Are attorney's fees included in the settlement of a FTCA claim?

Attorney's fees are not paid as part of the settlement of a FTCA claim. Under the FTCA, attorneys may not collect more than 20 percent of the amount of an administrative settlement (a settlement with EPA) paid to a claimant, or not more than 25 percent of a court judgment or settlement resulting from a FTCA lawsuit.

What is the Federal Tort Claims Act (FTCA)?

Congress, deeming this state of affairs unacceptable, enacted the Federal Tort Claims Act (FTCA), which authorizes plaintiffs to obtain compensation from the United States for the torts of its employees.

What is the FTCA section?

The Torts Branch’s Federal Tort Claims Act Litigation Section (FTCA Section) defends the United States in a wide range of complex, and often controversial, suits filed under the Federal Tort Claims Act.

Who is entitled to a cause of action under the FTCA?

Although the FTCA in general adopts state law to determine whether the facts give rise to a cause of action, it is federal law which determines “who” is entitled to assert the claim. In general, any person who has the capacity to sue and whose claim is within the coverage of the FTCA may institute an action against the United States under the Act.

What would be exclusion to the FTCA?

These exceptions stipulate that the federal government will not be held liable for the claims against its employees arising out of assault, battery, false imprisonment, false arrest, malicious prosecution, abuse of process, libel, slander, misrepresentation, deceit, or interference with contract rights.

How does the FTCA work?

Under the FTCA, the federal government acts as a self-insurer, and recognizes liability for the negligent or wrongful acts or omissions of its employees acting within the scope of their official duties. The United States is liable to the same extent an individual would be in like circumstances.

How long does the government have to respond to a FTCA claim?

six monthsThe agency has six months to respond to your claim. The federal agency has six months to rule on your claim. In some cases, the federal agency might "admit" your claim (that is, agree that your claim is valid) and offer to pay you some or all of the money damages you requested.

Are you covered under the Federal Tort Claims Act FTCA )?

Under the FTCA, 28 U.S.C. §§ 2671-2680, individuals who are injured or whose property is damaged by the wrongful or negligent act of a federal employee acting within his or her official duties may file a claim with the government for reimbursement for that injury or damage.

What is covered under FTCA?

Covered activities are acts or omissions in the performance of medical, surgical, dental, or related functions resulting in personal injury, including death, and occurring within the scope of employment (including within the approved scope of project).

What benefit does someone have in pursuing a Federal torts claim act FTCA action rather than a Bivens action?

What benefit does someone have in pursuing a Federal Torts Claim Act (FTCA) action rather than a Bivens action? The government is better able to pay for damages than an officer. According to the Monell (1978) decisions, under what circumstances is a local government liable for the actions of its employees?

Can you sue the military for emotional distress?

Think of the military as any big company — if that company is responsible for a wrong you have suffered, you are generally able to seek financial compensation. Unfortunately, most active duty members of the military CANNOT sue the military.

Can you sue the government for violating the Constitution?

Individuals whose constitutional rights are violated by the state government are legally entitled to file a civil action to recover damages. This can be done because of Section 1983, an abridged term for 18 U.S.C. Section 1983, which provides US citizens the right to sue government officials and employees.

Can a federal employee sue their supervisor?

Because the federal government has sovereign immunity, federal employees cannot file lawsuits against it unless the government waives this immunity.

Is FTCA a malpractice insurance?

The Health Resources and Services Administration (HRSA) considers Friends of Family Health Center (FOFHC) and its providers as Public Health Services employees, providing malpractice liability protection under the Federal Tort Claims Act (FTCA).

What are the 3 types of tort?

Torts fall into three general categories: intentional torts (e.g., intentionally hitting a person); negligent torts (e.g., causing an accident by failing to obey traffic rules); and strict liability torts (e.g., liability for making and selling defective products - see Products Liability).

What is FTCA audit?

(“FTCA”), established in 1948, is the. legal mechanism for compensating. people who have suffered personal. injury due to the negligent or wrong- ful action of employees of the U.S.

