The SSDI program pays benefits to you and certain family members if you are “insured.” This means that you worked long enough – and recently enough - and paid Social Security taxes on your earnings.

Does a workers' compensation settlement affect Social Security disability insurance?

Does a Workers' Compensation Settlement Affect SSDI? How does a workers' compensation settlement affect Social Security Disability Insurance payments? While you can receive Social Security Disability Insurance benefits and workers’ compensation for the same disability, the amount of workers’ compensation can reduce your SSDI.

Can I receive workers’ compensation benefits if I have Social Security disability?

Some workers who are eligible for Social Security Disability Insurance (SSDI) benefits may also be eligible for workers’ compensation benefits if their injury or condition is the result of a work-related accident or illness.

Will a lump-sum workers'compensation settlement affect Social Security benefits?

If you receive a lump-sum workers' compensation settlement, the amount of the Social Security benefits you and your family receive may be affected by an offset similar to the way that regular weekly workers’ comp payments are.

Does the offset apply to workers’ compensation and SSDI?

At this rate, the offset may not apply and they could collect both workers’ comp and SSDI with a minimal offset or not incur one at all. The rules about workers' compensation benefits and Social Security Disability Insurance are complicated.

Will a settlement affect my SSDI?

Generally, if you're receiving SSDI benefits, you typically won't need to report any personal injury settlement. Since SSDI benefits aren't based on your current income, a settlement likely wouldn't affect them. But if you're receiving SSI benefits, you need to report the settlement within 10 days of receiving it.

How does a lump-sum settlement affect SSDI?

A large personal injury settlement generally does not affect Social Security Disability Insurance (SSDI) benefits but can directly affect Supplemental Security Income (SSI) benefits. It can cause a reduction or loss of the SSI benefits. A lump sum workers' compensation settlement can reduce one's disability benefits.

Does a settlement count as income for Social Security?

Since the settlement is not earned income, it should not affect your receipt of SSDI benefits. SSI is also separate and distinct from Social Security Income, which workers paid through the Social Security Payroll Tax when they were working.

What is Social Security disability offset?

The Offsets The intent of the offset provision is to ensure that the combined benefits from workers' compensation and Social Security are not excessive. The offset of Disability Insurance benefits applies to disabled workers under the age of 65 and their families.

Does settlement money affect Social Security benefits?

Social Security and SSDI government-benefit programs are entitlements, therefore they are not means tested; asset and income limits do not apply; settlement proceeds will not impact eligibility.

How does getting a lump-sum affect my Social Security benefits?

If you take your government pension annuity in a lump sum, Social Security will calculate the reduction as if you chose to get monthly benefit payments from your government work.

What can affect my disability benefits?

Any change in your employment situation or your overall financial circumstances can therefore affect your eligibility for SSD or the amount of your monthly benefit payments.Financial Circumstances and SSD Benefits. ... Employment Income. ... Other Disability Benefits. ... Marital Status or Family Income. ... Retirement Benefits.

Will a settlement affect my Medicare?

Since Medicare is an entitlement benefit and not a needs-based program, a client who receives legal settlement won't lose their Medicare benefits. It will not be impacted when a client receives a settlement.

What types of income do you have to report to Social Security disability?

Income You Are Required to ReportEarned income is any money you receive in exchange for work you performed, whether you work for an employer or you are self-employed. The income must be reported each month, even if there are no changes.Unearned income is money you receive that is not in exchange for work.

Is SSDI deducted from long term disability?

As a result, most Long-Term Disability (LTD) policies will require you to apply for Social Security Disability Insurance (SSDI) benefits and, if you are approved for SSDI benefits, the insurance company will then look to offset your long-term disability benefits with your Social Security Disability benefits.

Why was my SSDI payment lowered?

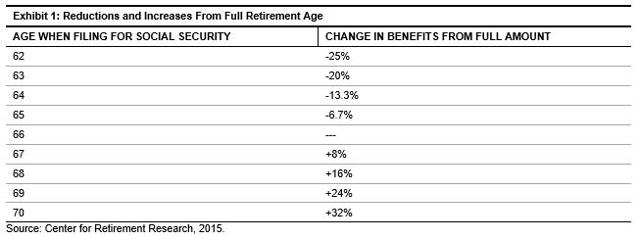

If you recently started receiving Social Security benefits, there are three common reasons why you may be getting less than you expected: an offset due to outstanding debts, taking benefits early, and a high income.

What is the monthly amount for Social Security disability?

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

How is SSDI offset calculated?

The offset is calculated by considering three factors: (1) the claimant's monthly workers' compensation benefit; (2) the claimant's monthly social security disability benefit; and (3) the claimant's average current earnings (ACE).

Can the IRS take your disability back pay?

If you have unpaid taxes from the past, the federal government has the right to garnish your social security disability benefits to cover these. Specifically, the federal agency Internal Revenue Service (IRS) will garnish a portion of your monthly benefits to pay for the arrears.

Can you collect long term disability and Social Security at the same time?

