Yes, fiduciary duty does apply to life insurance and life settlements. Financial advisors, trustees of irrevocable life insurance trusts (ILITs), and any advisors who label themselves as fiduciaries may be required to educate their clients about life settlements in certain scenarios.

Full Answer

What is a fiduciary duty?

A fiduciary duty is a responsibility to act on behalf of another person and, where necessary, to put the other person’s interest ahead of one’s own. The term “ fiduciary duties” (plural) is a catch-all term that generally includes two components: a duty of care and a duty of loyalty.

When will the court review the settlement terms?

The Court’s settlement terms will be reviewed on October 20, 2021, but class members have already begun to be notified. As part of the settlement, the companies agreed to make operational changes and to provide payment to class members.

Can an LLC operating agreement eliminate fiduciary duties?

While state LLC acts allow the LLC operating agreement to alter or eliminate fiduciary duties, other state LLC acts limit the operating agreement’s ability to do so. Failure to understand state rules regarding fiduciary duties can open the LLC members and managers up to liability.

How much of the settlement has been allocated to individuals?

The bulk of the settlement – $1.76 billion – has been allocated for individuals and fully insured groups and their members, while the remaining $120 million has been allocated to self-funded groups and their members.

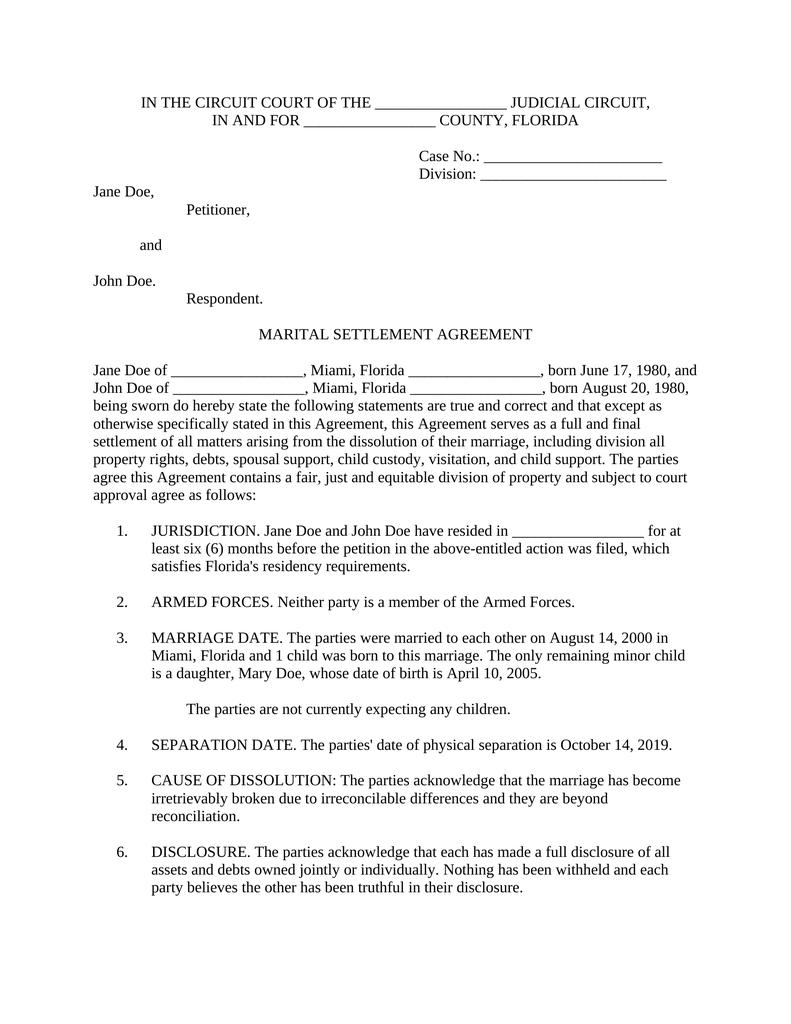

What is the purpose of a settlement agreement?

