What is the Federal Reserve payments study?

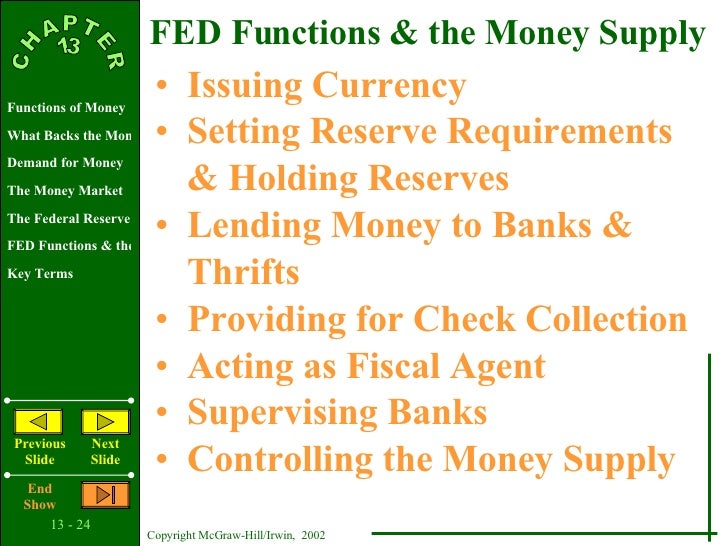

Federal Reserve Payments Study finds that ACH and card payments grew rapidly from 2015 to 2018, outpacing the prior three-year period. The twelve Federal Reserve Banks provide banking services to depository institutions and the federal government.

What is a Federal Reserve payment order?

Payment orders received by the Federal Reserve Banks are processed over the Fedwire Funds Service. The payment order serves as authorization to debit the account of the sending bank maintained by its Federal Reserve Bank for the amount of the transfer.

What is a payment order and how does it work?

The payment order serves as authorization to debit the account of the sending bank maintained by its Federal Reserve Bank for the amount of the transfer. The bank identified on the payment order as the receiving bank will be credited by the Federal Reserve Bank that holds the receiving bank’s account for the same amount.

Do you have to pay taxes on settlement money?

While some settlement money is tax-free at the start, once you invest the money into things such as stocks or bonds, then the dividends earned are fully taxable. – How can I protect my settlement money? There are several things that you can do to protect your settlement money.

How does Fedwire settlement work?

The Fedwire Funds Service is a real-time, gross settlement system. Each transaction is processed individually and settled upon receipt via a highly secure electronic network. Settlement of funds is immediate, final and irrevocable (See Operating Circular 6 for specific terms and conditions.).

How does the Fed make its money?

The Federal Reserve is not funded by congressional appropriations. Its operations are financed primarily from the interest earned on the securities it owns—securities acquired in the course of the Federal Reserve's open market operations.

How does the Federal Reserve get paid back?

Federal Reserve System income is derived primarily from interest earned on U.S. government securities that the Federal Reserve has acquired through open market operations.

What is the settlement type under Fedwire payment system?

Fedwire Funds Service is a real-time, gross settlement (RTGS) payment system of USA. It processes each RTGS payment initiated by the Fedwire Member bank on an individual basis and settles it immediately upon receipt.

Who profits from the Federal Reserve?

The Federal Reserve is a nonprofit entity. After its expenses are paid, any remaining profits are paid to the Department of the Treasury. The Department of the Treasury then uses that money to fund government spending.

Why U.S. can print money without inflation?

“The short answer is because the U.S. dollar is the global reserve currency. In other words, most countries and companies from other countries usually need to transact business in U.S. dollars, making them exposed to the value of their currency relative to U.S. dollars.

Does the US print money to pay debt?

The Fed does not actually print money. This is handled by the Treasury Department's Bureau of Engraving and Printing. The U.S. Mint makes the country's coins.

What do banks do with the money not held in reserve?

Required and Excess Bank Reserves Banks have little incentive to maintain excess reserves because cash earns no return and may even lose value over time due to inflation. Thus, banks normally minimize their excess reserves, lending out the money to clients rather than holding it in their vaults.

How much money has the Fed printed in 2021?

In 2021 $13 trillion was printed. Breaking down to $5.2 for COVID + $4.5 for quantitative easing + $3 for infrastructure.

What is the difference between DTC and FED settlement?

For settlement in DTC and NSCC, the cash settlement is performed at the end of the processing day, on a net basis. For settlement in Fedwire Securities, the cash settlement is performed transaction by transaction during the day.

How much does Fedwire cost?

Summary of the new per transfer volume-based pricing structure for 2022:TierMonthly VolumePer Transfer Pre-Incentive PriceTier 1For Transfers up to 14,000$0.880Tier 2For Transfers 14,001 - 90,000$0.255Tier 3For Transfers Over 90,000$0.170

What is the difference between Fedwire and ACH?

Wire transfers cost money for both the sender and the receiver whereas ACH payments are free or cost very little per transaction. Wire transfers are initiated and processed by banks while ACH payments are processed automatically through a clearinghouse.

