Do I have to pay taxes on a settlement check?

Most settlements are not taxable unless they are directly associated to wage earnings: for instance, if you sue for back wages. Other types of settlements, like insurance, are not taxable until they produce income. If you sue and get an award, the awarded amount will become taxable once deposited and earning income or dividends.

Do I have to pay taxes on my insurance settlement?

Once you file an insurance settlement or claim, the money you receive does not tend to be taxable. However, in some cases, this money is subject to taxes. Unfortunately, many people don’t realize they have to pay taxes on their settlement until it is a little too late. The IRS levies taxes based on income alone. If you receive a payment from your insurance, in most cases, you will only receive enough to cover the situation at hand.

Are settlements taxed like income?

Settlements themselves are not taxed because the CRA does not consider a personal injury settlement to be “income.” Your settlement is considered “compensation” for expenses incurred by another person’s negligence. Indeed, personal injury settlements rarely function as any kind of windfall.

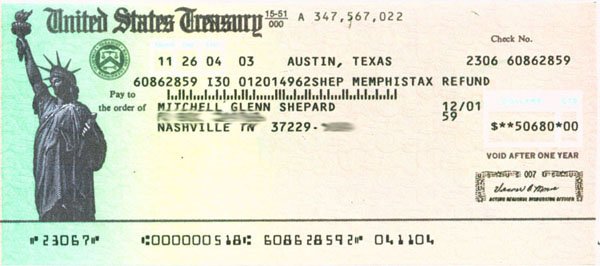

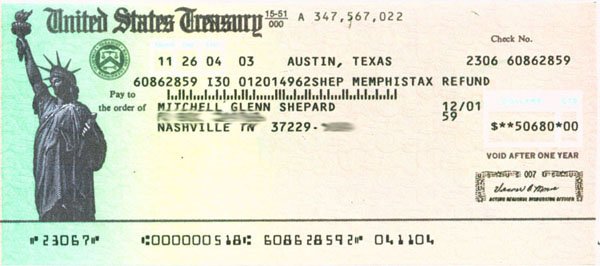

How to cash an insurance settlement check?

Where to Cash Insurance Checks – 5 Places

- Walmart Insurance Check Cashing. Walmart stores provide one of the best places one can cash their insurance claim checks. ...

- Local grocery stores. In most cases, grocery stores are unreliable check cashing spots. ...

- 7-Eleven. The only trick involved here is that one must download the app called Transact by 7-Eleven. ...

- Using Apps. ...

- NetSpend. ...

How do I avoid taxes on a settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

Do settlement checks get reported to IRS?

If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

What percentage of taxes do you pay on a settlement?

How Legal Fees are Taxed in Lawsuit Settlements. In most cases, if you are the plaintiff and you hire a contingent fee lawyer, you'll be taxed as receiving 100% of the money recovered by you and your attorney, even if the defendant pays your lawyer directly his contingent fee cut.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

What are the tax implications of a settlement agreement?

Normally on a settlement agreement there will be a “tax indemnity” which means that if an employer is later asked to pay the tax by the employee, the employer can then pursue the employee for that tax: plus interest, penalties and the cost of “grossing up”.

How do you report settlement income on taxes?

If you receive a settlement, the IRS requires the paying party to send you a Form 1099-MISC settlement payment. Box 3 of Form 1099-MISC will show “other income” – in this case, money received from a legal settlement. Generally, all taxable damages are required to be reported in Box 3.

Can the IRS take my personal injury settlement?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What happens if you get paid with contingent fee?

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Do you have to pay taxes on a 1099 settlement?

Where many plaintiff's 1099 attorneys now take up to 40% of the settlement in legal fees, the full amount of the settlement may need to be reported to the IRS on your income tax. And in some cases, you'll need to pay taxes on those proceeds as well. Let's look at the reporting and taxability rules regarding legal settlements in more detail as ...

Is money from a lawsuit taxed?

Taxation on settlements primarily depends upon the origin of the claim. The IRS states that the money received in a lawsuit should be taxed as if paid initially to you. For example, if you sue for back wages or lost profits, that money will typically be taxed as ordinary income. If you receive a settlement allocations for bodily personal physical ...

Is a settlement for physical injury taxed?

If you receive a settlement allocations for bodily personal physical injury, you are not typically taxed on those proceeds as those monies are deemed to make you whole after an accident. Before 1996, all personal damages were treated as tax-free recoveries, including physical, defamation, and emotional distress injuries, for example.

What to do if you settle a personal injury claim?

If you resolve your personal injury claim with a settlement between yourself and the other party, first, enjoy your victory. Then, think about the large sum of money you are about to receive. You will have to pay your attorney’s fees and any court costs in most cases, on top of using the settlement to pay for your medical bills, lost wages, ...