How do I file a tort claim with the USPS?

Claims for Loss or DamageOnline: Go to www.usps.com⁄help⁄claims. htm for information on USPS domestic insurance.By mail: Call 800-ASK-USPS (800-275-8777) to have a claim form mailed to you. ... Evidence of Insurance.Proof of Value.Proof of Damage or Partial Loss of Contents.

What is a tort claim against the VA?

A Federal Tort claim is a lawsuit against the VA and applies to any situation in which a VA employee, acting on behalf of the VA, is negligent and causes injury.

What are the 3 types of tort?

Torts fall into three general categories: intentional torts (e.g., intentionally hitting a person); negligent torts (e.g., causing an accident by failing to obey traffic rules); and strict liability torts (e.g., liability for making and selling defective products - see Products Liability).

How much does the FTCA have to settle?

The FTCA Section’s Director has authority to act on settlements by federal agencies of up to $1,000,000. For settlements in excess of that amount, the Director makes recommendations to higher-level DOJ officials.

What is the FTCA lawsuit?

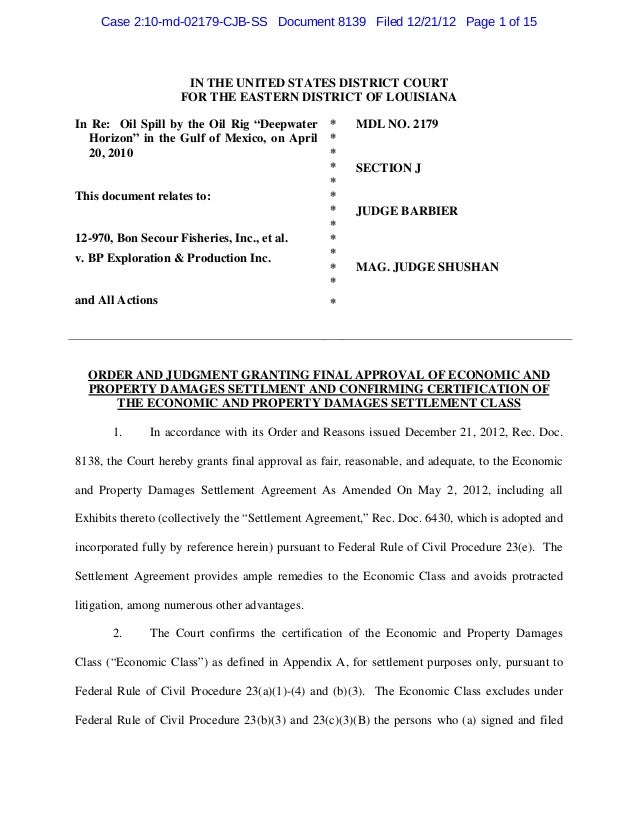

The FTCA Section has handled the defense in litigation related to Hurricane Katrina, which seeks billions of dollars in damages for losses caused by flooding.

What is the FTCA?

The Torts Branch’s Federal Tort Claims Act Litigation Section (FTCA Section) defends the United States in a wide range of complex, and often controversial, suits filed under the Federal Tort Claims Act. Enacted on August 2, 1946, the Federal Tort Claims Act provides a limited waiver of the United States’ immunity from suit, ...

When was the Tort Claims Act passed?

Enacted on August 2, 1946 , the Federal Tort Claims Act provides a limited waiver of the United States’ immunity from suit, allowing claims for damages.

What is the FTCA process?

The FTCA is federal legislation enacted in 1946 that provides a legal means for compensating individuals who have suffered personal injury, death, or property loss or damage caused by the negligent or wrongful act or omission of an employee of the federal government. ...

Where to send FTCA claim form?

A signed claim form and supplemental information (as described below) may also be sent via electronic mail to FT CA[email protected] . Electronic submission of claim forms and supplemental information will facilitate receipt.

How can I file a claim for personal injury or property damage/loss caused by EPA or EPA employees?

