- Assess your situation. ...

- Research your creditors. ...

- Start a settlement fund. ...

- Make the creditor an offer. ...

- Review a written settlement agreement. ...

- Pay the agreed-upon settlement amount.

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

What to include in a debt settlement letter?

There are some key details that all debt settlement offer letters should have:

- The full name used for the credit account

- Your full address

- Your account numbers or a reference number from the creditor

How to write a debt recovery letter?

- A debt collection letter reminds a debtor that they owe you money.

- You can use a debt collection letter to set up a repayment plan or warn of impending legal proceedings.

- A debt collection letter should include the total debt owed, the initial due date, and any necessary warnings of impending legal action.

Is a debt settlement worth it?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you’re able to offer a lump sum of money to settle your debt. If you’re carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you. There are numerous debt settlement and credit card companies that promise to help you settle your debt for half or even a small fraction of the total balance you owe, but is debt settlement really a good idea?

How do I write a debt settlement letter?

When writing a debt settlement letter, it's important to be explicit and detailed. Treat the letter as a contract between you and your creditor. Include your personal information and account number for easy identification. You'll need to outline the amount you can pay and what you expect in return.

Can I do my own debt settlement?

You may be able to get faster results with DIY debt settlement. While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

What is a reasonable offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What percentage will creditors settle for?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Is it worth it to settle debt?

In general, paying off the total amount of debt you owe is a better option for your credit. An account that appears as "paid in full" on your credit report shows potential lenders that you have fulfilled your obligations as agreed, and that you paid the creditor the full amount due.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What should you not say to debt collectors?

9 Things You Should (And Shouldn't) Say to a Debt CollectorDo — Ask to see the collector's credentials. ... Don't — Volunteer information. ... Do — Make a preemptive offer. ... Don't — Make your bank account accessible. ... Maybe — Ask for a payment-for-deletion deal. ... Do — Explain your predicament. ... Don't — Provide ammunition.More items...

Is it better to settle a debt or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Will Debt collectors settle for half?

Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

What happens when you settle a collection for less?

When you settle an account, its balance is brought to zero, but your credit report will show the account was settled for less than the full amount. Settling an account instead of paying it in full is considered negative because the creditor agreed to take a loss in accepting less than what it was owed.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

How much should you settle a debt?

Use this template during the early stage of negotiations – start negotiations at 10% – 20% of what the balance is on each debt – and from there you can expect to settle somewhere close to the middle, between your original offer and the creditor’s counter-offer.

What should your state of mind be when negotiating debt?

Your state of mind when negotiating debt should be calm and alert, focused, and confident, and grounded but yet creative. Whatever you do, don’t become agitated or too disengaged.

How long do you have to wait before renegotiating?

You may have to wait six more months or a year even before re-negotiating, and in that time you focus on another debt, and one by one you will eventually get all of your debts paid off and settled, and that is the art of debt settlement and negotiating to settle debts.

Can you settle a debt over the phone?

Never negotiate to settle a debt all over the phone, everything needs to be in writing.

Is debt validation better than debt settlement?

A less expensive and more efficient debt resolution option could be debt validation, take a look at debt validation next. Often, when it comes to debt collection accounts, debt validation can be a better option than debt settlement or settle debt on your own.

Can a credit card company sue you?

Even if they do sue you, more than 90% of credit card lawsuits are flawed or inaccurate. Therefore, go to court and state your case to the judge. In most cases, the creditor won’t even show up to court, so you will automatically win the case, due to them knowing that the lawsuit is flawed. You can always contact Golden Financial Services, and we can help with almost any type of debt problem.

Can a debt collection company counter offer?

Most of the time the debt collection company will counter offer on your original offer. Don’t say yes. Don’t listen to them tell you that this is their final offer, they are bluffing and often full of nonsense and lies!

How long should a telephone call be for creditors?

When talking to your creditors, follow the suggestions listed below: 1. Keep it Short – The telephone call must be less than 10 seconds.

Why do creditors choose a settlement over bankruptcy?

Most likely, your creditors will choose a settlement over bankruptcy because no one wins with a bankruptcy except the bankruptcy attorney. Also remember to never let them know exactly how much money you have because this can jeopardize your negotiations.

What is debt settlement?

The definition of debt settlement as found in Wikipedia states, “Debt settlement, also known as debt arbitration, debt negotiation or credit settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.”.

How long does it take for a creditor to settle a debt?

Generally, creditors send accounts that have been delinquent for four to six months to outside collections agencies. After this happens, you have the option of settling your debts if you have a sum of money to offer them.

What happens if you know what debt collectors are?

If you know what debt collectors are and are not allowed to do, you will be protected from those who wish to take advantage of you. When these people violate the FDCPA, you will know right away, and you can report their abuses to the authorities.

Can creditors sue you for bankruptcy?