Can you elude tax?

You may be able to elude taxation if you can prove even the smallest amount of physical injury. A lawyer may be able to help you with this burden of proof and ensure you receive a non-taxable settlement as much as possible.

Is lost wages taxable?

Lost wages. This economic damage award is typically taxable since the government sees it as money you would have had to pay taxes on were it not for the injury. Since your normal wages would have been taxes, your lost wage award will be as well. The IRS has the right to impose the taxation of your award as it sees fit. Interest on judgment.

Do you pay taxes on a judgment?

Interest on judgment. If the court adds interest to the verdict for the amount of time the claim has been pending, the government may tax this portion of your award or settlement. For example, you may have to pay taxes on interest you receive for a claim you brought in 2014 that did not resolve until 2017.

Is a non-taxable settlement taxed?

Keep in mind that the only non-taxable claim settlements are those that arise from physical injury or illness claims. If your lawsuit deals with emotional distress or employment discrimination, the government will tax your settlement. You may be able to elude taxation if you can prove even the smallest amount of physical injury. A lawyer may be able to help you with this burden of proof and ensure you receive a non-taxable settlement as much as possible.

Is there a tax on personal injury settlements?

As a general rule, neither the federal nor the state government can impose taxes on the proceeds you receive from a personal injury claim. Claim proceeds are more or less tax-free, whether you settled your claim or went to trial to get a jury verdict.

Can California state tax settlements?

The federal Internal Revenue Service (IRS) and the California state government cannot tax settlements in most cases. There are, however, exceptions to this rule. You may face taxation on the following: Breach of contract settlements or awards.

What to do if you have already spent your settlement?

If you’ve already spent your settlement by the time tax season comes along, you’ll have to dip into your savings or borrow money to pay your tax bill. To avoid that situation, it may be a good idea to consult a financial advisor. SmartAsset’s free toolmatches you with financial advisors in your area in 5 minutes.

What happens if you get a settlement from a lawsuit?

You could receive damages in recognition of a physical injury, damages from a non-physical injury or punitive damages stemming from the defendant’s conduct. In the tax year that you receive your settlement it might be a good idea to hire a tax accountant, even if you usually do your taxes yourself online. The IRS rules around which parts of a lawsuit settlement are taxable can get complicated.

Is a lawsuit settlement taxable?

The tax liability for recipients of lawsuit settlements depends on the type of settlement. In general, damages from a physical injury are not considered taxable income. However, if you’ve already deducted, say, your medical expenses from your injury, your damages will be taxable. You can’t get the same tax break twice.

Is representation in a civil lawsuit taxable?

Representation in civil lawsuits doesn’t come cheap. In the best-case scenario, you’ll be awarded money at the end of either a trial or a settlement process. But before you blow your settlement, keep in mind that it may be taxable income in the eyes of the IRS. Here’s what you should know about taxes on lawsuit settlements.

Is emotional distress taxable?

Although emotional distress damages are generally taxable, an exception arises if the emotional distress stems from a physical injury or manifests in physical symptoms for which you seek treatment. In most cases, punitive damages are taxable, as are back pay and interest on unpaid money.

Can you get a bigger tax bill from a lawsuit settlement?

Attaining a lawsuit settlement could leave you with a bigger tax bill. Let's break down your tax liability depending on the type of settlement you receive.

Is a physical injury taxable?

In general, damages from a physical injury are not considered taxable income. However, if you’ve already deducted, say, your medical expenses from your injury, your damages will be taxable. You can’t get the same tax break twice. In some cases, you may get damages for physical injury stemming from a non-physical suit.

How Are Lawsuit Settlements Paid?

There are several steps you will need to follow in order to get your money. Read all the paperwork carefully.

What Types of Lawsuits are Taxed?

In general, lawsuits that deal with wages are treated as wages. A lawsuit that deals with injuries or damages are not. However, this is not cut and dried, so always speak with a professional to determine how your lawsuit is laid out and how the damages are allocated.

What does it mean to pay taxes on a $100,000 case?

In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law generally does not impact physical injury cases with no punitive damages. It also should not impact plaintiffs suing their employers, although there are new wrinkles in sexual harassment cases. Here are five rules to know.

Is punitive damages taxable?

Tax advice early, before the case settles and the settlement agreement is signed, is essential. 5. Punitive damages and interest are always taxable. If you are injured in a car crash and get $50,000 in compensatory damages and $5 million in punitive damages, the former is tax-free.

Do you have to pay taxes on a lawsuit?

