Like many other closing costs included in the VA homebuying process, you can ask the seller to pay some or even all of the buyer’s property tax and insurance premiums. RESPA Escrow Rules The Real Estate Settlement Procedures Act ("RESPA") protects home buyers and helps them understand the costs associated with buying a home.

Full Answer

Can a VA loan buyer pay the costs of selling a home?

Again, these are costs and fees that a VA buyer cannot pay. But that doesn’t automatically mean the home seller has to pay these costs. Any of the other parties to the loan -- like the lender or a real estate agent -- can cover these expenses.

What fees does the VA allow veteran borrowers to pay?

The main allowable fees can be listed in an easy-to-remember acronym (ACTORS): appraisal, credit report, title insurance, origination fee, recording fee, and survey. Costs that the VA allows the veteran borrower to pay can also be split into 2 forms: POC (paid outside closing) and PFC (prepaid finance charges).

What are non-allowable fees when selling a VA home?

The fees which the VA prohibits from being charged to the veteran buyer are called “non-allowable fees.” Though these will vary between lenders and title companies, there are two primary fees you as the seller should be aware of. Most lenders charge a fee called a processing or underwriting fee. This is different from the origination fee.

Can the borrower of a VA Loan Charge a lawyer?

VA Loan Fees the Borrower Cannot Pay. If the buyer chooses to pay for his or her own attorney, that's the buyer's call, but the buyer can't be charged for the bank's legal representation. The VA also prohibits a real estate agent from charging the buyer a commission. You'll also find VA mortgage rules that close any loopholes...

What is a VA buyer not allowed to pay?

Here are the VA non-allowable fees that you need to consider. Real estate attorney fees: Attorney fees are not allowed for VA home loans. Real estate broker fees: You cannot pay for real estate broker fees when buying a home with a VA loan. Agent or REALTOR® fees: VA borrowers cannot pay real estate agent fees.

What is the VA 1% rule?

The 1 Percent Fee This flat 1 percent fee covers the lender's costs associated with originating, processing, and underwriting the loan. On a $200,000 VA loan, this fee would be $2,000. If the lender is charging the 1 percent fee, they are not allowed to tack on additional charges for things the VA considers overhead.

Are VA closing costs tax deductible?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is “no.” The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

Do VA clients pay closing costs?

Like other types of home loans, VA loan borrowers will have to pay fees known as closing costs to lenders for processing their loan. Fortunately, VA loan borrowers have options to reduce the amount they pay out of pocket.

Why do sellers not like VA loans?

Why don't sellers like VA loans? Many sellers — and their real estate agents — don't like VA loans because they believe these mortgages make it harder to close or more expensive for the seller.

Do you pay earnest money with VA loan?

Earnest money deposits are not required when using a VA loan to purchase a home. However, depending on the current real estate market conditions, a seller may request an earnest money deposit as part of an offer.

How can I avoid closing costs with a VA loan?

You can reduce how much you spend on VA closing costs in a variety of ways, such as:Making a down payment to reduce the VA funding fee.Applying to eliminate it, if you qualify.Negotiating so that the seller pays most of the closing costs.Purchasing discount points to reduce the interest rate on your loan.

Can you roll closing costs into VA loan?

That's OK! The VA loan allows you to include some of the closing costs into your total loan amount. The big thing is that you can roll your funding fee into the total mortgage amount. Although you'll pay more in interest, this can help you get into a home now.

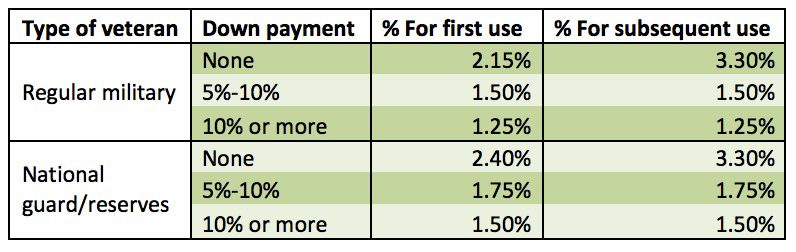

What is the VA funding fee for 2022?

