What is the HUD VASH program for veterans?

Overview The HUD-Veterans Affairs Supportive Housing (HUD-VASH) program combines HUD’s Housing Choice Voucher (HCV) rental assistance for homeless Veterans with case management and clinical services provided by the Department of Veterans Affairs (VA).

Can a veteran be housed in HUD-VASH with no income?

While a Veteran can be housed in HUD-VASH with no income, living long term without resources is difficult; therefore we recommend that case managers and veterans begin immediately working to obtain income. Veterans must be sober or “ready” for housing.

What happens when you pass the screening for HUD-VASH?

When you pass the screening, you will receive a housing voucher and assistance from a HUD-VASH case manager. The caseworker will help you find a home within a reasonable distance from your local Veterans Affairs Medical Center (VAMC).

What disqualifies you from the HUD-VASH program?

If you do not meet any of the descriptions listed above, HUD-VASH does not consider you homeless. This will disqualify you from becoming part of the program. Additionally, applicants must require case management services in order to obtain and sustain independent community housing.

Does assets count as income?

Assets themselves are not counted as income. But any income that an asset produces is normally counted when determining a household's income eligibility.

How does HUD calculate adjusted gross income?

Adjusted Income is defined as Annual Income minus any HUD allowable deductions. So, to calculate your Adjusted Income, you must first calculate your Annual Income, and then subtract certain amounts deemed “deductible” by HUD.

How are HUD assets calculated?

Owners must count assets disposed of for less than fair market value during the two years preceding certification or recertification. The amount counted as an asset is the difference between the cash value and the amount actually received. counted, including cash gifts as well as property.

How does HUD define income?

(1) The full amount, before any payroll deductions, of wages and salaries, overtime pay, commissions, fees, tips and bonuses, and other compensation for personal services; (2) The net income from the operation of a business or profession.

What is not counted as income?

Irregular gifts, inheritances, life insurance proceeds, Payments from insurance, worker's compensation, or court judgments or settlements that compensate for loss or personal injury..

What is considered other income?

Other income is income derived from activities unrelated to the main focus of a business. For example, a manufacturer of washing machines earns rental income from sub-leasing unused office space to a third party; this rental income would be classified as other income on the company's income statement.

What are considered assets?

An asset is anything you own that adds financial value, as opposed to a liability, which is money you owe. Examples of personal assets include: Your home. Other property, such as a rental house or commercial property.

Does 401k count as asset?

Retirement funds: Retirement accounts such as your 401(k), IRA, or TSP are considered assets.

How are household assets calculated?

How to set up a personal net worth statement.List your assets (what you own), estimate the value of each, and add up the total. Include items such as: ... List your liabilities (what you owe) and add up the outstanding balances. ... Subtract your liabilities from your assets to determine your personal net worth.

What is the most HUD will pay for rent?

The maximum housing assistance is generally the lesser of the payment standard minus 30% of the family's monthly adjusted income or the gross rent for the unit minus 30% of monthly adjusted income.

What is the highest income for Section 8?

To qualify for Section 8 Housing, a tenant must make no more than 50 percent of the median income for the metro area to which they're applying. In areas of the country that have the highest income limits such as New York and San Francisco, that totals $117,400 for a family of four.

What is the most Section 8 will pay?

The payments cover some or all of the voucher holder's rent. On average, each household will pay somewhere between 30% and 40% of its income on rent.

How is monthly adjusted gross income calculated?

Subtract your deductions from your total annual income Now that you have your total annual income and the total amount of your deductions, subtract your deductions from your total annual income. This will result in your annual adjusted gross income. To get your monthly adjusted gross income, divide this figure by 12.

How do you calculate 30% of rent?

To calculate, simply divide your annual gross income by 40 - if you make $120,000 a year, you can spend $3,000 on rent. An equivalent is the 30% rule, meaning that you can put 30% of your annual gross income in rent. If you make $90,000 a year, you can spend $27,000 on rent, and so your monthly rent will be $2,250.

What's total gross income?

Gross income refers to the total earnings a person receives before paying for taxes and other deductions. The amount that remains after taxes are deducted is called net income. When looking at a pay stub, net income is what's shown after taxes and deductions.

How does HUD define family?

Family Member is defined as follows, regardless of actual or perceived sexual orientation, gender identity, or legal marital status: • child, parent, or grandparent; o a child is defined as a son, stepson, daughter, or stepdaughter; o a parent or grandparent includes a step-parent/grandparent or foster.

Does the PHA determine if a family is eligible for HUD?

After admission, income limits do not apply.

Can a VA family enroll in FSS?

Yes. HUD-VASH families are eligible to enroll in FSS. The focus of the FSS program isemployment of the head of the FSS family. In developing the Individual Training and ServicesPlan (ITSP) for a veteran, the head of the FSS family, the FSS program coordinator will workwith both the veteran and the veteran’s VA case manager. This coordination will ensure that theplan is appropriate for the veteran, that it does not conflict with case management requirementsor impose unrealistic burdens on the veteran and that it incorporates VA resources plus anyadditional resources available through the local FSS program. The FSS escrow account thataccrues during the term of the FSS contract will be a valuable asset building tool for HUD-VASH participants.

