If you want to check whether your data was exposed, the FTC and official settlement site have an online tool you can use to check if you were part of the Equifax breach. You'll need to enter your last name and last six digits of your Social Security number to see if your data was part of the hack.

Full Answer

What you should know about the Equifax breach settlement?

The Federal Trade Commission (FTC) has issued a consumer alert regarding the Equifax Data Breach. In September 2017, Equifax announced a data breach, which affected the personal information of 147 million people. Under a recent settlement filed, Equifax agreed to spend up to $425 million to help people affected by the data breach.

What to do after the Equifax breach?

- Work to help consumers (you can offer credit monitoring or other services)

- Increase your cybersecurity measures to prevent future attacks

- Show your customers how you are improving security through open communication and a commitment to transparency

Should you freeze your credit after the Equifax data breach?

Whether you could benefit from a credit freeze after a data breach depends on what information was compromised. If only your credit card information was stolen, getting a replacement card should reduce your exposure to fraud. But when identifying information is accessed, like your Social Security number, a credit freeze could be a smart move.

How to take advantage of the Equifax data breach settlement?

- Get a free credit report at www.annualcreditreport.com or by calling 877-322-8228.

- Call the Equifax Settlement Administrator at 1-833-759-2982.

- Take advantage of any free services being offered as a result of the breach.

- Use two-factor authentication on your online accounts whenever available.

- Consider a credit freeze.

See more

What's going on with the Equifax settlement?

Court Approves Equifax Breach Settlement: Money for Some, Free Credit Monitoring for All. Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

How much will each person get from Equifax settlement?

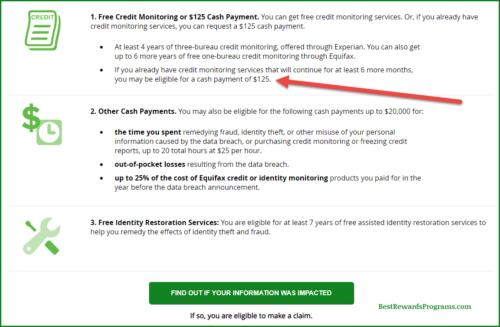

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

How much can you get from a data breach settlement?

The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

How do I know if I was affected by the Equifax data breach?

If you want to check whether your data was exposed, the FTC and official settlement site have an online tool you can use to check if you were part of the Equifax breach. You'll need to enter your last name and last six digits of your Social Security number to see if your data was part of the hack.

Has Equifax settlement been approved?

The Settlement received final approval from the Court on January 13, 2020. You may review the Final Approval Order and Final Order and Judgment by clicking here. Settlement appeals have been resolved and the Settlement is now effective.

How much was the Equifax settlement?

$425 millionEquifax data breach class action lawsuit settlement updates: On June 3, 2021, the 11th Circuit Court of Appeals upheld the $425 million Equifax data breach settlement.

Does Equifax sell your information?

We use and sell personal data to nonaffiliated third parties for the following commercial purposes: Consumer credit reporting. Some of our affiliates collect, use, and sell personal data when acting as a consumer reporting agency, as this activity is regulated by the FCRA.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

Is Equifax being sued?

Equifax sued over glitch sending inaccurate credit scores to lenders. Consumer credit reporting agency Equifax is being sued for a three-week glitch earlier this year that may have sent incorrect credit scores for potentially millions of Americans to lending agencies and banks across the country.

What happens if impacted by breach of Equifax?

Information Assurance recommends that anyone who may have been affected by the Equifax data breach take the following five actions:Put a fraud alert on your credit report. ... Keep an eye on bank account and credit card statements. ... Check your free credit reports. ... Turn on two-factor for Weblogin and for personal accounts.More items...•

Should I give my Social Security number to Equifax?

Is it okay to give it to them? Yes. The credit reporting agencies ask for your Social Security Number (or Taxpayer ID Number) and other personal information to identify you and avoid sending your credit report to the wrong person. It is okay to give this information to the credit reporting agency that you call.

Does Equifax need my SSN?

We ask for personal information, such as your Social Security number, during the order process to verify your identity and to locate your Equifax credit report.

How much can you expect from a class action lawsuit?

A class action usually ends in a settlement as opposed to going to trial. Settlements in recent years have averaged $56.5 million. However, a settlement does not guarantee a large payout for the individual members of a class.

How much will I get from the Bank of America lawsuit?

What does the Settlement provide? Bank of America has agreed to establish a Settlement Fund of $27.5 million from which Settlement Class Members will receive payments or Account credits. The amount of such payments or Account credits cannot be determined at this time.

How are class action settlements divided?

Class action lawsuit settlements are not divided evenly. Some plaintiffs will be awarded a larger percent while others receive smaller settlements. There are legitimate reasons for class members receiving smaller payouts.

Are class action settlements worth it?

In general, yes – class action lawsuits are worth it. For Class Members who are able to recover benefits from a class action settlement, all it takes is filling out a claim form and potentially providing documentation. This can allow them to recover up to thousands of dollars in compensation.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

How much time can you spend on a data breach?

You may be eligible for the following reimbursement cash payments for: Time Spent during the Extended Claims Period recovering from fraud, identity theft, or other misuse of your personal information caused by the data breach up to 20 total hours at $25 per hour.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Can you claim out of pocket time spent?

Submit a claim to receive reimbursement for Out-of-Pocket Losses and/or Time Spent. You may claim Out-of-Pocket Losses, Time Spent, and Credit Monitoring Services under the Settlement depending on whether you file claim(s) during the Initial or Extended Claims Period.

