Does the settlement date exclude weekends?

The settlement date excludes weekends, i.e., Saturday and Sunday, as well as exchange holidays. The settlement date is the date on which a trade is deemed settled when the seller transfers ownership of a financial asset to the buyer against payment by the buyer to the seller.

What is a settlement date?

The settlement date is the date on which a trade is deemed settled when the seller transfers ownership of a financial asset to the buyer against payment by the buyer to the seller. The settlement date for securities ranges from one day to three days, depending on the type of security.

How long does it take for options to settle?

The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1).

Can a house settlement be delayed by a day?

It’s not unusual for settlements to be delayed by hours or even a day after the nominated time as everything is organised with solicitors, real estate agents and banks. If you’re the seller and moving to another home that settles on the same day, think about finding accommodation elsewhere that night just in case.

How are settlement days calculated?

The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date.

Is Friday a settlement date?

The first day of the settlement cycle starts on the first business day following the trade date. Business days are generally defined as days when the market is open. For example, if a trade is made on a Thursday, the first day of a two-day settlement cycle is Friday and the settlement day will be the following Monday.

Is settlement date beginning or end of day?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

What do you mean by settlement date?

Definition: Settlement date is the day on which a trade or a derivative contract must be settled by transferring the actual ownership of a security to the buyer, against necessary payment for the same.

What time of day is settlement date?

9:00 AM ET on the settlement date.

Does T plus 2 include weekends?

Weekends and public holidays are not included in the day count.

Can I use funds on settlement date?

While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade. (Proceeds from a day trade can only be used on the following trading day.)

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

Why does it take 3 days to settle a trade?

This date is three days after the date of the trade for stocks and the next business day for government securities and bonds. It represents the day that the buyer must pay for the securities delivered by the seller. It also affects shareholder voting rights, payouts of dividends and margin calls.

Who determines settlement date?

the sellerIt's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale. As a general rule, property settlement periods are usually 30 to 90 days, but they can be longer or shorter.

Why does it take 2 days to settle a trade?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

Is settlement a business day?

The most common time period for settlements in different states is 60 days, except in New South Wales where it is 42 days.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What is a settlement date for taxes?

There are two related and important dates when you buy or sell stock. The trade date is the date when you place an order to buy or sell. The settlement date is the date that the cash or shares are transferred to or from your account.

Is value date same as settlement date?

The settlement date is the date when the transaction is completed. The value date is the same as the settlement date. While the settlement date can only fall on a business day, the value date (in the case of calculating accrued interest) can fall on any date of the month.

Is settlement a business day?

The most common time period for settlements in different states is 60 days, except in New South Wales where it is 42 days.

What Is a Settlement Date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date. Options contracts and other derivatives also have settlement dates for trades in addition to a contract's expiration dates .

What causes the time between transaction and settlement dates to increase substantially?

Weekends and holidays can cause the time between transaction and settlement dates to increase substantially, especially during holiday seasons (e.g., Christmas, Easter, etc.). Foreign exchange market practice requires that the settlement date be a valid business day in both countries.

How far back can a forward exchange settle?

Forward foreign exchange transactions settle on any business day that is beyond the spot value date. There is no absolute limit in the market to restrict how far in the future a forward exchange transaction can settle, but credit lines are often limited to one year.

How long does it take for a stock to settle?

Most stocks and bonds settle within two business days after the transaction date . This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

How long does it take to settle a stock trade?

Historically, a stock trade could take as many as five business days (T+5) to settle a trade. With the advent of technology, this has been reduced first to T=3 and now to just T+2.

How long does it take for life insurance to be paid?

If there is a single beneficiary, payment is usually within two weeks from the date the insurer receives a death certificate.