A settlement agreement is a type of legal contract that helps to resolve disputes among parties by coming to a mutual agreement on the terms. Primarily used in civil law matters, the settlement agreement acts as a legally binding contract. Both parties agree to the judgment's outcome in advance.

What are the 5 fiduciary duties?

Specifically, fiduciary duties may include the duties of care, confidentiality, loyalty, obedience, and accounting.

How is a fiduciary duty created?

A fiduciary owes a duty of care to execute his or her duties in an informed manner and to act as an ordinary prudent person. If the fiduciary has special skills, he or she is under a duty to use those skills. A fiduciary duty may be created by contract when the parties agree to a fiduciary relationship.

What are some examples of fiduciary duty?

Some examples of fiduciary duties include duties of undivided loyalty, due diligence and reasonable care, full disclosure of any conflicts of interest, and confidentiality. While a fiduciary duty may be violated accidentally, it is still a breach of ethics.

What constitutes a breach of fiduciary duty?

The directors and other officers of a company are considered to have breached their fiduciary duties when they: Fail to make a business judgment in good faith or in the best interests of the company. Have placed a material personal interest in the subject matter of the business judgment ahead of the company's interest.

What are the two main types of fiduciary duties?

Fiduciary duties fall into two broad categories: the duty of loyalty and the duty of care.

What are the 3 fiduciary duties?

Three Key Fiduciary DutiesDuty of Care. Duty of care describes the level of competence and business judgment expected of a board member. ... Duty of Loyalty. Duty of loyalty revolves primarily around board members' financial self-interest and the potential conflict this can create. ... Duty of Obedience.

What is the most important fiduciary duty?

duty of loyaltyA duty of loyalty is one of the most fundamental fiduciary duties owed by an agent to his principal. This duty obligates a real estate broker to act at all times solely in the best interests of his principal to the exclusion of all other interests, including the broker's own self-interest.

What contract involves a fiduciary relationship?

A fiduciary relationship may be created by an express agreement made in writing between the two parties or be implied by law due to the conduct of each party.

What are three examples of breaches of fiduciary duty?

Breach of Fiduciary Duty ExamplesSharing an employer's trade secrets;Failing to follow the employer's directions;Improperly using or failing to account for employer funds;Acting on behalf of a competitor;Failing to exercise care in carrying out duties; and.Profiting at the employer's expense.

What are the limits of fiduciary duty?

PERSONAL LIABILITY AND THE STATUTE OF LIMITATIONS Inherent in the concept of fiduciary duty is that one is personally liable if one violates it. Thus, if you are a trustee or a real estate broker, the law imposes personal liability upon you for the breach of that duty.

How hard is it to prove breach of fiduciary duty?

Proving this is not always easy, so plaintiffs often enlist the help of an attorney to assist in the case. Proving the breach starts with proving the fiduciary duty was present. Sometimes this is easy, such as in the case of someone who is taking on the role of business partner or trustee.

What are the 3 fiduciary duties?

Three Key Fiduciary DutiesDuty of Care. Duty of care describes the level of competence and business judgment expected of a board member. ... Duty of Loyalty. Duty of loyalty revolves primarily around board members' financial self-interest and the potential conflict this can create. ... Duty of Obedience.

What do you mean by fiduciary duties?

Fiduciary duty is the responsibility that fiduciaries are tasked with when dealing with other parties, specifically in relation to financial matters. In most cases, it means that the duties involve a fiduciary overseeing the wealth of their clients, acting on the client's behalf, and in their best interests.

What are the fiduciary duties in real estate?

Fiduciary duty in real estate requires realtors to act in the best interests of their clients. This includes disclosing any conflicts of interest and negotiating in good faith. Fiduciary duty in real estate consists of six parts: obedience, loyalty, disclosure, confidentiality, accounting, and reasonable care.

Who is considered a fiduciary?

A fiduciary is someone who manages property or money on behalf of someone else. When you become a fiduciary, the law requires you to manage the person's assets for their benefit—and not your own. In a fiduciary relationship, the person who must prioritize their clients' interests over their own is called the fiduciary.

What is a Fiduciary Duty?

