When closing on a mortgage loan package, it is mandatory for the borrower to review and sign a settlement statement. With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive.

Do you get a settlement statement at closing?

In a cash transaction, there is no need for a Closing Disclosure since no one is borrowing money — however, buyer and seller would still receive a settlement statement summarizing their costs and any payouts. What is an ‘excess deposit’ at closing?

Do you have to sign a settlement statement for a loan?

Borrowers are usually required to review and sign a closing, settlement statement in order to fully complete the lending process and receive their loan. The signing of the settlement statement also usually binds all of the terms associated with a loan, which typically cannot be easily amended.

What does the seller’s closing statement look like?

What does the seller’s closing statement look like? A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line.

How do you write a settlement statement for a house sale?

A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line.

Is the settlement statement the same as the closing?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is the primary purpose of the settlement statement?

A The primary purpose of the settlement statement is to set forth all of the financial details of closing, showing each party's costs and credits.

What is settlement date on closing statement?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

Is a closing disclosure the same as clear to close?

A Closing Disclosure is not technically the same as being declared clear to close, but the disclosure typically comes after you have been cleared. After reviewing your Closing Disclosure, you can look forward to a final walkthrough of the home and closing day itself.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

Which document must the borrower receive at least three days before the signing appointment?

The Closing Disclosure is a form that lists all final terms of the loan you've selected, final closing costs, and the details of who pays and who receives money at closing. Your lender sends you a Closing Disclosure at least three business days before closing.

Who should review the settlement statement before closing quizlet?

-gives buyer the right to review the completed settlement statement one business day prior to closing. -specifically prohibits any payment or receiving of fees or kickbacks when a service has not been rendered.

Which of the following items are typically prorated at closing?

Mortgage interest, general real estate taxes, water taxes, insurance premiums, and similar expenses are usually prorated at closing.

Does closing on a house mean you get the keys?

Buyers often wonder: “Do you get the keys to the house at closing?” You signed all the paperwork. So, you get the keys right away, right? Not so fast. Signing your documents is just one part of a closing.

Can lender back out after closing?

Yes. For certain types of mortgages, after you sign your mortgage closing documents, you may be able to change your mind. You have the right to cancel, also known as the right of rescission, for most non-purchase money mortgages.

What happens if I lose my job after closing on a mortgage?

Certainly, losing your job after getting approved for a mortgage can be a devastating scenario. Getting a new job can take weeks, months, or even years. During this time, your lender may cancel the loan. The important thing in these scenarios is to act fast and notify your lender as soon as possible.

What is FnF in salary?

What is full and final settlement? Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

How is FnF amount calculated?

Calculation of per day basic: (number of days of non-availed leaves * basic salary) / 26 days ( Avg paid days in a month). As per Section 7 (3) of the Payment of Gratuity Act 1972, Gratuity should be offered within 30 days of the resignation. If you fail to do so you need to pay with interest.

What is included in full and final settlement?

The full and final settlement consist of clearance of dues towards an employee upon their exit from the company. It includes the salary drawn, leave encashment, reimbursements, variables etc.

What is F&F process?

Full and Final Settlement is the process when an employee quits an organization. It is actually the amount of money an employee receives after all the deductions after leaving the organization. In some cases, the employee has to pay the organization in order to get his/her relieving letter.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is a RESPA?

The Real Estate Settlement Procedures Act (RESPA) govern s the formulation of both closing disclosures and HUD-1 statements for the mortgage lending market. RESPA has been revised and updated throughout history to help manage mortgage lending disclosures and protect borrowers. RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure.

How many pages are required for HUD-1?

The HUD-1 is a three-page form generally required to be provided to a borrower one day before closing. The mortgage closing disclosure is a five-page form generally required to be provided to a borrower three days before closing.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

What does escrow mean in real estate?

Escrow means it’s being held by a third party until everything is settled and the sale is ready to be completed. You can start packing up whatever isn’t already in storage but remember, until the deal is closed and the new buyer takes possession, you’re responsible for maintaining the home.

How long does it take to get paid for a home purchase?

That’s the day when the final papers are signed and you (and your mortgage holder if you have one) finally get paid. This typically takes four to six weeks after finalizing the purchase and sales agreement . During this time, any earnest money the buyer paid will be held in escrow. Escrow means it’s being held by a third party until everything is settled and the sale is ready to be completed.

What do you bring to closing?

What you’ll bring to closing. • The deed, if your home is paid off. • A valid, state-issued photo ID like a driver’s license or passport. • A certified check if required in the amount requested by the escrow officer. • The keys and security codes, if possession of the house is granted at closing.

