Is workmans comp considered earned income credit for taxes?

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. However, retirement plan benefits are taxable if either of these apply:

How to calculate a worker's Comp settlement?

How to Calculate a Workers' Comp Settlement

- Permanent Impairment. If you suffer an injury at work that results in permanent impairment, it means you have a physical, psychological, or functional loss of ability that is expected to ...

- Impairment Rating. ...

- Permanent Impairment Benefit. ...

- Bodily Impairment Rating. ...

Can creditors Levy workmans comp settlement?

Creditors can levy anything, or garnish your wages or freeze your assets and even place liens on your property (from homes to cars). A workers compensation settlement is a settlement, just like a regular civil lawsuit, so those monies when deposited into your bank account can certainly be taken.

How does worker's Comp determine a settlement?

Workers' compensation settlements are calculated based on a variety of factors including lost wages, current and future medical expenses, your impairment rating, your education, and the cost of retraining for a different position if a worker is unable to return to their previous position.

Does compensation count as income?

Any interest you receive after you've invested your compensation might be taxable, and you'll need to declare it on any tax return. In some cases, the tax will have already been paid 'at source' - this means the tax has already been paid before the interest is given to you, but you'll need to declare it either way.

Is a compromise and release settlement taxable?

Workers' compensation benefits are not taxable. This includes payments an injured worker receives in a Compromise and Release workers' compensation settlement.

Should workers compensation be reported on w2?

No, your employer didn't make an error if you don't see your workers' compensation reflected on 2020's W-2. That's because workers' compensation is not considered taxable income. As a result, it is not reported on your W-2 form.

What is the most you can get from workers comp?

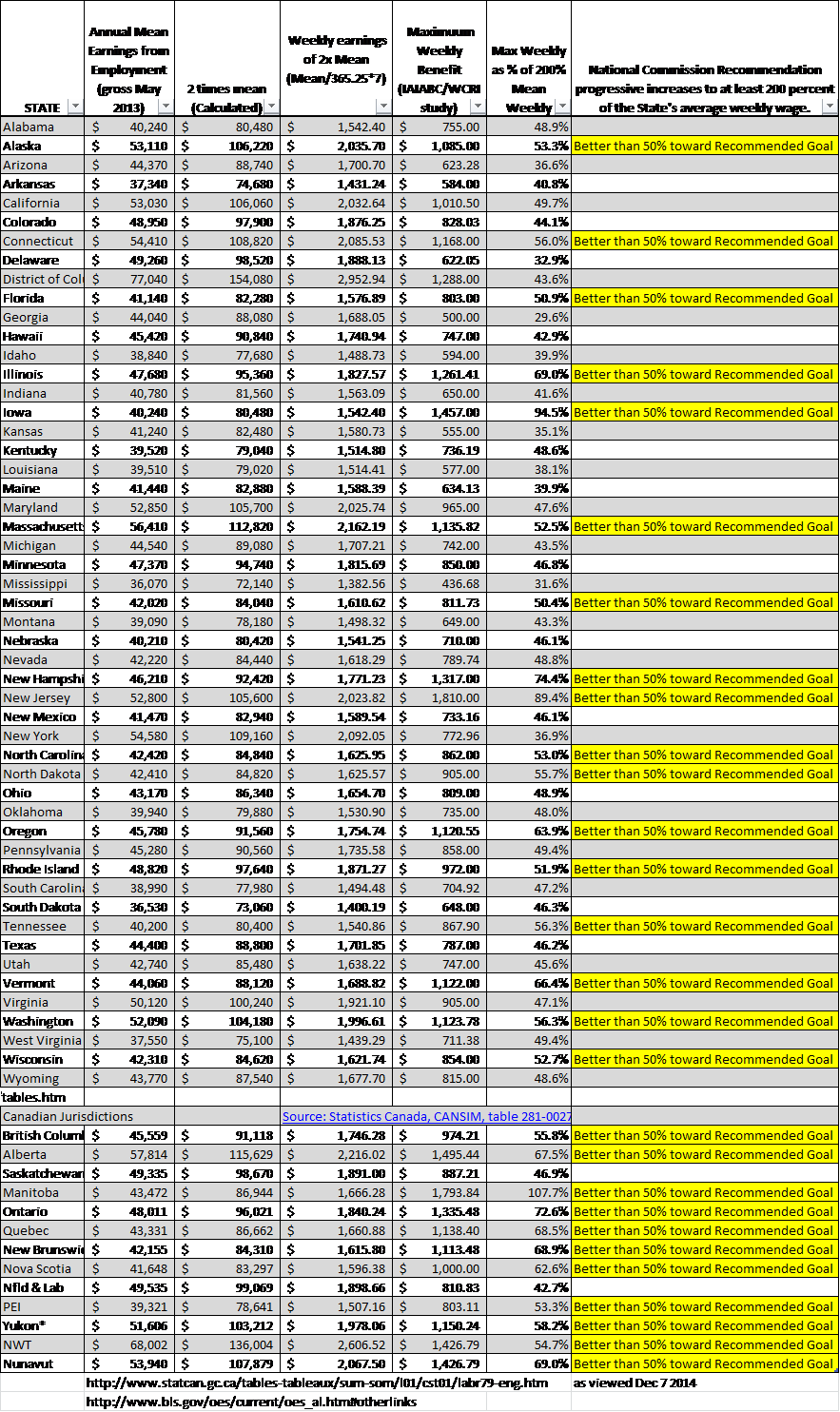

Average Workers' Comp Benefit Amounts However, most states have capped the maximum weekly benefit at around $1,000 per week, regardless of the employee's AWW. The benefits for partial disability are calculated in a different way.