A claim predicated on a negligent or wrongful act of EPA or its employees may be filed using Standard Form 95. Use of the form is not mandatory, but in order for a claim to be valid, it must include your or your authorized agent or legal representative's signature, sufficient information to investigate the allegations, and a specific monetary demand amount. A claim must be filed within two years of the date the claim accrued. Instructions for completing the form can be found at FTCA Instructions for SF95.

What information should I submit with my claim?

In support of a claim, you should submit all documentation and evidence relating to your allegations and monetary damages. This includes, but is not limited to, medical records, doctors’ statements, itemized bills for medical expenses incurred, proof of property ownership, at least two itemized estimates for necessary property repairs, photographs of property, and police reports. Personal information will be safeguarded in a manner consistent with EPA’s privacy policy.

How long will it take for EPA to adjudicate my claim?

If EPA has not adjudicated your claim within 6 months, you may elect to treat the claim as having been denied and file suit in an appropriate U.S. District Court.

What are my options if EPA denies my claim?

If you receive a written denial from EPA, you may either file a request for reconsideration with the EPA Claims Officer or file suit in an appropriate U.S. District Court. Either option must be exercised no later than six months after the date of mailing of the written denial. A request for reconsideration does not require any special format, but should include a written explanation as to why the matter should be reconsidered, such as new or additional evidence that exists. If a request for reconsideration is subsequently denied, you may file suit in an appropriate U.S. District Court no later than six months after the date of mailing of the subsequent denial. If EPA has not adjudicated your request for reconsideration within 6 months, you may elect to treat the request as having been denied and file suit in an appropriate U.S. District Court.

Whom may I contact if I have additional questions?

You may direct inquires to 202-564-2738 or via electronic mail at [email protected]. If you are contacting EPA about a pending claim, please reference the EPA claim number located on the acknowledgment letter you received.

Who is entitled to assert a claim under the FTCA?

In general, any person who has the capacity to sue and whose claim is within the coverage of the FTCA may institute an action against the United States under the Act.

How long does it take to file a lawsuit under the FTCA?

Suit may not be brought until after the agency has formally denied the claim or failed to respond within a period of six months. The plaintiff may, at his option, file suit at any time after the six month period of time. If suit is filed before the notice of claims requirement is met the case will be dismissed. See 28 USC § 2675.

What is a wrongful death claim in Alabama?

In a wrongful death action brought under the FTCA where the act or omission causing death occurs in Alabama, the United States will be liable for “the actual or compensatory damages, measured by the pecuniary injuries.”.

What is the basis for a claim of negligence against a government employee?

28 USC § 2674 states that the United States shall be liable “in the same manner and to the same extent as a private individual under like circumstances.” 28 USC § 1346 ( b) states the basis for claims as the “negligent or wrongful act or omission” of any government employee while acting within the scope of his employment. Consequently, virtually every kind of negligence action that could be brought against private individuals can be maintained against the government whether based on misfeasance or nonfeasance. There are some specific exceptions which can be found at 28 USC § 2680.

What is the basis for claims as the “negligent or wrongful act or omission” of any?

28 USC § 2674 states that the United States shall be liable “in the same manner and to the same extent as a private individual under like circumstances.” 28 USC § 1346 (b) states the basis for claims as the “negligent or wrongful act or omission” of any government employee while acting within the scope of his employment.

How long can a plaintiff file a lawsuit?

The plaintiff may, at his option, file suit at any time after the six month period of time. If suit is filed before the notice of claims requirement is met the case will be dismissed. See 28 USC § 2675. Standard Form 95 may be used for the filing of a claim against most federal agencies. Click here to view the form.

What is a 95 form?

Standard Form 95 may be used for the filing of a claim against most federal agencies. Click here to view the form. The claim must be filed with the government agency by whom the tortfeasor is employed. The FTCA is a waiver of sovereign immunity, granting certain plaintiffs a tort claim for money damages.

What is FTCA exception?