What is a certificate of title?

You’ll need this form for your federal income taxes. Certificate of title. This is a statement swearing you have the right to sell the property. The deed. The deed is the instrument for transferring title. The type of deed used varies by state — grant deed, warranty deed, etc. — but the purpose is the same.

What is the closing agent's accounting?

The closing agent prepares this accounting of all the money involved in the transaction. This statement is required by federal law. There is a buyer’s column and a seller’s column on this form. (You should have received a copy for review prior to the closing meeting.) Double-check all figures and look for clerical errors before signing the HUD-1 form. Check everything from the sales price to the payoff balances on your loan and the pro-rated tax and utility bills you’re being charged. You’ll need this form for your federal income taxes.

What to ask the closing officer before closing?

Ask the closing officer to give you a copy of the documents you’ll be signing a few days before the closing meeting so you have time to carefully review and correct them.

Do you have to sign closing instructions when escrow is open?

You may have signed closing instructions when your escrow account was opened, but if not, you’ll do it now. Make sure the credits and debits are exactly correct. The escrow company will pay off any existing liens on the property, including your mortgage balance, and any property taxes owed until the date of closing.

What is Closing?

Closing is the process where a buyer and seller come together to exchange funds for the title of a property. Due to the different transactions costs involved with closing, a balance sheet must be kept which is known as a closing statement. It lists out all the debits and credits of the transaction.

What is the most important document in a settlement?

The sales document is the most important document in the settlement. The terms of the sales contract (also called Purchase & Sales Agreement) are what will dictate the requirements of the closing. The P&S includes names, addresses, purchase price, closing date, contingencies, and much much more. Contingencies are what need to be satisfied ...

What happens at title closing?

At the title closing, sellers are paid the balance of the purchase price after existing liens (mortgage) and any closing costs are deducted. Typically, buyers pay the purchase price with a combination of a mortgage loan and down payment.

What is a real estate broker?

This includes things like helping you obtain title insurance or helping you apply for a loan. Your broker as mentioned should outline the closing process and steps for you clearly as well as the expected costs. They’ll communicate with the other broker on the other side of the deal and negotiate on your behalf as well.

How do sellers grant their property to the buyer?

Sellers attend to grant their property to the buyer via a signed deed, approve the settlement statement, give the keys to the buyer, and receive payment.

What happens when a deed is signed and delivered?

Once all parties are satisfied, the deed can be signed and delivered, thus transferring title to the new owners.

When should a broker attend a walk through?

Your broker should also attend the final walk through with you on the day leading up to closing or on closing day. This final walk through is done to ensure the condition of the property as well as any agreed upon repairs or construction that was supposed to be done prior to closing.

What is an escrow statement?

The Initial Escrow Statement, which lists the estimated taxes, insurance premiums, and other charges the lender anticipates paying from your escrow account during the first year of your loan.

What is closing disclosure?

The Closing Disclosure is a form that lists all final terms of the loan you’ve selected, final closing costs, and the details of who pays and who receives money at closing. Your lender sends you a Closing Disclosure at least three business days before closing. Visit our interactive sample Closing Disclosure with tips and definitions.

What is a mortgage security instrument?

The place where the payments are to be sent. A mortgage or security instrument: This explains your responsibilities and rights as a borrower. The mortgage grants the lender or servicer the right to foreclose on your home if you fail to make payments as you’ve agreed.

