Do I have to pay taxes on a debt settlement?

You only pay taxes on the difference. (Even if you don't get a 1099c for less than $600, you still owe taxes). And...debt "reduction" usually means they remove the penalty and interest from the balance, and you pay the rest. Debt "settlement" means they reduce the amount you borrowed. You pay taxes on settlement.

How to settle your tax debt with the IRS?

While IRS evaluates your offer:

- Your non-refundable payments and fees are applied to the tax liability (you may designate payments to a specific tax year and tax debt)

- IRS may file a Notice of Federal Tax Lien

- IRS suspends other collection activities

- Your legal assessment and collection period is extended

- You make all required payments per your offer

What are the tax consequences of debt settlement?

Tax Consequences of Debt Settlement. When a creditor writes off all or part of a debt, that creditor can turnaround and then report it to the IRS as lost income and the creditor’s tax burden is reduced by doing this. However, that means you could be responsible for that lost amount. Your forgiven debt or partially forgiven debt can be ...

Can you really settle IRS tax debt?

Yes – If Your Circumstances Fit. The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. This is called an offer in compromise, or OIC. In fact, there are more than 16 million individual taxpayers who owe the IRS – but in 2017, only 25,000 got an OIC.

Will the IRS take a settlement offer?

Yes – If Your Circumstances Fit. The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. This is called an offer in compromise, or OIC.

How much will the IRS usually settle for?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

Will IRS take a lump sum settlement?

A "lump sum cash offer" is defined as an offer payable in 5 or fewer installments within 5 or fewer months after the offer is accepted. If a taxpayer submits a lump sum cash offer, the taxpayer must include with the Form 656 a nonrefundable payment equal to 20 percent of the offer amount.

How long does it take to settle IRS debt?

The IRS computes your settlement amount based on your assets and future ability to pay. Time to complete: Tax bills of less than $50,000 take 4-6 months. Tax bills of more than $50,000 take 7-12 months.

Does IRS ever forgive debt?

The short answer is Yes, but it's best to enlist professional assistance to obtain that forgiveness. Take a look at what every taxpayer needs to know about the IRS debt forgiveness program.

Can you negotiate with the IRS without a lawyer?

Tax attorney Beverly Winstead says there are many aspects of negotiating with the IRS you can do yourself, but there are some situations where a professional can help.

What happens if you owe the IRS more than $50000?

If you owe more than $50,000, you may still qualify for an installment agreement, but you will need to complete a Collection Information Statement, Form 433-A. The IRS offers various electronic payment options to make a full or partial payment with your tax return.

What do I do if I owe the IRS over 10000?

What to do if you owe the IRSSet up an installment agreement with the IRS. Taxpayers can set up IRS payment plans, called installment agreements. ... Request a short-term extension to pay the full balance. ... Apply for a hardship extension to pay taxes. ... Get a personal loan. ... Borrow from your 401(k). ... Use a debit/credit card.

How likely is the IRS to accept an offer in compromise?

A rarity: IRS OIC applications and acceptances for 2010-2019 In 2019, the IRS accepted 33% of all OICs. There are two main reasons that the IRS may not accept your doubt as to collectibility OIC: You don't qualify. You can't pay the calculated offer amount.

How do I negotiate a settlement with the IRS?

Apply With the New Form 656 An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

What if I owe the IRS and can't pay?

The IRS offers payment alternatives if taxpayers can't pay what they owe in full. A short-term payment plan may be an option. Taxpayers can ask for a short-term payment plan for up to 120 days. A user fee doesn't apply to short-term payment plans.

Is IRS debt forgiven after 10 years?

In general, the Internal Revenue Service (IRS) has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations. It is not in the financial interest of the IRS to make this statute widely known.

How do I get the IRS to settle for less?

Apply With the New Form 656 An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

How likely is the IRS to accept an offer in compromise?

A rarity: IRS OIC applications and acceptances for 2010-2019 In 2019, the IRS accepted 33% of all OICs. There are two main reasons that the IRS may not accept your doubt as to collectibility OIC: You don't qualify. You can't pay the calculated offer amount.

What if I owe the IRS more than 50000?

If you owe more than $50,000, you may still qualify for an installment agreement, but you will need to complete a Collection Information Statement, Form 433-A. The IRS offers various electronic payment options to make a full or partial payment with your tax return.

What to do if you owe the IRS a lot of money?

Here are some of the most common options for people who owe and can't pay.Set up an installment agreement with the IRS. ... Request a short-term extension to pay the full balance. ... Apply for a hardship extension to pay taxes. ... Get a personal loan. ... Borrow from your 401(k). ... Use a debit/credit card.