A fiduciary duty is a responsibility to act on behalf of another person and, where necessary, to put the other person’s interest ahead of one’s own. The term “ fiduciary duties” (plural) is a catch-all term that generally includes two components: a duty of care and a duty of loyalty.

What is the duty of good faith and fair dealing?

Duty of Good Faith and Fair Dealing. In addition to the fiduciary duties of loyalty and care, state LLC acts impose a contractual duty of good faith and fair dealing. Although not a fiduciary duty, this duty is important and, as a general rule, may not be waived. Most states do not allow the LLC operating agreement to waive the duty ...

What is the purpose of an LLC?

Given that a primary purpose of LLC formation is liability protection, most LLC operating agreements indemnify LLC members or managers for acts taken in good faith on behalf of the LLC. In many state LLC acts, this indemnification does not extend to any actions that breach a fiduciary duty. If a breach of fiduciary duty opens a member ...

What happens if a member fails to meet the fiduciary duty?

If the member or manager fails to meet that standard, he or she can be personally liable for breach of the fiduciary duty. The duties of care and loyalty that apply to LLC members and managers vary by state. In states that impose fiduciary duties, the state LLC act will define the duty.

Why is an LLC manager managed?

If the LLC is manager-managed, the fiduciary duties of care and loyalty apply to the managers instead of the members.

How to modify fiduciary duties?

Some state LLC acts impose fiduciary duties, but allow the operating agreement to make limited modifications to the standards that apply. For example, Section 105 of RULLCA allows the operating agreement to modify fiduciary duties in two ways: 1 Ratification After Disclosure. RULLCA allows the operating agreement to define a procedure for ratifying a specific act or transaction that would otherwise violate the duty of loyalty. The person with the conflict of interest must disclose all material facts, and one or more disinterested persons must then authorize or ratify the act or transaction. 2 “Not Manifestly Unreasonable” Modifications. RULLCA allows the operating agreement to make certain modifications, as long as they are not “manifestly unreasonable.” As long as it meets the “manifestly reasonable” standard, the operating agreement may:#N#Alter or eliminate aspects of the duty of loyalty;#N#Identify specific types or categories of activities that do not violate the duty of loyalty, alter the duty of care (but not to authorize conduct involving bad faith, willful or intentional misconduct, or knowing violation of law); and#N#Alter or eliminate any other fiduciary duty.

How can a member breach a fiduciary duty of care?

There are three ways that a member or manager may breach the fiduciary duty of care under RULLCA: by failing to account for (and hold in trust) a prohibited benefit; by engaging in a conflict-of-interest transaction with the LLC; and by competing with the LLC.

What is the BCBS settlement?

In October of 2020, Blue Cross Blue Shield (BCBS) Association and member plans reached an agreement to settle a class action lawsuit brought by subscribers alleging antitrust violations. While the companies denied the allegations, they agreed to the settlement to avoid further litigation costs and risks. The Court’s settlement terms will be ...

What are the fiduciary duties of an employer under ERISA?

Employers should be aware, though, that they may have fiduciary duties under ERISA regarding the use of any of the proceeds from the settlement. Under ERISA, plan assets must be held for the exclusive purpose of providing benefits to participants in the plan and their beneficiaries and defraying reasonable expenses of administering the plan. While the Department of Labor has not issued any guidance regarding the proper treatment of claim proceeds from this particular lawsuit, they have previously issued guidance related to the treatment of Medical Loss Ratio (MLR) rebates received under the terms of the Affordable Care Act. Unless and until specific guidance is issued related to the BCBS settlement, employers may want to use the MLR guidance as a reference when determining how to calculate what portion of the BCBS settlement proceeds should be considered “plan assets” and how those funds can be used.

Can employers direct employees to settlement website?

Plan sponsors are not obligated to notify employees about the settlement or advise them on what to do, but since there are likely to be questions, employers can simply direct employees to the settlement website.

Is BCBS settlement time consuming?

As a final note, the BCBS settlement claims process is not complicated or time-consuming. Although you may receive solicitations from third parties offering to assist in filing a claim in exchange for a portion of the proceeds, it is unlikely that any professional assistance should be needed.