How much is a VA funding fee 2022? The VA funding fee is 2.3% of the total loan amount for first-time homebuyers with no down payment. Repeat VA homebuyers (also known as subsequent use homebuyers) pay a fee of 3.6% for the same loan. Fees decrease if you can put 5% down or more.

Who pays the escrow fee on a VA loan?

It is typically between $300 and $900. The is a non-allowable cost. Some lenders waive it on VA loans, but many will charge it to the seller. The other fee is from the title company and will be called an escrow, settlement or closing fee.

How do you get closing costs waived?

7 strategies to reduce closing costsBreak down your loan estimate form. ... Don't overlook lender fees. ... Understand what the seller pays for. ... Think about a no-closing-cost option. ... Look for grants and other help. ... Try to close at the end of the month. ... Ask about discounts and rebates.

Who pays the VA funding fee?

BorrowersBorrowers must pay the one-time VA funding fee when taking out a new VA loan or refinancing an existing VA mortgage. Borrowers pay the fee directly to the Department of Veterans Affairs, who uses the money collected to continue funding home purchases for active military members, retired veterans and surviving spouses.

What is tax-deductible when buying a home?

The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points). To deduct prepaid mortgage interest (points) paid to the lender if you must meet these qualifications: Your main home secures your loan (your main home is the one you live in most of the time).

What home improvements are tax-deductible 2021?

"You can claim a tax credit for energy-efficient improvements to your home through Dec. 31, 2021, which include energy-efficient windows, doors, skylights, roofs, and insulation," says Washington. Other upgrades include air-source heat pumps, central air conditioning, hot water heaters, and circulating fans.

What house expenses are tax-deductible?

There are certain expenses taxpayers can deduct. They include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent. Taxpayers must meet specific requirements to claim home expenses as a deduction.

What home buying expenses are tax-deductible?

You itemize your deductions on Schedule A Form 1040. Homeowners can generally deduct home mortgage interest, home equity loan or home equity line of credit (HELOC) interest, mortgage points, private mortgage insurance (PMI), and state and local tax (SALT) deductions.

How long does it take for VA to return closing costs?

Borrowers get an idea of closing costs expenses once they complete a full loan application. Within three business days of receiving the application, a VA lender will return a Loan Estimate to the borrower. The Loan Estimate is non-obligatory and does not commit the borrower to that lender or loan amount.

What to do with VA loan estimate?

Using the Loan Estimate as a launching point, borrowers should talk with their VA loan specialist and real estate agent about the best closing cost approach. Some VA loan users have the capital to pay some closing costs, while others prefer to find sellers who are willing to pay more upfront to sell their property.

Who Pays Closing Costs?

Negotiation between VA loan homebuyers and sellers dictates who pays how much of the closing costs. There is no VA maximum concerning how much sellers can cover in terms of loan-related closing costs, so buyers can ask home sellers to pay for everything.

How much can a seller pay for closing costs?

In addition, sellers can pay up to 4 percent of the loan amount in concessions.

Can you pay closing costs on a VA loan?

VA Loan Fees the Borrower Cannot Pay. When you go to purchase a home with a VA guaranteed mortgage, you’ll typically encounter fees like closing costs and other expenses. How those get paid is often a matter of negotiation between you and the seller. But there are also fees the VA does not allow the buyer to pay.

Do you get compensation for listing a lender?

When listing lenders or partners we may also receive compensation that impacts how, where and in what order those partners appear. Our partnerships allow us to provide a non-intrusive, user-friendly way to learn about mortgage finance options.

Can a buyer be charged for a lawyer?

If the buyer chooses to pay for his or her own attorney, that's the buyer's call, but the buyer can't be charged for the bank's legal representation. The VA also prohibits a real estate agent from charging the buyer a commission.

What if the Seller Balks?

Sellers often realize they need to engage in some give-and-take in order to sell their property. But not all markets are competitive, and not all sellers are motivated.

When is the first mortgage payment due?

