Property settlements for loss in value of property that are less than the adjusted basis of your property are nottaxable and generally do not need to be reported on your tax return. However, you must reduce your basis in theproperty by the amount of the settlement.

Do I have to report settlement on my tax return?

Property settlements for loss in value of property that are less than the adjusted basis of your property are nottaxable and generally do not need to be reported on your tax return. However, you must reduce your basis in theproperty by the amount of the settlement.

Do I have to report loss in value of property?

Loss-in-value of property • Property settlements for loss in value of property that are less than the adjusted basis of your property are not taxable and generally do not need to be reported on your tax return. However, you must reduce your basis in the property by the amount of the settlement.

Are property settlements for loss in value of property taxable?

• Property settlements for loss in value of property that are less than the adjusted basis of your property are not taxable and generally do not need to be reported on your tax return. However, you must reduce your basis in the property by the amount of the settlement.

Do you have to pay tax on settlement of property?

• Property settlements for loss in value of property that are less than the adjusted basis of your property are not taxable and generally do not need to be reported on your tax return. However, you must reduce your basis in the property by the amount of the settlement.

Do settlements need to be reported to IRS?

If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Do you have to put a settlement on your taxes?

Personal injury settlements are one of the few types of lawsuits that are tax exempt. Most other lawsuit settlements are taxable, meaning the party winning the lawsuit must give a portion of their compensation to the IRS.

Are 1099 required for settlement payments?

The IRS requires the payer to send the recipient a 1099-MISC, as long as the settlement meets the following conditions: The payee received more than $600 in a calendar year. The settlement money is taxable in the first place.

How do I report a settlement to the IRS?

Attach to your return a statement showing the entire settlement amount less related medical costs not previously deducted and medical costs deducted for which there was no tax benefit. The net taxable amount should be reported as “Other Income” on line 8z of Form 1040, Schedule 1.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Do you get a w2 for a settlement?

The settlement agreement should also explicitly provide for how the settlement will be reported as well. The two primary methods to report the settlement to the IRS are either on a Form W-2 or a Form 1099-MISC.

What happens if I don't file my 1099 NEC?

Find out more about 1099 filing penalties here. The late filing penalty is $50 per form if you file within the 30 days of the due date. If you file after 30 days, but before August 1 of the filing year, the penalty is $110 per form. If you file after that or do not file at all, then the penalty is $280 per form.

Why do I have to fill out a w9 for a settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

How do you account for legal settlements?

How to Account for a Record Estimated Loss From a LawsuitRead the documents from the company's attorney. ... Write a journal entry to record the estimated loss. ... Enter the dollar amount in the general ledger to increase the "Lawsuit Expense" account.More items...

What percentage of taxes are taken out of a settlement?

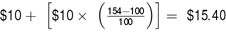

For 2017, that percentage is 39.6 percent, while for 2018 it is slightly less, at 37 percent.

Do you have to pay taxes on a class action settlement check?

Settlement Payment made to the registered plan that suffered the loss. If a Settlement Payment is made directly to the registered plan, the controlling individual does not need to take any further action as the payment is not taxable and is not considered a contribution to the plan.

Do you have to pay taxes on a lawsuit settlement in Florida?

In most cases in Florida, a settlement will not be taxed. However, there are certain types of damages that could be considered taxable. These include the following: Punitive Damages – These are damages that go beyond your initial loss.

Is emotional distress settlement taxable?

Pain and suffering, along with emotional distress directly caused by a physical injury or ailment from an accident, are not taxable in a California or New York settlement for personal injuries.

Do you have to report a settlement on your taxes?

Property settlements for loss in value of property that are less than the adjusted basis of your property are nottaxable and generally do not need to be reported on your tax return. However, you must reduce your basis in theproperty by the amount of the settlement.

Is severance pay taxable?

If you receive a settlement in an employment-related lawsuit; for example, for unlawful discrimination or involuntary termination, the portion of the proceeds that is for lost wages (i.e., severance pay, back pay, front pay) is taxable wages and subject to the social security wage base and social security and Medicare tax rates in effect in the year paid. These proceeds are subject to employment tax withholding by the payor and should be reported by you as ‘Wages, salaries, tips, etc.” on line 1 of Form 1040.

Is a settlement for physical injury taxable?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

What Is the Basis of the Asset?

