to negotiate for housing. Otherwise make housing unavailable.

Which of the following is a possible penalty for violating the Fair Housing Act?

The maximum civil penalties are: $16,000, for a first violation of the Act; $37,500 if a previous violation has occurred within the preceding five-year period; and $65,000 if two or more previous violations have occurred within the preceding seven-year period.

Can a federal judge award actual damages?

The U.S. Constitution limits punitive damages awards in all state and federal courts: punitive damages are permissible only to the extent they are proportionate, reasonably related to the harm the plaintiff suffered, and in response to reprehensible conduct.

How long does it take to get a HUD payoff?

Please allow up to 6 business days for the request to be processed. Any questions may be directed to the FHA Resource Center Toll-Free Telephone Number at (800) CALLFHA (225-5342) or by email to [email protected].

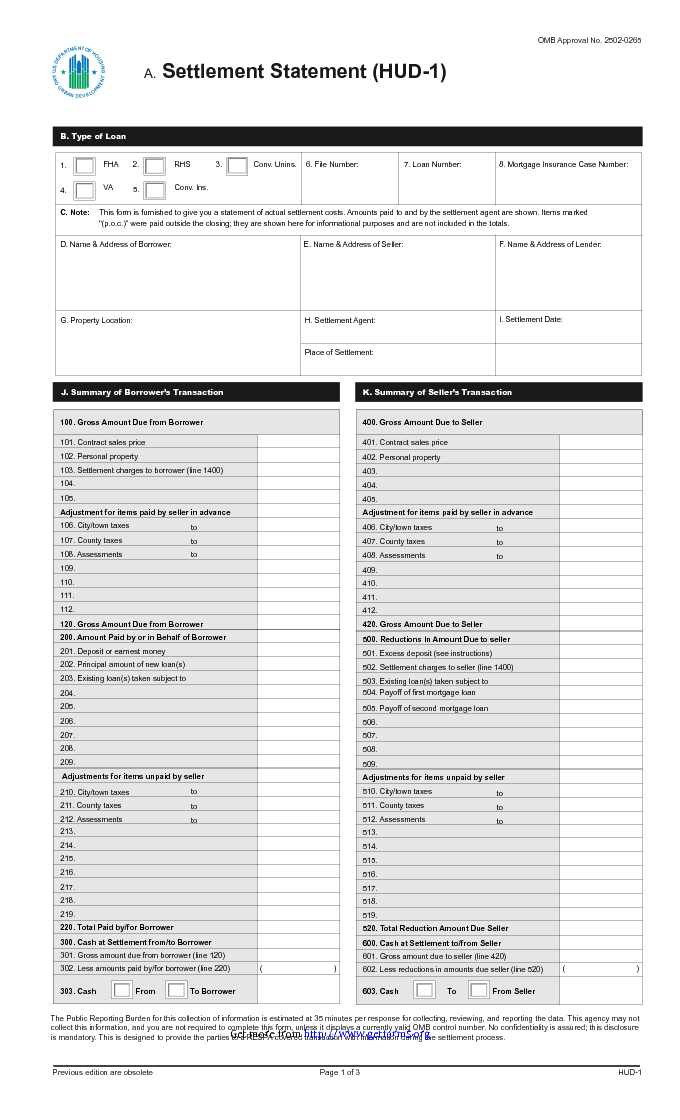

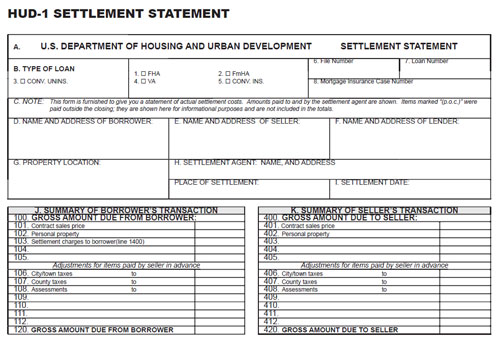

What is a final HUD statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is the HUD statement called now?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Is income and asset same?

In general, income is money that “comes in.” 106 C.M.R. § 704.100. An asset is money or property you already have.

What does the IRS consider assets?

In most situations, the basis of an asset is its cost to you. The cost is the amount you pay for it in cash, debt obligations, and other property or services. Cost includes sales tax and other expenses connected with the purchase. Your basis in some assets isn't determined by the cost to you.

Do savings count as income?

How much tax you'll pay on savings? Although the interest you get on your savings, like any other income you receive, is normally taxable any savings interest from your bank or building society is usually paid 'gross'. Here are the limits for the amount of interest you can earn tax-free.