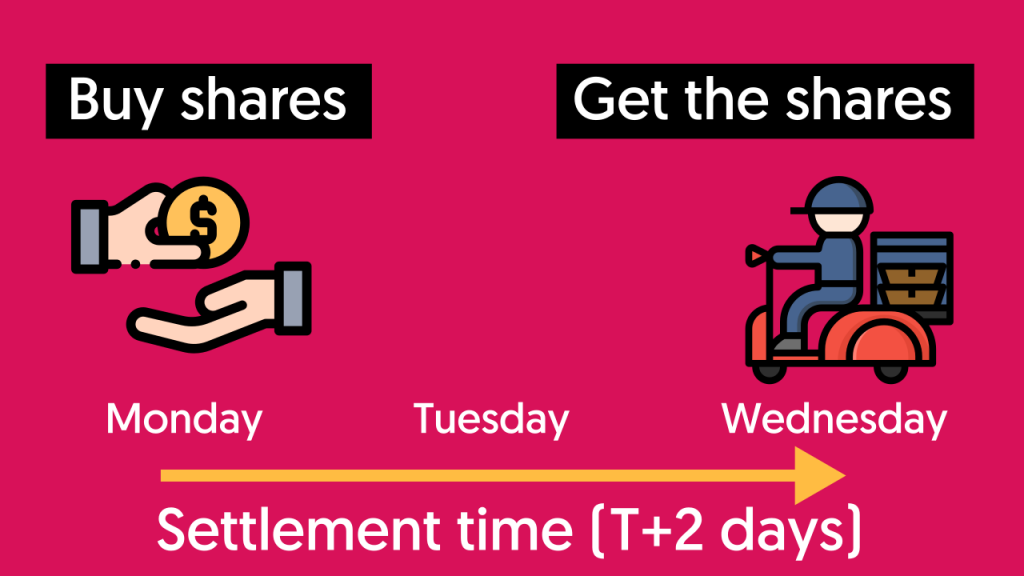

When Does Settlement Date Occur?

When investors purchase bonds, stocks, or any other financial instruments, the transactions are broken down into two key dates – transaction and settlement dates. Transaction date refers to the date when the trade actually got initiated. However, the trade is not settled on the transaction date as there is some time gap for making the payment and transferring the asset ownership. Therefore, the transaction date and the settlement date doesn’t fall on the same day.

What is the settlement date in a security document?

The settlement date occurs after the specified time has elapsed after the transaction date, which is mentioned in the security document. For instance, if the document says that the settlement date is T+2, then it means that the trade will be settled after two [business] days from the transaction date. The time gap between the transaction date and the settlement date is known as the settlement period. It is to be noted that the date doesn’t occur on exchange holidays as well as weekends [Saturday & Sunday], and it is shifted to the next business day.

What is the difference between a settlement date and a transaction date?

The difference between the transaction date and the settlement date is owing to the time required by the seller to deliver the assets. Nowadays, the transactions are executed electronically which were previously done manually. Once the buyers receive the delivery of the assets, they make the payment for the assets.

What is settlement risk?

Settlement Risk: It occurs when either the seller or the buyer fails to honor their part of the contract. For instance, the seller might be unable to deliver the underlying asset in exchange for the payment or the buyer might fail to make the payment in time after the transfer of the asset ownership.

Is settlement date accounting a conservative approach?

Therefore, in the case of month-end transactions, there is a likelihood that the trading month will be different in date accounting as compared to transaction date accounting. Accounting is a conservative approach and it captures the cash position of a company more accurately.

Why is it important to know the settlement date of a stock?

Knowing the settlement date of a stock is also important for investors or strategic traders who are interested in dividend-paying companies because the settlement date can determine which party receives the dividend. That is, the trade must settle before the record date for the dividend in order for the stock buyer to receive the dividend.

Why is the settlement date a little trickier?

However, the settlement date is a little trickier because it represents the time at which ownership is transferred . It's important to understand that this doesn't always occur on the transaction date and varies depending on the type of security.

When Do You Actually Own the Stock or Get the Money?

If you buy (or sell) a security with a T+2 settlement on Monday, and we assume there are no holidays during the week, the settlement date will be Wednesday, not Tuesday. The 'T' or transaction date is counted as a separate day. 2

What does the transaction date mean?

As its name implies, the transaction date represents the date on which the actual trade occurs. For instance, if you buy 100 shares of a stock today, then today is the transaction date. This date doesn't change whatsoever, as it will always be the date on which you made the transaction.

Do all mutual funds have the same settlement period?

Not every security will have the same settlement periods. All stocks and most mutual funds are currently T+2. 3 However, bonds and some money market funds will vary between T+1, T+2, and T+3.

What is the settlement period of a property?

