Although Bloomberg PTS and SSCNet might allow for either FIX messages, proprietary message types or ISO 15022 message types to be used, the output — or matched instruction — must be reformatted into a version of the ISO 15022 message that is accepted by DTC’s settlement system. The same applies to Omgeo.

Full Answer

What is the settlement service at DTC?

DTC’s Settlement Service for equity, corporate debt and municipal debt securities transactions consolidates and facilitates end-of-day net funds settlement of a participant’s net debits and credits. The Depository Trust Company’s Inventory Management System (IMS) enables participants to centrally manage their settlement deliveries.

What does DTC stand for in banking?

The Depository Trust Company (DTC), the central securities depository subsidiary of DTCC, provides settlement services for virtually all broker-to-broker equity and listed corporate and municipal debt securities transactions in the U.S., as well as institutional trades, money market instruments and other financial obligations.

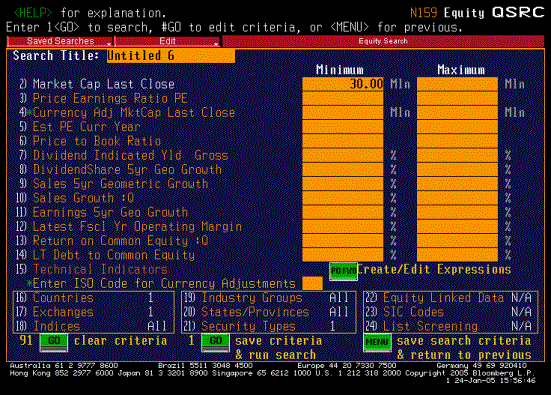

Where can I find Bloomberg data?

Data.Bloomberg.com is our ready-to-use data website, featuring a self-service data marketplace that helps Data License clients more easily discover, access and immediately use high-quality, market leading content from Bloomberg and third-party data providers. View our newest and featured enterprise datasets.

What can you do with Bloomberg Terminal?

List of the most common Bloomberg functions and shortcuts for equity, fixed income, news, financials, company information. In investment banking, equity research, capital markets you have to learn how to use Bloomberg Terminal to get financial information, share prices, transactions, etc. Bloomberg functions list

Why is DTCC moving to T+1?

DTCC has been building industry support for the move to T+1 for some time, and market participants are galvanizing around this because it will deliver significant benefits, such as increased capital efficiencies, significant risk reduction and lower margin requirements, especially during times of high volatility.

How long is the T+2 settlement cycle?

When speaking about the settlement cycle timelines, the current T+2 settlement cycle (two business days after the trade is executed) is a market structure convention and shortening it would require industry alignment. Technology – whether legacy or new – is not a factor in determining settlement times.

What is NSCC in trading?

NSCC, which clears and efficiently nets U.S. equities trades down to a single position each day, processes same-day settlement for transactions received prior to 11:30am ET. This timing is critical because it enables transactions to go through NSCC’s continuous netting process, which is crucial to market participants as it consolidates the amounts due from – and owed to – a firm across the securities it has traded, down to a single net debit or net credit.

What does netting at NSCC do?

Every day, netting at NSCC reduces the value of payments that need to be exchanged by an average of 98% or more, which frees up capital and reduces risk for the entire industry. After completing the clearing and netting process in NSCC, the netted positions are sent to DTC for near-instantaneous settlement on the same day.

Can you settle on the same day?

Same-day settlement is not a new capability . DTCC’s National Securities Clearing Corporation (NSCC), the equities clearing subsidiary, and The Depository Trust Company (DTC), the depository and securities settlement system, can clear and settle transactions on the same day (T+0) a trade is executed. However, market convention is to settle on a T+2 basis due to market structure complexities, and legacy business and operational processes.

Can the NSCC extend the deadline?

It is important to note that while NSCC has the capability to extend the deadline beyond 11:30am ET until later in the afternoon, such a move would require industry demand and coordination, and regulators would need to be engaged.

Is T+0 still supported at NSCC?

As mentioned, same-day settlement (T+0) is already supported today at NSCC and DTC using existing technology.

What is DTC settlement?

DTC’s Settlement Service for equity, corporate debt and municipal debt securities transactions consolidates and facilitates end-of-day net funds settlement of a participant’s net debits and credits.

What is a DTC?

The Depository Trust Company (DTC), the central securities depository subsidiary of DTCC, provides settlement services for virtually all broker-to-broker equity and listed corporate and municipal debt securities transactions in the U.S., as well as institutional trades, money market instruments and other financial obligations. Settlement, a consolidated end-of-day process and the final step of a securities trade, completes the transfer between trading parties of securities ownership and cash.

What is DTCC learning?

DTCC Learning offers comprehensive, fast-track training for DTCC customers of financial services organizations who are looking to expand their expertise and abilities in using the post-trade processing products and services provided by DTCC’s subsidiaries.

What is the end of day net funds settlement?

End-of-day net funds settlement is conducted through settling banks that act on behalf of participants, so that funding occurs via a single transmission, called the National Settlement Service (NSS), to the Federal Reserve.

What is smart track for agency lending?

SMART/Track for Agency Lending Disclosure is a centralized communications hub that transmits open loan data between lenders and borrowers.

Why is Bloomberg Terminal important?

To be more productive, faster, and more efficient when performing financial analysis or research it’s important to be proficient at using the Bloomberg Terminal. That means knowing the most important Bloomberg functions.

What is a precedent transaction analysis?

Precedent Transaction Analysis Precedent transaction analysis is a method of company valuation where past M&A transactions are used to value a comparable business today.

What are analysts expected to be efficient at using the terminal?

Analysts are expected to be efficient at using the Terminal and need to be able to quickly pull information.

Can analysts use Bloomberg?

In addition to using Bloomberg functions on the Terminal, analysts also have to be good at integrating Bloomberg into Excel. Analysts will often build custom formulas that pull data directly from the Terminal to their desktop where it can be integrated into financial analysis, financial modeling.

Products and Services Menu

Click on the boxes below to learn about the transaction types and activities that make up the settlement process.

Inventory Management System

The Inventory Management System provides you with the ability to manage when and in what order deliveries from your inventory should be attempted. IMS is a service offered to you as a deliverer. Inventory is the number of shares you have available to meet your deliveries.

Record Formats Messages

Clients may submit their transactions to DTC via ISO 15022 Messaging and Batch Files. Batch files utilize a CCF (Computer to Computer File Transmission, a proprietary format) and MQ Series. For more information contact [email protected] .

Settlement Web

The Settlement Web is DTC's primary Settlement user interface. Clients have the ability to view their settlement activity as well as to submit transactions to DTC for end of day money settlement.

SMARTTrack Services

SMART/Track provides a centralized communications hub for the transmission of various message types between clients.