Can you get Social Security Disability Insurance and long term disability at the same time? Yes, it's possible. If you qualify for Social Security disability benefits, your benefit amount will not be reduced if you are also receiving individual LTD benefits.

What is offset in insurance policy?

Offset (Setoff) — the reduction of the amount owed by one party to a second party by crediting the first party with amounts owed it by the second party. The existence and scope of offset rights may be determined by reinsurance contract language as well as statutory, regulatory, and judicial law.

What are the ways a claimant can settle a workers compensation case?

Ways a claimant can settle a workers' compensation case, such as lump-sum settlements or monthly payments

How much does SSDI reduce?

Generally speaking, the Social Security Administration (SSA) reduces its SSDI benefits so that the total amount that a disabled worker receives monthly is no more than: 80% of the amount the worker earned when they were fully employed . This amount is known as "average current earnings.".

How much is a worker comp benefit for 20 months?

Social Security will consider the worker to have received $1,000 per month in workers' comp benefits for 20 months ($20,000/$1,000) for purposes of calculating the SSDI offset.

How does Social Security convert workers comp to monthly?

In most cases, Social Security converts the workers’ comp lump sum to a monthly amount by dividing the lump sum by the periodic workers' compensation payment that the person had been receiving, and then applying the SSDI offset for the resulting number of months. This is best illustrated with an example:

How does Social Security offset lump sum?

In most cases, Social Security converts the workers’ comp lump sum to a monthly amount by dividing the lump sum by the periodic workers' compensation payment that the person had been receiving, and then applying the SSDI offset for the resulting number of months.

What happens if you receive lump sum workers compensation?

If you receive a lump-sum workers' compensation settlement, the amount of the Social Security benefits you and your family receive may be affected by an offset similar to the way that regular weekly workers’ comp payments are.

How to maximize Social Security benefits?

There are a few actions you can take to help maximize your benefits without hurting your Social Security Disability, like: 1 Understand your exclusions: With Social Security, there are a few deductions you can take from your gross workers’ compensation settlement, like attorney fees, rehab costs, and certain dependent payments. Just make sure you keep proper documentation of any costs and your attorney can help you from there. 2 Adjust your payments: A lump-sum agreement makes it seem like you're making far more money than you really are. And that can decrease your SSDI benefits. With your attorney, though, you can actually structure your settlement so it appears the opposite, like it's being paid out over a longer period of time. 3 Switch to retirement benefits (if you can): The settlement offset doesn't apply to Social Security retirement benefits, so if you're getting close to retirement, you may want to switch to Social Security retirement benefits instead of SSDI benefits.

What to do if you are worried about Social Security reducing your SSDI benefits?

If you are worried about Social Security reducing your SSDI benefits because of a workers' compensation award, you should consult a disability attorney to help you resolve your worker's compensation case in a way that leaves you with the most money possible each month.

When does SSDI offset?

When a claimant receives more money than the applicable limit in any given month, then Social Security offsets SSDI in the amount required to bring the total back down to the applicable limit. Worker's compensation offsets of SSDI happen more often to those who earned lower incomes when they were working, because their applicable limits are lower and more easily exceeded once the worker starts to receive SSDI and worker's compensation.

What is the process of reducing disability benefits to account for worker's compensation called?

The process of Social Security reducing disability benefits to account for worker's compensation is called a worker's compensation "offset.". The rules about how Social Security calculates worker's compensation offsets are complicated. Worker's compensation programs vary from state to state, and each state has different rules about things like ...

How does Social Security lump sum work?

Social Security has several ways of converting a lump sum workers' comp payment into a monthly benefit for the purposes of calculating an offset, and it will take a close look at the language of the settlement document when it is offsetting a lump sum. In the most basic method, Social Security converts the lump sum to a monthly amount by dividing ...

How does Social Security calculate the offset?

How Social Security Calculates the Offset. To calculate the amount of the offset for a particular recipient, Social Security first determines what it calls the "applicable limit," or the maximum total monthly amount of combined benefits that the recipient is allowed to get under federal law. When a claimant receives more money than ...

What percentage of earnings is higher for SSDI?

For most SSDI recipients, the 80% of earnings figure will be higher, and Social Security will use that figure in the offset calculation.

Does Social Security offset SSDI?

Social Security will not offset SSDI when the state is already offsetting worker's compensation, as long as the state worker's compensation law that requires the offset was in effect before February 18, 1981. States that apply a reverse offset might not apply it to all types of worker's compensation benefits.

Michigan Law

Workers’ comp protects employees hurt at work. It covers all reasonable and necessary medical treatment. It also pays lost wages equal to 80% of a person’s after-tax average weekly wage. These benefits continue for as long as a person needs medical care and/or is disabled from employment.

Lump Cash Payout

Many of our clients want to trade workman’s compensation benefits for a lump sum cash payout. This allows them to use money for any purpose they desire. We see clients find a new job, start a business, pay off debt, or just retire. The amount awarded will depend upon future medical needs and length of time a person will be disabled.