Many plaintiffs win or settle a lawsuit and are surprised they have to pay taxes. Some don't realize it until tax time the following year when IRS Forms 1099 arrive in the mail. A little tax planning, especially before you settle, goes a long way. It's even more important now with higher taxes on lawsuit settlements under the recently passed tax reform law . Many plaintiffs are taxed on their attorney fees too, even if their lawyer takes 40% off the top. In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law generally does not impact physical injury cases with no punitive damages. It also should not impact plaintiffs suing their employers, although there are new wrinkles in sexual harassment cases. Here are five rules to know.

Is there a deduction for legal fees?

How about deducting the legal fees? In 2004, Congress enacted an above the line deduction for legal fees in employment claims and certain whistleblower claims. That deduction still remains, but outside these two areas, there's big trouble. in the big tax bill passed at the end of 2017, there's a new tax on litigation settlements, no deduction for legal fees. No tax deduction for legal fees comes as a bizarre and unpleasant surprise. Tax advice early, before the case settles and the settlement agreement is signed, is essential.

Is attorney fees taxable?

4. Attorney fees are a tax trap. If you are the plaintiff and use a contingent fee lawyer, you’ll usually be treated (for tax purposes) as receiving 100% of the money recovered by you and your attorney, even if the defendant pays your lawyer directly his contingent fee cut. If your case is fully nontaxable (say an auto accident in which you’re injured), that shouldn't cause any tax problems. But if your recovery is taxable, watch out. Say you settle a suit for intentional infliction of emotional distress against your neighbor for $100,000, and your lawyer keeps $40,000. You might think you’d have $60,000 of income. Instead, you’ll have $100,000 of income. In 2005, the U.S. Supreme Court held in Commissioner v. Banks, that plaintiffs generally have income equal to 100% of their recoveries. even if their lawyers take a share.

Is $5 million taxable?

The $5 million is fully taxable, and you can have trouble deducting your attorney fees! The same occurs with interest. You might receive a tax-free settlement or judgment, but pre-judgment or post-judgment interest is always taxable (and can produce attorney fee problems).

Is emotional distress tax free?

2. Recoveries for physical injuries and physical sickness are tax-free, but symptoms of emotional distress are not physical. If you sue for physical injuries, damages are tax-free. Before 1996, all “personal” damages were tax-free, so emotional distress and defamation produced tax-free recoveries. But since 1996, your injury must be “physical.” If you sue for intentional infliction of emotional distress, your recovery is taxed. Physical symptoms of emotional distress (like headaches and stomachaches) is taxed, but physical injuries or sickness is not. The rules can make some tax cases chicken or egg, with many judgment calls. If in an employment dispute you receive $50,000 extra because your employer gave you an ulcer, is an ulcer physical, or merely a symptom of emotional distress? Many plaintiffs take aggressive positions on their tax returns, but that can be a losing battle if the defendant issues an IRS Form 1099 for the entire settlement. Haggling over tax details before you sign and settle is best.

Does settlement money count as income?

It will come as no great surprise that the answer is almost universally yes . Settlement money counts as income, and the amount, including any interest on the award, must be declared accordingly. Now, as with all matters related to taxes, exceptions exist.

Is attorney fees taxable?

Attorney's fees are also taxable, and in situations where these were expected to be paid out of a lump sum payment, it is your responsibility to keep records of these payments to ensure you don’t end up paying taxes on money you no longer have.

Is a settlement from a lawsuit tax free?

The criteria for this exemption are pretty specific. An individual needs to have received the award as compensation for physical injury or sickness and/or emotional distress caused by physical injury or sickness (punitive damages remain taxable even in these circumstances.) The physical / emotional injury also needs to be the result of a wrongful act. So, if you suffered a back injury at work because of faulty equipment, and you sued the product’s maker for negligent design, any settlement money you received may be tax-free. Equally, if the injury leads directly to emotional distress – anxiety, for example – the money may be tax-free because of this direct link.

Is the IRS vigilant about physical injury?

The link to a physical injury is crucial, and the IRS is likely to be vigilant about these things. Take, as an example, the class action lawsuit filed by motorists caught up in New Jersey’s “Bridgegate” scandal.

Is back injury compensation tax free?

So, if you suffered a back injury at work because of fault y equipment, and you su ed the product’s maker for negligent design, any settlement money you received may be tax-free. Equally, if the injury leads directly to emotional distress – anxiety, for example – the money may be tax-free because of this direct link.

Is settlement money taxable?

If you’re the victim of discrimination and, say, lose your job, and this leads to emotional distress, any settlement money you receive will remain taxable. Under that “other sources” category, you may wonder about lawsuit settlement money.

Is class action settlement money taxable?

So, class action settlement money will, in general, be taxable.