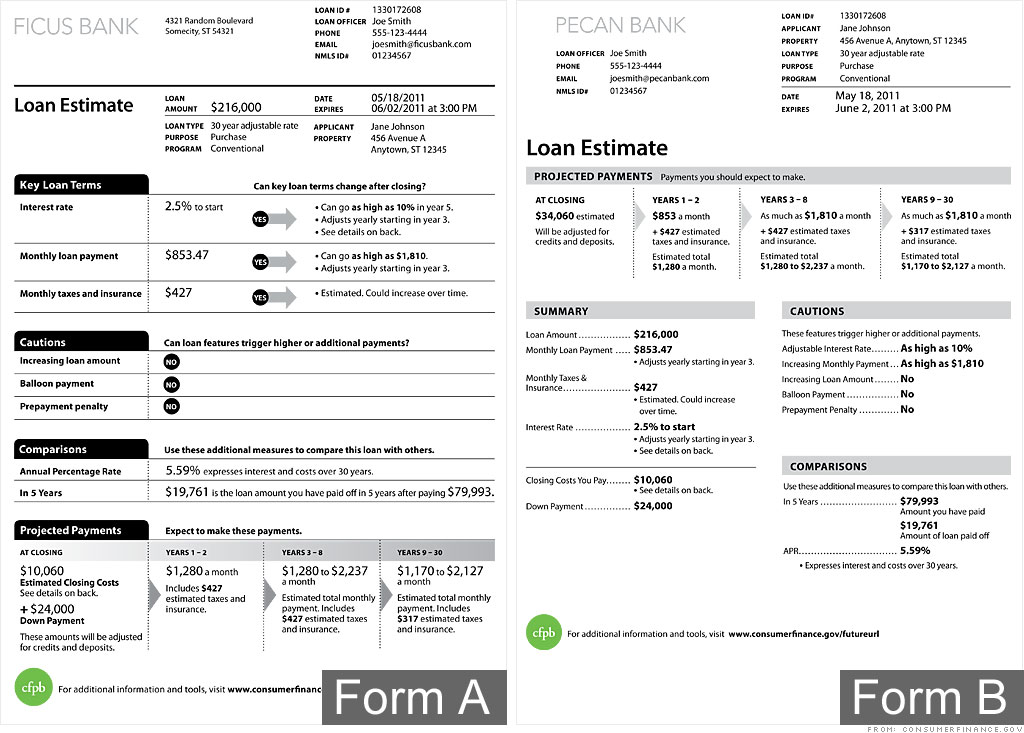

How long does it take to get a loan estimate?

The Loan Estimate is a form that lays out important information about the loan you applied for. The lender sends you a Loan Estimate within three business days of receiving your application. Visit our interactive sample Loan Estimate with tips and definitions.

What is a loan estimate?

They outline your key rights and responsibilities as a borrower, and record the transaction between you and your lender. The Loan Estimate is a form that lays out important information about the loan you applied for.

How long does it take to rescind a loan?

This notice informs you that you have three business days from the lender’s fulfillment of certain conditions to cancel your loan and provides a form for cancelling the loan.

What is a promissory note?

A promissory note, which describes what you are agreeing to. It provides you with details regarding your loan, including:

How to tell if your loan costs have increased?

Compare the Annual Percentage Rate (APR) on the Closing Disclosure to the APR listed on your Loan Estimate. This is an easy way to see if your costs have increased.

How long do you have to receive a copy of closing disclosure?

By law, you must receive a copy of your Closing Disclosure three business days prior to closing. Contact your lender or closing agent (title company, escrow officer, or attorney) at least a week before closing to find out how you will receive your Closing Disclosure.

What documents are included in closing disclosure?

Key documents include: Promissory Note. Mortgage (also known as the Security Instrument or Deed of Trust)

What to do if your loan is not what you are expecting?

If any of the basic loan terms are not what you are expecting, ask questions and be wary. Double-check the loan amount, loan type, loan term, interest rate, monthly payment amount, whether there is a prepayment penalty, whether you are paying points or receiving credits, and other key details.

Where do closing disclosures come from?

The Closing Disclosure may come from your lender or your closing agent. Find out who will send it to you. Find out if your Closing Disclosure will come via email, postal mail, or if you will have to download it from a website.

What to do if you buy a house with another person?

For example, if you’re buying with another person, you’ll want to make sure that the deed is structured to give you the type of ownership you want.

Can closing costs be increased?

It's not uncommon for some of the individual closing costs to have changed by small amounts compared to your Loan Estimate. By law, some fees cannot increase at all unless you have asked your lender for a change in your loan or your financial information has changed. Other fees are limited to a 10 percent increase, ...

What fees would a seller pay?

Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents. This would be listed in your seller’s disclosure statement. You might also pay your prorated portion of the property taxes, or homeowners insurance for the period you’re still living in the home.

What happens if you offer to pay buyer fees?

If you as the seller offer to pay any of the buyer’s fees for obtaining a loan, you’ll probably receive a version of the Closing Disclosure , which outlines the lender’s charges.

How long does it take to get a closing disclosure?

Since the subprime lending crisis of the 2000s, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure no later than 3 days before closing. It outlines loan costs among other fees and information pertinent to the borrower,

What is the net sheet of a home sale?

A net sheet is a document that can be provided throughout the sale process to give the seller an estimate on what they can expect to make.

What is a closing statement?

The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. Everything from the sale price, loan amounts, school taxes, and other important information is contained in this document. Sellers can expect to pay between 6-10% of the final sale price in commissions and closing costs. So, it’s good to see exactly where that money is going.

What is due when closing a mortgage?

The Big Stuff. Anything you owe on the mortgage is due when you close the sale. That’s the first big thing to think about from a seller’s perspective. Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents.

What is settlement statement cash?

Settlement Statement Cash – This version is used for liquid cash transactions for property sales.