Should I accept an insurance settlement offer?

Accepting a settlement is your choice, and yours alone. The insurance company may put a time limit on how long you have to respond, trying to ratchet up the pressure you feel. In reality, however, the insurance company probably expects you to say “no” to its opening offer.

How do you respond to an offer of settlement?

The right way to respond to an offer of settlement is through principled negotiations. That means you respond specifically and directly only to the items in dispute, state your objections clearly, and propose compromises. November 14, 2018 by James J. Gross

Why did I receive a low settlement offer from my attorney?

If you are represented by a personal injury attorney for your injuries and they have already sent the initial demand letter for your claim, you may receive a low settlement offer from an insurance company, or the law firm representing the at-fault party.

Can a plaintiff draft a settlement offer?

However, in some situations the plaintiff may draft it, particularly if the offer was initiated with the plaintiff. If both sides have attorneys, professional ethics rules dictate that all settlement offers must be communicated between attorneys, who then have an immediate duty to inform their respective clients.

What happens if you ignore a settlement offer?

When someone rejects a settlement offer, it is automatically terminated and can not be accepted at a later time. From here, you can negotiate or make a counteroffer, but will be up to the other party if they want to accept or reject the offer.

Is it good to accept a settlement offer?

It is not in your best interest to accept a settlement offer without speaking with an attorney. The initial settlement offer from the insurance company is probably not fair. The offer may be much lower than the value of your damages. If the insurance company sends you a check, do not cash the check.

How do you respond to a settlement?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

Can you negotiate a settlement offer?

If the offer is reasonable, you can immediately make a counteroffer that is a little bit lower than your demand letter amount. This shows the adjuster that you, too, are being reasonable and are willing to compromise. A little more bargaining should quickly get you to a final settlement amount you both think is fair.

Do you accept first offer compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

Should you accept first offer insurance claim?

Once the offer is made, you have 21 days to decide whether or not to accept it. You should always take legal advice before accepting a Part 36 offer, especially if you have a conditional fee agreement or are using an insurance policy to cover your legal expenses, as you may find you invalidate your contract.

How do you decline a low settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

Why do debt collectors offer settlements?

Debt settlement is a practice that allows you to pay a lump sum that's typically less than the amount you owe to resolve, or “settle,” your debt. It's a service that's typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Is settled in full good on credit report?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

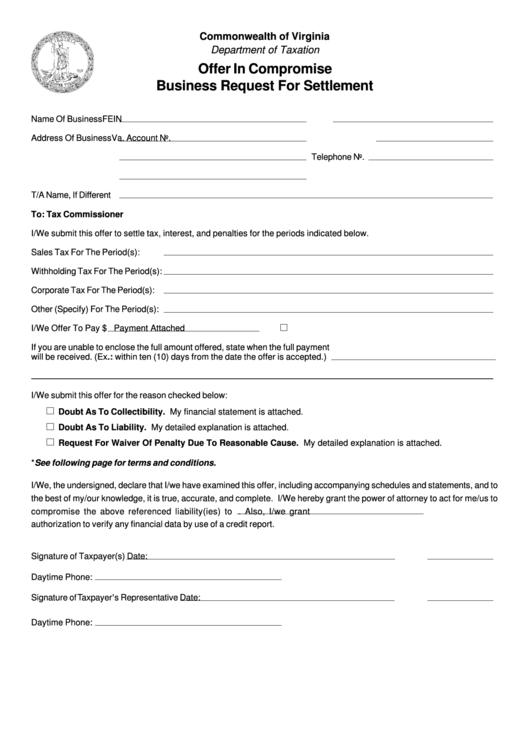

What does it mean to make a settlement offer?

A settlement offer during trial might mean that the other side thinks it’s going to lose and wants a more predictable way out of the situation.

What is a settlement offer?

Since a settlement offer is essentially a contract between the parties , you can feel free to suggest -- and agree to -- terms that might not have been available if you tried your case in court. For example, some settlement agreements require one party to make a formal apology to the other for the wrongs committed.

How to guarantee a settlement doesn't include any terms that violate the law?

The best way to guarantee your settlement doesn’t include any terms that violate the law is to hire an attorney. Attorneys are bound by professional ethics rules and bar regulations to alert you to illegal terms and have them removed.

Why do you need a settlement?

2. Use a settlement to avoid risk. Whether you’re a plaintiff suing someone else or a defendant who’s been sued, a settlement provides the same opportunity to avoid the financial and emotional costs of litigation and create certainty in the outcome.

Why do plaintiffs prefer an open settlement agreement?

Aggrieved plaintiffs may prefer an open settlement agreement because they want the public to know about a particular injustice. Allowing a settlement’s terms to be made public also allows attorneys to adequately ascertain the value of similar cases that may arise in the future.

How many times should you read a settlement agreement?

Carefully read terms. Whether your side or the other side drafts the settlement agreement, read it several times and make sure you understand everything in it.

What to do if you don't like your chances of winning at trial?

If you don’t like your chances of winning at trial, though, a settlement may begin to look more attractive. Take the opportunity to get creative. A settlement offer allows you to craft terms that actually fit the nature of the issue and come closer to satisfying the needs of all involved.

How to respond to an offer of settlement?

The right way to respond to an offer of settlement is through principled negotiations. That means you respond specifically and directly only to the items in dispute, state your objections clearly, and propose compromises.

What is the purpose of negotiation?

The purpose of negotiation to is reduce difference between offer and counteroffer until you reach a settlement. If you are increasing the difference, you are not going anywhere. Once you have offered alimony of $2,000 a year, it will be impossible to get your spouse to accept $1,000 a month in the next round of negotiations. ...

Is it better to settle a divorce case out of court or a trial?

Settling your divorce case out of court is almost always better than a divorce trial. Knowing how to respond to a divorce settlement offer is important. Many people don’t know how to use principled negotiation techniques to reach a divorce settlement.