What is HUD VASH?

HUD-VASH is a collaborative program between HUD and VA combines HUD housing vouchers with VA supportive services to help Veterans who are homeless and their families find and sustain permanent housing.

How to find a VA homeless coordinator?

Use the VA locator tool www.va.gov/directory to find your nearest VAMC and call or visit today.

Answer

Receipt of Federal benefits with income limits implies that you qualify based upon the guidelines set by the federal government. Personal injury awards are actually considered “income” (whether or not you get taxed on the award is a different story), so it is something you would ultimately need to claim.

Cancel reply

Don’t ask a personal injury question here – comments are not reviewed by an attorney. Ask your question on this page. Required fields are marked *

How does HUD affect special needs trusts?

HUD benefits add a layer of complexity to special needs trust administration due to both the rules and the inconsistent way in which they are applied. Special needs trusts, whether pooled or standalone, must follow certain rules to ensure their beneficiaries do not lose the public benefits. One such rule is that the trust be used only to supplement but not replace or supplant those benefits. In practicality, this means Trustees apply categorical prohibitions. For example, if a beneficiary has SSI, a Trustee may not pay for food or shelter expenses. This is relatively straightforward and simple from an administration perspective.

How does the housing authority determine the amount of a voucher?

The local housing authority determines the amount of the voucher based on the above factors and the cost of rent in the local housing market. It is then up to the voucher recipient to find a suitable dwelling for that price (if the rent is higher than the voucher, the recipient pays the excess). The recipient will likely also pay 30-40% of monthly adjusted income.

What is HUD voucher?

The best-known of these programs is the Section 8 voucher program . To qualify for the voucher program, the local housing authority will assess a person’s income, net family assets, and family composition.

Why did the Housing Authority rule cite above allowing trust distributions to be counted?

The housing authority’s argument boiled down to an assertion that had the funds gone straight to the beneficiary’s bank account they would have been excluded from income. Because the funds went to an irrevocable trust, they triggered the rule cited above allowing trust distributions to be counted.

What is Section 8 housing assistance?

If your client has housing assistance through the U.S. Department of Housing & Urban Development (HUD), which includes Section 8 benefits, it is critical from a planning perspective to understand how those benefits work. Not understanding the federal program and the nuances of your client’s local program could result in a variety of issues from inconvenience to your client to loss of a benefit he or she desperately needs.

What is included in HUD guidelines?

HUD’s guidelines list the categories of income that are included and excluded. [2] Income generally includes what one would expect it to include: wages, income from a business , interest earned on investments , periodic annuities, etc. Of note are exclusions for lump sums (inheritances, insurance payments, and settlements for personal or property losses) and reimbursement of medical expenses. The lump sum category has an exclusion to the exclusion, however, for payments in lieu of earnings which includes worker’s compensation (meaning these payments are income).

Can Section 8 vouchers be counted as income?

For a beneficiary with Section 8 vouchers, any regularly-occurring distribution could be counted as income while “sporadic” distributions are excluded. Navigating this rule has created a “best practice” of distributing funds irregularly. This can be achieved by only paying for one-time purchases as opposed to purchases that occur every month such as a cable or cell phone bill. Depending on the nature of the expense, creative solutions can sometimes be utilized such as paying ahead a few months on a bill (varying the number of months each time). Another option is making distributions to an ABLE account. These decisions must be made on a case-by-case basis in full consideration of the beneficiary’s other benefits.