Does Federal Reserve print money?

The U.S. Federal Reserve controls the money supply in the United States, and while it doesn't actually print currency bills itself, it does determine how many bills are printed by the Treasury Department each year.

What assets does the Fed buy?

Beginning in June 2020, the Fed officially announced that it would purchase $80 billion worth of Treasury securities and $40 billion mortgage-backed assets a month. The Fed also created new emergency lending programs, some of which purchased municipal bonds and corporate debt for the first time in Fed history.

How much money has the Fed printed in 2021?

In 2021 $13 trillion was printed. Breaking down to $5.2 for COVID + $4.5 for quantitative easing + $3 for infrastructure.

What do banks get from the Fed?

Most of the time the only money banks get from the Fed are interest in excess reserves that are kept with the Fed. In that way they act like a bank for banks, paying interest on money kept in the equivalent of a savings account.

Why were large bills pulled from circulation?

Those large bills were pulled because of their association with criminal activity (money laundering, tax evasion, etc). If they were brought back today due to inflation, it would be a prime target for counterfeiting.

What to do if a bank doesn't give you money?

If you’d prefer more direct advice than what we’ve talked about thus far, here you go: the best thing you can do is give the money to the bank, explain the situation, and leave it to them to try and get the money back to its rightful owner. If they don’t, that’s their onus, not yours, and maybe you should consider moving your own assets to another bank. If they do, you’ve done a good deed to a total stranger. What’s wrong about that?

What is bank money?

Bank money is like your own money and that of your employer, an entry in a computer.

Where to take $500 bill?

If you ever find a $500 or $1,000 bill in an attic or inherit one, definitely take it to a paper money/coin collector. Or find one of these individuals if you’re looking to obtain such a bill, and be prepared to pay a premium over face value.

Do banks buy new currency from the Fed?

If you are talking about currency, banks buy new currency from the Fed with older currency and when necessesary with other money using EFTs just like your employer does when it pays you.

Is the Federal Reserve a bank?

The Federal Reserve is a bank, too. All money in the banking system, is “moved" via excel csv files. It contains the bank code, bank account, date, amount, transfer in or transfer out, tracing code. That is all that is necessary with two lines of entry, one bank has millions more and the other has millions less. Done. It is recorded. Next subject. I am sorry if you think there is more to it than that. There is not.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

Is dismissal pay a federal tax?

As a general rule, dismissal pay, severance pay, or other payments for involuntary termination of employment are wages for federal employment tax purposes.

How Are Lawsuit Settlements Paid?

There are several steps you will need to follow in order to get your money. Read all the paperwork carefully.

What Types of Lawsuits are Taxed?

In general, lawsuits that deal with wages are treated as wages. A lawsuit that deals with injuries or damages are not. However, this is not cut and dried, so always speak with a professional to determine how your lawsuit is laid out and how the damages are allocated.

Tip One: Settlement Taxability

The first question you may have in mind is “is the money taxable?” This really depends on your situation. If it’s a settlement from a personal or physical injury, it’s usually non-taxable. Emotional distress settlement awards are typically non-taxable if the distress is attributable to a physical injury or physical sickness.

Tip Three: Giving Money to Family

Another common question that comes up is, “Should I give money to my family?” Your family members or relatives may not necessarily be in the best financial situation, so I totally understand if you feel the urge to help them out. There is nothing wrong with that. Or maybe they’re financially ok,, but they’ll still come knocking at your door.

Tip Five: Overall, what should you do with the settlement money?

The fifth and final question that I’d like to help answer is, “What should I do with the settlement money?” I would like to urge you to find some quiet time and reflect on your life goals. What is important to you? What brings you joy? And then think about how you can use the settlement money as a tool to help you live your best life.

Additional settlement money questions that you may have

Your financial goals and situation will dictate how you use a large settlement check. Working with a certified financial advisor will help you come up with a settlement check plan tailored to your unique needs. The money will then be less likely to be used on impulse. We share our top 5 tips on what to do with your settlement money in the blog.

Need help with your settlement money?

You probably have a lot more questions to ask on what to do with your settlement money. Feel free to schedule a free discovery call with one of our financial advisors to go through your personal situation.

What is the Federal Reserve's wholesale payment service?

The Federal Reserve Banks operate three wholesale payment services: the Fedwire Funds Service, which is a real-time gross settlement system to settle funds electronically between banks; the Fedwire Securities Service, which provides issuance, settlement and transfer services for U.S. Treasury securities and other government-related securities; and the National Settlement Service, which is a multilateral settlement service used by clearinghouses, financial exchanges, and other clearing and settlement groups.

What is the New York Fed?

The New York Fed provides a wide range of payment services for financial institutions and the U.S. government. The New York Fed offers the Central Banking Seminar and several specialized courses for central bankers and financial supervisors.

What is Fedwire Securities Service?

