Where can I find out more about the Equifax settlement?

Learn more at the FTC’s official site for information: ftc.gov/Equifax. Remember that you don’t have to pay for credit monitoring as part of this settlement, and nobody will call, text, or email out of the blue to ask you for your credit card or bank account numbers, or to “help” you get your free credit monitoring.

Did you get an email about free credit monitoring through Equifax?

Lots of people recently got an email or letter about free credit monitoring through the Equifax settlement. That’s because the settlement with Equifax was just approved by a court. So now, if you signed up for credit monitoring as part of that settlement, you can take a few steps to switch it on. The email or letter tells you how.

How much did you pay for the Equifax breach?

As a result, consumers who were affected by the breach had the option of signing up for either up to $125 or free credit monitoring at all three of the largest credit reporting firms: Equifax, Experian and TransUnion. (Consumers who sought cash payments should visit the settlement claims administrator’s website for updates, Equifax told CNBC.)

What is a settlement class member of the Equifax breach?

A settlement class member of the Equifax breach is any one of the 147 million people impacted by the breach—i.e., who had their information stolen.

See more

Who qualifies for the Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

How much can you get from a data breach settlement?

How much can I receive from the Capital One settlement? Class members can collect up to $25,000 in cash for lost time and out-of-pocket expenditures relating to the breach, including unreimbursed fraud charges, money spent preventing identity theft and fees to professional data security services.

Has anyone received money from Equifax?

After a data breach in 2017 exposed personal data of more than 147 million consumers, including in some cases Social Security and driver's license numbers, credit bureau Equifax agreed to pay hundreds of millions in compensation to help affected consumers.

Where is my Equifax settlement check?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

Is Equifax accurate?

Both TransUnion and Equifax are reliable credit reporting agencies that compile reports and calculate your credit scores using different scoring models.

How do I know if my Equifax breach is affected?

If you want to check whether your data was exposed, the FTC and official settlement site have an online tool you can use to check if you were part of the Equifax breach. You'll need to enter your last name and last six digits of your Social Security number to see if your data was part of the hack.

Is there really a Capital One settlement?

Important Update: 2019 Cyber Incident Settlement Reached On February 7, 2022, a U.S. federal court preliminarily approved a class action settlement relating to the cyber incident Capital One announced in July 2019.

How much is the Capital One settlement per person?

The settlement allows reimbursement for up to $25,000 in out-of-pocket expenses related to the data breach. This includes money spent preventing identity theft or fraud, unreimbursed fraud charges, miscellaneous expenses, professional fees, and up to 15 hours of lost time at a rate of at least $25 per hour.

What happened to the Equifax settlement Payments?

The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach.

How much is the Equifax data breach settlement?

$425 millionEquifax data breach class action lawsuit settlement updates: On June 3, 2021, the 11th Circuit Court of Appeals upheld the $425 million Equifax data breach settlement.

Is my Equifax the same as Equifax?

Highlights: With a free myEquifax account, you can receive free Equifax credit reports, place a security freeze, fraud alert or submit a dispute. A myEquifax account is FREE, and for anyone to easily view and monitor their Equifax credit report and needs credit report assistance.

How much can you expect from a class action lawsuit?

A class action usually ends in a settlement as opposed to going to trial. Settlements in recent years have averaged $56.5 million.

How much will I get from the Bank of America lawsuit?

What does the Settlement provide? Bank of America has agreed to establish a Settlement Fund of $27.5 million from which Settlement Class Members will receive payments or Account credits. The amount of such payments or Account credits cannot be determined at this time.

How are class action settlements divided?

Class action lawsuit settlements are not divided evenly. Some plaintiffs will be awarded a larger percent while others receive smaller settlements. There are legitimate reasons for class members receiving smaller payouts.

Are class action settlements worth it?

In general, yes – class action lawsuits are worth it. For Class Members who are able to recover benefits from a class action settlement, all it takes is filling out a claim form and potentially providing documentation. This can allow them to recover up to thousands of dollars in compensation.

How long does it take to get a free credit report from Equifax?

You can get six free credit reports from Equifax in a 12-month period, for seven years beginning January 2020. These are in addition to the free reports you’re already entitled to under the law.

When did Equifax breach?

In September 2017 , Equifax announced a breach that exposed the personal data of approximately 147 million people. If your data was impacted, under a legal settlement, you may claim free services and payments.

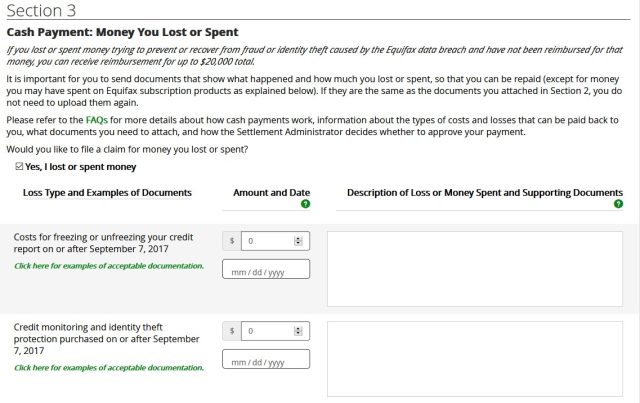

Can you request reimbursement for Equifax?