Is a 401k an asset or income?

Retirement funds: Retirement accounts such as your 401(k), IRA, or TSP are considered assets.

What Happens After the Investigation of a Fair Housing Act Complaint?

When your complaint's investigation is complete, HUD will issue a determination as to whether or not reasonable cause exists to believe discrimination occurred. If HUD determines that there is reasonable cause to believe that discrimination occurred, HUD will issue a Determination of Reasonable Cause and a Charge of Discrimination. All complainants and respondents have twenty (20) days after receiving notice of the Charge to decide whether to have the case tried before a Federal District Court judge. If no one does so, the case is heard by a HUD Administrative Law Judge (ALJ).

What happens if a complaint is not resolved voluntarily?

If the complaint cannot be resolved voluntarily by an agreement, FHEO may issue findings from the investigation. If the investigation shows that the law has been violated, HUD or the Department of Justice may take legal action to enforce the law.

What does FHEO do?

Generally, FHEO will either investigate the complaint or refer the complaint to another agency to investigate. Throughout the investigation, FHEO will make efforts to help the parties reach an agreement. If the complaint cannot be resolved voluntarily by an agreement, FHEO may issue findings from the investigation.

How does HUD resolve a complaint?

During the complaint process, HUD will assist the parties in resolving the complaint through informal resolution or voluntary compliance. FHEO will develop a written voluntary compliance agreement to obtain the resolution of findings of noncompliance. A Voluntary Compliance Agreement will obtain assurances from the Program to remedy any violations and ensure that the Program will not violate the rights of other persons under fair housing or civil rights authorities.

What is FHEO in housing?

As part of HUD's Fair Housing Assistance Program (FHAP), FHEO may refer a fair housing complaint to a state or local government agency for investigation. In certain circumstances, FHEO may initiate a compliance review based on the information submitted in a complaint.

What happens at an ALJ hearing?

The ALJ hearing will be conducted in or near the locality where the discrimination allegedly occurred. During the ALJ hearing, the parties have the right to appear in person, to be represented by legal counsel, to present evidence, to cross-examine witnesses and to conduct discovery of evidence. HUD attorneys will be assigned to represent you during the ALJ hearing at no cost to you; however, you may also choose to intervene in the case and retain your own attorney. At the conclusion of the hearing, the ALJ will issue a decision based on findings of fact and conclusions of law. If the ALJ concludes a violation of the Fair Housing Act occurred, the following relief can be ordered:

What happens at the conclusion of an ALJ hearing?

At the conclusion of the hearing, the ALJ will issue a decision based on findings of fact and conclusions of law. If the ALJ concludes a violation of the Fair Housing Act occurred, the following relief can be ordered: Compensation for your actual damages, including out-of-pocket expenses and emotional distress damages.

Answer

Receipt of Federal benefits with income limits implies that you qualify based upon the guidelines set by the federal government. Personal injury awards are actually considered “income” (whether or not you get taxed on the award is a different story), so it is something you would ultimately need to claim.

Cancel reply

Don’t ask a personal injury question here – comments are not reviewed by an attorney. Ask your question on this page. Required fields are marked *

What is HUD voucher?

The best-known of these programs is the Section 8 voucher program . To qualify for the voucher program, the local housing authority will assess a person’s income, net family assets, and family composition.

How does HUD affect special needs trusts?

HUD benefits add a layer of complexity to special needs trust administration due to both the rules and the inconsistent way in which they are applied. Special needs trusts, whether pooled or standalone, must follow certain rules to ensure their beneficiaries do not lose the public benefits. One such rule is that the trust be used only to supplement but not replace or supplant those benefits. In practicality, this means Trustees apply categorical prohibitions. For example, if a beneficiary has SSI, a Trustee may not pay for food or shelter expenses. This is relatively straightforward and simple from an administration perspective.

Why did the Housing Authority rule cite above allowing trust distributions to be counted?

The housing authority’s argument boiled down to an assertion that had the funds gone straight to the beneficiary’s bank account they would have been excluded from income. Because the funds went to an irrevocable trust, they triggered the rule cited above allowing trust distributions to be counted.

Why would a client need a trust?

Most likely the client would need a trust to protect their SSI,Medicaid , or the means-tested benefits of a family member in the household who might have income deemed to them by the settlement.

What is Section 8 housing assistance?

If your client has housing assistance through the U.S. Department of Housing & Urban Development (HUD), which includes Section 8 benefits, it is critical from a planning perspective to understand how those benefits work. Not understanding the federal program and the nuances of your client’s local program could result in a variety of issues from inconvenience to your client to loss of a benefit he or she desperately needs.