How can I avoid paying taxes on a settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

How long do most workers comp settlements take?

around 12-18 monthsHow Long Does It Take to Reach a Settlement for Workers' Comp? The entire settlement process—from filing your claim to having the money in your hands—can take around 12-18 months depending on the details of your case and whether or not you have legal representation.

Is permanent disability taxable?

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

Where do I put workers comp on TurboTax?

@aman2020 You should receive a form 1099-G reporting your workmen's compensation income and you will enter that in the Unemployment section of TurboTax, which is in the federal Wages and Income section.

How is workers comp calculated?

Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.

What is permanent impairment benefit?

Non-Economic Loss benefits A permanent impairment means a physical, functional, or psychological loss of ability that is expected to last for the rest of the person's life. To qualify for NEL benefits, the medical report must show the condition will not likely improve, referred to as maximum medical recovery or MMR.

How much do I get paid for injury on duty?

Employers are also required to meet the compliance standard that states that it is their responsibility to make up payment of 75% of the wages or salary of the injured employee for the first three months after the injury on duty. The amount is refundable by the Compensation Commissioner.

How long does it take to get the Rtwsp check?

An eligibility determination will be made within 60 days. Privacy Notice on Collection of Personal Information: The Department of Industrial Relations will use the personal information collected below to determine your eligibility for, and pay the benefit authorized by Labor Code § 139.48.

What type of legal settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do you get a 1099 for a legal settlement?

Forms 1099 are issued for most legal settlements, except payments for personal physical injuries and for capital recoveries.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Do you get a w2 for a settlement?

The settlement agreement should also explicitly provide for how the settlement will be reported as well. The two primary methods to report the settlement to the IRS are either on a Form W-2 or a Form 1099-MISC.

Do you have to pay taxes on your retirement income if you were hurt at work?

If you retire after you were hurt at work, you will have to pay income tax on your retirement income, just like you would if you retired when you planned. Money coming out of a 401 (k) or IRA will have the same taxes as it normally would.

Does workers comp affect Social Security?

Your workers’ comp benefits do not affect your regular Social Security at all.

Is workers comp tax free?

The following types of workers’ comp money are tax-free: · Money for medical bills for treating your work-related injury. You do not need to pay federal tax or state (Virginia) tax on any of this money. If you’re just worried about if workers’ comp counts as income for taxes, the easy answer is no, it does not.

Do you file for workers comp if you are injured?

If you’re injured at work, you’ll file for workers’ compensation benefits for your medical bills and missing income. Whether or not your workers’ comp benefits count as income varies depending on what type of income you’re looking at. The following information is for general guidance only and should not be taken as tax advice.

Do you have to pay taxes on workers comp?

You do not need to pay federal tax or state (Virginia) tax on any of this money. If you’re just worried about if workers’ comp counts as income for taxes, the easy answer is no, it does not.

Do you have to pay taxes on SSDI?

If you take Social Security Disability Income (SSDI) after an injury at work and are also getting workers’ comp benefits, the SSDI may be reduced but you may still have to pay income tax on the full amount. Whether or not this happens depends on your specific situation and circumstances.

Does workers compensation count as income?

Workers’ compensation benefits are required to be reported on the FAFSA (Free Application for Federal Student Aid, required to get federal student loans) and may affect what federal student aid is offered. Workers’ compensation may count as income for other scholarships and grant-based programs.

Is compensation for sickness taxable?

Many other amounts you receive as compensation for sickness or injury aren't taxable. These include the following amounts.

Is workers compensation taxable?

No, workers' compensation benefits are not taxable income.

How Is a Settlement Calculated for Workers Compensation?

The formula for calculating a workers compensation settlement package involves four major factors:

What is workers compensation settlement?

Workers Compensation Settlements. Workers compensation insurance provides a safety net for medical expenses and lost wages of those who get hurt on the job. But that doesn’t mean such workers have to accept whatever the insurance company offers. A workers compensation settlement is a way you can negotiate the immediate payment ...

What happens if you dispute a workers comp claim?

If your claim is disputed, a trial or workers comp hearing is time-consuming and risky. The judge or hearing officer may award you less money than the insurance company offered to settle your workers comp claim. Note: Workers comp settlements are entirely voluntary. You don’t have to agree to a settlement offer proposed by your employer ...

How long does it take to settle a workers comp case?

Short answer: It varies greatly. The Martindale-Nolo survey of readers turned up an average of 15.7 months to resolve a case, and less than 20% of cases are resolved in less than six months. Obviously, those who try to negotiate a better workers comp settlement may hire legal assistance to negotiate the best terms for a settlement or to bring a hearing if there is a disputed issued. This can be time consuming. However, a shorter time frame is not always better. Those actions that lengthen the process can also bring higher settlements.