Your creditors may eventually accept your lower offer to prevent a bankruptcy, but they may also initiate lawsuits. If your creditors do sue, you could always go to court and plead your case with the judge. Show the judge your hardship letter and explain your circumstances.

Can you file bankruptcy if you have saved 20 percent?

Bankruptcy is NOT an Option! You can begin negotiating settlements with your creditors after you have saved between 10 and 20 percent of your balances. Then, you can call or write to each one. Use this debt settlement letter to send each creditor your initial low-ball-offer.

What is a counteroffer letter?

This template letter makes a counteroffer when an original creditor offers you an initial settlement amount. The goal is to offer a lower amount and negotiate for a removal of the negative information from your credit history.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!

Why do you need to include account number on credit report?

This must be included so the creditor will know exactly which debt you’re proposing to settle. The account number you’ll include on the reference line should be the one provided directly by the creditor. Account numbers listed on credit reports are sometimes scrambled, which makes them invalid.

Why do you need to sign a letter?

Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt. If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

What to do if you can't pay your debt?

If you decide to try to settle your debts, you’ll start the process by writing a debt settlement letter. You’ll use the letter to propose settling the debt for a reduced amount.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

What is do it yourself debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed.

How much does a debt settlement company charge?

With a debt settlement company, you’ll likely pay a fee of 20% to 25% of the enrolled debt once you agree to a negotiated settlement and make at least one payment to the creditor from an account set up for this purpose, according to the Center for Responsible Lending.

What company did the CFPB take legal action against?

In 2013, the CFPB took legal action against one company, American Debt Settlement Solutions, saying it failed to settle any debt for 89% of its clients. The Florida-based company agreed to effectively shut down its operations, according to a court order.

What is the difference between debt settlement through a company and doing it yourself?

Time and cost are the main distinctions between debt settlement through a company and doing it yourself.

What does "settled" mean on credit report?

Settled debts are generally marked as “Settled” or “Paid Settled,” which doesn’t look great on credit reports. Instead, you'll try to get your creditor to mark the settled account “Paid as Agreed” to minimize the damage.

How long can you be behind on a debt settlement?

Debt settlement is an option if your payments are at least 90 days late, but it’s more feasible when you're five or more months behind. But because you must continue to miss payments while negotiating, damage to your credit stacks up, and there is no guarantee that you’ll end up with a deal.

How long does it take to settle a debt?

While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

How much of your debt should you settle?

When negotiating, you need to come to the table with at least 50% of what you owe for the creditor to seriously consider offering a debt settlement.

What is debt settlement?

Debt settlement is a financial agreement where the lender agrees to accept a lump-sum payment from the borrower to settle an outstanding debt. The payment is for a significantly lower dollar amount that what was owed, making it one of the most attractive debt-relief options available.

What happens if a creditor believes they are unlikely to receive the full payment?

If the creditor believes they are unlikely to receive the full payment, you have a great chance at debt settlement. The older the debt is, the better the chance you will succeed with a debt settlement offer.

What happens if you settle a debt yourself?

If you do it yourself, you negotiate the debt settlement on your terms without the cost of hiring someone who you can’t afford.

How long does it take to settle a debt?

Working with a debt settlement company can take 3-5 years to complete. Doing it yourself involves only you and the creditor when you cut out the third party. This saves you money from paying a percentage of the settlement to the third-party settlement company.

How long does debt settlement stay on your credit report?

A drawback to debt settlement is that it stays on your credit report for seven years, discouraging any lenders (home, auto, credit card, etc.) from giving you more credit. It also damages your credit score by 75-100 points, meaning that if a lender gave you credit, they would do so at a very high interest rate. For example, a 5% car loan might cost you 18% -20% because of debt settlement. That would be thousands more you must pay for a car because you have debt settlement on your credit report.

What happens if you make a plan and save money to execute the plan?

If you make a plan, and save money to execute the plan, you will be well on your way to being debt free.