For example, the FTCA contains several exceptions that categorically bar plaintiffs from recovering tort damages in certain categories of cases . Federal law also restricts the types and amount of damages a victorious plaintiff may recover in an FTCA suit.

What are the limitations of the FTCA?

Apart from the exceptions to the United States' waiver of sovereign immunity discussed above, 297 the FTCA may also limit a plaintiff's ability to obtain compensation from the federal government in other ways. Although, as a general matter, the damages that a plaintiff may recover in an FTCA suit are typically determined by the law of the state in which the tort occurred, 298 the FTCA imposes several restrictions on the types and amount of damages that a litigant may recover. 299 With few exceptions, 300 plaintiffs may not recover punitive damages or prejudgment interest against the United States. 301 The FTCA likewise bars most awards of attorney's fees against the government. 302

What is the case of Rich v. United States?

The Fourth Circuit's decision in Rich v. United States 185 exemplifies how courts evaluate whether a federal employee has engaged in discretionary conduct. The plaintiff in Rich —a federal inmate who was stabbed by members of a prison gang—attempted to file an FTCA suit alleging that the Bureau of Prisons (BOP) should have housed him separately from the gang members. 186 Federal law permitted—but did not affirmatively require—BOP "to separate certain inmates from others based on their past behavior." 187 Because federal law empowered prison officials to "consider several factors and exercise independent judgment in determining whether inmates may require separation," the Rich court held that BOP's decision whether or not to separate an inmate from others was discretionary in nature and therefore outside the scope of the FTCA. 188

What does FTCA 246 mean?

246 The FTCA defines that term to include "any officer of the United States who is empowered by law to" (1) "execute searches," (2) "seize evidence," or (3) "make arrests for violations of Federal law.".

What is the Federal Tort Claims Act?

The Federal Tort Claims Act (FTCA): A Legal Overview. A plaintiff injured by a defendant’s wrongful act may file a tort lawsuit to recover money from that defendant. To name a particularly familiar example, a person who negligently causes a vehicular collision may be liable to the victim of that crash.

What is the intentional tort exception?

However, the intentional tort exception contains a carve-out known as the "law enforcement proviso" 242 that renders the United States liable for certain intentional tort claims committed by "investigative or law enforcement officers of the United States Government.".

Why is the federal government subject to tort liability?

However, subjecting the federal government to tort liability not only creates a financial cost to the United States, it also creates a risk that government officials may inappropriately base their decisions not on socially desirable policy objectives, but rather on the desire to reduce the government’s exposure to monetary damages.

Why did the district court dismiss King's FTCA claims?

The court held that because Michigan law provides immunity for officials who do not act with malice, a state tort claim was not viable. (In a footnote, the Supreme Court noticeably did not express a view on whether state immunities would apply in this context).

Who reversed the FTCA?

The Supreme Court unanimously reversed. In an opinion by Justice Clarence Thomas, the court noted that the parties agreed that there “must have been a final judgment on the merits to trigger” the FTCA judgment bar.

What happened in Brownback v. King?

King, began in 2014, when officers working with an FBI task force in Grand Rapids, Michigan, tackled, choked and punched college student James King in the head after mistaking him for a fugitive. King sued the United States under the FT CA, which allows individuals to bring state law tort claims against the federal government.

What doctrine is the judgment bar drafted against?

The court held that it was. Thomas explained that “the judgment bar was drafted against the backdrop doctrine of res judicata, ” and to trigger the doctrine of res judicata, a judgment must be “on the merits.”.

What court did King appeal to?

On appeal, King wanted to pursue only the Bivens claims. The U.S. Court of Appeals for the 6th Circuit had to decide whether the appeal could go forward in light of the FTCA judgment bar.

What is the unanimous ruling on the judgment bar?

Unanimous court issues limited ruling on judgment bar in Federal Tort Claims Act. The Supreme Court issued a narrow ruling against a man who claims two federal officers violated his rights, but the court did not fully close the door on his lawsuit. (Guyyoung1966 via Wikimedia Commons)

Which circuit did not address the arguments in the case of the Supreme Court?