To calculate your capital gain or loss, you need to know the adjusted basis of the home. You start with the cost basis, which is the amount you paid for the home, and then make certain adjustments.

What form do you report real estate sales?

Gains from the sale of real estate are reported on Form 8949 and on Schedule D to Form 1040. If you're able to exclude all your gain from taxation, you don't have to report the sale unless you received a Form 1099-S.

What is a 8949?

Form 8949 will require you to list each property sold during the tax year along with the date you bought the property, the date you sold it, the amount of the proceeds, the amount you paid for the property, any adjustments to the gain or loss and the total gain or loss.

How long are long term gains taxed?

Long-term gains are gains on capital assets that you've owned for more than one year. If you buy a house and keep it for three years, any gains realized from the sale will be long-term gains.

How much can you exclude from taxes if you are single?

If you're single, you can exclude $250,000 of that amount and pay tax on only $50,000. If you're married and you file jointly, you can exclude the entire $300,000 gain. To qualify for the exclusion, you must have owned the home for two of the last five years. The home must be your residence and not a vacation property.

How to report a sale of real estate to the IRS?

How to Report a Sale of Real Estate Property to the IRS. When you sell real estate (also called real property), you have to report it to the IRS. If you made money from the sale, you'll report a gain; if you lost money on the sale, you'll report a loss. IRS Form 8949 (Sales and Other Dispositions of Capital Assets) is used to report your gain ...

What is the basis of an increase in taxes?

An increased basis means a reduced tax when you sell the asset. If you buy a house for $50,000 and pay $10,000 in property taxes for an adjusted basis of $60,000, and then make $25,000 in improvements, your adjusted basis grows to $85,000. If you then sell the property for $90,000, your taxable gain is $5,000.

Is insurance reimbursement taxable?

Insurance reimbursement isn't usually taxable income . The IRS regards it as compensation for losses you've suffered -- a way to restore your property to its former condition. If you report a property loss on your tax return, however, your insurance reimbursement affects how big a loss you can deduct. In some circumstances, you do have ...

Can you claim a loss on your taxes?

Deductible Losses. You can claim a tax deduction for property loss if the cause was sudden and swift, unexpected, and not an everyday happening. The IRS includes car accidents, earthquakes, fires, floods, shipwrecks and storms in that list. If you claim the loss, which requires itemizing deductions, you have to adjust it for any insurance ...

Is reimbursement on a replacement car taxable?

If your reimbursement is more than your adjusted basis, you don't always have to report income: If you spend it all restoring your property or buying a replacement, the gain isn't taxable. Any money left over after you buy the replacement, however, remains taxable income. You have to spend the reimbursement payment on the new property: If someone gives you money to replace your car and you spend the reimbursement on something else, all the gain is taxable.

When did Fraser Sherman start writing?

A graduate of Oberlin College, Fraser Sherman began writing in 1981. Since then he's researched and written newspaper and magazine stories on city government, court cases, business, real estate and finance, the uses of new technologies and film history.

Is an insurance check worth more than the adjusted basis?

If your property has grown in value since you bought it, your insurer's check may be worth more than the adjusted basis. In that case, the excess is taxable income. Use form 4684 and Schedule D to report your gains to the IRS.

Is the loss in value of a property taxable?

If your property has grown in value since you bought it, your insurer's check may be worth more than the adjusted basis. In that case, the excess is taxable income. Use form 4684 and Schedule D to report your gains to the IRS.

Is a lawsuit taxable income?

The taxable amounts received will depend on how the lawsuit proceeds were labeled. If the proceeds were given solely to compensate you for property damage, that is not taxable income and you will enter the amount on line 21 of your return and then take it out as a negative to show the IRS. If part was DESIGNATED as attorneys fees those are taxable

Is a settlement taxable income?

Yes, the settlement is considered taxable income unless it is for pain and suffering due to bodily or psychological injury.

Can rental income be offset?

The taxability of that income can be offset by the 'qualified" rental expenses it was used to pay for.

Is pain and suffering included in rental income?

With the exception of "pain and suffering" (of which I don't see any of that here), all rental income received for rental property from any source for any reason , is included in the total of all rental income received for the tax year. So it gets included with the amount in the rental income section.

What line do you add settlement proceeds to on a 1040?

After reporting taxable settlement proceeds on Line 21 (labeled "other income") of Schedule 1 (1040), add Lines 1 through 21 and enter the sum on Line 22 before transferring this sum to Line 6 of Form 1040.