What is included in HUD guidelines?

HUD’s guidelines list the categories of income that are included and excluded. [2] Income generally includes what one would expect it to include: wages, income from a business , interest earned on investments , periodic annuities, etc. Of note are exclusions for lump sums (inheritances, insurance payments, and settlements for personal or property losses) and reimbursement of medical expenses. The lump sum category has an exclusion to the exclusion, however, for payments in lieu of earnings which includes worker’s compensation (meaning these payments are income).

How does the housing authority determine the amount of a voucher?

The local housing authority determines the amount of the voucher based on the above factors and the cost of rent in the local housing market. It is then up to the voucher recipient to find a suitable dwelling for that price (if the rent is higher than the voucher, the recipient pays the excess). The recipient will likely also pay 30-40% of monthly adjusted income.

1 attorney answer

Most settlement income is not counted in the Section 8 income calculations. So long as it is for a personal loss (injury or the like) or a property loss, it should not be included, unless it is disability or unemployment money. Attached is the HUD page describing this. Look under "Part 5 Exclusions" for an explanation...

Nicholas William Mason

Most settlement income is not counted in the Section 8 income calculations. So long as it is for a personal loss (injury or the like) or a property loss, it should not be included, unless it is disability or unemployment money. Attached is the HUD page describing this. Look under "Part 5 Exclusions" for an explanation...

What happens if you receive SSI?

But, if you receive any of the following needs-based benefits, your settlement may affect your eligibility and could cause a lapse or termination of your benefits: SSI (Supplemental Security Income): A cash benefit that provides assistance to the aged, blind or disabled.

How long does it take to report a settlement?

Please note that you must report any settlement you receive to your caseworker within 10 days of receiving the funds.

Can you lose your SSI if you give away part of your settlement?

You will likely lose your needs-based public assistance benefits for a period of time if you accept a lump sum payment that causes you to exceed the program’s income and resource limits. Likewise, if you give away part of your settlement as a gift or donation, you could also lose your SSI and/or Medicaid benefits for at least a time. Or, the government could seek reimbursement for benefits you’ve received.

Who is eligible for medicaid?

Medicaid: Medical coverage provided to the disabled and needy. In many states, disabled people who receive SSI will also automatically qualify for Medicaid.

Can you lose your medical benefits if you receive a settlement?

Many public assistance programs that provide you with monthly income or payments for medical services have strict financial eligibility limits. Without careful planning, your settlement award may cause you a reduction or even loss of your benefits for a period of time.

Can you add videos to your watch history?

Videos you watch may be added to the TV's watch history and influence TV recommendations. To avoid this, cancel and sign in to YouTube on your computer.

How much did HUD spend on housing discrimination in 2000?

Of that total amount, $18 million will be exclusively for private fair housing groups, such as Project Sentinel.

What is the HUD v Gutleben case?

A HUD Administrative Law Judge in 1994 ruled (HUD v Gutleben) that the verbal abuse of tenants or threats against tenants with racial epithets interferes with the their right to use and enjoy their homes, and is prohibited under the Fair Housing Act.

How to file a complaint against HUD?

People who believe they've been harmed by housing discrimination can file complaints with HUD by calling 1-800-669-9777 or on the Internet.

What does the S.W.P. stand for in the Lafenier case?

In addition to the verbal harassment, Fairrer said that the letters "S.W.P." and lightning bolts were scratched onto her front door. She said that Lafenier's girlfriend told her later that the markings stood for "Supreme White Power."

Who is the executive director of Project Sentinel?

Project Sentinel Executive Director Ann Marquart said: "We believe the evidence was overwhelming and supports the settlement of $100,000. This settlement sends a strong message to housing providers that the creation and maintenance of a hostile living environment will not be tolerated."

Who filed the Fairrer lawsuit?

The lawsuit against the apartment owners was filed on Fairrer's behalf by Project Sentinel, a San Francisco Bay-area private fair housing group that receives HUD funding to fight housing discrimination.

Who was the apartment manager that told Fairrer nothing could be done?

Fairrer said that she reported the incidents several times to the apartment complex manager Melissa Cohea, who allegedly told Fairrer nothing could be done.

Can you keep your SSI, Social Security Benefits if you receive a Settlement of a Personal Injury Lawsuit?

A primary question with regards to filing a lawsuit is whether a lawsuit impacts your SSI, SSDI or Social Security benefits.

Supplemental Security Income (SSI) Benefits – Social Security

Generally the only benefits which are impacted as a result of such settlements are SSI benefits. Social Security Income benefits are “ resource based ” or “ need based “.