What is the difference between a tax lawsuit and a federal lawsuit?

There are a few major differences between the two, the biggest being that that tax court has much laxer requirements for filing a lawsuit (you needn’t pay any outstanding amounts), while suing through the federal court may potentially yield better results (but you must either countersue after first being sued by the IRS, or pay all fees and penalties and then sue for a refund).

How to appeal a tax liability?

This is done via Form 656–L.

How long do you have to file a tax return after receiving a notice?

In both cases, there are deadlines and other rules to follow. The first and most important is the 90-day deadline for suing the IRS after receiving a notice for a penalty you consider false or inapplicable.

How to pay off a proposed total payment?

Pay off your proposed total payment on a monthly installment plan, sending the first month’s payment with the offer itself, and continuing to make monthly payments while the IRS deliberates.

Can the IRS take your property if you have a tax balance?

If you have any outstanding tax balance with the IRS, they expect you to go above and beyond to pay them back. To that end, the IRS possesses the ability to put a lien on your assets that prioritizes your debt to them above any other debts you have, and if push comes to shove, they can even levy (take) portions of your income and sell your property.

Can you sue the IRS?

Should you manage to file a lawsuit against the IRS and have sufficient evidence to refute their penalties, chances are that they will seek to settle. However, again, it’s worth noting that this is an option that is rarely applicable – and when it is, you want to be prepared to deal with the IRS through a reputable legal team, and have plenty of evidence at hand to dispute whatever they claim.

Can you sue the IRS for a mistake?

In general, lawsuits against the IRS are only an option in cases where a taxpayer has proof that they have incurred financial damages as a result of the IRS’s actions, specifically in cases where the IRS makes a mistake and charges you more money than it should.

Use an OIC (Offer in Compromise)

Since winning an IRS debt settlement (for many people) means being able to reduce tax debt, an OIC is a great tool to consider. If accepted, an OIC allows a taxpayer to settle their debt for a lower amount than the tax owed.

Use Penalty Relief

The IRS can reduce or remove penalties charged on tax debt. You can accumulate penalties for many reasons ranging from filing or paying taxes late. Inaccurate returns also attract fines.