Despite this question consuming much of the briefing, the court punted in a footnote, noting that the 6th Circuit did not address the arguments, and that the Supreme Court is “a court of review, not of first view.”. Thus, the court left it to the 6th Circuit to decide how the judgment bar would apply in this case.

What is the first step in bringing a claim under the FTCA?

The first step in bringing a claim under the FTCA is to file an administrative claim. The administrative claim must be filed with the government branch or entity that is responsible for the alleged negligence. So if you get rear-ended by a post office truck, you would file your administrative claim with the U.S. Postal Service. There is a standard FTCA claim form available for use in submitting administrative claims.

Where to file FTCA lawsuit?

Lawsuits under the FTCA must be filed in the United States District Court for your home state or for the state where the alleged incident occurred. Federal government entities can not be sued in state court.

How long does it take to file a FTCA claim?

This FTCA administrative claim should be filed as soon as possible. The FTCA requires administrative claims to be filed within 2 years of the date of the alleged incident, but we strongly recommend filing within 1 year. Once your administrative claim is filed, the government entity has a 6-month time frame to formally respond to your claim. They can either accept your claim and agree to pay a certain amount in damaged. Or they can reject your claim and refuse to pay any damaged. If your claim is rejected, you have only 6 months to file a lawsuit against the government entity.

What was the settlement in Carshall v. United States?

Carshall v. United States (Oklahoma 2019) $7,500,000 Settlement: This is a birth injury malpractice claim against a tribal hospital. Mother was induced via Pitocin and the fetal heart monitor showed abnormal results. However, the hospital staff failed to modify Pitocin doses accordingly. As a result, excessive uterine activity occurred, causing fetal distress that resulted in hypoxic-ischemic encephalopathy. About 60 hours later, the baby was born with metabolic acidosis. He ultimately developed spastic quadriplegia and cerebral palsy. This case settled for $7,500,000.

What are some examples of FTCA?

First, a large percentage of hospitals around the country are funded by the federal government. Anytime you have a medical malpractice case against a hospital that is federally funded you have to bring that malpractice claim under the FTCA. Second, let's say you get rear-ended by a post office delivery truck and suffer serious injuries. Your auto accident claim against the mail carrier will fall under the FTCA.

How much was Godfrey v. United States settlement?

Godfrey v. United States (North Carolina 2020) $1,000,000 Settlement: A 28-year-old woman went to a federal clinic after with breathing problems, coughing, nausea, vomiting, and congestion. Hours after being discharged home, the woman’s husband found her unresponsive and she died shortly after. Her cause of death was a septic shock that was caused by a tension empyema. The woman’s husband made a wrongful death claim against the federal government. He alleged that the federal clinic staff’s failure to properly evaluate and diagnose the woman’s condition caused her death. This case settled for $1,000,000 .

What was the verdict in Mouton v. United States?

Mouton v. United States (Louisiana 2020) $169,756 Verdict: An FAA-owned sedan struck a man’s vehicle at an intersection causing soft-tissue neck injury , a concussion, and the aggravation of a pre-existing spinal injury. The man underwent steroid injections for treatment. He also claimed that he would need to undergo future surgery for the treatment of his aggravated spinal injury. The claim was brought under the FTCA. The FAA contested the man’s injuries, arguing that he only suffered mild symptoms and that his symptoms were related to a previous spinal injury.

Why did women invoke the FTCA?

women at the infamous Tailhook Convention in 1991, those women invoked the FTCA in an attempt to hold the United States liable for those officers’ attacks.10Family members of persons killed in the 1993 fire at the Branch Davidian compound in Waco likewise sued the United States under the FTCA, asserting that federal law enforcement agents committed negligent acts that resulted in the deaths of their relatives.11Additionally, the U.S. Court of Appeals for the First Circuit12affirmed an award of over $100 million against the United States in an FTCA case alleging that the Federal Bureau of Investigation (FBI) committed “egregious government misconduct” resulting in the wrongful incarceration of several men who were falsely accused of participating in a grisly gangland slaying.13

When was the FTCA enacted?