How to claim $125 from Equifax?

The process to claim your $125 payment from the Equifax breach settlement now has one more step. If you already filed your claim, you may have received an email over the weekend instructing you to provide further information. An email from the breach settlement administrator states that if you filed to receive $125 in lieu of free credit monitoring, you must verify that you already have credit monitoring set up and will retain it for at least the next six months. You must either verify your claim, or amend it to instead request free credit monitoring, by October 15.

How to verify a claim?

To verify your claim, visit the settlement website and use your claim number (it’s also listed at at the top of your email) to access your claim.

Do you need to pay for credit monitoring?

If you have a free monitoring service like Credit Karma or Credit Sesame, that service should be valid for verifying your claim; the settlement does not specify that you need to have paid for a service, only that you are signed up for one. Double-check your status with those sites before adjusting your claim. Look under your account settings and you’ll be able to see whether you have credit monitoring and/or identity monitoring turned on, with notifications reaching you in some way if the service detect an issue.

Do vacuums pick up dirt?

You don’t have to pick up or move anything, these vacuums will identify everything that isn’t dirt and go right around it.

Will alternative compensation be lowered?

Based on the number of potentially valid claims that have been submitted to date, payments of these benefits likely will be substantially lowered and will be distributed on a proportional basis if the settlement becomes final. Depending on the number of valid claims that are filed, the amount you receive for alternative compensation may be a small percentage of your initial claim.

How many hours of time can you claim for a data breach?

To claim reimbursement of more than 10 hours of Time Spent during the Initial Claims Period, you must have also provided reasonable documentation of fraud, identity theft, or other alleged misuse of your personal information fairly traceable to the Data Breach (i.e., letter from IRS or bank or police report).

When is the deadline for credit monitoring?

The deadline for all claims for Credit Monitoring Services was 1/22/2020. If you submitted a valid claim form and elected to enroll in Credit Monitoring Services, you will receive enrollment instructions by email after the Settlement becomes effective.

Did Equifax protect consumers' personal information?

Plaintiffs claimed that Equifax did not adequately protect consumers’ personal information and that Equifax delayed in providing notice of the data breach. The most recent version of the lawsuit, which describes the specific legal claims alleged by the Plaintiffs, is available here.

Facts about the Equifax data breach and settlement

Equifax initially disclosed the data breach September 7, 2017. The company said it discovered the data breach in July 2017.

How can I help protect myself and my identity after a data breach?

In the wake of the Equifax data breach, there are some steps you can take to help protect yourself — or to detect if identity thieves may have targeted you.

What does Sunday's communication from Equifax's settlement administrator mean?

Sunday’s communication from Equifax’s settlement administrator means that consumers who filed their claim before the FTC spelled out the consequences of the capped settlement amount now have a second chance to opt for the credit monitoring.

What is the Equifax cyber security incident?

A mobile phone open to the web site of credit bureau Equifax, with text on the website reading ‘Equifax Cybersecurity Incident’, providing steps for consumers to take following a security breach in 2017 that affected 143 million Americans .

How much did Equifax pay for data breach?

In July, credit bureau Equifax agreed to pay nearly $700 million over its massive 2017 data breach. Under the terms of the settlement, affected consumers could potentially get up to $20,000 in reimbursement.

When do you have to act on an Equifax claim?

Yet on Sunday, consumers who filed for the $125 cash payout were sent an email with the subject line: “Your Equifax Claim: You Must Act by October 15, 2019 or Your Claim for Alternative Compensation Will Be Denied.”. Under the new requirements, consumers have two options: verify their claim by providing more information or amend their paperwork ...

Can you amend a claim with Equifax?

You can also opt to amend your claim and select the free credit monitoring option instead of the cash payout. If you don’t want to use Equifax’s designated website to update your claim, you can also send the settlement administrator a letter that includes your full name, claim number and zip code at the following address:

When will my unemployment claim be rejected?

If you do nothing before Oct. 15, 2019, your claim will be completely rejected.

What happened to Equifax?

If you remember, just three years ago (it seems like forever to many of us), Equifax was hit with a massive data breach that exposed sensitive financial information for over 145 million people . The company eventually settled lawsuits and promised payments to everyone affected, which led to a very simple promise: Those affected would get ...

How many people were affected by Equifax?

If you remember, just three years ago (it seems like forever to many of us), Equifax was hit with a massive data breach that exposed sensitive financial information for over 145 million people. The company eventually settled lawsuits and promised payments to everyone affected, which led to a very simple promise: Those affected would get a $125 check.

Is Equifax a credit bureau?

Equifax is, of course, one of the big three credit bureaus. When signing up for the initial claim, those affected had two choices: They could get a cash payment, or they could choose to get ten years of free credit monitoring instead, divided between the other bureaus and Equifax.

Can you appeal an Equifax settlement?

The payments are only required after all the lawsuits on this particular issue are wrapped up, and claims have been validated by an administrator. A lot of that has already happened, and since Equifax is settling, they can’t appeal the ruling. However, other claimants can appeal the settlements via their own legal channels and have done so – whether they wanted more money, or whatever reason they had, several appeals over the settlement appear active.

Can Equifax appeal the ruling?

A lot of that has already happened, and since Equifax is settling, they can’t appeal the ruling .

When is the deadline to file a class action lawsuit?

However, the big catch is that the deadline to file the initial claim was January 22, 2020, which means it’s now too late to qualify.