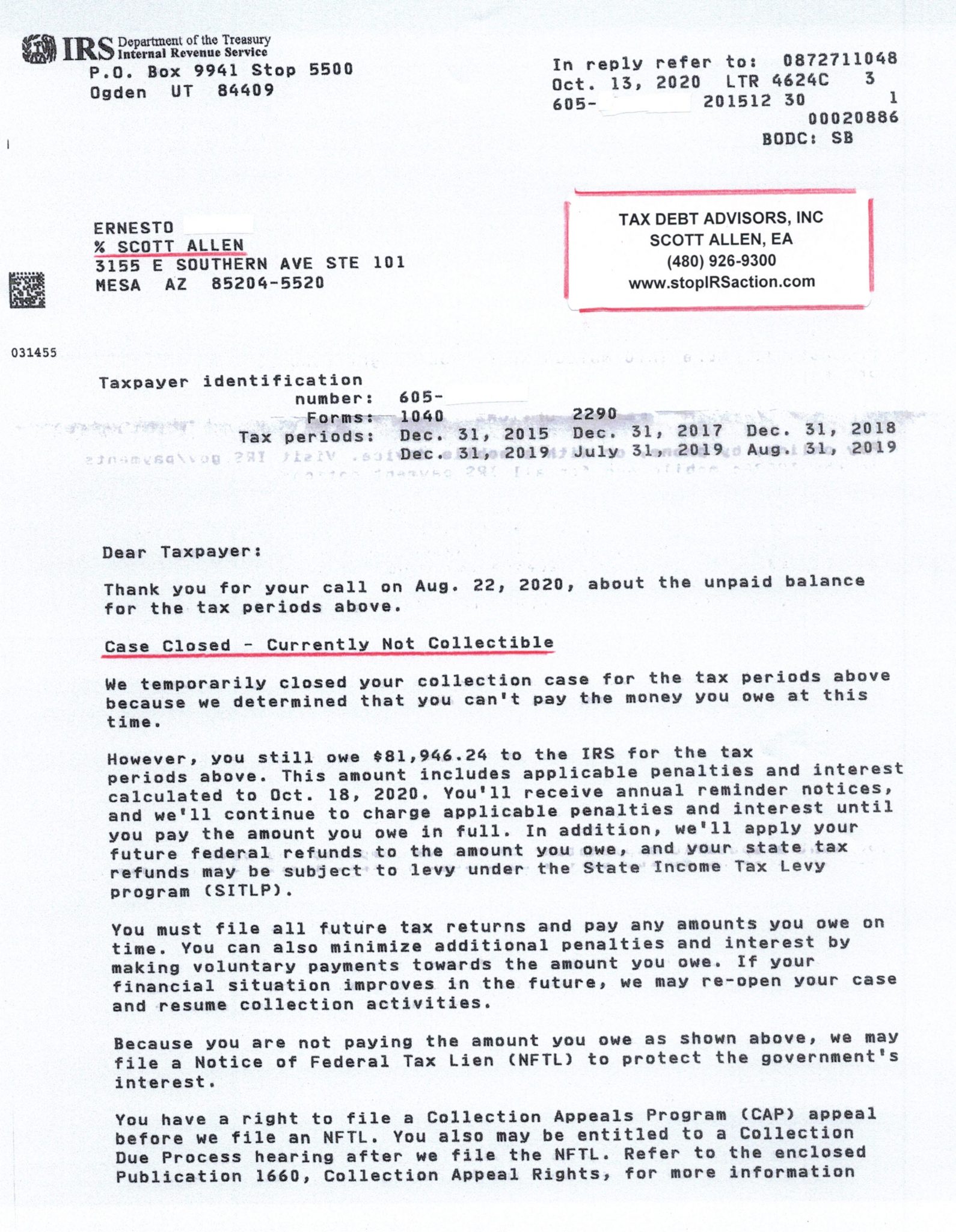

Get a CNC status

You can also stop the IRS from taking over your assets or getting access to money in your bank by getting a CNC status. A CNC (Currently Not Collectible) status is granted to individuals who successfully show the IRS they can’t repay debt because of financial hardship.

Summary

In a nutshell, The IRS can allow reprieve for debt owed provided a taxpayer utilizes arguments, tools, or guidelines that fall within the IRS’s regulatory guidelines and procedures.

How Does IRS Debt Settlement Work?

There’s no simple approach that works for everybody. There are many ways to settle your tax debt, and you need to choose one that best suits your situation.

How long does it take to collect IRS debt?

According to this law, the IRS has only 10 years to collect your tax debt, starting from the time you file your tax return. If you’re able to interrupt and delay its enforcement and collection activities for 10 years, you’ll be off the hook.

Why are tax holdouts so risky?

Tax holdouts are a risky business because the IRS may take extreme measures to collect tax debts and has no qualms imprisoning people whom they consider to be “tax cheats.”. Then again, you can increase your chances of success and minimize your risks by hiring a tax professional.

How does Solvable get paid?

Most often, Solvable receives fees when one of our readers clicks, fills out a form, applies for, or receives a financial product from one of our partners. We also earn fees for capturing consumer stories and writing about them, displaying advertising, having our partners sponsor certain parts of the site, and writing content that may be relevant to our partner and their audience. This compensation may impact where products appear on this site, including article pages, comparison listings, the order in which they appear or if they will even appear on a given page, and our matching recommendations. Solvable has not written about, reviewed, or rated all financial products available to consumers.

How to get a tax levy on your bank account?

In order to get the IRS to release a levy on your bank account, you need to prove to the court that the levy will have a significant effect on your quality of life and result in dangerous circumstances . You’ll be required to provide certain financial information, including your outstanding balances, current and projected annual income, and the total value of your assets. To increase your chances of preventing a bank account levy, you have to make your financial situation look bad.

Does the IRS have a collection program?

The Currently-Not-Collectible Debt Program doesn’t help with debt reduction or write-offs, but it gives you more time to pay back what you owe to the IRS. The IRS will grant you a deferment and put your payments on hold for a year or longer if you’re able to prove that your tax debt is currently not collectible. If you qualify for this program, you’re typically not required to make principal tax payments. However, you’ll rack up interest on the amount of tax debt you owe.

Can you file for bankruptcy if you have IRS debt?

Depending on your financial situation, you can either use Chapter 7 or Chapter 13 bankruptcy to get rid of your tax debt. If you decide to pursue Chapter 7 bankruptcy, you can have all of your IRS debt written off with just the stroke of a pen. However, it’s a lot more difficult to win this type of case. On the other hand, if you choose to declare Chapter 13 bankruptcy, you’ll only be able to discharge a portion of your debt, but you’ll have a much better chance of winning in court.

How long does it take for an IRS offer to be accepted?

Your offer is automatically accepted if the IRS does not make a determination within two years of the IRS receipt date.

What happens if you accept a tax offer?

You must meet all the Offer Terms listed in Section 7 of Form 656, including filing all required tax returns and making all payments; Any refunds due within the calendar year in which your offer is accepted will be applied to your tax debt;

Does the IRS return an OIC?