37Id. at 348. See alsoAxelrad, supranote 2, at 1332 (“Until the [FTCA] was enacted in 1946, no general remedy existed for torts committed by federal agency employees.”).

What is the meaning of 28 U.S.C. 2674?

§ 2674 (“The United States shall be liable, respecting the provisions of this title relating to tort claims, in the same manner and to the same extent as a private individual under like circumstances. ”).

How many tort cases were filed in 2018?

15Table 5 of the United States Attorneys’ Annual Statistical Report, https://www.justice.gov/usao/page/file/1199336/download, reports that plaintiffs filed 3,009 tort cases against the United States during FY2018, and that an additional 4,211 tort cases against the federal government remained pending from the previous year. In addition, the report states that the Department of Justice received 3,051 new tort-related civil matters during FY2018.

When was the Federal Tort Claims Act passed?

Congress, deeming this state of affairs unacceptable, ultimately enacted the Federal Tort Claims Act (FTCA) in 1946 .7The FTCA allows plaintiffs to file and prosecute certain types of tort lawsuits against the United States and thereby potentially recover financial compensation from the federal government.8Some FTCA lawsuits are relatively mundane; for instance, a civilian may sue the United States to obtain compensation for injuries sustained as a result of minor accidents on federal property.9Other FTCA cases, however, involve grave allegations of government misfeasance. For example, after naval officers allegedly sexually assaulted several

Can a private plaintiff sue the government?

A plaintiff suing the United States , however, may nonetheless encounter significant obstacles.34In accordance with a long-standing legal doctrine known as “sovereign immunity,” a private plaintiff ordinarily may not file a lawsuit against a sovereign entity—including the federal government— unless that sovereign consents.35For a substantial portion of this nation’s history, the doctrine of sovereign immunity barred citizens injured by the torts of a federal officer or employee from initiating or prosecuting a lawsuit against the United States.36Until 1946, “the only practical recourse for citizens injured by the torts of federal employees was to ask Congress to enact private legislation affording them relief”37through “private bills.”38

Who pays for FTCA?

Likewise, the Postal Service pays judgments for its torts.

Who should submit final money judgments to?

In cases delegated to them by the Civil Division, United States Attorneys should submit adverse final money judgments or compromises that cannot be paid by the client agency, insurer, surety, or indemnitor, to Treasury’s BFS or the Postal Service as appropriate.

What is post judgment interest?

§ 1304. The rate of interest is set forth in 28 U.S.C. § 1961. Judgments on claims brought against the United States in the Court of Federal Claims bear interest only under a contract or a statute which expressly provides for interest.

What is a tort action?

In tort actions, parties in addition to the injured plaintiff may have a legal interest in the funds generated by a judgment or settlement. See United States v. Aetna Casualty & Surety Co., 338 U.S. 366 (1949). The United States Attorneys should design settlement documents and documents for release of judgment so as to extinguish all claims arising from the subject matter of the lawsuit, including not only the claim of the primary plaintiff but also of all parties having a subrogated or other interest.

What is the Improper Payment Elimination and Recovery Improvement Act?

The Improper Payment Elimination and Recovery Improvement Act of 2012 and Executive Order 13244, require federal agencies to take additional steps to verify that payments are proper before submitting claims for payment to the Judgment Fund.

What is the federal statute for attorney fees?

The most generally applicable statute authorizing attorney’s fee awards against the United States is the Equal Access to Justice Act (EAJA), 28 U.S.C. § 2412. Generally, the amount of the fee is set by the court.

What statutes are relevant to costs in the district courts?

Other statutes relevant to costs in the district courts include 28 U.S.C. § 1914 (filing and miscellaneous fees); 28 U.S.C. § 1920 (Taxation of costs); 28 U.S.C. § 1921 (United States Marshal’s fees); and 28 U.S.C. § 1923 (attorneys’ docket fees and costs of briefs). Where no statute specifically allows for the recovery ...