The insurance company settlement and release agreement is a legally binding contract. It’s up to you to know what you’re signing. Consider asking a personal injury attorney to review the release before you sign it or cash the settlement check.

Full Answer

How do you negotiate an insurance settlement?

Tips for negotiating bike insurance settlement claim

- Begin the bike insurance claim process immediately. After a bike accident, initiate the bike insurance claim as soon as possible so that even the smallest of details is not ...

- Understand what your bike insurance policy covers. Insurance coverage need not necessarily mean coverage for damages to your bike. ...

- Maintain accurate records about the accident. ...

How much money could I get in a settlement agreement?

then a reasonable settlement agreement payment would be between 1 and 4 months’ salary plus notice pay. If you have evidence of discrimination or whistleblowing, you may be able to get more, and the 2 years’ service requirement doesn’t apply.

How to negotiating an insurance claim settlement?

- When To Consider Self-Representation. It's certainly possible to represent yourself in a personal injury claim after an accident come away with a satisfactory result.

- Important First Steps & Tips. ...

- Estimating Your Damages. ...

- Sending Your Demand Letter. ...

- Countering and Accepting a Settlement. ...

What do you need to know about settlement agreements?

These six factors will help you to calculate your settlement agreement value:

- Your length of service.

- Length of Notice entitlement.

- Discrimination

- How long you will take to secure a new job.

- Strength of Claim.

- Employer attitude to settlement.

Is it good to accept a settlement offer?

It is not in your best interest to accept a settlement offer without speaking with an attorney. The initial settlement offer from the insurance company is probably not fair. The offer may be much lower than the value of your damages. If the insurance company sends you a check, do not cash the check.

Why do insurance companies want to settle?

When an insurance company offers you a settlement, they are essentially acknowledging their client's fault in the accident. They want you to settle to avoid litigation or going to court. Insurance companies usually do not want to get legal help involved.

Can you ask the insurance company for a settlement?

Once you've made an estimate, you'll need to send a demand letter to the insurance company demanding fair compensation. A Demand Letter is a formal letter that outlines all of the damages you incurred from your accident. The objective with your demand letter is to make a case for the compensation you're entitled to.

What does it mean to settle an insurance claim?

Definition of 'settle a claim' If an insurer settles a claim it pays money to a policyholder for the occurrence of a loss or risk against which they were insured.

Should you accept first offer insurance claim?

Once the offer is made, you have 21 days to decide whether or not to accept it. You should always take legal advice before accepting a Part 36 offer, especially if you have a conditional fee agreement or are using an insurance policy to cover your legal expenses, as you may find you invalidate your contract.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What should you not say to an insurance adjuster?

The top 5 things to not say to an insurance adjuster areadmitting fault,saying that you are not hurt,describing your injuries,speculating about what happened, or.saying anything on the record.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease or eliminate payments for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

How do you respond to a low ball settlement offer?

Here's a quick summary of the steps you and your attorney will follow when responding to a low settlement offer: Remain calm and analyze the offer even if you feel like the adjuster is trying to take advantage of you. Ask questions to find out how the adjuster came to the conclusion that they did.

What are the 4 steps in settlement of an insurance claim?

Negotiating a Settlement With an Insurance Company. ... Step 1: Gather Information Needed For Your Claim. ... Step 2: File Your Personal Injury Claim. ... Step 3: Outline Your Damages and Demand Compensation. ... Step 4: Review Insurance Company's First Settlement Offer. ... Step 5: Make a Counteroffer.More items...

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How long does an insurance company have to investigate a claim?

within 30 daysIn general, the insurer must complete an investigation within 30 days of receiving your claim. If they cannot complete their investigation within 30 days, they will need to explain in writing why they need more time. The insurance company will need to send you a case update every 45 days after this initial letter.

Do insurance companies want to settle quickly?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

Is Geico good at settling claims?

Fortunately, most GEICO claims are settled quickly and never result in a lawsuit. However, if you are sued, don't worry—just notify GEICO immediately.

How long does it take Liberty Mutual to settle a claim?

In general, it can take Liberty Mutual an average of ten weeks to respond to a demand package. After reaching a settlement, it can take anywhere from two to six weeks to receive a settlement check.

