You may be eligible if you are a person in the US whose identity was used to file a fraudulent tax return for years 2014, 2015, or 2016 using TurboTax

TurboTax

TurboTax is an American tax preparation software package developed by Michael A. Chipman of Chipsoft in the mid-1980s. Intuit acquired Chipsoft, based in San Diego, in 1993. TurboTax for the Mac was originally named MacinTax, and was developed by SoftView. SoftView was in turn pur…

How much will I get from TurboTax settlement?

Eligible TurboTax users will receive notification, either in an email or letter. Impacted customers will receive approximately $30 for each year that they were deceived into paying for filing services. How do I file a settlement claim with TurboTax?

Why did TurboTax pay $141 million?

Intuit, the company behind TurboTax, has agreed to pay $141 million to customers across the U.S. in connection to a settlement regarding deceptive practices involving its free tax-filing services. More than 4.4 million taxpayers are eligible under the terms of the settlement by signed attorneys general of all 50 states,

Are you eligible for TurboTax free edition?

According to Fox59 News, one-third of U.S taxpayers would have been eligible for the company’s Free Edition and 70 percent of taxpayers would have qualified for the TurboTax partnership with IRS Free File Products. The settlement comes after Intuit was accused of using deceptive practices.

Did you have to pay to file taxes with TurboTax?

Intuit is providing restitution to nearly 4.4 million people in all 50 states who used TurboTax's Free Edition between tax years 2016 and 2018. These people were told they had to pay to file, even though they qualified for the IRS Free File program, a partnership between the agency and major tax prep software companies.

Who is eligible for TurboTax settlement?

Individuals and families with an adjusted gross income of less than $73,000 are typically eligible for the Free File program, as are members of the military.

What is the TurboTax settlement?

$141 millionNEW YORK — The company behind the TurboTax tax-filing program will pay $141 million to customers across the United States who were deceived by misleading promises of free tax-filing services, New York's attorney general announced Wednesday.

How do I claim money from TurboTax settlement?

0:431:30No action required to receive money from TurboTax settlement - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd you file between the 2016. 17 or 18. Tax years you are now eligible for a 30 check and you don'tMoreAnd you file between the 2016. 17 or 18. Tax years you are now eligible for a 30 check and you don't have to do anything to get it simply get a notice in the mail.

Do I get money back from TurboTax?

Satisfaction Guarantee/ 60-Day Money Back Guarantee: If you're not completely satisfied with TurboTax Desktop, go to refundrequest.intuit.com within 60 days of purchase and follow the process listed to submit a refund request.

Is the lawsuit against TurboTax real?

TurboTax maker will pay $141M in settlement over ads for free tax-filing Under a settlement signed by the attorneys general of all 50 states, Intuit Inc. will suspend TurboTax's "free, free, free" ad campaign and pay restitution to nearly 4.4 million taxpayers.

How long does it take to get a check from TurboTax?

21 daysMost refunds will be issued in less than 21 days. You can start checking the status of your refund within 24 hours after you have e-filed your return. Remember, the fastest way to get your refund is to e-file and choose direct deposit.

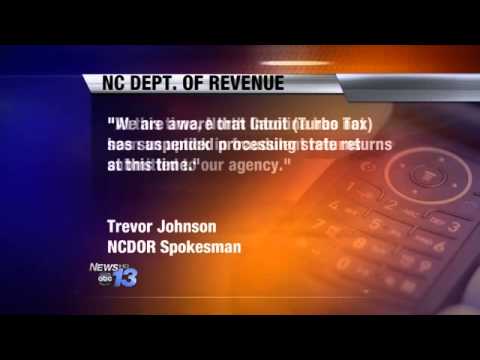

What is going on with TurboTax?

Intuit, the owner of popular tax filing software TurboTax, will pay $141 million in restitution to millions of low-income Americans who were “unfairly charged” for services that should have been free, according to a multistate agreement announced Wednesday. TurboTax also agreed to reform its business practices.

How do I get a bigger refund from TurboTax?

Maximize your tax refund in 2021 with these strategies:Properly claim children, friends or relatives you're supporting.Don't take the standard deduction if you can itemize.Deduct charitable contributions, even if you don't itemize.Claim the recovery rebate if you missed a stimulus payment.More items...•

Why is my refund lower this year TurboTax?

If you owe taxes to the IRS from a previous tax year, those taxes will be reduced from any eligible tax refund for the current year. The IRS will actually take payments for owed federal taxes from a previous year before any other federal or state agency under the Treasury Offset Program.

Who is Tara in the TurboTax commercial?

Brenda Romero (I)

Where do I enter a lawsuit settlement in TurboTax?

Sign in to TurboTax and open or continue your return. Search for lawsuit settlement and select the Jump to link. Answer Yes to the question Any Other Taxable Income? If you've already entered miscellaneous income, select Add Another Miscellaneous Income Item.