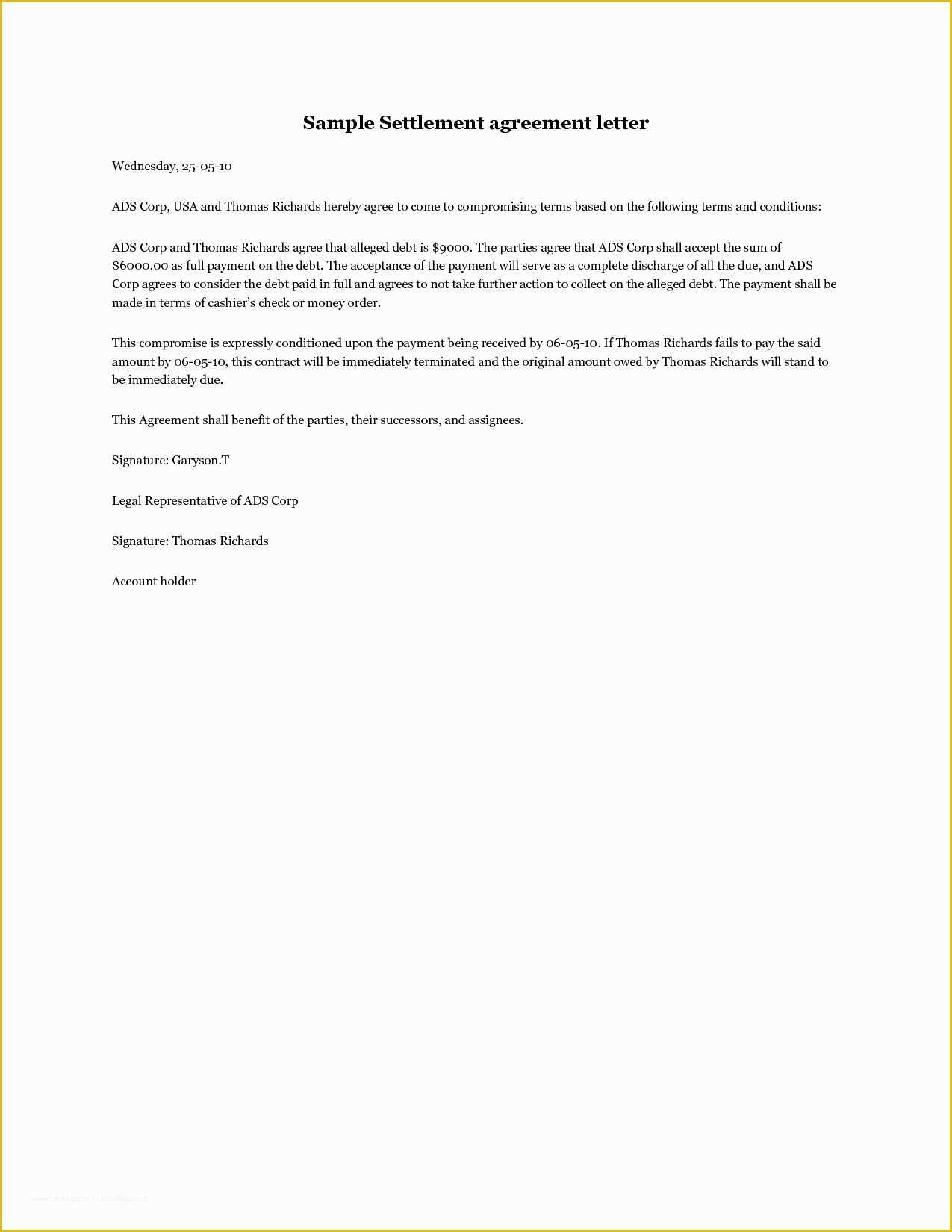

What a Debt Settlement Agreement Must Include

After you have negotiated a debt settlement with a creditor, such as a credit card company, you will need to formalize your agreement in writing. You can write the agreement yourself and send two copies to your creditor so that they can send a signed copy back to you. Or it may be easier to have your creditor draft up a letter and send it to you.

Sample Debt Settlement Letter Template

Here is a general template that you can use to draft your debt settlement agreement. You can add to, remove, or modify the information contained in this agreement to match your circumstances. The agreement letter can be either simple or complex, depending upon your specific financial situation and the type of debt that you owe.

How to avoid credit damage?

However, there are several solutions you can negotiate which may allow you to avoid credit damage, including: Negotiating to list a credit account status as paid in full. Negotiating to re-age an account to remove delinquent payments. Using pay for delete to remove a debt collection account from your credit report.

Why is it important to negotiate a settlement?

It’s important when trying to negotiate a settlement that you have realistic goals. You’re not going to get out of debt for nothing – you’ll need to pay something to get your balances discharged. How much you end up paying depends on what you want to accomplish and who you’re negotiating with.

What is the original creditor?

The original creditor – i.e. the credit card company that you have the account through. An in-house collections department, who may be trying to collect on a debt that’s past-due but not charged off yet. A third-party debt collector that’s attempting to collect on a charged off debt on behalf of the original creditor.

What is debt buyer?

A debt buyer, who purchased a portfolio of bad debts from the credit card company for a small percentage of each amount owed. A debt buyer is much more likely to settle for a lower amount. They paid pennies on the dollar to purchase your debt from the credit card company.

How much does a debt settlement pay?

The average debt settlement pays out roughly 48% of the original amount owed.

What to do if your debt is not matching your records?

Ask for the agency’s name, the name of the representative that you’re speaking with , and a contact call-back number. Then ask that they send you a written notice about the debt immediately.

What happens when you settle your debt?

When you settle your debt, you agree to pay less than what you owe. Depending on your situation, this may be the right form of debt relief for you. Unlike some other methods, you don’t always have to use a professional service to settle. The following steps will teach you how to negotiate debt settlement on your own.