The IRS will return any newly filed Offer in Compromise (OIC) application if you have not filed all required tax returns and have not made any required estimated payments. Any application fee included with the OIC will also be returned. Any initial payment required with the returned application will be applied to reduce your balance due. This policy does not apply to current year tax returns if there is a valid extension on file.

Why is debt taxed as if it were your regular income?

It’s essentially treated as if it were your regular income because it’s money you borrowed that you’re no longer obligated to pay back. If you settle large amounts of debt, the tax bill can easily run to thousands or tens of thousands of dollars in additional tax.

Who is the founder of Debt.com?

Contributors to this page include Jacob Dayan, co-founder of Community Tax LLC – a full-service tax company helping customers nationwide with tax resolution, tax preparation, bookkeeping, and accounting – and Howard Dvorkin, CPA and founder of Debt.com.

How much is the IRS exclusion for canceled mortgages?

Until 2016, the IRS allowed an exclusion of up to $2,000,000 in canceled mortgage debt. This exclusion allowed the vast majority of taxpayers forced into foreclosure or short sales to escape the “double penalty” of a tax bill for any unpaid mortgage debt. However, beginning in 2017 the IRS dialed back the exclusion.

What is the key to a successful tax return?

The key is to have an experienced tax preparer on your side. You need someone to guide you through the process and ensure you are not overpaying. Without guidance, it is easy to fall prey to the “double penalty” of tax on canceled debt.

Can you avoid taxes on canceled credit card debt?

For example, if the canceled credit card debt was from a bankruptcy, or if you can prove to the IRS that you owed more total debt than the value of your assets (home, car, retirement accounts, etc.) at the time of the settlement, you may be able to avoid tax on the canceled debt income. IRS will exclude canceled debt if the discharge occurs for:

Can you pay extra taxes on forgiven debt?

So, an extra tax bill on any forgiven debt as part of your gross income adds a financial burden to someone already experiencing hardship. But there is some good news — IRS allows taxpayers to exclude canceled debt income (i.e. no extra tax due on canceled debt) under certain conditions.

Is canceled debt taxable income?

Under IRS guidelines, canceled debt counts as taxable income. In ordinary circumstances, receiving a loan is not considered income, and paying it back is not a deduction. But when a lender cancels the debt, the IRS treats the amount of canceled debt as if it is indeed income. Most taxpayers know they pay income tax on their wages, ...

What is IRS debt forgiveness?

IRS Debt Forgiveness is basically paying less than you owe to the IRS, getting part of the debt forgiven.

How long does it take for a tax debt to be forgiven?

The third type of tax result that some may consider tax debt forgiveness, but is really more of a legal technicality, is the debt expiring after about 10 years. The IRS has 10 years to collect on a debt from the time it was assessed, with some exceptions. The assessment time is usually when they send the letter out for the tax debt.

What is the second form of tax debt relief?

The second common form of tax debt relief is a First Time Penalty abatement. The IRS looks at the first year in a series of years for which you owe taxes. If you did not get a penalty posted to your account for at least 3 years prior to that first year of debt, you should be able to get a first-time penalty abatement.

Can you settle for a fraction of a penny?

We often get settlements accepted for a fraction of a penny on the dollar. For example, we had a client with a debt of almost $250,000 settle for $100. The truth is a lot of people just do not qualify, but a lot of companies sell this as a viable option to potential clients.

How does debt settlement work?

Debt settlement plans work a bit differently than debt management plans. With debt settlement plans, the debt management company you chose negotiates a reduced balance owed with each of your creditors.

How long does it take to get rid of IRS debt?

There is a chance you may be able to reduce or eliminate your IRS tax debt due to statute of limitation laws. The law says the IRS has ten years from the date of assessment to collect your IRS tax debt.

What can a qualified tax debt expert do?

A qualified tax debt expert can help you strategize to use statute of limitation laws to your advantage. Have you already started making the installment payments on your tax debt?

What is tax resolution?

Tax resolution companies employ expert CPAs and attorneys to help you reduce the amount you owe to the IRS. They can help you use one or more of several creative ways to reduce your tax burden. Here are some legit ways you can settle your IRS tax debt for less. 1.

What is IRS offer in compromise?

The Offer in Compromise is another IRS program that can help you reduce your tax debt. This program allows you to make a lump sum payment on your IRS tax debt that is lower than what you actually owe. This means you settle your debt for less with the stipulation that the IRS gets the agreed upon money all at once.

What is innocent spouse relief?

Innocent Spouse Relief offers you tax burden relief if your spouse failed to report income. It also applies if your spouse reported income improperly or claimed improper deductions or credits.

What is debt management plan?

Debt Management Plans. Debt Management Plans are plans created by a debt management company that can help you pay off debt faster.