So if you close in mid-September, your first mortgage payment wouldn’t typically be due until November 1. But lenders will collect prepaid interest on the loan between your closing date and the end of the month you close. Lenders calculate it as a per-day rate (yearly interest cost/365 days per year = one day of interest payment). That prepayment is due at the closing table.

How long does it take to get a closing cost estimate?

But you won’t get an official estimate of your closing costs until a lender has a full application that includes information on your income, your credit and a specific property address. Once a lender has that application in hand, they’re legally required to send you some key documents and disclosures within three business days. One of the most important is the Loan Estimate.

Do you have to pay closing costs before closing?

Some need to be paid before you get to the closing table, while others can wait until that happy day arrives. Your closing costs will vary depending on a host of factors, from your lender and loan type to the location and more. With VA loans, this program actually limits what buyers can pay in closing costs.

Do VA disability buyers pay closing costs?

Buyers who receive VA disability compensation are exempt from paying this fee. The funding fee is the only closing cost VA buyers can roll into their loan balance, and that’s how most borrowers approach this fee. You could ask the seller to pay it, but doing so would count against the 4 percent concessions cap.

Do veterans get exempt from closing costs?

Veterans are exempt from the funding fee if they receive compensation for a service-connected disability, whether they're at 90 percent or 10 percent. In terms of closing costs, we would need to learn more about where you're buying and more to best assess potential closing costs.

Do sellers have to pay closing costs on VA loans?

One of the big benefits of VA loans is that sellers can pay all of your loan-related closing costs. Again, they’re not required to pay any of them, so this will always be a product of negotiation between buyer and seller.

What are VA closing costs?

The list for VA closing costs allowed may look lengthy and expensive, but it is actually much, much shorter than the list of non allowable VA fees. The VA forbids lenders from charging borrowers these fees because the VA loan is meant to be a huge benefit for veterans. The program is meant to give them an affordable option for owning a home in the country they’ve fought for. As that veteran borrower, you can feel more secure in your home loan knowing that you don’t have to pay the following fees: 1 Escrow 2 Loan tie-in 3 Lender documents 4 Warehouse 5 Processing 6 Tax service contract 7 Underwriting 8 Photo inspection 9 Administration 10 Recording fees charging more than $17 11 Termites 12 Notary 13 Change of ownership 14 Commission 15 Transaction coordinator 16 Title policy endorsement 17 Reconveyance (allowable for refinances) 18 Prepayment penalties (allowable for refinances) 19 Demand or payoff statement (allowable for refinances)

What are VA allowable fees?

Fees and closing costs are essentially the price you pay to actually process your loan while the interest rate is the price you pay to borrow the money. The main allowable fees can be listed in an easy-to-remember acronym (ACTORS): appraisal, credit report, title insurance, origination fee, recording fee, and survey.

How much can you charge for closing costs?

Even the fees that can be charged have a limit to how much money they are allowed to be charged for each cost. For example, the origination fee cannot exceed 1 percent of the loan amount. The recording fee has a similar restriction and cannot exceed $17. It’s also important to know that closing costs can often be financed into the loan amount, meaning you pay nothing out of pocket on the day of closing, but you do eventually pay off all of those costs throughout the life of your loan.

What are the two forms of VA loan?

Costs that the VA allows the veteran borrower to pay can also be split into 2 forms: POC (paid outside closing) and PFC (prepaid finance charges). Beyond the allowable fees listed in the acronym ACTORS, there are also a few other items on the VA’s official list: Document draw fee. Notary fee.

Can a seller pay closing costs?

The seller may pay all or part of the total cost of closing—there aren’t any VA rules regarding this. The lender can also cover closing costs if the borrower is unable to, but this option comes with a sometimes heavy price—usually in the form of a higher interest rate.

Is closing cost allowed for VA loans?

The list for VA closing costs allowed may look lengthy and expensive, but it is actually much, much shorter than the list of non allowable VA fees. The VA forbids lenders from charging borrowers these fees because the VA loan is meant to be a huge benefit for veterans.

Do you have to pay down a VA loan?

VA loans are popular with those who are eligible primarily because of the low cash needed to close. There is no money down required with a VA loan, which certainly helps keep cash to close to a minimum. In addition, veterans are restricted from paying certain types of fees. A veteran cannot pay for an attorney fee or escrow charge but can pay for others. What fees can the veteran pay?