When are compensatory damages taxable?

Compensatory damages are those awarded to a plaintiff to replace something lost. Compensatory damages are taxable when they do not pertain to any sort of injury.

Is lost wages a punitive or compensatory damages?

Often, the compensatory damages in a personal injury settlement, such as lost wages or medical expenses, are listed separately from any punitive damages, so it is easy to figure out the correct amounts.

Is personal injury settlement taxable?

Personal Injury Settlement Not Taxable. Most personal injury settlements are not taxable, and that’s true at the state as well as at the federal level. You don’t have to report such monies on your Form 1040.

Do settlements have to be taxed?

Taxable settlement monies are taxed at ordinary income tax rates, although it is likely the settlement will put you into a higher tax bracket.

Do you report insurance settlements on 1040?

How to Report Insurance Settlement Proceeds on IRS Form 1040. Before you report taxes on an insurance settlement on your Form 1040, you must know which settlement proceed s are considered taxable by the Internal Revenue Service and which are not . The answer depends on the nature of the lawsuit and the settlement.

Is a car accident settlement taxable?

A Car Accident Settlement May Be Taxable. If your car accident settlement involved personal injury, that part of the lawsuit settlement isn’t taxable. However, if you received monies for emotional distress and the emotional distress wasn’t directly related to your injuries, you must pay tax on that amount.

What forms do you use to file taxes for a lawsuit?

If you do receive taxable payment from a lawsuit, you'll likely receive a 1099 form to use when filing your taxes. Common taxable payouts from lawsuits include: Punitive damages. Lost wages. Pain and suffering (unless caused by a physical injury) Emotional distress.

Why are insurance claims not taxed?

One of the most common reasons you receive money from an insurance claim is to pay for the repair or replacement of a damaged piece of property.

When does the FSA expire?

But money you put into an FSA generally expires at the end of each year, so you should only put in as much as you think you will spend in a given year.

Is insurance settlement taxed in a lawsuit?

Just like a normal insurance settlement, compensation for medical bills and repair of property are not taxed in a lawsuit.

Do you have to pay taxes if you get hit by an auto accident?

For example, if someone hits you in an auto accident, you wouldn't be taxed for a payment you receive for your medical bills. However, if the judge also awards you punitive damages, you would have to pay tax on those. If you do receive taxable payment from a lawsuit, you'll likely receive a 1099 form to use when filing your taxes.

Do you get a 1099 form if you have insurance?

If you do have to pay taxes on an insurance claim, you'll receive a 1099 form to help you file.

Is life insurance income taxed?

A life insurance payout — the kind that's distributed after the insured person dies — isn't taxed.

How to calculate the value of a property?

To determine the value of your destroyed, damaged, or stolen item (s): 1 Figure out the original amount of the item/property. 2 Estimate the value of the item now (after the event). The difference is the decrease in the item's fair market value (FMV). 3 Choose the smaller amount of either (1) or (2) above. 4 Subtract any insurance reimbursements you may have received from the number you came up with in #3. 3

Can you deduct appraisal fees from taxes?

A professional appraisal can provide you with an accurate estimate of the value of your items and serve as evidence for your insurance claims, and the appraisal fee can be deducted from your taxes. (For more, check out: Tax Tips for The Individual Investor .)

Can you deduct personal property damage?

If you have personal property that has sustained damage—or has been completely destroyed— by any of the following four categories of events, you may be able to deduct a portion of your loss from your federal income tax bill:

Can you get tax relief if you have been affected by a natural disaster?

If you have been affected by a natural disaster recently, visit the IRS website to see if you qualify for tax relief. The site states that individuals in certain states affected by recent events qualify for tax relief.

Can you write off a tornado on your taxes?

In addition to being devastating natural disasters, these events have another common denominator: the property damage they cause can be deducted from federal income taxes. If your home, vehicle, or household items and possessions are damaged or destroyed as the result of a qualifying event that the IRS considers "sudden, unexpected or unusual"—including natural disasters—you may be able to write a portion of the loss off of your federal income tax. 1

Can you deduct a loss on your taxes?

Unless your loss is due to a disaster and the president has declared your community a federal disaster area, you will need to deduct your loss the year that it occurred. If you live in a presidentially-declared disaster area, you can deduct the loss on your federal income tax return for the year before the event. 2 (For more, see: 5 Insurance Policies Everyone Should Have .)