Why insurance claims are rejected?

Most of the reasons behind your car insurance claim being rejected are fairly obvious and self-explanatory. In the instance of an unlicensed driver, drunken driver, unpaid premiums or unroadworthy vehicle, your short-term insurance company is highly unlikely to approve your claim.

Do I Need to Hire a Personal Injury Lawyer for a Car Accident Claim?

It depends on the facts of the case. Some car accident cases do not require the assistance of an attorney. If you sustained minor injuries, understand the value of your damages and the insurance company agrees to pay you the amount you desire, you might not need an attorney’s assistance.

What to do if you are not happy with the insurance company's settlement offer?

If you are not happy with the insurance provider’s settlement offer, you can make a counteroffer and negotiate a settlement. It is best to make a counteroffer for more money than you are willing to accept to settle the claim. Using a higher figure allows you to negotiate if the insurance company rejects your counteroffer.

What happens when you accept a settlement offer from an insurance company?

When you accept a settlement offer from an insurance company, the settlement agreement is a final resolution of your claim. After you sign the agreement, you cannot demand more money for your claim.

Why do insurance companies pay the lowest amount?

Insurance companies want to pay the lowest amount possible to resolve your car accident claim. The company is in business to make money. Paying claims hurts the company’s profit margin

What is a settlement offer in a car accident?

The insurance company for the at-fault driver in a car accident case might make a settlement offer. A settlement offer is an agreement to end the dispute. The insurance adjuster offers a specific amount of money to resolve your injury claim.

Do insurance companies release all claims?

The insurance company may not explain that you are releasing all claims and all parties when you sign a car accident settlement agreement. The language of the release could be difficult to understand and buried within a lengthy document.

Can you get a quick settlement for a car accident?

The insurance company may offer you a quick settlement for your car accident claim. In some cases, the company may issue an offer before you complete medical treatment for injuries. Beware of a settlement offer issued before each accident victim completes treatment for their injuries.

What is a settlement agreement?

A settlement agreement is a legally binding document between and employee and employer, which settles claims the employee may have arising from the employment or termination of employment. The employee must be advised by a qualified independent adviser, usually a solicitor, before signing the agreement.

How to protect a settlement agreement conversation?

If the conversation is protected it can’t be used. If an employer has made an offer and it’s not protected, that could be used as leverage in negotiations by an employee or to support an unfair dismissal claim.

Should I accept a settlement offer?

We recommend you talk to a specialist employment solicitor and weigh up the merits of the offer against the alternative options available. The table above provides a framework to help you come to the best decision for you.

What happens if I don’t accept a settlement agreement?

If the employee rejects the offer often the underlying risk is that the employee’s employment may be terminated following the completion of the relevant process.

What does Without Prejudice mean?

If a letter or discussion is Without Prejudice it means it cannot be used or referred to in any legal proceedings like an employment tribunal claim. The opposite of a without prejudice communication is an ‘open’ communication which is capable of being used or ‘admitted’ in legal proceedings.

How do I respond to a low offer?

If the offer isn’t anywhere near the ballpark you’d accept, you may decide to reject it and make it clear you see no point making a counter offer as your miles apart . That’s a bold strong move but risks killing off the negotiations and pushing you towards a dispute and tribunal claim.

What is notice in lieu of notice?

notice (or payment in lieu of notice if not worked) statutory redundancy entitlement. If the employer asks the employee to sign a settlement agreement an employee should reasonably expect something extra to sign. Usually this will come in the form of an enhanced tax-free termination payment.

Why do you have to include reason for termination in settlement agreement?

Reason for termination. Although not a requirement, you may want to include the ‘reason for termination’ in the settlement agreement. This can be important if you have income protection insurance which will only pay out in specific circumstances. Some policies specify that the reason for termination must be redundancy in order for payments ...

What is settlement agreement?

Essentially, a settlement agreement is a means of an employee agreeing not to bring an employment law claim in return for something – usually financial compensation, although there may be other benefits in addition to this – from the employer.

Is the first £30,000 of a payment in respect of the termination of your employment tax free?