Can veterans pay for title insurance?

Veterans can pay for an appraisal, credit report, title insurance, and related title charges, an origination fee if expressed as a percentage of the loan amount and a recording fee. In states where a survey is required, a veteran is also allowed to pay for a survey. Everything else must be paid for by others. Lenders often refer to the acronym ACTORS when quoting closing costs. Who can pay?

Can you pay closing costs with VA offer?

The sellers can always decline to pay for additional closing costs, but with an accepted VA offer, sellers will pay for closing costs sometimes referred to as “unallowable” fees. These fees are off-limits for buyers but still charged to provided needed services.

Can a seller pay for closing costs?

Sellers are often asked to pay for certain closing costs the veteran is not allowed to pay. When an agent makes an offer and the contract states VA financing will be used, the sellers need to be aware of what charges they can expect to pay. The sellers can always decline to pay for additional closing costs, but with an accepted VA offer, sellers will pay for closing costs sometimes referred to as “unallowable” fees. These fees are off-limits for buyers but still charged to provided needed services.

Do VA loans have closing costs?

VA Closing Costs: Seller or Buyer Paid? Even though you’ve probably heard the term “no closing cost” loan, the fact is that all mortgages come with closing costs. There’s just no way around it. There are lender closing costs and non-lender closing costs needed to perform various services and retrieve documents from various third parties.

Can a seller pay for a VA loan?

With VA loans, sellers are allowed to pay for some or all of the buyer’s costs. VA loans allow the sellers to contribute up to 4.0 percent of the sales price of the home. In this example, that would be $8,000 but closing costs on a $200,000 generally won’t be quite that high. Your loan cost estimate will have that figure.

Can you increase an offer above what the seller is asking?

Sometimes buyers can increase an offer above what the sellers are asking. If a home is listed at $200,000 and closing costs to the buyer are estimated to be $3,000, an offer of $203,000 can be made with the sellers using the extra proceeds to pay for the buyer’s closing costs.

Who owns Valoans.com?

VALoans.com is owned by Mortgage Research Center, LLC. Information, recommendations and advice from VALoans.com is grounded in decades of experience in the mortgage industry. Our goal is to educate and help you make better homebuying decisions.

Can a bank use the same minimums as a VA loan?

But there's no rule that forces a bank to use the same minimums. A lender is free to set higher standards for borrowers as long as those standards don't violate the terms of the VA loan program. The lender is also free to set requirements for escrow accounts for payment of property taxes and/or other costs required as part of a VA loan.

How much can a seller contribute to closing costs on a VA loan?

VA loan rules dictate that the seller can contribute up to 4%. Seller concessions on VA loans may include payments toward a buyer’s judgments and debts, as well as VA funding fees.

What closing costs can a veteran not pay?

The 1 Percent Fee If your lender is charging the flat fee, there’s a host of things you cannot pay for, including: Loan application or processing fees. Interest rate lock-in fees. Document preparation fees.

What fees are veterans not allowed to pay?

Here’s a list of the VA fees a borrower cannot pay outside of the 1% origination fee:

What are VA allowable closing costs?

VA closing costs average around 3-6% of the loan amount — or roughly $9,000 to $18,000 on a $300,000 home loan. Some of the closing costs a veteran can pay include: VA funding fee. Appraisal.

How can I avoid closing costs with a VA loan?

Now, you know there are closing costs on VA loans, but what if you don’t want to or cannot bring those costs to closing? The most common way to overcome bringing these funds to closing is by seller paid closing costs and VA sales concessions. Remember, the seller is NOT required to pay the buyer’s closing costs.

Can a VA buyer pay for repairs?

Can a Buyer Pay for VA Required Repairs? The reality is VA buyers can pay for home repairs needed to close a loan, even if they’re issues related to the VA’s Minimum Property Requirements. To be sure, if the VA appraisal indicates there are repairs needed, buyers should first ask the seller to cover these costs.

What is a VA non allowable?