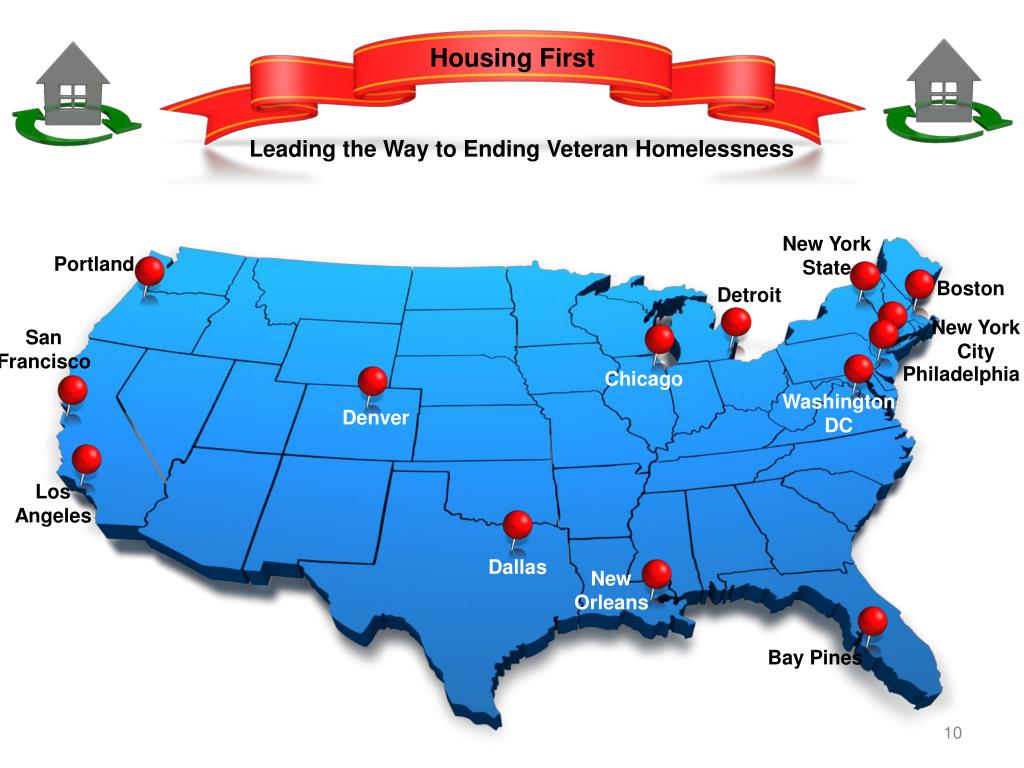

How can we end veteran homelessness?

It requires knowing every veteran experiencing homelessness in a community by name, a streamlined and coordinated system to connect these veterans with housing, and the necessary housing resources to ensure that every veteran in need has a place to call home.

How long can a veteran stay in transitional housing?

Truth: Although veterans who are in transitional housing for longer than 90 days are no longer considered “chronically homeless” by the HEARTH Act definition, they are still eligible for the HUD-VASH program if they meet the criteria, that is: have high vulnerability and need case management services to successfully sustain permanent housing. Case Managers should begin work toward permanent housing with veterans who are appropriate for HUD-VASH as soon as possible in their transitional stay, concurrently (rather than sequentially) with other programs. There are no maximum or minimum thresholds for the number of days before a veteran may start to work with HUD-VASH. However, the target population of HUD-VASH includes those who are most at risk, vulnerable and in need of HUD-VASH, particularly those who may not “successfully” complete a transitional housing placement.

Do veterans have to follow PHA rules?

The veteran must agree to participate in case management services tailored to meet his or her needs. The veteran will be required to follow the PHA and landlord’s rules, which may have a requirement for no drug or alcohol use, but there is no set period of sobriety to qualify for HUD-VASH.

Does the VA shorten the time between HUD vouchers?

Thanks to the effort from the VA to help communities meet the resource needs, many communities are now focusing on shortening the time between when a HUD-VASH voucher is issued to the veteran and the veteran moves into housing.

Do you have to be clean to be eligible for HUD VASH?

The veteran will be required to follow the PHA and landlord’s rules, which may have a requirement for no drug or alcohol use, but there is no set period of sobriety to qualify for HUD-VASH. It is not the role of the case manager to enforce PHA and landlord rules, but rather to work with the veteran to understand the consequences of violating tenant rules. VA case managers are not cops!

Is prior treatment required for HUD VASH?

Truth: Prior treatment completion is NOT a requirement to participate in HUD-VASH. Veterans must simply be stable enough to participate in the voucher program (i.e.: not a threat to self or others.) The case manager works with the veteran on housing stability, which will include discussions around barriers to sustaining housing and treatment options available to help address those barriers. The veteran drives the case management goals and agrees to the options that he/she feels will help him/her to sustain permanent housing.

Can a veteran be housed in HUD?

Truth: While there is a cap on how much income a veteran can have, there is not a minimum amount of income. Any minimum income requirement is locally determined and not a requirement of HUD-VASH. While a Veteran can be housed in HUD-VASH with no income, living long term without resources is difficult; therefore we recommend that case managers and veterans begin immediately working to obtain income.

What is a hud vash?

What is HUD-VASH? HUD-VASH is a program that offers rental assistance for veterans and their families. The goal of VASH housing is to end veteran homelessness and provide those who have served this country with the help and services they need to live independently.

Why is case management important for veterans?

Case management is one of the key components of the program, which is why the veterans housing assistance program targets vulnerable veterans. Applicants accepted often times have mental health problems, physical disorders or substance use issues.

Can a veteran receive HUD VASH?

If you are a veteran who wants assistance with paying rent, that does not mean you are eligible to receive HUD-VASH benefits. There are certain requirements you must first meet in order to enter the program.

Does HUD consider you homeless?

If you do not meet any of the descriptions listed above, HUD-VASH does not consider you homeless. This will disqualify you from becoming part of the program.

Can you move into a new home with a HUD voucher?

He or she ensure the home meets appropriate standards for you to live in. If the case manager approves of the unit, you can move into your new home. You must remember that you are responsible for participating in case management and paying for the remaining of the rent not covered by the voucher.

Can a family member be eligible for HUD VASH?

Note: For veterans and their families to be eligible for HUD-VASH, the veterans must be the individuals who require the casework. If a veteran does not need assistance and it is instead a family member who needs help, the family is not eligible.