Can I get long-term disability benefits after a workers comp settlement?

Yes, you can get long-term disability benefits after a workers’ comp settlement in Michigan. If an employee also has a claim under a long-term disability (LTD) insurance policy. These are typically offered through an employer and it’s a good option. LTD typically pays around 60% of an employee’s salary.

Review the language in the policy regarding LTD

Something to note with association to long-term disability benefits after a workers’ comp settlement is that just because an individual collects a lump sum cash payout after winning a workman’s comp claim does not mean they necessarily forfeit a claim for LTD benefits.

Injured while on the job in Michigan? Contact our lawyers for a free consultation

To speak with an experienced attorney about your work injury claim in Michigan, call us now, or fill out our contact form for a free consultation. There is absolutely no cost or obligation. We’re here for you.

Do you have to reapply for SSDI if you get $0?

I'll try to explain, but let me start by saying that no matter how the offset works out, even if you receive $0 in monthly SSDI for a time, you shouldn't have to re-apply once the offset ends. It should lift automatically, and then you'll start receiving your monthly SSDI amount again.

Do you have to refile SSD?

Good answers all by my colleagues. Just to answer your last question, about the amount of your SSD benefit after worker's compensation offset is lifted: you do not have to refile, and the amount of your Social Security Disability benefit would be the same as you're getting now (or more if there have been cost-of-living adjustments). Once approved for SSD, the person's earnings record is "frozen" for as long as the...

Is SSDI disability or SSI?

If you are speaking about SSDI (the insurance-like disability program based on the taxes deducted from your paycheck) rather than SSI (Supplemental Security Income - a welfare-like program) disability then some of your information is not correct.#N#What is most important is how your WC attorney structures your WC settlement...

How long does it take to report a lump sum settlement to Social Security?

If you accept a lump sum settlement, you must report it to your Social Security caseworker within 10 days.

What percentage of Social Security disability is reduced?

If the combined total amount (Social Security disability payment plus your public disability payment) exceeds 80 percent of your average earnings before you became injured or ill, your Social Security disability benefit will be reduced so that the total does not exceed 80 percent of average prior earnings. NO: Typically, disability payments ...

What happens if you get Medicaid over the limit?

Medicaid, like SSI, is based on income and family size. If the settlement amount pushes your income over the limit, your Medicaid, SNAP Food Assistance, and Subsidized Housing benefits could be affected.

Can I get disability if I receive a settlement?

Answer: No. Generally speaking, your Disability Insurance Benefits (DIB) would not be affected if you received a settlement. However, if you are receiving Supplemental Security Income (SSI) through Social Security, your SSI would likely be decreased.

Can you qualify for SSI without a job?

SSI is a needs-based rather than earnings-based program for which you can qualify without ever having held a job or accumulating credits, so long as you meet certain asset and income limitations. If the settlement amount pushes you over the income limit, then your SSI payments could be decreased.

Does disability affect Social Security?

NO: Typically, disability payments from private sources, such as a private pension or insurance benefit, do not affect your Social Security disability benefits.

Can you give away part of your medicaid?

Even if you choose to give away part of your settlement as a gift or a charitable donation, the government could reduce your Medicaid or even seek reimbursement for the benefits you’ve received .

How does the SSA offset workers compensation?

They divide the lump sum by the periodic workers’ compensation payments the individual had been receiving and then apply the SSDI offset for those number of months.

How much is reduced in SSDI?

In this situation, SSA generally requires a reduction in SSDI benefits so that the total monthly amount received is not more than 80% of the amount the individual earned when he or she was employed and working.

How does SSA determine offsets?

In determining offsets, SSA will look closely at the specific language of the workers’ compensation settlement agreement. As a result, workers’ compensation attorneys try to draft settlement agreements that will minimize potential SSDI benefit offsets. They will specifically exclude medical and legal expenses from the total lump sum so that SSA cannot consider those items part of the total settlement amount. If the language is not clear, however, SSA can consider the whole amount as eligible for offsets.

How does lump sum affect Social Security?

How Do Lump Sum Settlements Affect Social Security Disability? Some workers who are eligible for Social Security Disability Insurance (SSDI) benefits may also be eligible for workers’ compensation benefits if their injury or condition is the result of a work-related accident or illness.

What happens if the settlement agreement is not clear?

If the language of the settlement agreement is not clear, SSA will likely ask for immediate documentation of the medical and legal expenses associated with the settlement. The rules about which items have to be written specifically into the settlement agreement are determined by state law, not federal law; therefore, settlement agreements vary widely from state to state.

Do workers compensation claims settle?

Many times, claimants for workers’ compensation settle their cases before their claim gets to the hearing or trial stage. They choose to give up their entitlement to monthly workers’ compensation benefits in exchange for an immediate lump sum cash settlement.

Can SSA reduce SSDI benefits?

If you are worried that SSA will reduce your SSDI benefits because of a lump sum workers’ compensation settlement, talk to a disability attorney so that your workers’ compensation case can be resolved in a way that leaves you with the maximum payment amount each month.