The ‘settlement period’ is the amount of time between the exchange of contracts and the property settlement.

What to do during settlement period?

During the settlement period, communication is key. Talk to your agent, solicitor, financial provider and conveyancer about your expectations regarding your settlement period. The two major things that might occur are: 1. Missing the settlement date:

How long does it take to settle a contract?

From the day the contract is signed, the settlement period begins. As the length of the period is one of the clauses in the contract, the vendor has the ability to negotiate a settlement period with the buyer. Many vendors have no special preference for when settlement occurs. If the buyer is also flexible, then chances are that they will agree on 30, 60 or 90 days. A 60 day settlement is most common (except in NSW which is usually 42 days). That normally gives the vendor and the buyer enough time to organise the financing, paperwork, moving, cleaning and other details that need to be resolved before settlement.

Why do you need a pre settlement inspection?

The agent will usually arrange a pre-settlement inspection to allow the buyer to see the property before finalising the payment. This is when issues that could delay the settlement may arise. As a vendor, it’s important to make sure the house is looking as it did (or better) than when the buyer last saw it.

What happens if you don't settle on a property?

Missing settlement can be very serious. For example, a buyer who is unable to settle can be forced to pay interest on the amount they owe for the property. Usually, they have to pay 10% a year – calculated daily. This is negotiable, as the payment date can be extended or interest payments waived if you, as the vendor, agree.

What happens after a property is sold?

Once a property has been sold, there is a period of time – between the contract being signed and the handover of the keys (property settlement) – in which a number of important steps must be completed. Property settlement is usually handled between yourself and your official legal, financial and property representatives.

Who will reconcile any adjustments that were pre-paid or accrued during the settlement period?

The vendor and the buyer will reconcile any adjustments that were pre-paid or accrued during the settlement period (such as rates).

When negotiating the number of days for any contingency agreement or addendum in the contract, is it important?

Therefore, when negotiating the number of days for any contingency agreement or addendum in the contract, it is important to consider business days, weekends and holidays, as it is not uncommon for a contingency period to include all three.

What is the day commencing the period?

Day commencing the period is Day 0. 5 days or less - count Business Days ONLY. Greater than 5 days - count ALL days. All periods must end on a Business Day - except that "possession" can be on a weekend. All periods end at 9pm local time.

How long is the inspection contingency period?

For example, if your Inspection Contingency is 5 days, and the agreement was entered into on Wednesday (Day "zero"), but also includes the coming Memorial Day weekend, then your contingency period is actually 8 calendar days, ending on the following Thursday at 9pm.

How long is a real estate contract?

While all contract contingencies are important, arguably, the most critical contingency in any real estate purchase and sale contract is the Financing Contingency, which is typically 20-30 days. All parties, especially the home buyer and their real estate agent, need to accurately count the number of days - and to adhere to any related terms ...

Does Seattle have a time calculation?

In the Seattle area, the Computation of Time is incorporated into the contract, being clearly stated in the NWMLS Form 21, Residential Purchase & Sale Contract. Unless the parties agree to the contrary in writing, all real estate contracts using NWMLS forms will automatically count the number of days according to the following computation of time summary:

Why is it important to have a closing date?

The right closing date can help reduce your closing costs, and ensure that the remainder of the home-buying process looks like a well-choreographed ballet of financial, legal and real estate professionals.

What happens if you have a wrong date?

The wrong date could produce a slapstick comedy of errors and costly delays. In some cases, it might even cause the whole deal to fall apart.

What happens if you close your mortgage early?

If you set the closing for early in the month, you’ll give yourself more time before the first mortgage bill arrives.

How long does it take to pay off a mortgage on September 5th?

However, if you close on September 5 instead of the 25th, you’ll pay more interest at the closing, but you won’t have to come up with the (much larger) first mortgage payment for eight weeks (rather than 5 weeks). In the long term, neither strategy actually saves money.

What happens if you don't allow time for closing?

If you don’t allow enough time, the closing date might arrive before your financing is approved. If that happens, the seller might be able to cancel the deal in favor of a more attractive offer. Although most sellers will agree to a new date, why take the risk?

How long does it take to close a mortgage?