You can request reimbursement if you spent money, for example: For certain Equifax products before the breach. To freeze or unfreeze your credit. For credit monitoring services. Dealing with fraud or identity theft after the breach.

How much of your emergency savings can you use to pay off debt?

Once you've done that for say 2-3 months like clockwork, you're welcome to use UP TO 50% of your emergency savings to negotiate payoffs with old debts. Chargeoffs with balances come first. Collections to be paid IF you can get a PFD (pay for delete) in writing. If you don't get any PFD acceptance from collections, keep offering it every month until someone accepts, but keep growing your emergency savings account.

Does Equifax have a proprietary score?

If you purchased a report/score directly from Equifax, you most likely received their proprietary score. It is certainly possible that it hasn’t updated and you should be able to tell by reading through the reports from all of bureaus.

Is EQ a Fico score?

When I was purchasing my reports and scores from EQ, it was never a Fico or vantage score. They have their own scoring model.

Does Experian 581 have Equifax?

Experian 581 Transunion 573 but didn't have Equifax.. so I went to Equifax popped off 16 bucks to pull it....

For Those Affected by the Equifax Security Breach

Consumers affected by the Equifax Security Breach are eligible for at least 10 years of free credit monitoring service, plus at least 7 years of identity restoration, also for free, if you are a victim of identity theft. If you choose to use a different credit monitoring service, you could be reimbursed up to $125 for that cost.

What You Need to Do to Access Benefit from the Equifax Settlement

A series of deadlines have been set up for filing claims or opting out of the Equifax Settlement. The first deadline actually is for those who wish to opt out of the settlement, which leaves you free to pursue your own lawsuit against the company should you so choose. The opt-out deadline is Nov. 19, 2019.

Equifax Settlement: Bottom Line

We want to see everyone remaining financially safe and sound, so we encourage you to check to see if you have been affected by the Equifax security breach and if you are entitle to an Equifax settlement. Those affected should be prepared to file their claims for monetary damages by the Jan.

If you signed up for the Equifax Breach Settlement, activate your benefit online

Jim Probasco has 30+ years of experience writing for online, print, radio, and television media, including PBS. His expertise includes government programs and policy, retirement planning, insurance, family finance, home ownership and loans. He has a bachelor's from Ohio University and Master's from Wright State University in music education.

Who's a Settlement Class Member?

A settlement class member of the Equifax breach is any one of the 147 million people impacted by the breach—i.e., who had their information stolen. If you are unsure of your status, the settlement administrator has a tool to check your status as a class member on the Equifax Data Breach Settlement website.

Who's an Eligible Claimant?

If you submitted a claim and opted for free Credit Monitoring Services during the Initial Claims Period, which ended Jan. 22, 2020, you are eligible for free credit monitoring for four years, as well as other benefits and coverage that will be explained to you when you sign up for your membership.

How to Sign Up for Free Credit Monitoring

By Feb. 25, 2022, all valid claimants will receive a letter or email from the settlement administrator that will include an activation code. 7 You will be instructed to go to the Experian IdentityWorks website and enter your activation code by June 27, 2022 to begin your free four-year membership. 2

How to Avoid a Scam

For every legitimate offer of free services, there are likely hundreds of scams. The Equifax settlement will be no different. Keep the following things in mind when evaluating any communications you receive: 3

Extended Claims Period

Although the deadline for settlement class members to file an Initial Claims Period claim passed on Jan. 22, 2020, class members may submit reimbursement claims for Out of Pocket Expenses and/or Time Spent for the Extended Claims Period (Jan. 23, 2020 through Jan. 22, 2024. 7

Free Identity Restoration Services

If you are a settlement class member, you are entitled to at least 7 years of free assisted identity restoration services beginning Jan. 11, 2022, to help you remedy the effects of identity theft and fraud. 7

How do you verify or amend your claim?

Once you do, you’ll have an option to verify your claim by entering the name of the credit monitoring service you were using when you filed your claim and that you will have for at least the next six months.

Does compensation factor into how and where products appear on our platform?

Compensation may factor into how and where products appear on our platform ( and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Is Equifax a scam?

Although the email may look suspicious, it’s not a scam — it’s important to read the email and follow the instructions closely so your claim can be processed.

Does Credit Karma pay advertisers?

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted.

Does Credit Karma monitor credit?

As a reminder, if you’re a Credit Karma member you may have credit monitoring through Credit Karma and can check your account to confirm.

How much can you claim for time spent on Equifax?

The Equifax settlement has a provision through which victims can claim a cash payment for "time spent.". This means that you can claim a rate of $25 per hour for up to 20 hours of the time you wasted dealing with the fallout of the breach.

How much can you claim for a credit freeze?

If you spent hours researching what to do about the breach, setting up credit freezes, hopping on the phone with your bank, or doing anything else remotely relevant, you can claim up to $250 for that time without needing to show any specific evidence.

Can you still get your money from Equifax?

The Equifax settlement process has been absurd, but don't worry. You can still get your money. Photograph: David Muir/Getty Images

Does Equifax have free credit monitoring?

The free credit monitoring Equifax offered after its breach has now expired, but many states offer a list of disclosed breaches that you can check. Many of those companies have given out free credit monitoring as recompense.