VA Non Allowable Fees are fees Veterans using a VA home loan cannot pay. However, a seller, the veterans real estate agent and/or buyer’s lender may pay for the VA Non Allowable Fees.

What are the benefits of a veteran home loan?

They offer 100% financing, with no mortgage insurance and fairly easy qualifying guidelines. Like most everything else the Government does, there are some “quirks” to the program. We are helping a Rookie Agent with a closing… and we are answering MULTIPLE questions about ...

Who to call for HUD1 settlement statement?

If you are considering a purchase, and want to know more about qualifying for a VA mortgage loan, please call Steve and Eleanor Thorne, Govenment Mortgage Loan Experts, 919-649-5058.

Do veterans pay for title insurance?

The veteran may pay a fee for title examina tion and title insurance. In most cases, the ATTORNEY FEE will be shown as a Title Examination Fee in NC. Although this has been updated, some underwriters still do not want to see a Veteran pay for an ATTORNEY Fee. SPECIAL MAILING FEES ONLY FOR REFINANCING LOANS.

Can a veteran pay for a hazard insurance premium?

The Veteran can not pay for an “application fee.”. PREPAID ITEMS. The veteran can pay their part of taxes, assessments, and similar items for the current year including the amounts needed to create an Escrow Account. HAZARD INSURANCE. The veteran can pay for homeowner’s or hazard insurance premium.

Can a veteran pay for a VA inspection?

The veteran can NOT pay for the builder inspections charged during construction.

Can veterans pay for express mail?

SPECIAL MAILING FEES ONLY FOR REFINANCING LOANS. Only in the case of refinancing a loan, the veteran can pay charges for Express Mail or a similar service. Veterans can NOT pay for Commitment Fees, Underwriting Fees, Processing Fees – or the like.

Who pays for termite report?

The Seller pays for the Termite report. The veteran can pay a charge for a survey, though we don’t always require this for VA loans. It will depend on the seller’s ability to provide a survey. The veteran may pay a fee for title examination and title insurance.

What are the benefits of buying a home as a veteran?

Besides the VA loan program, there are other benefits to buying a home as a veteran. Grants and subsidies from local communities and housing initiatives may be available to help cover some of the loan costs for both buyers and sellers. Though the onus is typically on a buyer to find out if they can get any assistance in buying a home, if you are selling to a veteran, it is to your benefit to know about any programs in your area. These assistance grants can be used to pay VA non-allowable costs in addition to the buyer’s other costs of obtaining a loan. Talk to your community housing authority before listing your home to find out what might be available in your area.

What is a VA loan?

The Department of Veteran Affairs created the VA loan programto help veterans and their families buy homes. One of the advantages for the Veteran is that the VA limits the amount of fees the lender and title company is allowed to charge the buyer. Some of the non-allowable costs are considered “junk fees,” while others represent actual costs ...

What are VA non-allowable fees?

Non-Allowable Fees. The fees which the VA prohibits from being charged to the veteran buyer are called “non-allowable fees.”.

Lender Origination Fee

Breaking Down VA Non-Allowable Fees

- Now that we have a good idea of which fees are allowed and which are not, let’s break down what some of these VA non-allowable fees mean: 1. Application fees: The lender cannot charge the borrower for applying for a mortgage. 2. Attorney fees: These are not permitted for VA loans. However, the buyer can choose to pay for their own attorney. 3. Real...

Breaking Down VA Allowable Fees

- These are the most common fees that you might be expected to pay when using a VA home loan. However, these could differ depending on your specific lender. 1. Appraisal fee: The VA appraisal helps protect Veteran buyers and ensures you’re buying a home that is up to standards. 2. Credit report fee: A lender can charge a VA borrower for a copy of their credit report, but the charge ca…

Non-Allowable Fees on VA Refinances

- When it comes to refinances of VA loans, the rules are slightly different. A mailing fee may be passed on to you if you’re refinancing. This fee covers costs like FedEx, Express Mail or similar services needed to mail out loan documents. If you are refinacing through a VA Interest Rate Reduction Refinancing Loan (IRRRL), it’s even possible to close with no money out of pocket. Thi…