The first £30,000 of a payment in respect of the termination of your employment can be free of tax and National Insurance. However if you receive contractual payments – for example bonus payments -, these will be taxable.

Is a settlement confidential?

However, if the discussions are not in the context of proceedings or a dispute between the parties, it used to be the case that they would not automatically confidential. Since 2013, section 111A Employment Rights Act 1996 allows these discussions to be kept confidential for the purposes of an unfair dismissal claim, even if there are no existing proceedings or dispute between employer and employee However, the confidentiality provided for by section 111A does not apply to claims to have been dismissed for an automatically unfair reason – such as dismissal related to maternity – to discrimination claims or breach of contract claims.

Can an employer change a term of employment?

Alternatively, your employer may wish to change a term of your employment in a way that could otherwise be a breach of contract. They may offer compensation to you under a settlement agreement to try ...

Can you negotiate a settlement agreement with an employment tribunal?

Whether the discussions have come as a surprise to you, or are something you have anticipated, there are advantages to negotiating a settlement agreement which might not be achieved through an employment tribunal claim – for example you may obtain an agreed reference or an apology from your employer which the tribunal could not order.

Does an adviser have insurance?

In every case, the adviser has to have insurance covering any claim arising from the advice given to the employee. Your employer may well offer to pay for you to receive this legal advice, to ensure that this aspect of the requirements for a valid settlement agreement is met.

What happens if you don't read a settlement agreement?

Still, if you don’t read a settlement agreement carefully or know where to look, you may not realize it says that when you take money from Insurance Company X, you are giving up your ability to sue Insurance Company Y and Party Z for additional damages. This, too, is a reason why it is so important to run any settlement agreement past an attorney or, better yet, to retain an attorney to conduct settlement negotiations for you. There is nothing more unfortunate than when someone asks for our help at Hasner Law and it turns out they’ve already signed away their rights against parties who would otherwise have owed them significant damages.

What is release of legal claims?

Like the release of legal claims described above, the release portion of a settlement agreement also typically demands you give up claims relating to all injuries and other damages arising from or relating to the car accident. This means that if you sign a settlement agreement believing the accident caused you a relatively limited injury, only to discover later that you suffered a much worse injury than you thought, you are out of luck. The insurance company or opposing party wants to make sure it’s paying you once, and only once, for your car accident injuries. It is extremely rare for insurer or opposing party to agree to leave wiggle room for you to assert new injuries down the road, especially if you try to negotiate the settlement agreement yourself instead of through a qualified attorney.

What does a release cover in a car accident?

The defendant in a car accident case usually demands a release that covers all legal claims (what lawyers call causes of action) that could exist now or in the future against the defendant, arising out of or relating to the car accident, whether or not the injured party ever actually asserted those claims against the defendant.

What is a release in a settlement agreement?

Settlement Agreements Cover Legal Claims You Didn’t Make. The part of the settlement agreement that the party paying money to you cares most about is called a release. In fact, depending on legal practice where you live, some settlement agreements have the title settlement agreement and release, or simply release.

How to contact Hasner Law in Atlanta?

Call Hasner Law in Atlanta today at 678-888-4878 or contact us online.

What happens if you get injured in a car accident in Atlanta?

In Atlanta, a person injured in a car accident caused by someone else’s wrongful actions has the right to take legal action seeking compensation. Most, but not all, of these personal injury lawsuits end in a settlement in which someone (usually, but not always, an insurance company) pays the injured person money in exchange for ...

Can you trust a form contract?

Never trust a form contract. It’s always written in favor of the party who asks you to sign it. That’s especially the case when it comes to form settlement agreements from insurance companies. If an insurance company gives you one of these agreements to sign, beware.

1. Settlement Agreements Are Binding

When both parties are planning a settlement, they will have an agreement drawn up. Once the relevant parties sign the settlement agreement, it is final.

2. Settlement Agreements and Release

When a settlement agreement is drafted, it includes something called “release.” In fact, these contracts are sometimes called “settlement agreement and release.”

3. Settlement Agreements and Unknown Injuries

Settlement agreements release a defendant from all claims related to the injury accident. This means that a settlement agreement might not cover future treatments for your injuries if you sign the settlement before you’ve fully recovered.