Most people schedule the closing date for 30-to-45 days after the offer has been accepted – and they do this for good reason. Mortgage lending is a document- and labor-intensive process that requires the various players to coordinate many different steps. Under the best of circumstances, it’s a time-consuming effort.

How much interest do you pay on September 25th?

If you choose September 25 as a closing date, you’ll owe just five days’ interest at the closing, whereas if you close on the 5 th, you’ll pay 25 days’ interest at the closing – a sum that could easily total in the hundreds of dollars.

What day does a security settlement date in T+2 count?

Weekends and holidays are excepted. So, if you purchase a security on a Friday, your settlement date will be the following Monday. And if one of the two days in T +2 lands on a holiday, that day doesn’t count.

What are the dates of a securities transaction?

Whether you’re buying or selling securities, two important dates are part of every transaction: the trade date and the settlement date. These two dates are important whether you’re trading stocks, municipal bonds, mutual funds or exchange-traded funds. For commercial paper and certificates of deposit, trade date and settlement date are the same.

Is closing date the same as settlement date?

It’s the same as settlement date, no difference.

Is the settlement date the same as the trade date?

However, unlike Amazon, which offers choices of how quickly you can receive your item, settlement dates are strictly set and governed by the Securities Exchange Commission. As far as trade date vs. settlement date price goes, they’re the same. The price is set the moment you make the trade. It won’t change between then and settlement date.

Do you have to pay for securities when you buy them?

When you initiate the purchase of securities (the trade date), you have a legal obligation to pay for them. On the other side of the deal, also as of trade date, the seller has a legal obligation to provide the securities that you purchased. But you don’t legally own the securities you’ve bought until settlement date.

What Is A Settlement Date?

- The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchang...

Understanding Settlement Dates

- The financial market specifies the number of business days after a transaction that a security or financial instrument must be paid and delivered. This lag between transaction and settlement datesfollows how settlements were previously confirmed, by physical delivery. In the past, security transactions were done manually rather than electronically. Investors would have to wai…

Settlement Date Risks

- The elapsed time between the transaction and settlement dates exposes transacting parties to credit risk. Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement riskbecause the currencies are not paid and received simultaneously. Furthermore, time zone differences inc…

Life Insurance Settlement Date

- Life insurance is paid following the death of the insured unless the policy has already been surrendered or cashed out. If there is a single beneficiary, payment is usually within two weeks from the date the insurer receives a death certificate. Payment to multiple beneficiaries can take longer due to delays in contact and general processing. Most states require the insurer pay inter…

Explanation

When Does Settlement Date occur?

- When investors purchase bonds, stocks, or any other financial instruments, the transactions are broken down into two key dates – transaction and settlement dates. Transaction date refers to the date when the trade actually got initiated. However, the trade is not settled on the transaction date as there is some time gap for making the payment and transferring the asset ownership. T…

Risks of Settlement Date

- There are two main risks associated with – credit risk and settlement risk. 1. Credit Risk: It refers to the risk of loss emanating from the buyer’s inability to meet the contractual trade obligations. Some of the reasons for the credit risk include liquidity issues or unanticipated volatility in the market during the time period between the transaction and settlement dates. 2. Settlement Risk…

Breaking Down Settlement Date

- The financial markets clearly specify the number of business days at the end of which the transaction has to be completed, i.e.the assets/ securities have to be delivered in exchange for the payment. The difference between the transaction date and the settlement date is owing to the time required by the seller to deliver the assets. Nowadays, the transactions are executed electr…

Importance

- The importance can be ascertained on the basis of the following: 1. Regulation:According to regulatory bodies, the prospective buyer can’t resell the particular securities until the trade settlement, while the seller can’t use the funds to be received in exchange for the particular securities for buying any another security until the trade settlement. Hence, the date is equally i…

Conclusion

- So, it can be seen that the settlement date is a very important aspect of any transaction as it signifies when the trade has been actually settled, which is usually after certain days from the trading date. Further, accounting based on date is also a better indicator of the actual cash position of a company.

Recommended Articles

- This is a guide to Settlement Date. Here we also discuss the introduction and when does the settlement date occur? along with the importance and example. you may also have a look at the following articles to learn more – 1. Date of Record of Dividends 2. Dividends EX-Date vs Record Date 3. Future vs Option 4. Spot Market