The Fedwire Securities Service processes securities transfers on an individual , or gross, basis in real time, and the transfer of the securities and the related funds (if any) is final and irrevocable when made. Although Fedwire Securities Service participants can send securities free of payment, most securities transfers involve the delivery of securities and the simultaneous exchange of payment for these securities, a process known as delivery versus payment (DVP). A DVP system is a settlement mechanism that ensures the final transfer of one asset occurs if, and only if, the final transfer of another asset (or other assets) occurs. The Fedwire Securities Service plays a significant role in the conduct of monetary policy and the government securities market by increasing the efficiency of Federal Reserve open market operations and helping to keep the market for government securities liquid.

What is a Fedwire fund transfer?

In a typical funds transfer, an individual or a business—known as an originator—will instruct a bank to pay or cause another bank to pay a beneficiary. The originator’s bank will debit its customer’s account and will send a payment order intended to carry out the originator’s request either directly to the beneficiary’s bank or to an intermediary bank such as a Federal Reserve Bank. Payment orders received by the Federal Reserve Banks are processed over the Fedwire Funds Service. The payment order serves as authorization to debit the account of the sending bank maintained by its Federal Reserve Bank for the amount of the transfer. The bank identified on the payment order as the receiving bank will be credited by the Federal Reserve Bank that holds the receiving bank’s account for the same amount. The Fedwire Funds Service will also notify the sending bank that the Fedwire Funds Service portion of the funds transfer has been successfully processed and will notify the receiving bank that funds have been credited to its Federal Reserve account. At this point, the payment made to the receiving bank is final and irrevocable.

What bank will debit the account of the beneficiary?

The originator’s bank will debit its customer’s account and will send a payment order intended to carry out the originator’s request either directly to the beneficiary’s bank or to an intermediary bank such as a Federal Reserve Bank.

Is Fedwire a real time transaction?

Fedwire funds and securities transactions are processed in real time when received by the Fedwire applications and, once settled, are final and irrevocable. History of the Fedwire Services. The Federal Reserve Banks have been moving funds electronically since 1915. It was not until 1918, however, that the Federal Reserve Banks established ...

Is Fedwire free?

Until 1981, the Fedwire services were provided free but were available only to Federal Reserve member banks. However, the Depository Institutions Deregulation and Monetary Control Act of 1980 required most Federal Reserve Bank financial services to be priced, including funds transfers and securities safekeeping, and gave nonmember depository institutions direct access to these priced services. To encourage private-sector competition, the law requires the Federal Reserve Banks’ fees to reflect the full cost of providing financial services, including imputed costs, such as the cost of capital and taxes, that would have been incurred, and the profits that would have been earned, if a private firm had provided the services.

When did the Fed start charging fees?

Until 1981, the Fedwire system was only available to member banks and services were free of charge. The Fed began charging fees after the Depository Institutions Deregulation and Monetary Control Act of 1980 (the Monetary Control Act) was signed into law.

What banks use the Fed system?

Banks that use the system include depository financial institutions (FI) in the U.S. , as well as the American branches of certain foreign banks or government groups, provided they maintain an account with a Fed Bank.

What Is Fedwire?

Fedwire refers to a real-time gross settlement system of central bank money used by Federal Reserve (Fed) banks to electronically settle final U.S. dollar payments among member institutions. The system processes trillions of dollars daily and includes an overdraft system that covers participants with existing and approved accounts.

What is Fedwire money?

Fedwire is a real-time gross settlement system of central bank money used by Federal Reserve (Fed) banks to transfer funds electronically between member institutions. Banks, businesses, and government agencies use Fedwire for large, same-day transactions.

What time does Fedwire work?

Fedwire operates Monday through Friday between 9 p.m. Eastern Time (ET) on the prior calendar day to 7 p.m. ET. The Fed may extend its hours, and the system is closed on all federal holidays. The Fedwire system processes trillions of dollars daily among its member participants.

How long has Fedwire been around?

The History of Fedwire. The Fedwire system, along with the other two wholesale payment systems operated by the Fed, goes back more than 100 years. It is considered to be very robust and reliable. The Fed began to transfer funds between parties as early as 1915.

Is Fedwire a profit?

Although Fedwire is not managed for profit, the law mandates that the system charge fees in order to recoup costs; thus, both participants in a given transaction pay a small fee. Participating institutions can initiate fund transfers online or on the phone.

What is the Federal Reserve?

The Federal Reserve provides many payment system services to the financial industry. Formally, the Fed "fosters payment and settlement system safety and efficiency through services to the banking industry and the U.S. government that facilitate U.S.-dollar transactions and payments."

How many Federal Reserve banks are there?

The twelve Federal Reserve Banks provide banking services to depository institutions (such as commercial banks) and the federal government. Every Federal Reserve Bank provides cash services to the banking industry. Since 2003, all Fed check processing is handled by the Federal Reserve Bank of Atlanta.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account...

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - The …

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages resulting from physical or non-physi…

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).