4. Settlement Agreements and Other Parties

Some settlement agreements include even more restrictions. Some of these contracts prevent you from pursuing compensation from certain parties other than the defendant.

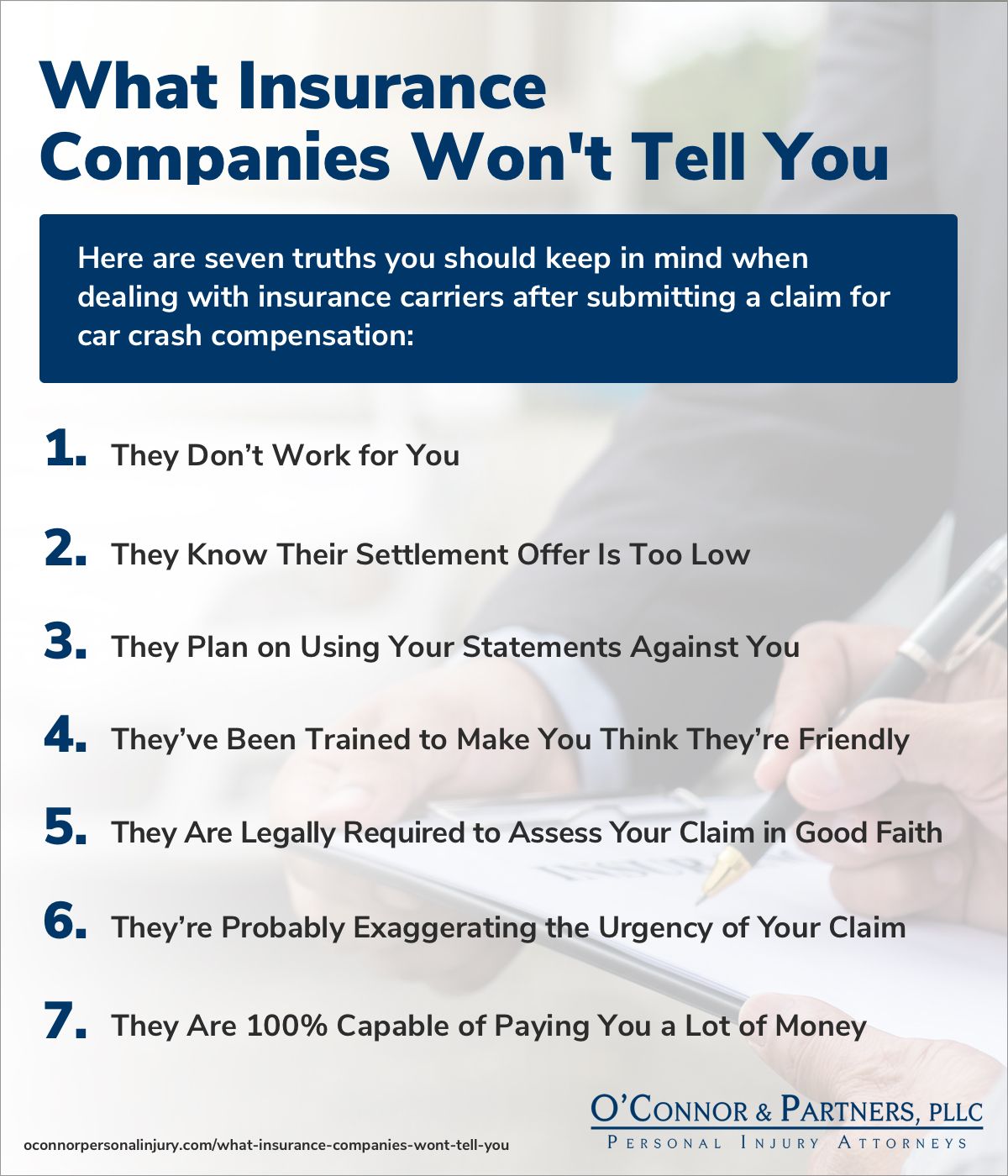

5. Insurance Companies Work Against You

It is important to understand that insurance providers are not on your side. Insurance companies are incentivized to pay the least amount possible on each claim.