Why do you settle a lump sum claim?

If you settle the claim, you can choose or change your physicians. However, if you have severe and complicated work-related injuries, you may not want to settle the medical portion of the claim because you can be entitled to medical benefits for your accident for the rest of your life. Some injuries are too complicated to take the risk that you will not have enough money through a settlement to meet your medical needs.

What happens if you don't receive temporary benefits?

If the injured worker did not receive temporary benefits for medical expenses and lost wages prior to the settlement, those variables will be included in a final agreement. Typically, however, settlement negotiations only involve workers who were permanently disabled.

How long does it take for a settlement to be approved?

Those actions that lengthen the process can also bring higher settlements. Once an agreement is reached, it can take four-to-eight weeks for money to arrive while settlement contracts are drafted, signed and approved.

What is workers compensation?

In the event of on-the-job injury or illness, workers' compensation covers all associated medical treatment. Medical claims can be made for emergency care or regular treatment for less urgent work-related health problems. Based upon the situation, coverage may activate immediately upon injury or require pre-approval from the insurance company.

What is workers comp?

In employment-related deaths, workers' comp provides funeral and burial expenses for all covered employees. For workers with spouses or dependents, it also distributes cash benefits, typically equivalent to what the deceased would have received for total permanent disability. Benefits stop if/when the spouse remarries or dependent recipients reach adulthood.

What does a workman's comp judge do?

In most cases, a workman's comp judge must review and certify a settlement before it becomes final. If the injured worker has not retained a workers compensation attorney to negotiate on their behalf, the judge will attempt to ensure the amount of money and duration of benefits are fair.

Can you file a lump sum claim for workers compensation?

In this case, the injured party does not give up their right to claim future benefits for the same work-related health problem. If unexpected medical bills crop up later, the injured worker may still be able to file a claim for them.

Can you get a bulk disability payment?

In lieu of continued weekly or bi-weekly disability payments, the insurance company may offer one bulk payment . Ideally, the amount offered will cover the employee's medical bills and a portion of lost wages for the expected duration of disability.

Is Workman's comp taxable?

The Federal Government does not count workman's comp disability benefits as taxable, but some states may.

Can an employer cover emergency care?

Emergency Care Claims: In most cases, employees are free to seek immediate emergency services, and the workers' compensation insurer will cover them without prior clam approval. The employer may tell them to obtain such care from a specific healthcare provider. Regardless, the employee should inform emergency healthcare providers that the injury or illness is work-related (if they are able). If the claim is later denied, the employee may or may not have to cover the cost.

How Does a Workers’ Comp Settlement Work?

Instead, they can go after a monetary settlement with the help of workers’ comp lawyers.

What happens if you don't settle for workers comp?

Workers’ comp settlements can end with one lump sum amount or a structured payment plan . However, if your employee doesn’t settle or isn’t willing to negotiate, it could go to trial. This is often referred to as a workers’ comp hearing or workers’ compensation lawsuit.

How to make sure your settlement process runs smoothly?

You can also make sure the settlement process runs smoothly by giving your employees the contact information for your insurance company. This will help them stay updated on your business’ work injury policies.

Do all workers comp cases end in a settlement?

Not all workers’ comp cases will end in a settlement offer. They are most common for permanent disability claims.

How much is the average worker comp settlement?

While the average workers’ comp settlement is $42,000, settlement values will differ for different types of work injuries. For example, while the average settlement in a head injury case is $92,493, the average settlement involving an injured hand is $24,627.

What are the two types of workers comp settlements?

An insurance company typically offers two types of workers’ comp settlements. These are lump-sum settlements and structured settlements.

What to do if an adjuster is trying to force you into settling your case?

If you believe an adjuster is trying to force you into settling your case, contact an experienced workers’ compensation lawyer for help.

How much did Antonio's attorneys settle his workers compensation claim?

Five years after the work accident, Antonio’s attorneys settles his workers’ compensation claim for an $8.9 million structured settlement.

Can a worker's comp case be settled?

Unpaid Medical Bills: Sometimes a workers’ comp case settles after a worker wins on appeal following an initial claim denial . If your doctors agreed to postpone payment of their bills until after the appeal, then they have a doctor’s lien against a percentage of your settlement.

Does every state have workers comp?

Every state has its own workers’ compensation laws impacting a person’s workers’ comp benefits or their settlement amount.

Do you have to be familiar with your state's workers compensation laws before settling your case?

Make sure you’re familiar with your state’s workers’ compensation insurance laws before settling your case.

4 attorney answers

Workers' comp benefits paid for a physical injury are excluded from income for Federal income tax purposes, but may still count as assets for the purposes of qualifying for public assistance.

Joanne Reisman

Civil Damages and Workers' Compensation Damages for Physical Injuries or Sickness are not Considered Gross Income. 26 United States Code § 104 (a) provides in pertinent part, “Except in the case of amounts attributable to (and not in excess of) deductions allowed under section 213 (relating to medical, etc., expenses) for any prior taxable year, gross income does not include-....